A couple of months after How to Web released a thorough report on the state of the Romanian venture capital for 2020, the Romanian conference organizer partnered with the Bulgarian Private Equity and Venture Capital Association (BVCA) to conduct a comparative analysis on the investment activity in the two neighboring SEE countries.

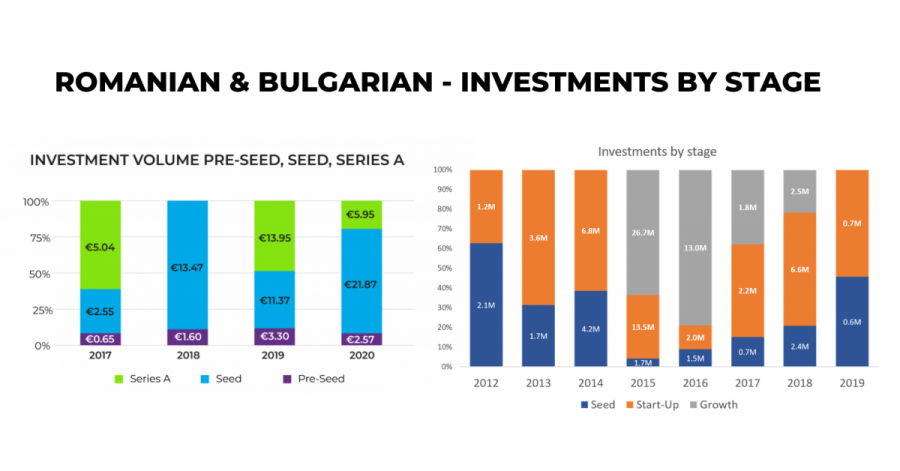

As the graph below shows, although the two ecosystems are not in the same stages of development in terms of VC activity, in 2020 Bulgaria and Romania achieved a similar steady growth in the number and value of investments, closed the same number of funding deals (59), and were not negatively affected by the implications of the Covid-19 pandemic. Among the common traits between the investment activities in the two ecosystems for 2020, the report also points at one major difference, which is that Romanian VCs have invested more in Series A companies, while Bulgarian VCs have put relatively more resources into pre-seed investment rounds.

Growth in pandemic times

The latest data for 2020 that BVCA gathered from General and Limited Partners points at 56 VC and private equity and 3 business angel investments with a combined value of €29.4M while the Romanian ecosystem saw the completion of 59 VC deals with a slightly higher value of €30.4M. Looking back in the years, the report uncovers that the steady increase in the number and value of the investment has become a trend in the two VC ecosystems – less than 10 years ago Bulgaria, for example, counted only 20 transactions while in 2020 they have increased to 286. The Chairman of BVCA Association Evgeny Angelov explains this acceleration with the fact that throughout the years the mix of funds targeting Bulgarian startups and SMEs have become more diverse and this was the reason why Sofia was selected as one of the 10 best cities worldwide to found a new company. Maria Marinova, who is the Executive Director at BVCA, notes that even though in 2020 some funds had just begun their investment operations, the already established and more mature funds fundraised actively, which was why local startups concluded almost 60 rounds.

Bulgarian funds for Romanian innovation but not the other way around

The co-investments and collaboration activities between the two neighboring SEE countries are bringing value-added to both ecosystems by benefiting Bulgarian funds with available capital and Romanian startups with innovative and promising solutions. The report highlights the co-investment of the Bulgarian early-stage LAUCHHub Ventures in FintechOS and its investment in the Bulgarian startups HelloHungry and Ucha.se which enables their expansion to the Romanian market. Other cross-country investment collaborations were done by the pre-seed and seed VC Eleven Ventures, which earlier this year closed the first out of several SEE-oriented investment rounders with SuperOkay and financed the expansion of the Bulgarian fintech insurance startup Boleron to the Romanian market.

Even though Bulgarian capital has supported Romanian startups for more than 5 years, as of now there are zero transactions of Romanian capital flowing to finance Bulgarian innovations. With the launch of the early-stage Catalyst, Romania II at the end of 2020 things might change, as the fund has a more regional focus and might show interest in investing in Bulgarian startups. The president of the Romanian business angels network TechAngels Malin-Iulian Stefanescu explains this phenomenon with the fact that venture capital firms in Bulgaria began emerging earlier than in Romania and that now there are more Romanian startups than Bulgarian ones, so the flow of cross-country investment is a win-win situation for both sides.

Another perspective on the investment asymmetry between the two countries was shared by the Partner of Early Game Ventures Dan Calugareanu according to whom Bulgaria’s VC ecosystem is more advanced and has the capacity to channel some funds beyond the local environment. Making a reference to EarlyGame Ventures, which is in its first round of funding and has a geographical delimitation, he explains why Romanian VCs are still focusing primarily on the local market.