What do startups need to know about ESG strategy? Why and how should they integrate ESG data monitoring and principles in their overall strategy and operations? These were some of the pressing questions addressed during a panel tackling ESG for startups and scaleups at the Alpha Wolves Summit, in Warsaw, Poland, last week.

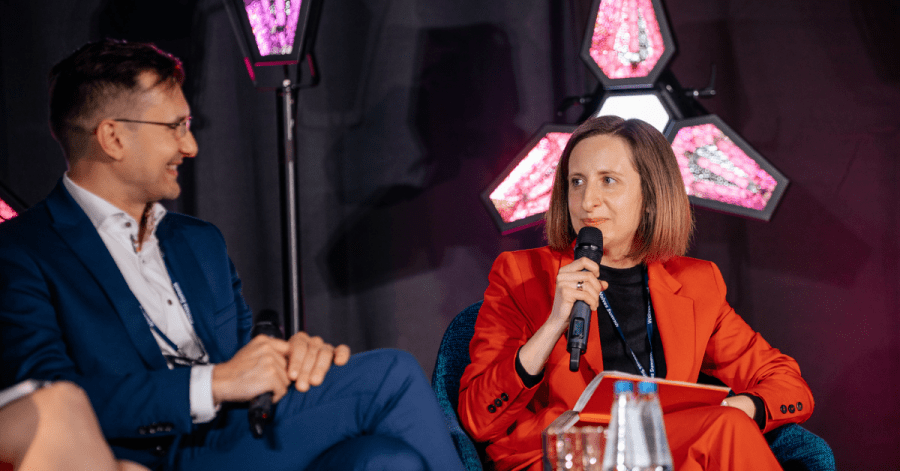

The Recursive decided to follow up on the topic and reached out to Ewelina Łukasik-Morawska, ESG Manager at PwC. Prior to her new role, Ewelina has built experience in the field as a Manager, Engagement Services at Sustainalytics, an independent ESG and corporate governance research, ratings and analytics firm.

During the conference, PwC also announced they will be mapping the top 50 Climate Tech Startups in CEE, in the 2022 edition of their Net Zero Future50, co-branded by the Wolves Summit. The report aims to help stakeholders assess the level of maturity of the climate tech landscape and discover potential next steps in the race to decarbonization. It also wants to help impact investors seize opportunities in the region.

In this interview, buckle up for more insights on ESG strategy, including:

• How ESG preparedness can create value, from increasing market share, to acquiring and retaining talent, and reducing costs;

• Why startups and scaleups are in a better position to implement ESG data monitoring and principles early on, and how they can get started;

• How technology can help, and how climate tech startups can successfully pitch their solution to investors;

• What every leader should start doing today to avoid a series of severe climate change-induced effects tomorrow.

The Recursive: Why should building an ESG strategy be important for startups and scaleups? What value can it bring?

Ewelina Łukasik-Morawska: Every business is intertwined with environmental, social, and governance concerns. Thus, it is reasonable to state that solid ESG preparedness creates value by, among other things, improving the retention of existing customers and attracting new ones, and in this way increasing market share.

And it can help scaleups acquire and retain talent, and also comply with current and future regulatory standards. Implementation of an ESG approach also offers value in fulfilling societal obligations and maintaining the license to operate. We even observe the trend that many new companies are launched and funded purely to meet societal goals, which can play a key role in motivating employees and driving innovation.

ESG can also substantially reduce costs. Among other advantages, executing ESG effectively can help combat rising operating expenses (such as raw-material costs and the cost of water or carbon), which can affect operating profits.

Last but not least, a solid ESG proposition can enhance investment returns by allocating capital to more promising and more sustainable opportunities (for example, renewables).

How do you expect ESG reporting requirements to impact startups and SMEs in the future?

Investors already recognize that organizations with strong responses to sustainability issues can better withstand adverse market conditions and outperform peer companies. The number of investors working to integrate environmental, social and governance-related insights into traditional investment approaches is increasing.

