At the heart of Europe, Poland serves as a bustling crossroads of the East and the West. Surrounded by seven neighboring nations, the country is a vibrant center for innovation and business, playing a pivotal role in the CEE startup landscape.

Let’s shed light on the potential of the Polish ecosystem. Take a moment to explore!

The Startup Scene

Poland is one of Eastern Europe’s best countries for establishing a startup according to Startup Blink. Poland’s startup scene remains stable in 2023 in the 33rd position in the global ranking, and 4th in the regional one. Poland is home to over 3K startups, and an increasing number of VC firms, currently with 210 active ones.

The rapid growth of Poland’s economy, recording an average growth rate of 3.7% in the decade to 2022, above the 2.5% average for Eastern Europe, set the stage for the development of its technology sector. Poland has been developing as a country with a particular interest in IT innovation, since the beginning of the century.

Furthermore, there has been an increase in the number of companies providing high-value services and niche products since the early 2000s. This entails various sectors such as healthtech, gaming, fintech, edtech, and more.

Warsaw stands as the largest city and primary tech hub in the country, with over 260 tech companies. It is also a leader in Poland’s rise of specialized tech firms, which comprise the majority of companies in the capital.

Investors’ Landscape

Specifically for the Polish entrepreneurial scene is the support, coming from the public sector, which serves as a prime example of centralized planning. The Polish government has supported the startup ecosystem through financial support, tax benefits, and other initiatives, all of which have played a crucial role in cultivating a favorable environment for the growth of the startup scene.

There are two public entities that reshaped Poland’s entrepreneurial environment by addressing certain gaps in local funding:

- The National Centre for Research and Development (NCBR) was founded in 2007 with the aim of fostering the development of innovative solutions and technologies. It serves as an executive agency of the Polish Ministry of Education and Science, which brings together the world of science and business through co-financing of R&D projects.

- The Polish Development Fund (PFR) works as a financial institution dedicated to supporting economic development initiatives. Formed in 2016, with EU funds, it pumped capital into PFR Ventures, a government-owned institutional Limited Partner (LP), to initiate growth within the entrepreneurial ecosystem. PFR Ventures has since invested in more than 60 local venture capital and private equity funds, with a total indirect portfolio of more than 650 companies. In the past five years, PFR Ventures alone invested €2.5B in VC funds, including Inovo VC, Movens Capital, Innovation Nest, and SMOK Ventures.

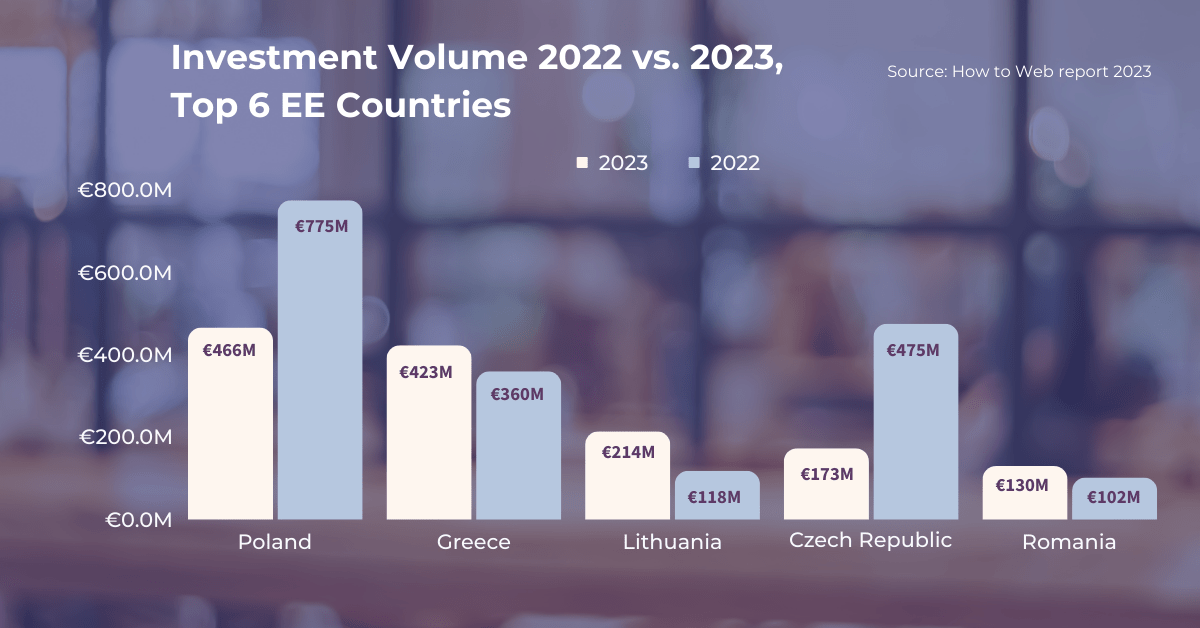

Over the past five years, Poland has seen a notable increase in the volume of venture capital deals, surpassing other CEE countries such as Bulgaria, Czech Republic, and Greece in overall investment amounts. Despite the shrink in 2023, Poland still stands out as the leader with the highest investment volume.

According to the latest Endeavour report on the Polish ecosystem, although local VC is still largely confined to seed and early stage capital, the market developed rapidly. This new capital unlocked a wave of specialized tech companies that grew fast after the injection of seed and series A rounds.

In Poland, there has been a notable rise in collaboration between domestic VCs and international investors in recent years. Co-investments in 2022 made up 45% of the total transaction value, a substantial increase from 21% recorded in the previous year.

The centralized approach of the ecosystem has been noted as a current weakness, due the limited influx of private capital from investors. However, the past two years indicate a positive shift as Polish venture capitalists are increasingly raising larger amounts of private capital and participating in higher rounds of co-investment.

“The Polish startup ecosystem is currently at a critical juncture. It has a lot of potential and innovation, yet it stands at a point where greater integration with the global entrepreneurial community could be immensely beneficial. This phase requires not just local support but also an openness to global perspectives and practices,” shared Wiktor Schmidt, co-founder of Netguru and Chair of Endeavour Poland.

Nurturing Tech Talent and Bridging Gaps

- Universities play an important role in the Polish tech ecosystem, especially in training tech talent, but more could be done to foster collaboration with tech founders.

- Technology incubators are one of the older forms of startup support in Poland. They provide various services including premises for business activity, common areas for networking, office support services, accounting services, business counseling, training and information services, assistance accessing capital and help with technology transfer.

- The country is home to more than 400 R&D centers. These include big industry names such as Google, Siemens, Microsoft, Samsung, and Amazon.

- Poland is one of the CEE countries with the highest number of unicorns, with startups such as Eleven Labs, Allegro, InPost Group, CD Projekt, Pracuj Group, and Techland. DocPlanner, a healthcare booking platform, has become the first Polish unicorn in 2021. Next in line are companies, currently considered soonicors, such as Booksy, DemoBoost and Mindgram.