Search for...

It’s no secret that the pandemic has reshaped the way we think about work. Digitalization, better access to the Internet, and technology overall allowed us to perceive online side gigs as one of the sound forms of income long before COVID-19, but it was the lockdown that created an enormous amount of work opportunities outside of the traditional office environment, and even independent of a particular company.

In the second quarter of 2020, Freelancer.com reported a 25% increase in job listings compared to the previous year. Today, the global freelance workforce reaches 1.2 billion people, around 22 million of which are in the European Union. If this number seems surprisingly big to you, there are indeed some statistics (like the EU) that take into account not only the gig-economy workers but also doctors, lawyers, farmers, and other manual laborers.

Nevertheless, popular gig websites, like Upwork, for example, do show impressive numbers. According to its recent study, 36% of the total US workforce does some sort of freelance work on a regular basis and the number is expected to grow even further by approximately 14% in the next 6 years

Following the fast-rising global employment trends, for some people independent freelance might sound good from a perspective but not as good in reality. One of the very first things people at the start of their journey are concerned about is how to get paid. The headlines like “freelancers wait three times longer to get paid than full-time workers” make it even scarier to take action towards independent work.

So what can the bravest of the freelancers and the hiring companies use as a solution for payments?

Flexible hours and location-free lifestyle seem appealing to many people. The generation that is more likely to choose freelancing for living than others is Gen Z. The youngest in the workforce seem to prefer non-traditional ways of working to 9 to 5 roles with freedom and flexibility as their main priority.

Another great benefit of freelancing is having multiple streams of revenue. Having a number of different sources of income provides an opportunity for better control over your finances and potentially leads to the financial freedom every person desires.

