SeedBlink, Europe’s tech-focused venture investment and equity management platform, recently marked down the most active year of activity in 2023 with 53 deals across 20 diffеrеnt vеrticals raised by CEE companies, including Dronamics, Alcatraz AI, Swipe, and others. Sееdblink also rеports €815M in asset ownership and €342M in startup investing mobilized for over 250 companies from 15 countries since it has been active.

SeedBlink was established at the beginning of 2020 and was the first crowd-investing platform on CEE. The democratization of investing in early-stage startups has become accessible to a broader audience via a range of products, financial services, and networks.

In 2024, some of their core goals include plans to expand investment opportunities, including the potential for co-investing in mature companies, developing the secondary market with convertible instruments, and a simplified investment process. A curious fact is that SeedBlink allows individual invеstors to enter with as little as €2,5K.

Delving into the ecosystems’ evolving trends and opportunities, we have prepared a visual overview, drawing insights from tech startups and their investors’ profile.

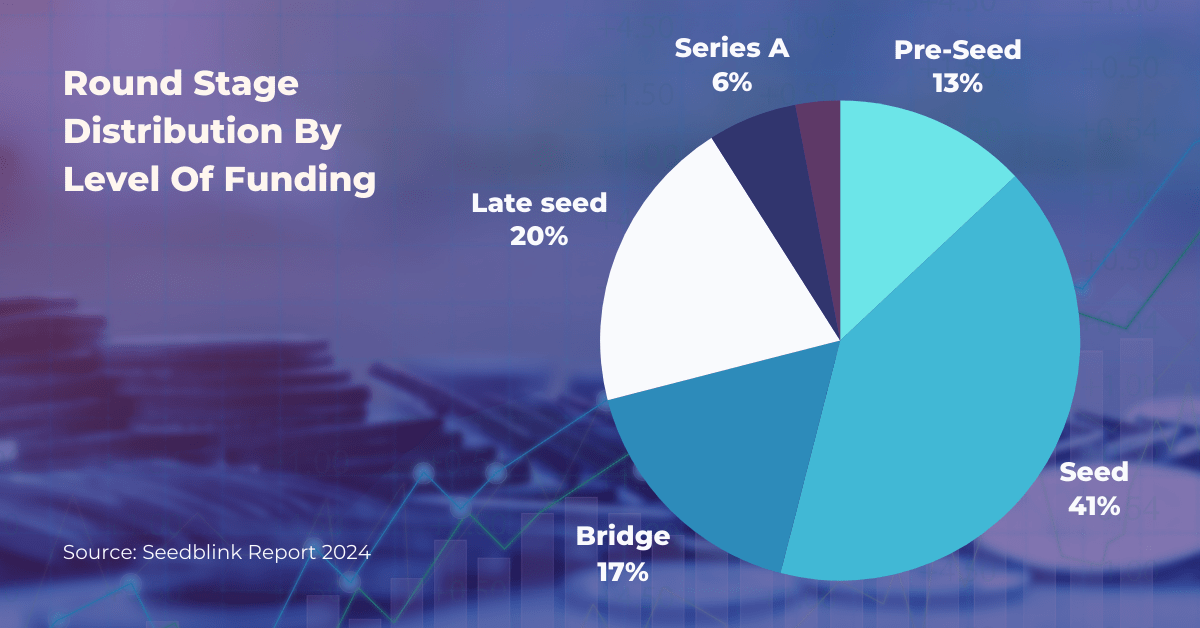

The Largest Share Of Rounds Is For Seed Funding

The platform currently provides three main categories of investment rounds, including VC-backed rounds, Syndicates, and Community Stars, catering to startups ranging from pre-seed to Series B.

Their investment amounts range from €50K to €2M. As of 2023, the top five funded sectors, based on the total amount mobilized, are Enterprise SaaS, AI/ML, FinTech, Marketplace, and MedTech.

