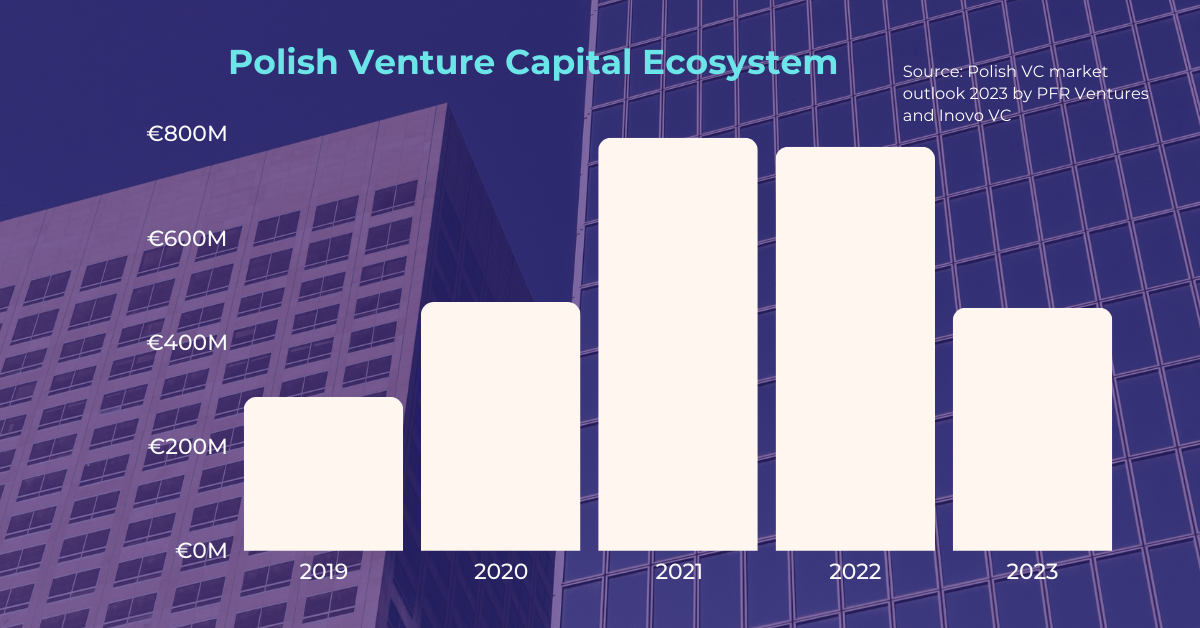

The Polish startup ecosystem is one of the leading hubs for innovation and entrepreneurship in the CEE region with over 3K startups, and an increasing number of VC firms, currently with 210 active ones.

PFR Ventures, the largest fund investor in the CEE region, recently published a report, together with Inovo VC, a seed-stage VC focused on CEE startups, summarizing transactions on the Polish VC market in 2023.

