In the rapidly evolving world of health tech, 2023 stands as a pivotal year. A recent report by PwC underscores this sentiment, revealing that health services executives are at a significant juncture. They’re navigating the intricate task of reshaping patient experiences in the face of economic shifts.

The data suggests a monumental five-year, $1 trillion revenue transition away from traditional healthcare avenues. By the end of this decade, we’re poised to witness the birth of a new health ecosystem, driven by orchestrators, integrators, and tech-savvy platform players.

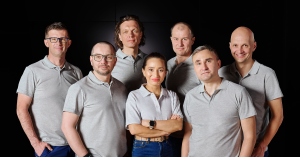

As we delve deeper into this transformative landscape, we’ve engaged with six leading VCs who are at the forefront of health tech investments in CEE. George Saliaris-Fasseas, Operating Partner at Big Pi Ventures, Kris Przybylak, Health Tech Investor at Inovo.vc, Johannes Blaschke, Principal at Calm/Storm, Marta Mrozowicz, Investor at Heal Capital, Bori Farkas-Fozy, Investor at UNIQA Ventures, and Jan Stanek, Founding Partner at Purple Ventures, have all shared their insights.

From the transformative potential of AI in healthcare to the revolutionary impact of weight loss innovations, these industry experts provide a comprehensive overview of the major health tech trends and their underlying subtrends. So, what are the pivotal movements in health tech that these VCs are closely watching? Read on to find out.

This article is the first part of a series that explores all things health tech through the eyes of VCs. Stay tuned for the next part where we’ll find out which health tech verticals attract the most investment at the moment.

1. AI in healthcare

Drug discovery and development & predictive solutions and diagnostics

George Saliaris-Fasseas believes we stand at a crucial juncture, on the brink of significant advancements in health technology, particularly in the realm of drug discovery.

“We are already witnessing the initial indications of Big Data and models being leveraged to unearth new treatments for previously incurable diseases. InSilico, based in Hong Kong, pioneered AI-discovered drugs, and we can anticipate many more entering the market in the years ahead”, Saliaris-Fasseas shares.

As part of Big Pi, he has invested in nine health tech startups, and he has observed that the ‘cycles’—such as sales, discovery, approval, and testing—are notably lengthier in this sector compared to others. “Data models and AI promise to accelerate this process, and leading U.S. tech giants like Microsoft and Google are already equipping the sector with the necessary tools”, Saliaris-Fasseas comments.

Bori Farkas-Fozy from UNIQA Ventures also believes that the current AI wave is here to stay and it will positively transform the healthcare status quo, making drug discovery and development easier. “The implications of AI for clinical trials, drug development, and real-world evidence (RWE) are substantial. However, these areas are somewhat less pertinent to our investment focus, which is exclusively centered on digital health”, she shares.

Within AI health tech trends, Bori Farkas-Fozy believes that predictive solutions will continue to be on the rise, along with AI-assisted diagnostics.

CEE companies in that vertical:

- Intelligencia.ai: Intelligencia.ai utilizes Artificial Intelligence for drug development risk assessment. Their platform specializes in evaluating clinical trial risks and deciphering related factors, aiming to connect innovation with risk reduction, expediting novel therapy delivery to patients. The platform offers data clarity and Machine Learning-driven predictions for critical decision-making. They collaborate with global pharmaceutical giants, as well as mid-size and smaller biotech firms. The company’s co-founders are Greek.

Co-pilots for medical and admin staff

Marta Mrozowicz from Heal Capital expects that, in the short term, the majority of innovation will be focused on the back office workflows. “Large language models (LLMs) can be used in all those tasks where a lot of information has to be reported, structured, and analyzed in the admin context – note taking, preventive screening and recall, prior authorization, medical code billing etc. I see a lot of potential for co-pilots for medical and admin staff helping them perform these tasks better and faster”, she comments.

Kris Przybylak from Inovo.VC is also optimistic about the potential applications of AI in back-office medical functions. According to him, there is a lot of repetitive/boring stuff like medical coding or other administrative tasks that can be automated in healthcare. “Back office functions are usually less risky to automate from the perspective of clinics/hospitals so this is a good entry point to start building trust and step by step automate more and more”, he says.

Przybylak is currently observing an increased interest in co-pilots – AI-assisted tools that can help medical professionals perform tasks more efficiently. Co-pilots can come in the form of a software that gives an initial diagnosis and suggests next steps based on patients’ symptoms and other inputs.

