How to Web, a technology conference that brings together entrepreneurs, founders, and investors, launched their 2023 Venture in Eastern Europe report. It aims to support the investment community focused on Eastern Europe by providing insights into the shifting landscape of the ecosystem.

Started in 2021 as an extensive analysis of the venture deals involving Romanian startups, the report expanded to showcasing the region’s dynamic of the venture deals raised yearly by tech startups, from early-stage pre-seed and seed rounds to late-stage series, exits, and IPOs.

Here are The Recursive’s top takeaways from the report.

- Investment volume in Eastern Europe dropped 57% in line with the broader trend

In contrast to the more favorable conditions of 2021, 2022 marked the onset of challenges, continuing in 2023. How to Web reports that the investment volume dropped by 57% in 2023, compared to a year earlier, reaching worth of €1.85B in Eastern Europe.

This goes in line with the European-level dynamic. The State of European Tech report for 2023 by Atomico also highlights a shift in the European tech investment landscape. In 2023, total capital invested in European tech was projected to be around $45B, marking a significant decrease of approximately 45% from 2022’s total of $82B and a 55% decrease from the record-breaking year of 2021, when investments surpassed $100B for the first time.

On the other hand, looking specifically at Eastern Europe, PitchBook’s Hot or Not Report reveals a remarkable 378.8% increase in investment volume in 2023 (€1.85B) compared to 2020 (€388.3M). This data indicates a dynamic evolution in the European tech ecosystem, with fluctuations in investment levels reflecting broader market trends and correlations.

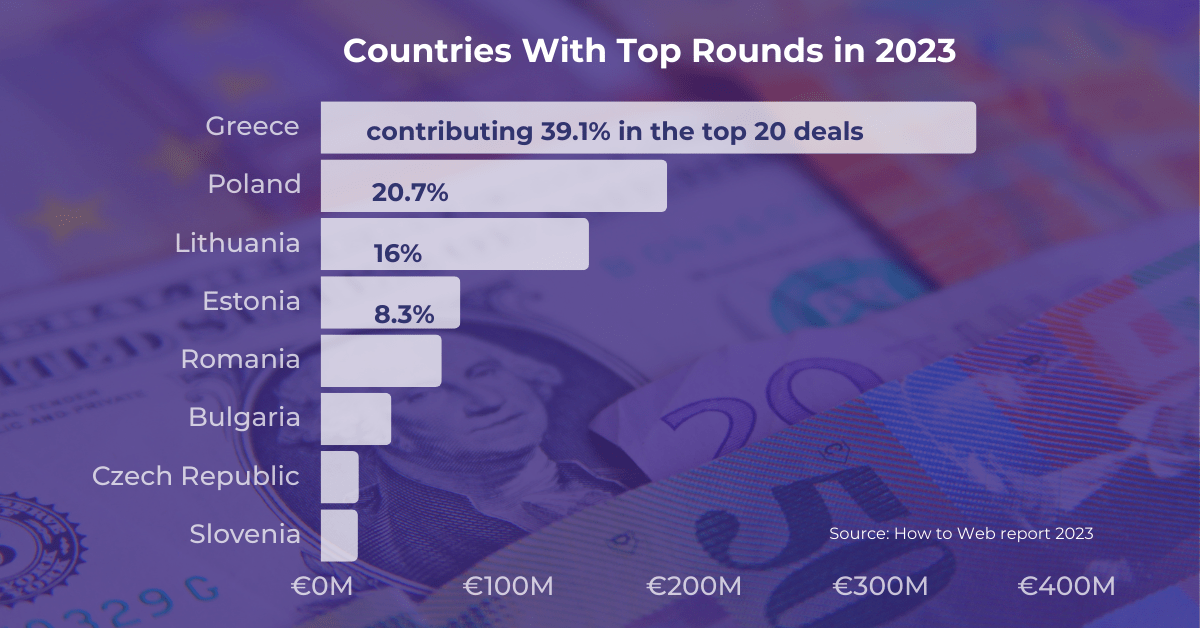

- 6 countries’ venture deals form 84% of the total investment volume, reaching €1.65B

Out of the 6 countries (Poland, Greece, Lithuania, Czech Republic, Estonia, and Romania) with investment volumes of more than €100M, Romania stands out as an unexpected new kid on the block. According to How to Web’s data, Romanian venture deals rose by 27.4% from €101.7M in 2022 to €129.6M in 2023, with 2023 marking the third consecutive year of investment volumes surpassing that milestone.

How to Web also used the data from PFR Ventures’ and Inovo.vc’s 2023 report, the Polish venture deals took a 39.9% plunge from €775M in 2022 to €466M in 2023. Check the highlights from the report in one of our latest pieces here.

Investment volume went up in Greece and Lithuania as well, while Estonia probably took a hard hit, going down by 90.1% from €1.6B in 2022 to €158M in 2023.

In addition to the bigger picture, startups from Greece, Lithuania, Poland, Estonia, and Romania reached 76.4% of the investment volume of follow-on rounds. The resulting average of follow-on rounds reached €4.36M.

- Late-stage investments comprised over 75% of the total investment volume

In 2023, Eastern Europe experienced a rise in late-stage investments, with Series A and Series B rounds leading the way with a total of €428.2M and €830.9M, respectively. As the report highlights, this trend had its drawbacks, as pre-seed and seed stage investments ended only with €395.9 million.