And even though we do not presume that there will soon be a legally binding requirement for startups to disclose non-financial information, it provides an opportunity to highlight the company’s active management of ESG issues, the operational value added and the impact achieved by its activities.

The metrics tracked in ESG reporting can also demonstrate improvements over time, providing data that helps with fundraising.

As the PwC Global Private Equity Survey 2021 indicates, ESG will become a necessary prerequisite for private equity funds and impact investors that are increasingly disclosing ESG data publicly. Venture capital firms also consider differentiating themselves through similar disclosures.

What steps can startups and scaleups take today to start preparing for a future where they are required to report sustainability performance?

Startups and scaleups have many advantages over large established companies in aligning their business models with ESG concepts. They can implement sustainability principles and best practices early in their corporate lives and products, and this way avoid many obstacles faced by multinationals, with their complex organizations and supply chains.

On top of that, startups and scaleups have the innovation skills and capacity to find groundbreaking solutions to society’s challenges.

I think young organizations should start their journey by getting a solid understanding of their ESG ecosystem, which will let them identify material sustainability issues including both opportunities and risks.

In practice, this means answering the following questions: who are the key stakeholders of my organization; what are their expectations, and how well am I prepared to meet those expectations? The above exercise should be followed by prioritizing key aspects and setting SMART objectives.

How would you advise scaleups to tackle the data monitoring aspect of an effective ESG strategy?

As we all know, what gets measured gets done. There are two aspects that you can measure: the progress you make against the goals that you’ve defined, and the impact that this progress has had on your ecological and societal business environment.

In most cases, setting sustainability KPIs measuring the progress your organization has made will be straightforward and will be reflected in the amount of energy or water saved, reduced greenhouse gasses emissions, or higher gender diversity.

It is also important to integrate any KPI into your overall company management systems and goals. Do not separate them as “sustainability measures” but make them part of your business strategy.

What are some effective ways for climate tech companies to present their solution and narrative to investors?

In addition to traditional financial and non-financial metrics that investors are already looking for, it is advised to communicate their solution within the context of the problem they aim to address.

For example, if their solution contributes to climate mitigation it would be wise to frame the growth potential of their solution based on emissions reduction potential, maturity of technology, scalability potential compared to the area of challenge the scaleup wants to solve and profitability.

It is also important to communicate and demonstrate a clear sense of purpose and how the clean tech scaleup is thriving to achieve its vision and mission.

What do you see as clear indicators or red flags for greenwashing?

There are a few, and it is tempting for organizations to fall into the greenwash-trap or to pick the low-hanging fruit. For instance claiming that practices are green when there is no verifiable evidence, overstating the emission reductions capabilities of their practices or promoting minor emission reduction plans in some operational areas, while the most material areas of operation far offset those reductions are good examples.

What do leaders need to do today to avoid a wave of severe climate-related events and costs tomorrow?

For the first time, the IPCC report highlights so strongly the interdependence between climate, humankind and nature. The climate-related impacts on ecosystems and biodiversity loss increases the vulnerability of people already contributing to the humanitarian crisis.

These new findings emphasize that the window to achieve net zero by 2050 and the 1.5 °C goal of the Paris Agreement is closing rapidly and that transformational action, cross-sector collaboration and innovation are required immediately and more urgently than ever.

Leaders first of all must assess their organization’s exposure to both transitional and physical risks. They should also understand the extent of their organizations’ contribution to aggravating (or solving) the complex issue of climate change and how to ensure they have the right governance structure to deal with this.

Then it is important to develop their organizational strategy not only within the context of short-term outside-in impacts, but also long-term inside-out impacts. Increasingly, we are seeing how climate-related impacts and costs are being internalized back to companies in different forms. Leaders should also look at longer time frames than usual and set ambitious mission-like targets that provide a clear direction to where companies should be in the future.

And finally, they should design and implement solutions through the lenses of collaboration and innovation. Technology will be very important to drive transformation, change business models, products and services. However, technology alone will not be enough. Many changes in regulations, investments, culture, behaviors and incentives among others are also required in order to ensure an effective transformation. And this is where building an ESG strategy also comes into play.