HR Capital, a Bulgarian investment company founded by serial entrepreneur, angel and current CEO of Darik Radio Hristo Hristov, plans to raise over €750K on BEAM, the growth market of the Bulgarian Stock Exchange (BSE). The IPO auction date is planned for December 15th and in case of oversubscription, there will be an option for additional ~€500K to be distributed among investors.

Mostly simply put, HR Capital bets mostly on the rise and success of the digital economy in Bulgaria. Its portfolio currently consists of fast-growing tech companies like eBag and Healee as well as three startup investment funds – Eleven 2.0 (with likely future unicorns Payhawk and Gtmhub and the noteworthy exit of SMSBump); Eleven’s new €60M vehicle; and the global Endeavor Catalyst, which already has 29 unicorn companies with valuation of over $1B in its own portfolio.

The Recursive is also the first to learn and report that HR Capital has made a direct investment in the recent $24M Series A round of Greek fintech startup Plum. With an HQ in London, the money management platform is on course to reach 2.5 million customers across Europe and has enjoyed a 189% increase in YoY revenue.

The funds raised during the IPO will be used for investments in portfolio businesses, more innovative companies, and established funds.

Going outside the startup bubble

But why is HR Capital doing an IPO in the first place (along with all the related bureaucracy)? Especially given that Hristov could probably raise money from just a few people in the startup community without too much hassle.

“Right now the success of innovative companies is shared among one very small group of people in Bulgaria. Those outside the bubble of the local entrepreneurial ecosystem don’t have access to startups. The big opportunities for digital transformation also open great opportunities for investments in tech. I want to share this success and involve a bigger part of the public,” he explains for The Recursive.

Hristov highlights that his goal is not only to successfully raise the money but also to attract as many individual investors as possible (and this is one of the reasons for the pro rate mechanism). People who want to generate returns from the few thousands of euros they’ve put aside and would otherwise be likely to keep in a bank deposit.