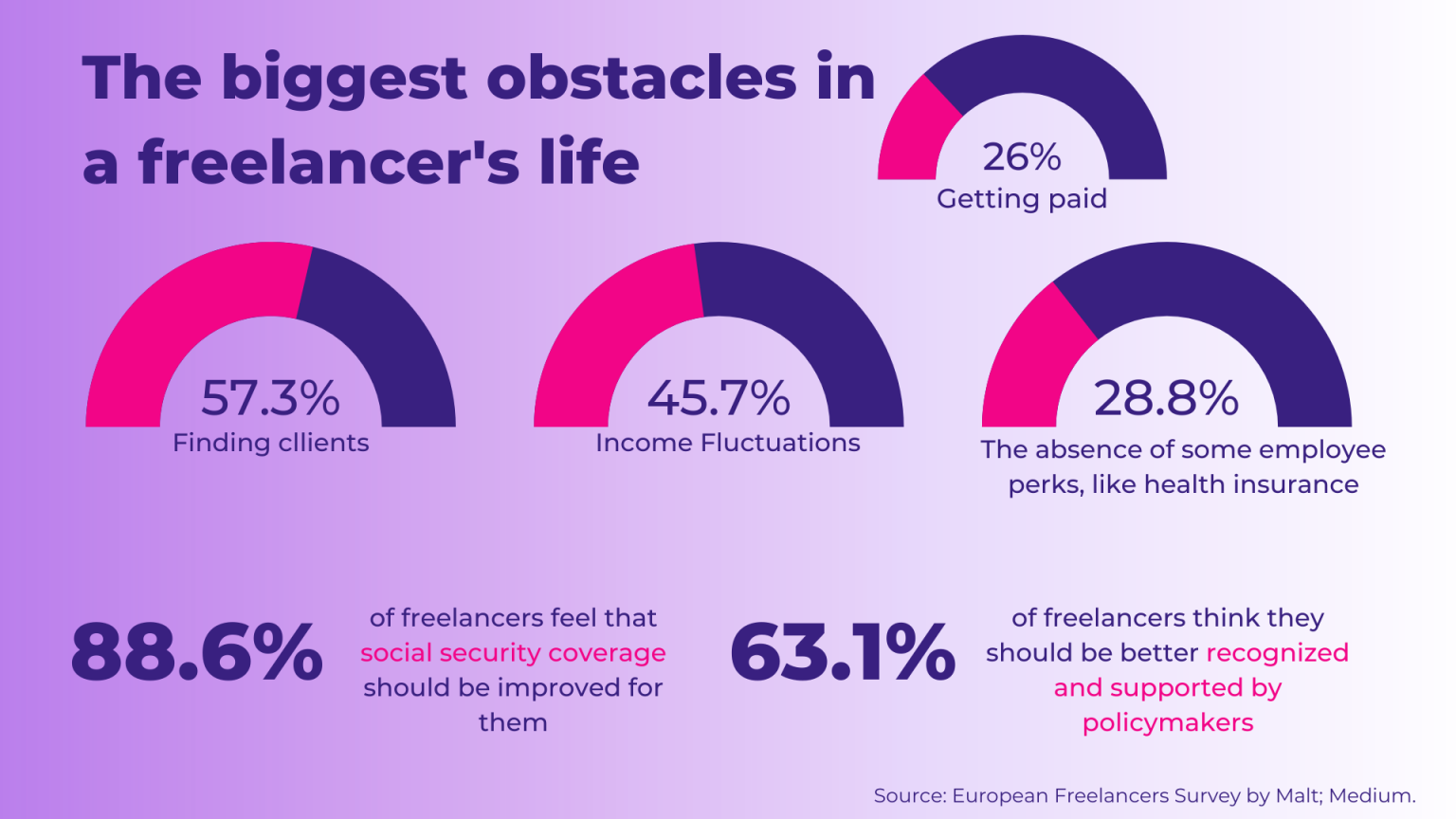

With opportunities come the challenges of the growing freelance gig economy, however. Both independent contractors, as well as hiring companies, experience difficulties when it comes to making/receiving international payments between people of different nations.

For companies, apart from payroll issues, the concerns include staying compliant with regulations while minimizing fees. This requires a lot of strategic planning and expertise, especially if the hiree lives abroad. Individual freelancer payment preferences might also cause some headache if the right financial tools are not present or not commonly used within the organization.

Modern digital gig workers are forced to fight the traditional financial system even beyond day-to-day payments. Freelancers often find it difficult to open bank accounts, apply for loans and mortgages, insurance, or use any other financial services offered to a regular full-time employee. Most of the time, the current banking system is simply unable to accommodate the needs of the self-employed crowd.

Many of the gig workers generally have little to no experience managing their own income, especially when it comes to invoicing and reporting. Not even mentioning finding an accountant or lawyer – people you do not think of much when you work for someone else.

The ever-growing gig economy brings the dramatic need for fintech solutions that will keep up with the newly arising employment trends and increasing demand for online and international transactions, and the bureaucracy that comes with it.

To date, plenty of payment companies have already established their brands in the fintech world.

Names like Paypal, Stripe, Payoneer, or Wise are widely accepted both by individuals and companies. Few of them, however, are tailored to the needs of the freelancing representatives particularly. For international payments, Paypal charges a 3% currency conversion rate and other extra fees; Wise cannot request payments from non-users, and Payoneer and Stripe require a longer account set up process. Also, wire fees through Payoneer or Wise are on the payer since the payment goes directly to the freelancer’s bank account, local or international.

When it comes to fintech startups dedicated exclusively to freelancers, the U.S. seems to have a big variety of startups. Some tax-related solutions include companies like an AI-powered mobile tax engine FlyFin, a financial services firm Formations focused on helping freelancers reduce self-employment taxes, as well as a fintech company dealing with tax automation but also access to healthcare and retirement options, Catch. Another interesting example is New York-based Archie, the fintech that helps businesses digitally collect the information needed from freelancers, manage tax filing, keep track of project deliverables and time spent, and make payments directly to the self-employed workers.

Some European freelancer payment solutions include a multi-device mobile-banking app Wedo from the UK, an integrated payment and invoice management platform Denario from Germany, a German/French fintech licensed bookkeeping and invoicing service Finom, and a Berlin-based bookkeeping and tax services digital banking solution Kontist.

The Recursive team reached out to the founders of freelancer payment solutions, Native Teams, and its co-founder Jack Thorogood, and Flow, and its co-founder Daan van Klinken.

Both startups are a part of the fourth season of the Visa Innovation Program for emerging fintech innovators that is managed by one of the leading early-stage venture funds in the region, Eleven Ventures.

Native Teams is a work payments and employer-of-record services platform that helps freelancers, remote workers, and their clients deal with international payments and paperwork.