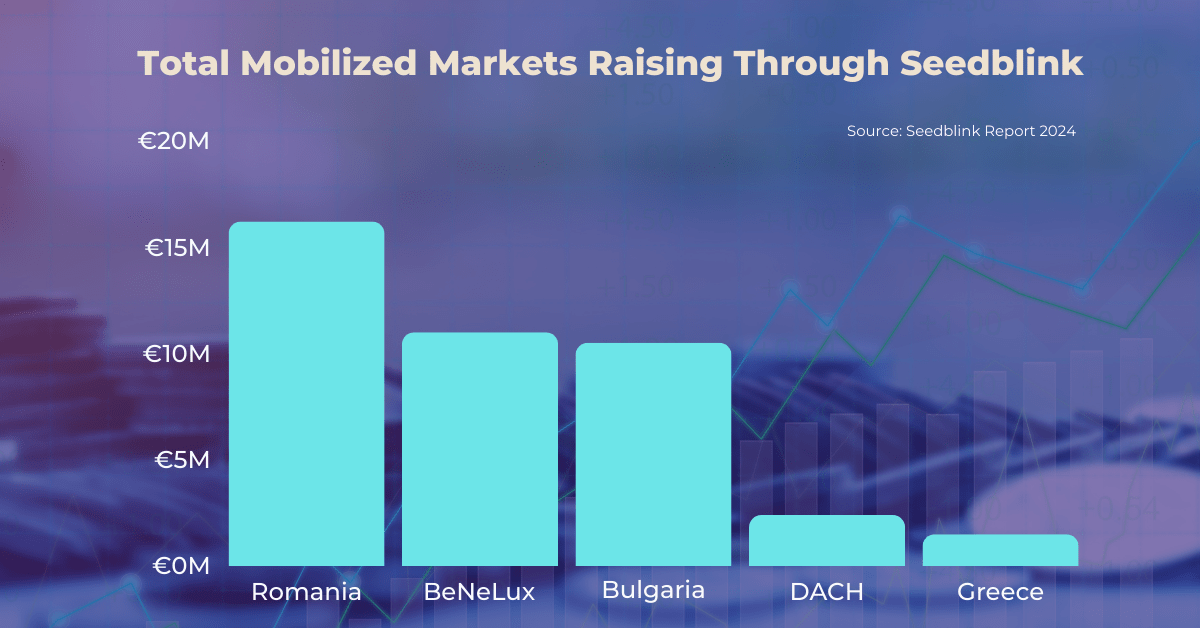

Romania Is The Top Mobilized Market

Romania secured an overall of €2M through SeedBlink only, while the BeNeLux region takes the second place, reaching €670K. Bulgaria and Greece also managed to raise substantial amounts through the platform. Moreover, one of the Bulgarian rounds attracted the largest individual investment in SeedBlink’s history with the amount of €500K.

As key insights from the Romanian market, SeedBlink shares that investing in startups is attractive to retail investors, as well as the need to make investment decisions deal-by-deal and to create diversified portfolios.

v

v

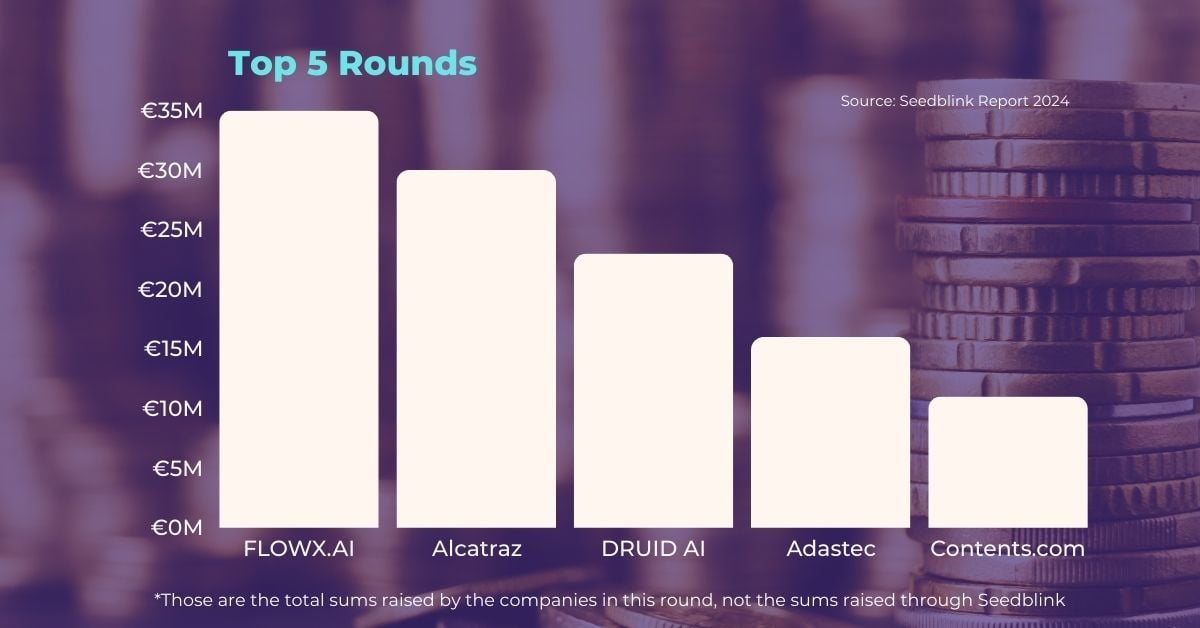

Flowx.AI Is The Leading Company, Raising Through Seedblink

More than 50 deals were raised through SeedBlink for 2023, with 53 newly funded companies and 6 follow-on rounds, including companies as FLOWX.AI, Dronamics, and Alcatraz AI, across 20 different tech verticals. Moreover, two financing rounds secured over €1.5M each in funding.