The portfolio of HR Capital

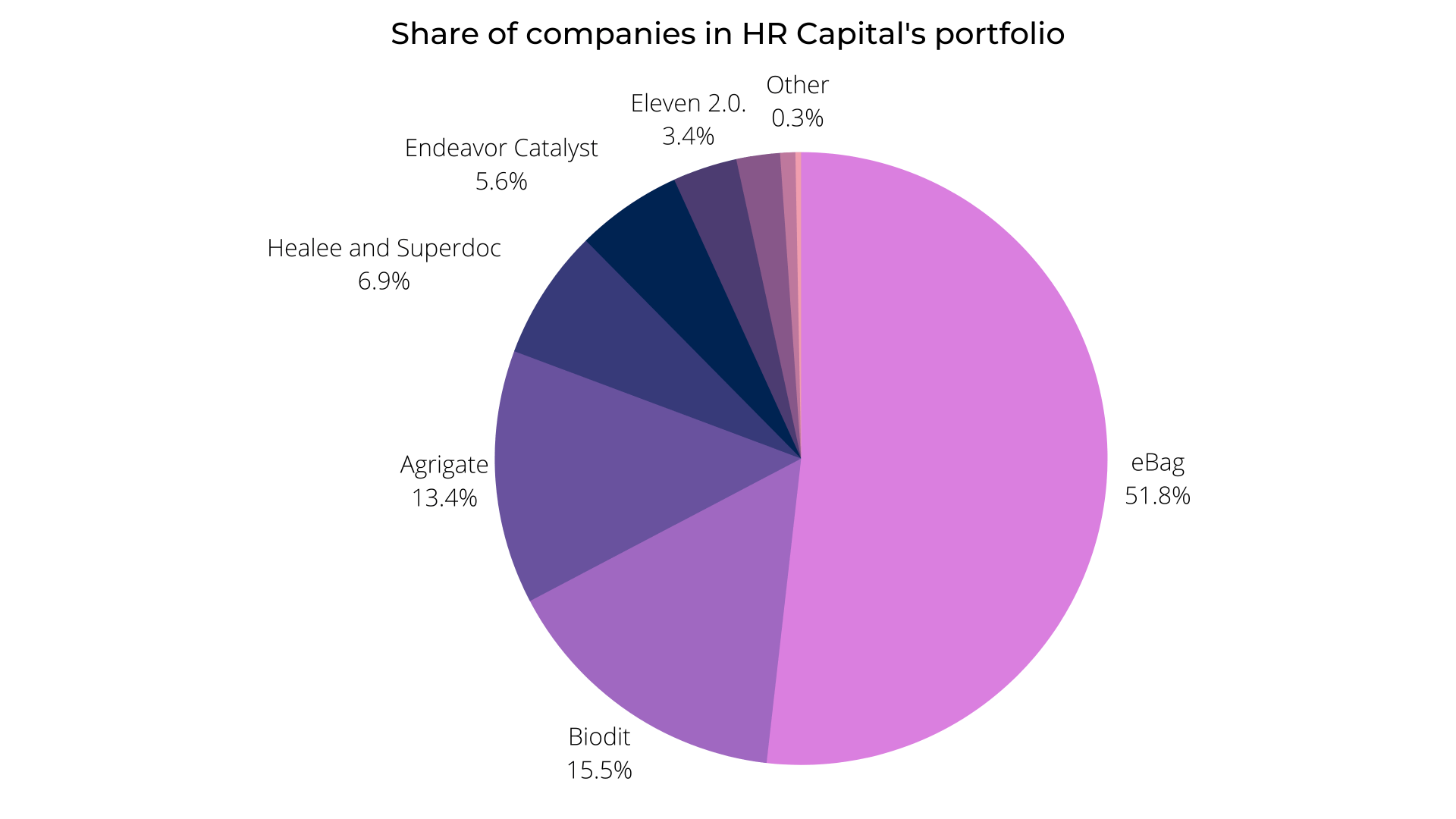

In the last 4 years, HR Capital has managed to grow its invested capital more than 3.5 times. Portfolio startups feature some of the leading for the Bulgarian market names in industries like e-commerce (eBag), telemedicine (Healee), smart farming (Ondo), and biometric security (Biodit). At the same time, with investments in funds and dividend producing companies, HR Capital aims to bring a much bigger diversification and minimize the risks.

For all details and breakdown of the performance of the separate companies, check the IPO presentation of HR Capital.

The biggest risk (and opportunity)

The biggest risk for the success of HR Capital’s portfolio is related to its big exposure to eBag (currently 51.8%).

Provided nothing goes wrong with the company or the market, eBag also seems to provide the biggest opportunity. The Bulgarian online supermarket has been growing extremely fast in the past few years, reaching 70% market share and €12M in revenue for 2020. The company expects to increase its income to more than €50M in 2022.

In addition, Czech e-grocery unicorn Rohlik has invested €1M in eBag so far, at a €17.8M valuation and has the option to eventually buy its Bulgarian counterpart.

However, it remains to be seen whether eBag will be able to hold its leadership position and continue to grow as fast while maintaining an excellent level of customer service. There is still a big market to be captured – according to a 2021 research survey with 1007 respondents, 56% of Bulgarians have never shopped online.

In theory, eBag’s relative weight in HR Capital’s portfolio should be lowered, as the investment company backs more startups. Yet, if eBag continues to grow as fast, its valuation will also increase, so there will likely be constant ups and downs in the digital supermarket’s share in the overall portfolio.

The outlook for the future

HR Capital looks in a good position to discover and attract the most promising tech companies in Bulgaria. First of all, Hristov’s key role in the local startup ecosystem gives him good visibility to emerging opportunities (he’s also in the board of directors at Endeavor Bulgaria, part of the advisory board at BESCO – the Bulgarian startup association and a mentor at Founder Institute – one of the leading pre-seed accelerators in the country). Then, thanks to its wide media network and expertise, HR Capital can also help portfolio companies with the reach of bigger audiences, marketing and sales, which is a good selling point for the investment company.

Hristov says that the listing on the BEAM market is just the first step and provided the team is successful in building its track record, it’s likely they will also pursue an IPO on the main market of the Bulgarian Stock Exchange.

Active capital markets are very important for any developed startup ecosystem. HR Capital’s is the 7th IPO on the BEAM market for 2021. However, the main segment of the stock exchange still hasn’t seen too many tech companies (with a few exceptions like Telelink and Allterco). And the BEAM market is still limited to just €3M of capital that can be raised.

*Those who wish to participate in this initial public offering, should submit an order to subscribe for shares no later than the end of the call phase of the IPO auction (scheduled for 15.12.2021). This can be done via the investment broker Karoll – remotely or in one of their offices.

You may also read:

What opportunities for fundraising on the public market do SEE founders have?