The story behind Native Teams is really the story of the solution we’ve built. Before Native Teams, we had a small software agency building tools for others. We were a distributed team, back then mainly in Macedonia but also in the UK, Serbia, and Armenia. We were normally paid by our clients in the UK, but then there could be some real challenges getting salaries into the pockets of our wider team.

Not only were there complexities with the money but there were real-life issues that our team members had as they weren’t “properly employed” by a local entity. This could be as extreme as not qualifying for state funded healthcare, through to softer disadvantages such as poorer creditworthiness in the eyes of the banks.

We put in place the infrastructure to fix this for our own team, and soon we began to get word-of-mouth enquiries to ask how we could help others. In early 2020 we made the decision that this was the product we wanted to devote our time, energy, love, attention, and to build it for the long term. We started building the system and by mid-2021 we had the scalable platform we had planned, living and in people’s hands.

The benefits we bring to business users (as opposed to freelancers and employee users) are significant.

First off, we give better access to talent. Any business can employ international team members on the same terms as a ‘local’ company in any of the countries we work, via Native Teams. This has been highly beneficial and more valuable, especially since the lockdown. We are passionate about our employee users being able to access the best opportunities without having to move countries to find them. It is the socially responsible way to hire international talent.

Secondly, we make things easy for finance teams. We give a single ‘total cost’ invoice to employer clients each month, and that’s it for them: They don’t have to think about accrued liabilities or net versus gross or employer contributions. CFOs love us for that!

Finally – and this isn’t yet available in all of our countries – we allow any business user to give their employees a real terms pay rise without it costing them anymore. We do this by automating access to tax allowances that might otherwise be overlooked. We are building out a network of tax and benefits consultants in more and more of our countries and by marrying this direct knowledge and experience to our technology platform we can ensure tax compliance and maximize earnings at scale. Great for employers as well as employees.

2022 has been a fantastic year for Native Teams. The year has certainly seen us move from a fledgling company to one that knows much more about what it wants to achieve and how to do it. As my co-founder Alex says, we’ve perhaps grown from a teenager to young adult.

How this looks tangibly is a 20x increase in revenues and a 4x bigger team than we had at the beginning of the year. We’ve got a solid product market fit, but we also know so many areas where we can do things better and we are relentlessly pursuing those improvements.

Our short and long-term plans are quite well-defined:

During 2023 we will roll out across South America and much of Africa, essentially replicating what we have done in Europe during 2022. We’ve already made preparatory steps for this by launching in Nigeria and shortly in Peru.

We will also go much deeper into each of our core European markets during the year ahead. The longer we’re in a country the faster we grow there, partly because people start to know more about us, but also because our product proposition becomes more tightly localized, unlocking new market opportunities.

For the longer term, we want to change the way people get paid for the work that they do – I mean every single person, not just those in ‘edge cases’. We are striving towards a goal where even those of us working in more ‘vanilla’ scenarios (e.g. working for a local employer in our home country) say “I’d love to have this job, but I’d be grateful if you can employ me through Native Teams please”.

Today, almost all employees are paid through the payroll system and this is something that has been around for over a hundred years, in most countries’ cases. We want to make people think about remuneration as payroll payments plus tax efficient employee benefits plus more, accessed at any time, not just on the 30th of the month. If we can empower employees like this where everyone’s a winner: The employee, their employer, and their country.

Our competitive advantage is that we are a totally different type of business than those we normally get compared to. We fall between two types of competitors today.

On the one hand, there are international payroll providers, for example, Remote and Deel, who indeed we do sometimes win business from or instead of because Native Teams can be used very well as an international work payments platform. On the other hand, our competitors are platforms such as Revolut and Wise.

Our fundamental competitive advantage is the way we are architected as it means we can be much more flexible for our users. This is important for how we work now but absolutely vital for where we’re taking the business into the future.

Secondly – and this is an advantage particularly when it comes to the payroll processors competition – we are employees first. Unlike pretty much anyone else, we can work with freelancers and employees who want to sign up on a self-serve basis.

Not only does this make us applicable to users where no one else is, it means that if we can be the provider an employee chooses.

