Software as a Service (SaaS) is experiencing a boom. According to Gartner’s 2021 Emerging Technology Product Leader Survey, almost half (48%) of the technology product leaders select cloud as one of their top three areas of their emerging technology investment.

Recognized not only among companies but also investors, the SaaS business models are known to be “sustainable in different business cycles”, explains the increased popularity Aleksandar Terziyski, Partner at New Vision 3 Venture Fund.

The Recursive met up with Aleksandar to learn about the latest SaaS industry updates on the regional and global levels. In the interview, we talked about how to grab the attention of an investor like NV3, what it takes to prove your growth potential as a startup, and the typical mistakes SaaS founders and companies make at the beginning of their journey.

The Recursive: What’s your experience with SaaS business models?

Aleksandar Terziyski: My experience with SaaS business models evolved with time. The interest started probably around 2013-14 back when I was working as a management consultant. I first read about the Cloud Economy and the SaaS business models in one of the magazine issues covered by my company at the time. I didn’t pay too much attention to it then, but later in 2016-2017, when I entered the VC world, I started getting the impression that more and more market leaders use this type of model. I started getting to know and working with startups that use SaaS. Content Insights was one of the first companies that I participated in the investment of in 2016, conducting my first due diligence in this sphere.

Overall, throughout the evolution of SaaS, that in my opinion had experienced many changes in the next 7-8 years, I have done the research and worked with different portfolio companies, like CloudCart, Releva, and Smartocto that eventually acquired Content Insights, as well as some public companies that later on migrated from the SaaS business model to a PaaS (platform as a service) model.

What are the metrics you’re usually looking for in SaaS companies?

Aleksandar: As a VC, we are looking into companies that are in their growth stage and have the potential for future scaling.

“Generally, what’s good about the SaaS model is that it has proved to be sustainable in different business cycles, as well as to be a good basis for exponential growth and scaling.”

When we talk about growth specifically, there are three things I personally look for – growth acceleration, growth endurance, and retention and expansion of/within existing clients.

In different stages of the company, there is a different spin/weight to each of the metrics but generally, the main ones are gross margin, retention rate, sales and marketing expenses that come from customer acquisition cost, and others.

Any specific thresholds a company needs to meet in order to be considered by NV3?

Aleksandar: There is no specific minimum threshold that we are looking for. We do not ask for X amount of revenue specifically, however, we do need to see proof of acceleration of some sort. Especially in the very early stage, we’d like to see double and triple digits revenue growth. Once passed, we can go into a more in-depth analysis where we look into customer lifetime value, customer acquisition costs, expansion potential, pricing, and business model.

At the end of the day, the most important indicator is “customers”. There are two aspects that come with it. First, is your ability to show that you have managed to grow the amount your existing clients paid in the previous year by at least 20% in the current year. This is called a dollar-based net retention or net expansion rate. Another aspect is the ability to grow your total client base and add new customers at a good rate, ideally showing higher average revenue per new customer or user. Once these components are present, there is no need to convince someone how amazing your product is because the numbers will show it for you.

How do you assess whether a SaaS company has enough growth potential and whether the market and the problem being solved are big enough?

Aleksandar: When it comes to competitive advantage, the goal is to be able to evaluate whether a company can continue to innovate and grow long-term. It is one thing to demonstrate your competitive advantage at the beginning of your journey, and another is to be able to do it for longer periods.

In the very early stages, it is very important to see how the company’s growth accelerates over time. If a company does not stop doubling its revenue over time, this is a sign that you have found the market in which you are able to grow very fast, i.e. it is big enough.

Another thing is growth endurance and expansion potential which is especially important to consider from the market’s point of view. Very often companies, especially SaaS companies with one product, show great numbers in the beginning, but when they get closer to their 3rd-5th year of existence they reach their peak growth acceleration and from that point on the growth becomes smaller, and smaller.

It is crucial for a company to show its expansion potential, expanding its TAM (total addressable market) by, let’s say, being able to add a second, or third product to its portfolio, thus, compensating for the growth stagnation of the first one. This is one of the keys to evaluating the growth cycle of a company and the size of the market they operate in.

Growing within the existing clients by introducing more products has been a very big marker among SaaS companies in the past 4-5 years. The true market leaders in specific verticals who started with one product have shown to offer on average around 7-9 products to one client eventually.