A recent study showed that ChatGPT outperforms physicians in high-quality, empathetic answers to patient questions. “Given that, it seems natural that at some point every GP should use some tool based on AI to provide care to patients with better accuracy and more empathy”, Przybylak says.

CEE companies in that vertical:

- Carebot: Carebot from the Czech Republic is an innovative computer-aided diagnostic tool. It identifies a patient’s medical observations, annotating them locally, thereby streamlining a doctor’s workflow and eradicating the potential for human errors.

2. Telehealth and digital therapeutics (DTx)

Hybrid healthcare clinics

Another major trend Kris Przybylak from Inovo.VC identifies is the hybrid healthcare clinics model, which is a combination of virtual and brick-and-mortar clinics for each part of the healthcare system.

“The companies that have already jumped on that trend are elevating traditional healthcare to new heights. They typically boast a stronger online presence than traditional clinics, provide superior customer service, and often develop their own technology infrastructure to optimize healthcare staff productivity. This approach not only boosts the satisfaction of medical professionals but also yields higher profit margins for these companies compared to the older generation of clinics”, Przybylak explains.

CEE companies in that vertical:

- Jutro Medical: Jutro Medical is a Polish startup that provides an innovative combination of clinics and a mobile app. Users of the app can get medical advice without leaving their home or schedule an appointment at the clinic.

Telemedicine

Jan Stanek from Purple Ventures identifies Telemedicine as one of the most promising health tech trends he sees emerging in the next year or two.

“The delivery of medical care over the internet has seen a surge in popularity due to its convenience, cost-effectiveness, and increasing availability of high-speed internet”, he comments.

Johannes Blaschke also thinks that telehealth and digital therapeutics (DTx) will be big in the next few years. “This category of digital health interventions or treatments will certainly continue to grow, offering convenient access to medical consultations and follow-ups remotely. I think we are only touching the surface of telehealth at this point. The same goes for DTx apps, which will gain recognition as legitimate treatment options for various conditions, providing evidence-based interventions”, he explains.

Another thing Blaschke puts a great deal of emphasis on is remote patient monitoring, which is all about using wearables, IoT, and other devices to monitor health conditions in real time.

Bori Farkas-Fozy from UNIQA Ventures expects that traditional telemedicine will transition into a hybrid care model, acknowledging that in-person visits may be necessary or preferred by patients. “Simultaneously, the tech health space will harness additional technology layers—such as AI, LLMs, and allocation algorithms—to take on an increasingly vital role in patient triage and support. Essentially, the aim of the industry is to reduce healthcare costs while enhancing patient satisfaction and expanding access to high-quality care”, she shares.

CEE companies in that vertical:

- Telemedi: Telemedi is a startup from Poland that’s on a mission to deliver a ready-to-use digital healthcare platform to businesses. The platform encompasses features such as telemedicine, automated triage, Artificial Intelligence, medical device monitoring, and seamless API integrations.

- Kardi AI: Kardi AI from the Czech Republic strives to provide affordable medical-grade cardiac home monitoring through AI-powered technology, achieving ECG-level performance from a cost-effective wearable device accessible to patients whenever required.

3. Precision and personalized medicine

Johannes Blaschke from Calm/Storm believes that the way we define digital health is by looking at the convergence of digital technologies with health, healthcare, living, and society to enhance the efficiency of healthcare delivery and make medicine more personalized and precise.

According to him, precision medicine is set to become (or to remain) a significant trend in health tech due to its personalized approach to treatment, tailoring medical decisions and interventions to individual genetic, environmental, and lifestyle factors.

“By analyzing vast datasets and employing advanced AI algorithms, precision medicine holds the promise of enhancing treatment effectiveness and minimizing adverse effects, marking a crucial advancement in patient care”, he explains.

George Saliaris-Fasseas from Big Pi Ventures also sees personalized medicine among the significant health tech trends emerging alongside a focus on prevention. According to him, as this field continues to progress, we can expect to see a multitude of solutions emerge. “However, it’s crucial to note that in the health tech sector, offering 100% service level agreements (SLAs) is imperative, as people’s lives are at stake, and the technology industry often falls short in this regard”, he clarifies.