Primarily, we charge on a per-seat per-month basis. However, this is supplemented by monthly recurring surcharges on benefits purchased through our platform, interchange from our card program, and some transactional fees, for example around FX or earned wage access.

Secondly, we are seeing that people want to make freelancing a long-term career. It’s no longer something people just do for a few years in their twenties: It’s a life-long choice for more and more people. This means that they have to think about how they can make it work for tomorrow, not just today, which is perfect for us as we can help with maternity and paternity leave planning or making it easier to get a mortgage. All life events which every freelancer will face.

Finally – and this is the one which it is difficult to objectively measure, but we notice it increasing – we see the trend in some countries that freelancing is becoming viewed as the best career choice to benefit a freelancer’s country, as well as themselves.

What I mean by this is freelancers can stay in their country of origin – the country that educated them, and where their family and friends live and which will benefit from their sharp minds and worldly awareness – rather than having to emigrate in search of better opportunities. Freelancing brings an opportunity to the individual rather than the individual having to migrate to the opportunity. The trend is that it isn’t just us seeing this: Government and civic-minded individuals are part of this too, and increasingly see the positivity freelancing can bring.

Another way that the Visa Innovation Program has been really useful is in finding the right solutions to different geographically related challenges. As we expand more globally – and even within some European countries – we need to make sure that we have the right banking-as-a-service and similar providers to help. Visa has made a series of introductions, and then managed those conversations as they advanced, with a number of highly useful provider partners.

Flow is a subscription-based money management application that uses rules and AI to connect several bank accounts in one place, and automate various payments that a user makes.

We recognized the effects of keeping all of your money in one big pile and your bank account everywhere. It’s really hard for people to reduce spending and start saving because they get overwhelmed with the amount of digital bank accounts they have to control at once.

We also saw that our grandparents in the Netherlands were already doing it better than us, putting money aside in a money box in each compartment separately, for clothing, fuel and so on. You take money from the jar and if it’s empty, you know, you’re going a little bit too fast there. So, we thought why not bring this back to the 21st century but digitally, giving people the same feeling of control over their finances.

We came up with the idea when we were freelancing ourselves. At the time, we were thinking of building a completely different fintech startup, actually. But we saw this problem being all around us and decided that we need this bank with multiple jars. Doing it by hand every time was annoying, so we decided to automate this process and that’s how we came up with the idea and built it first for ourselves and then for others.

Usually, when freelancers start, they tend to think of money short-term, that all the money is for them. Later they realize they have to pay taxes, think of the insurance, pension, etc. At the end of the day, you have to pay a big amount and it’s really annoying. So our solution is that every time any money comes in, we’ll make sure tax money and expenses are set aside. We help you build up a buffer as the first step towards financial control, and after that we help to look into the future and teach how to make sure that you are well off.

One is that you do not rely on your own willpower, instead you do it on autopilot. This way it is less likely for you to stop and go back to old habits.

Second, you get to choose a method that suits your lifestyle so you can manage your money in a way that suits you. On the app, you can see a video course from the author of a bestseller on money management, or an influencer you like, and you can implement their ideas into your financial routine.

Third, it gives you a feeling of control and relaxation. You know it works, that you are building up, reaching those financial goals and you don’t have to do anything for it.

The app is done, it’s live and regulated. You can connect to all the Dutch banks and some of the banks that are available in other countries in Europe. For now, we’re focusing on the Netherlands, but once we have a license for ESD countries, hopefully next year, it will be available all over Europe. We do have some German customers already and some other countries, and we are currently talking with Bavarian parties.

Long-term, maybe in a year, maybe in a couple of years, we want to reach the self-driving version of money management, and AI integrated, where you could tell the app about the thing you plan, like taking a student loan this year, mortgage in a couple of year or going to Bali next week, and we make sure all the bills are predicted and paid. That’s the big vision that is already in motion. We see a very big audience in the upcoming years to join us.

I actually used to work at ING, at a PFM, personal finance management app. There are a lot of FinTech apps that also want to help you with your money, which is great. But the traditional FinTech apps that connect your banks but only give you insight on, let’s say, categories you are spending your money on, they give a first understanding of how you manage your money but no other recommendation on how to improve it. We’ve noticed that after time people stop using those apps because it becomes annoying to see your own bad behavior.