You also consider their roadmap, of course, and how they envision their growth, where they see themselves in the next 3 years, and so on because if they do not have it in mind now the ambition won’t simply come to them later.

Can you give us an example of how a good go-to-market strategy for SaaS is built?

Aleksandar: Generally, there is no specific answer for the ideal go-to-market strategy that would fit all but a good start at the beginning of one’s journey would be the metrics called product-led growth. In a relatively early stage of the company’s growth, it is important to build this demand generation which comes from the product itself. You usually go through new and existing channels, build SEO optimization, paid search, make events, webinars, and figure out where you work best and how you can optimize them.

Eventually, you are aiming at building your go-to-market strategy where your sales and marketing are in strong alignment. This way you can extract the result measurement of all the channels you use (demand generation), as well as the measurement of optimization where you can see what works best for you depending on your specialization. Once this is achieved, you can move on to specializing in the sales process, your pricing strategy, ecosystem build-out approach, and others. But these last things are already signs of operational scaling which you do later in stages.

What are the usual mistakes you’ve seen SaaS companies in our region make on their growth journey? How do they get resolved?

Aleksandar: One of the things we experience especially among local companies is that some do not take into account the scaling of organizational processes. If you have a great product and this product generates high demand, in the beginning, you do get to some level on your own but later, when introducing different channels, you need to make sure the system and processes are set up and ready for scaling. Many companies fail at this stage as they do not have alignment between departments. It is usually resolved by introducing new people to the team with bigger experience or exploring best practices from successful companies.

Another mistake is adopting complicated pricing strategies or structures where customers often get lost in figuring out the value of the offering or when SaaS companies when migrating over to a new pricing strategy, do not realize that it does not fit clients’ purposes. Here it is important, first, to know your product well and where it is going, and, second, to know your customers and the customer segmentation, including getting to know their business models. The key is to not overcomplicate the structure of pricing, so the clients can orient themselves with what they pay for and how to pay for it.

Do you see any emerging trends in the SaaS space globally?

Aleksandar: In my opinion, vertical SaaS is something where the industry is going in the next 2-5 years because, on the one hand, more and more often data distribution allows players to specialize vertically within a specific industry level and offer new databases and better solutions. On the other hand, cloud adoption on the industry level continues to rise as well and this allows vertical SaaS businesses to grow exponentially.

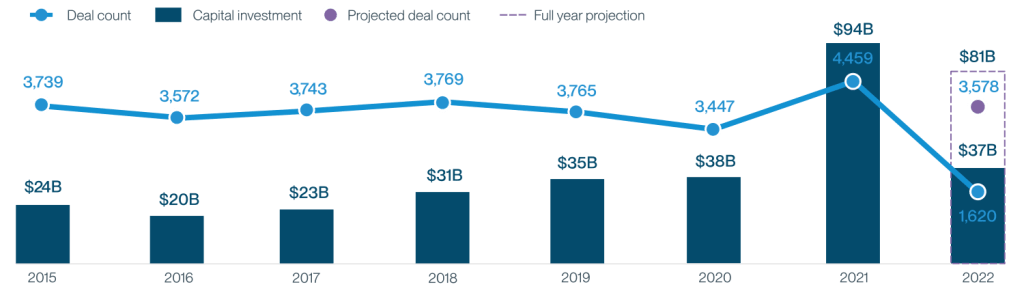

Another trend we have seen so far, which is macro-driven, is excessively high burn rates. As companies cannot survive without financing, this should change the way they specialize in a specific industry and become more cost-effective, which again favors transition towards vertical SaaS. According to publicly available data about SaaS companies in the past years, in the beginning, most used the motto of “growth at any cost”. Once this approach stopped working, however, only a part of these companies managed to turn to a different model, which proved the others to be capital inefficient.

Some of the best SaaS companies in the past 6-8 months did the following. In order to finance their growth, those that were at huge losses and with excessive burn rates, tried to stay at a breakeven. Out of those who made it through and quickly managed to move to breakeven, most kept the same growth rate (at a cost of no immediate further acceleration), which for a big company with a turnover of over 1 billion is pretty impressive. This is only from publicly available data but I assume similar happened to smaller-sized ventures too.