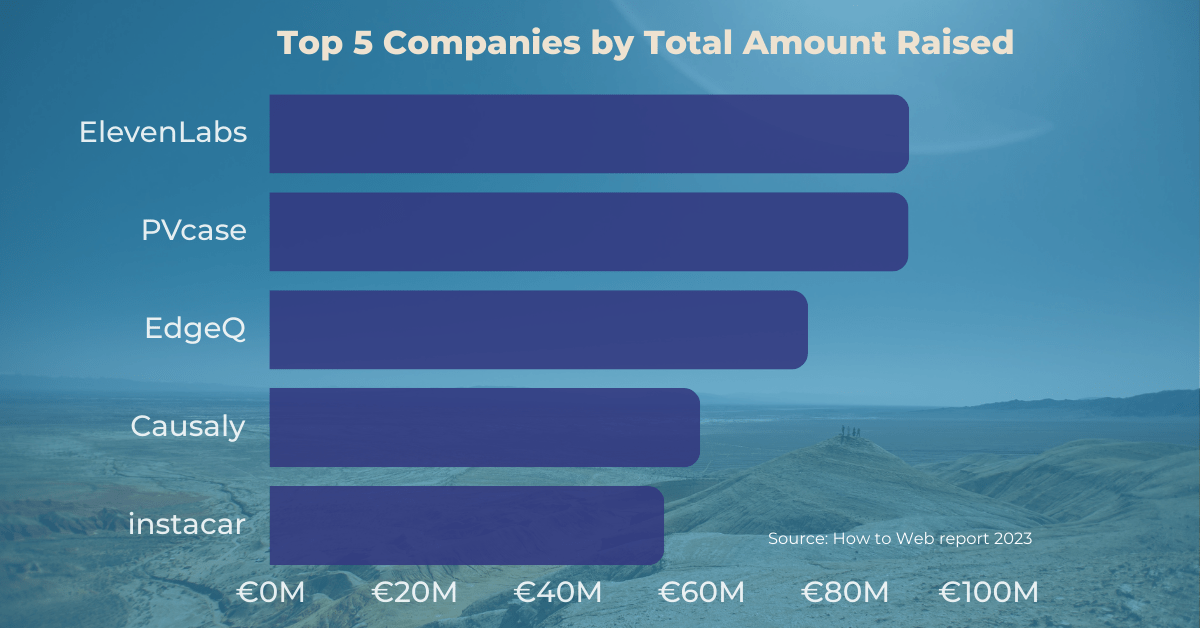

Companies that raised Series A rounds still tend to be rather well-baked and seen as the region’s most promising startups. Some examples are Poland’s ElevenLabs with its €17.1M round (leading them to their series B in early 2024), Bulgaria’s Dronamics with its €36M round, Romania’s FlowX.AI €35M round (that surpassed even UiPath’ Series A) and more.

Considering Series B rounds, the majority of investments come from the ecosystems of Greece, Poland, Lithuania, and Estonia, with examples such as Funderbeam, Causaly, PVcase, and more.

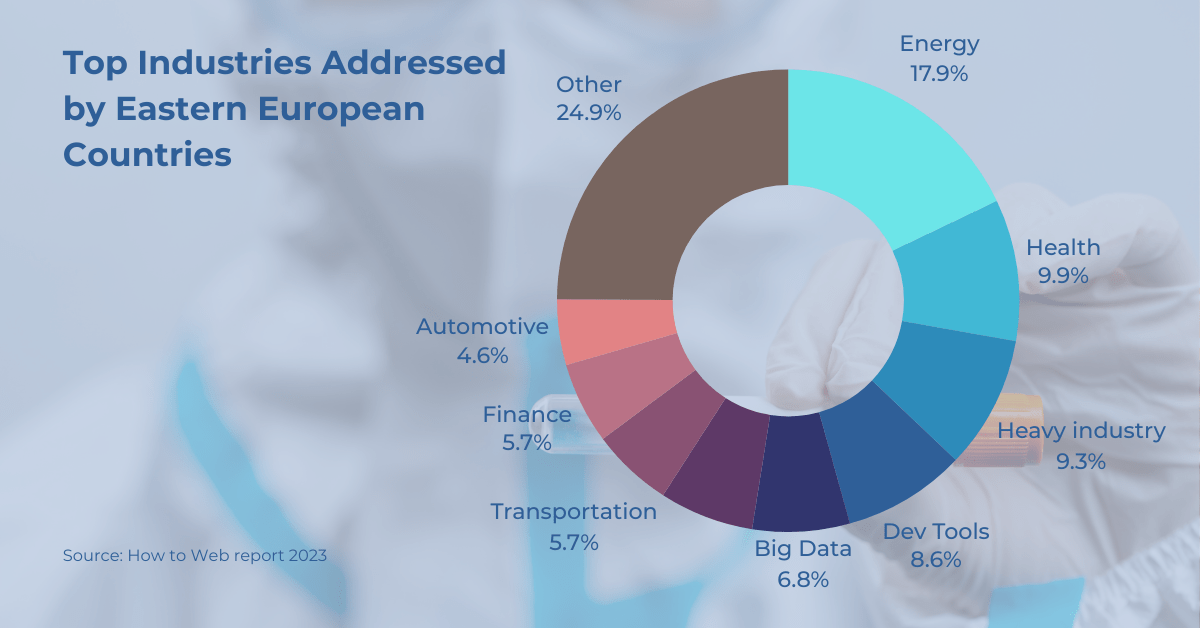

The energy sector emerges as a key industry, followed by health and heavy industry.