We do it completely differently, by looking into the future and asking where a person would like to go and achieve. That’s a very big difference between a lot of PFM fintechs. We could also consider neobanks that do a little bit of automation as competitors but they could also be our B2B audience. We are looking into integrating into neobanks at the moment and are moving in that direction actually. So it’s interesting that what today can be seen as a competitor, can also be seen as a customer tomorrow.

We see our competitive advantage to be that we, on the one hand, are very knowledgeable about banking, bank connection technology, which is really hard on its own. On top of it we are building a great UX, having a lot of product people in our team, me included. We’re not only giving you a technical app, which you can program your bank with, we have people from the health industry, health influencers and influencers that know how to build up habits and money behavior. We are making it more human, which is really hard for other companies to do. That I think, is very powerful that we have the whole spectrum of banks connections and new hardcore stuff, UX products, and then the behavioral part and content. That’s our power.

How does your business model work and how do you go about monetizing your service?

We started and still have in the Netherlands a B2C business model. It’s an app, a free app, but you can also choose to use a subscription for it, i.e a freemium business model.

But the one we’re moving into right now is a B2B, or B2B2C SaaS business model. We are integrating our technology and banks, financial parties, that pay for those integrations and that’s how we make money.

Our overall strategy for B2C is to make it available for free for as many people as possible for what they would use it in general. And then the power, advanced features, like the videos and recommendation come with the subscription.

We do have to say that 72% of the freelancers that use Flow also use it for personal money, because with one half of your finance dedicated to your business and another half to personal money, it makes it even harder to manage compared to other people.

As one of the trends, we see that people use different financial products next to each other more and more. Multiple banks at the same time, investment accounts, because they all have different benefits in different places. This creates new problems for people because you have money in different places. If you’re a freelancer, you have your business accounts, personal account and other bank account for budgeting, investing, and crypto. That we solve.

Second, people want to avoid financial surprises, as well as build wealth, for example, to retire early.

At the beginning of COVID, people thought it was going to be a financial crisis. Though it was not much of a financial crisis, people were googling about budgeting, and we saw our ads triggering a lot on the topic of saving and how to get the most out of your money.

And the third one is on reaching financial life goals. Compared to our parents, we see that it has become harder for freelancers and other people to afford buying their first home or start a family. There is generally an effect called ‘Lifestyle inflation’ when every time you get a higher salary, you increase your spending and, thus, your lifestyle. This is a rat race that is very hard to break out from. But the high inflation we are experiencing now is forcing people to live on a lower standard, thinking of paying energy bills first. We want to use this period for the benefit of those people, to show them that they do not need the higher standard to be happy. Instead they could have some extra cash, and build up their wealth to help their future self. This will have a good effect on the future.

The program helped us get in touch with parties that fast tracked our learnings on validating our B2B direction. Through meetings, we got to learn about the problems in Eastern European markets in Greece, Bulgaria and Romania, which gave us more insights on how we can develop products there, aligning to our goal of European expansion.

During the program we’ve seen a lot of enthusiasm around this direction from people in the industry, which pushed us to fast track. Being able to present our solution and attend the sessions was also of huge value, of course.

Every year the freelance gig economy generates over a trillion dollars in revenue, growing and developing at a rapid pace. It, in turn, fuels up the demand for better-serviced, trouble-free international online financial transactions, and innovative open banking solutions. This need not only increases investment in the fintech sector, but also generates tremendous employment opportunities.

The sky, in this case, is the limit as potential solutions are spread out in different directions, like introducing personal finance management, unlocking access to fairer financial services, as well as, of course, cooperating with governmental institutions for better freelance-friendly policies.

Without the right financial tools and infrastructure, gig workers are forced to take time out of their workday, chase unpaid invoices, and deal with bureaucratic procedures.

How to find the best freelancer payments platform

How [And Which] FinTech Startups Are Breaking Banking for Freelancers

How the Future of Work Will Impact Fintech

How to Pay Your International Freelancers

The Freelance Revolution is Just Getting Started: Key Trends in 2022

How to pay freelancers: balancing cost with compliance

40+ PROFOUND FREELANCE STATISTICS [2022]: FACTS, TRENDS, PREDICTIONS

Freelancing Trends and Predictions