CEE companies in that vertical:

- Powerful Medical: Born in Slovakia, Powerful Medical, along with its leading product, PMcardio, leverages artificial intelligence to enhance clinician capabilities in the precise diagnosis of cardiovascular diseases and the confident treatment of cardiac patients. PMcardio’s deep learning algorithms have undergone extensive training, analyzing a dataset of over one million ECG records, enabling the detection of 38 cardiac diagnoses from a single 12-lead ECG tracing.

4. Mental health tech

Jan Stanek from Purple Ventures believes that virtual reality therapy and other mental health technologies are among the biggest health tech trends that will continue to define the landscape in the next two years.

Kris Przybylak from Inovo.VC highlights software for mental health specialists as a major trend. He has observed that the best specialists are usually fully booked which makes it imperative to increase their capacity and share their knowledge with other specialists who are earlier in their career. “This kind of vertical software also enables creating a marketplace for mental health specialists in the future, and it might be better positioned to win this niche than startups that have a marketplace only (without any tools for specialists)”, he explains.

CEE companies in that vertical:

- Mentalyc Inc.: Mentalyc is a technology developed to support clinicians in reducing burnout and improving productivity. It aids in meeting reimbursement requirements, increasing revenue, and streamlining psychotherapy documentation. Mentalyc offers a time-saving potential of up to 30%, allowing clinicians to prioritize patient care. The company has a Bulgarian co-founder.

- VOS.Health: VOS from the Czech Republic specializes in mental health digitalization, serving over 3 million Gen Z and Millennials with an AI-driven well-being platform. VOS uses data such as weather, screen time, social media usage, and sleep patterns to help users identify patterns and triggers in their mental wellness journey.

- Upheal: Upheal is a Czech-US AI-assisted platform for mental health professionals with automated notes and analytics. The tool analyzes things that might be missed with the naked eye and gives a neutral second opinion from data points like speech cadence, talking ratio, and moments of silence, all in detailed session graphs.

5. Agetech

Johannes Blaschke from Calm/Storm believes that agetech will surely grow in relevance in the years to come, given the growing need for digital healthcare solutions tailored to the elderly population.

“With healthcare systems facing increased pressure and a demand for proactive approaches, there is a significant opportunity for health tech startups to develop solutions specifically designed for elderly users. These solutions could encompass technologies enabling voice-activated or gesture-based interactions, providing the elderly with ways to engage with their physical and mental well-being, and bridging the gap in digital healthcare access for this demographic”, he says.

6. Weight loss innovations

Kris Przybylak from Inovo.VC emphasizes the transformative potential of weight loss virtual clinics that combine behavioral change with drugs, such as Wegovy and Ozempic. He notes that while companies like Novo Nordisk manufacture these successful drugs, VCs in Europe, especially in the CEE region, rarely invest in drug manufacturers. Instead, the real potential lies in the next layer: companies that distribute the drug alongside their behavioral change programs, offering consultations with dieticians, coaches, and mental health specialists.

Marta Mrozowicz from Heal Capital echoes the significance of drugs like Wegovy in the weight loss sector.

“I’m also curious to see what will happen once Wegovy – the weight loss drug from Novo Nordisk – finally enters the European market. The new generation of weight loss drugs is transforming how we treat and think about obesity and they have been incredibly successful (all the celebrities that have suddenly become very skinny? That’s Ozempic or Wegovy). And a new trial has just demonstrated that these drugs can successfully reduce the risk of adverse cardiovascular events, which means they can be more widely prescribed. There will be a lot of money flowing into this space and potentially good business to be built around the demand for these drugs”, she shares

Returning to Przybylak’s insights about health tech trends, he mentions that while there are successful companies focusing solely on behavioral change, like Oviva, they often face challenges due to longer wait times for visible results, leading to patient drop-offs.

However, with GLP drugs (a class of medications used to treat type 2 diabetes and obesity), patients can witness rapid weight loss, motivating them to adopt and maintain healthier habits. “Obesity is a significant concern for many countries, leading to more severe diseases. So this is definitely a space where I’ve seen many good teams emerging in the recent 12-24 months”, Przybylak adds.

CEE companies in that vertical:

- Holi health: Holi is a fully digital metabolic health clinic in Poland. It offers a holistic approach to the treatment of obesity and overweight using innovative therapies. Their methodology was developed by a team of dietitians, psycho-dietitians, and doctors who understand that it is not enough to just eat less and move more.

- Ate Care: Ate Care offers a premium member’s only weight care personal programs that combine data science, AI, and longevity care to help busy professionals safely lose weight. The startup has a Polish founder.