Top 5 insights into the Polish VC Landscape in 2023

- The value of the market decreased, compared to 2022

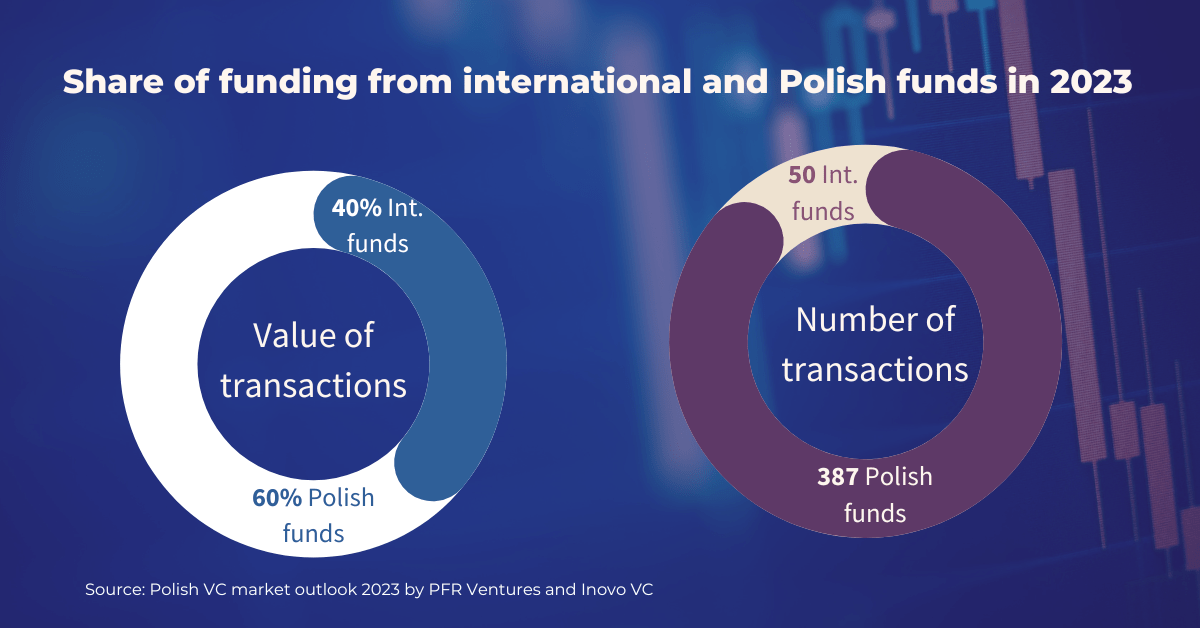

In 2023, €466M flowed through the Polish VC market. This is the total value of capital invested by Polish and foreign funds in 438 deals in 399 domestic innovative companies. Comparing 2023 to 2022, the value of the market decreased by 42%.

“In the face of the global crisis, VC funds, especially those investing in growth-stage companies, have reduced activity. This has resulted in fewer large investments and lower company valuations. Hence the overall decrease in the value of investments in 2023. I expect the first half of 2024 to be a difficult period for the Polish market”, commented Aleksander Mokrzycki, Vice-President of the Board at PFR Ventures. On the other hand, he predicts that the picture will change in the sеcond half of the year, due to the inflow of FENG (Thе European Funds for a Modern Economy) funds.

137 out of the 438 deals were investments involving PFR Ventures funds, contributing around 25% of the funding to innovative enterprises. Additionally, the funds of the National Centre for Research and Development (NCBR) also play an important role in the seed segment, with 148 deals accounting for 9% of the value.

- A new Polish Unicorn emerged with just stepping in 2024

Of all the investments, the ElevenLabs round was the most significant. The company raised around €74M and achieved unicorn status, meaning that its market valuation exceeded €1B. Among the first investors in ElevenLabs was a large group of business angels with links to Poland. However, the most recent transaction involved international funds such as Andreessen Horowitz and Sequoia Capital.

The report highlights Piotr Dąbkowski, Eleven Labs co-founder, researching the potential of transformer models, even before Chat GPT, which was crucial for the ecosystem at the time and led to the establishment of the company alongside Mateusz Staniszewski.

Karol Lasota, Principal at Inovo VC, notes: “The success the founders have achieved in such a short time is a remarkable inspiration for the entire startup ecosystem. This milestone has the potential to become a catalyst for the entire VC market.”

*An outlier, as definied by PFR Ventures, is a company that has raised ‘a megaround’ – transaction that exceeds 10% of the value of all investments in a given year. In 2023 that was ElevenLab’s record series B.

- The average value of a transaction decreased

Last year, there was a shift in the average value of transaction, from €1.4M in 2022 to €1M. Despite the number of investments remaining relatively stable compared to previous years, it’s evident that there has been a considerable decrease in the valuations of innovative companies. On the other hand, Piotr Marszałek, Investment Associate at PFR Ventures shares that “both average and median transaction values are likely to reach higher levels in the first half of 2024 than we have seen so far”.

The startup job market has also slowed down. Among the top 19 companies that secured the most venture capital funding from 2019 to 2023, 9 of them downsized their full-time workforce. At the same time, the total number of employees across all companies surveyed remained at a similar level.

- Seed investments are predominant on the Polish market

In 2023, seed investments continued to be predominant in the Polish market, comprising 380 transactions with a slight decrease of 7%, compared to the previous year. Series A rounds marked a notable increase of 27%, while Series B rounds experienced a substantial decrease, dropping by 70% compared to the previous period.

In the last 3 months of 2023, there were 14 recorded investments made by Polish funds abroad. The repeat of the previous quarter’s result shows that funds continue to actively seek attractive investments outside Poland.

“Co-investments by Polish and international funds reflect the amount of capital flowing into Polish startups at the stage of Series A+ rounds”, says Radosław Kuchar Investment Manager at PFR Ventures. “At the same time, the number of funds willing to invest in Series A+ rounds is growing in Poland. This trend could have a significant impact on the 2024 statistics. I expect to see a larger number of transactions by Polish funds with higher amounts”, he adds.

- Money from VC funds most often goes to companies in healthcare innovation

This is a trend that has continued over the last four years. In 2023, they accounted for 15.8% of all deals. With a share of more than 50%, SaaS (subscription-based model) remains the most popular business model.

Maciej Małysz, Partner at Inovo.VC, concludes that “with increasing competition and rapid technological advances, Polish early-stage funds need to be bolder. Simple strategies based on safe bets are no longer enough to develop our market and increase the share of later-stage rounds led by global VC/Growth funds. They are looking for ambitious projects with the potential to reach multi-billion dollar markets, led by founders with the right skills and vision.”