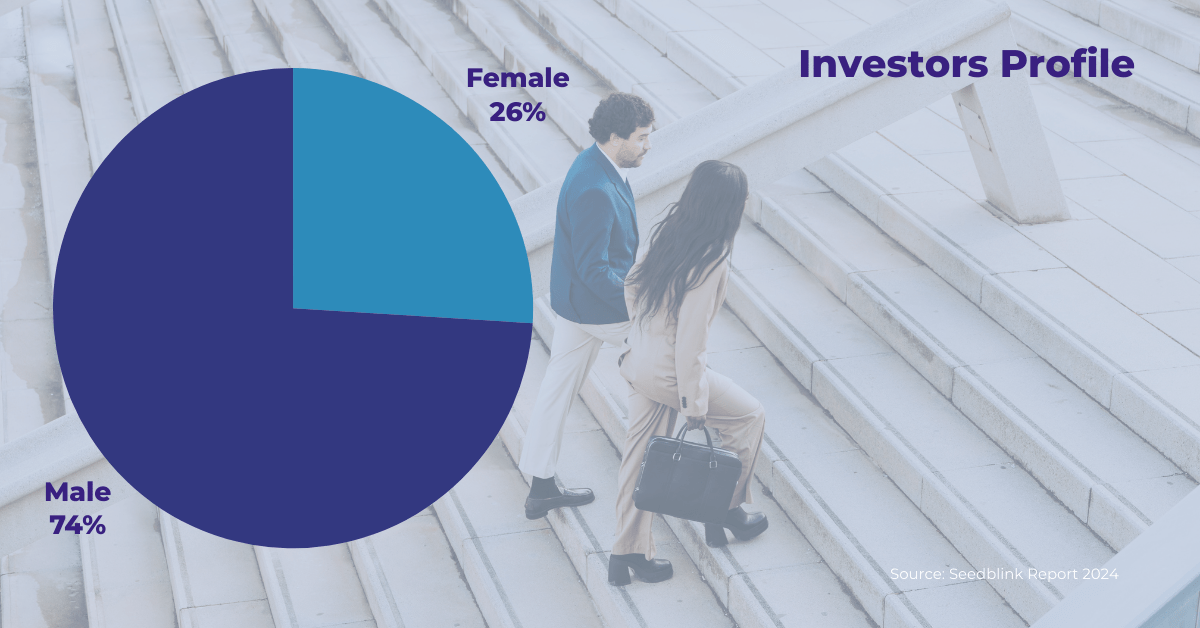

Community Of Investors

47,5% of active investors made more than one investment through SeedBlink, while up to 8% of them had financed more than 10 companies and diversified their portfolios.

In terms of their profile, male investors are surpassing female ones. Despite that, there has been a noticeable rise in the number of women investors over the past five years.

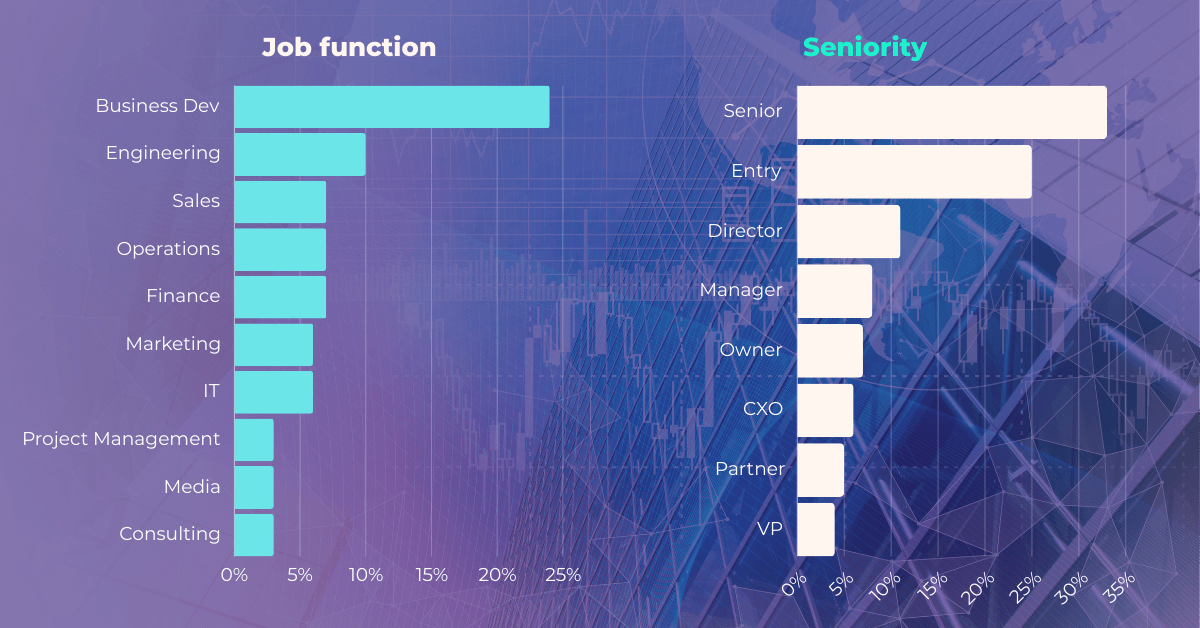

Business developers and engineers are forming the core of the active investors in Seedblink, while sales, operations, and marketing have similar shares.

Average Investment on European Level is €5,6K

The largest investor portfolio value on SeedBlink is over €900K with 49 investments, the average being €6,2K for a retail investor and €44K for a sophisticated investor with 25% of all portfolios including 5 or more companies.