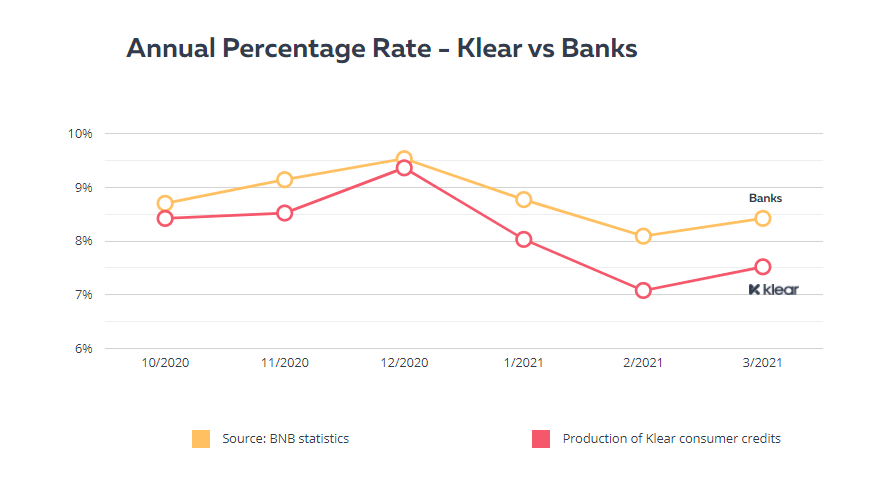

Bulgarian fintech startup KLEAR closed an €800K round, led by the Bulgarian VC New Vision 3 (NV3). KLEAR has developed a Peer-to-Peer (P2P) lending platform that connects money borrowers and lenders. The company facilitates an average nominal interest rate of 7%. Its annual percentage rate has remained one percent below, compared to traditional banks, according to the statistics of the Bulgarian National Bank.

Source: KLEAR

With the deal, NV3 becomes a minority shareholder of a little less than ¼ of KLEAR, by subscribing to newly issued series A preferred shares. The money received will mainly be used for implementing a marketing and communication strategy to achieve a 3% market share of the consumer lending market within the next 3 years. KLEAR will also be developing its platform and technology to make the online credit application process easier. The startup plans to add a new credit product to its portfolio.

“Fintech is one of our main investment verticals. From a macro perspective, NV3 strives to create an ecosystem of portfolio companies that are mutually beneficial and can create synergies between one another. At a closer look, we are looking for startups with solid founding teams, traction, and a scalable business model, offering big market opportunities. KLEAR fits into this description and I believe it was the right moment for them and for NV3 to close the deal,” Aleksandar Terziyski, partner at NV3 Venture Fund, told The Recursive.

“Since the very beginning, we have built the company with a long-term view, implementing sustainable practices. This investment is a strong booster to fuel our growth. Fairness is our key to ensure its sustainability,” stated Loic Le Pichoux, co-founder and CEO of KLEAR.

Developing the P2P market in Bulgaria

KLEAR was founded in 2016 and is a registered financial institution in Bulgaria, that carries out operations mainly on the local market. So far, the P2P platform has facilitated investments amounting to over €7.79M. The number of active investors is around 1500 and they have successfully backed 1806 financed loans, used for projects such as combinations, home improvement, consolidations, and car or motorbike purchases. KLEAR reports that its investment returns range between 4.2% and 7.7%, with the average being above 5.5%.

Тhe P2P lending model is 100% digital and gives anyone who has savings an alternative to deposits. On the other hand, the model often provides better conditions or at least a lower price for borrowers. The KLEAR platform relies on diversification strategies, through which it spreads small amounts of investors’ money in as many loans as possible. Le Pichoux explains that the unique thing about KLEAR is in the company’s values and ideology: “The revolution is at a different level than a better product. It’s about values. Since the very beginning, we have built the company with a long-term view, implementing sustainable practices. For example, we automatically attribute a discount to repeat customer, applying for another loan, we don’t charge any fee when someone needs a document to prove he has repaid his loan, we don’t charge any fee or penalty when there is an early repayment, neither when we postpone part of the due amount of a borrower having difficulties.”

Back in 2019, KLEAR received another €750K funding from Varengold, a German fintech-centric bank that started operating in Sofia in 2018. In this deal, Varengold received 20% equity in the startup.

About NV3

A successor of NEVEQ I and NEVEQ II, NV3 is co-financed by the Bulgarian Fund of Funds and has an investment capacity of €23.2M with a term of 10 years. For this period, the New Vision 3 aims to fund around 15 startups and 30 scaleups from the AI, IoT, shared economy and decentralized platforms, and fintech sectors. NV3 has also invested in the fintechs Paynetics, Phyre, and Phos back in March 2020, the e-commerce marketing and sales platform CloudCart and the local proptech startup FantasticStay.

The broader landscape

In Europe, there are more than 54 P2P lending platforms, whose funding exceeds €14B. For Bulgaria, KLEAR is one of the two leading platforms in the sector, with Iuvo being the other major player. So far, over €200M have been invested through the platforms of the two companies.