-

-

- In 2020 computer programming, consulting, and information services accounted for 5.6% of Bulgarian GDP, which is three times more than ten years ago.

- The local startup ecosystem shows promising signs to become the anchor of innovation in SEE due to its history of founder-led ecosystem development.

-

Endeavor Bulgaria released the results of its Insight Report named “Mapping the Sofia Tech Sector – a network analysis of the entrepreneurial community”. It was conducted with the support of the Bulgarian Startup Association (BESCO) and other ecosystem players. With the goal to assess the sector’s current state and allow decision-makers to better understand and support local tech entrepreneurship, the report makes an overview of the history of the tech sector in Bulgaria, emphasizes the importance of reinvesting back into the community with examples from the Telerik effect, and summarizes the challenges that founders in Bulgaria face.

The results of the study were presented at a formal event that gathered leaders from the local public and private business communities. Some of the speaker guests at the Endeavor Insight Report event were Daniel Lorer, Minister of Innovation and Growth, Martin Gikov, CEO and Chairman of the Management Board at Fund of Funds in Bulgaria, Tsanko Arabadjiev Executive Director of the Bulgarian Bank for Development, Dr. Maria Hristova, Executive Director of Sofia Investment Agency, and Nedyalko Dervenkov, CEO of BESCO. Irina Obushtarova, CEO of The Recursive moderated a panel discussion on the importance of give back mentality between Hristo Borisov, CEO of Payhawk, and Vassil Terziev, Managing Partner at Eleven Ventures and early investor in Payhawk.

The authors of the reports based their findings on 100 interviews with local tech entrepreneurs and data on more than 500 companies and their founders. Additionally, information on more than 160 ecosystem support organizations, investors, and mentors was analyzed.

Momchil Vassilev, Managing Director of Endeavor Bulgaria, shared during the event that tech entrepreneurship has the potential to be the engine of accelerated economic growth in Bulgaria, and can position the country as an anchor of innovation in Southeast Europe. Daniel Lorer commented that the Ministry of Innovation and Growth envisions its role as a bridge between academia and the private sector. He also revealed that the first AI research institute will soon open doors in Bulgaria.

Further in the story, explore the key findings of the Endeavor Insight Report.

An overview of 20-years growth

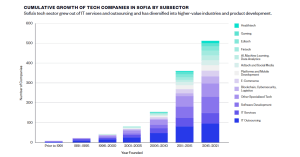

- Since the 2000s, Bulgarian companies have begun to increasingly specialize in various high-value-added industries. They have shifted their models from providing outsourcing services to offering R&D-intensive tech products and services. This trend is illustrated by the graph below.

- With time, the number of local VC and private equity funds grew to 17. Most of them were set up by various European investment funds and instruments such as the Fund of Funds.

- The tech sector currently accounts for around 4% of the national GDP and before the pandemic, it was growing at an annual average rate of 10%.

- Bulgaria can become the SEE leader and role model for Western Balkan countries like Albania, Bosnia and Herzegovina, Croatia, and North Macedonia if its startup ecosystem continues to grow at the same levels.

The Telerik effect: a key catalyst for ecosystem growth

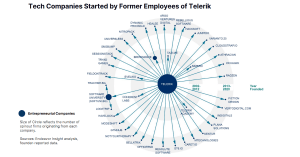

To trace the importance of the flow of information, capital, and people among founders, Endeavor Bulgaria conducted a thorough ecosystem network analysis. By interviewing more than 100 local founders, Endeavor was able to illustrate the connections between companies in terms of former employment, mentorship, and investment.

The two key takeaways that the report draws from the analysis are that founder-to-founder connectivity in the local ecosystem is strong and that there are certain types of connections that are particularly helpful for scaling founders. The data showed that 142 out of the 524 tech companies share some form of relationship, be it former employment, mentorship, or angel investment. In addition, it is highlighted that the top-performing founders tend to have previous experience working for a local tech company, which means that previous employment at a scaling company or mentorship leads to better chances for a successful startup.

Some 98% of the founders in Sofia share that they are open to connecting entrepreneurs with people from their own network who can help them, while 94% say it is good for their business when other local entrepreneurs are successful. In addition, almost 40% of the top-performing founders report they have been a former employee or previous founder of a local scaled tech company.

The software company Telerik, which was acquired by American company Progress in 2014, is so far the biggest catalyst of entrepreneurship in the local ecosystem. With former employees often being dubbed “Telerik Mafia”, the report outlines the history of companies who were started off by ex-Telerik employees.

Messages for local authorities

The main challenges that Sofia founders reported are the lack of availability of engineers, on one hand, and the lack of availability of quality managerial talent, on the other hand. And even though there are already private software and upskilling academies and in-house training initiatives, more impact would be achieved if reform to visa and work permit regulations are put in place. These can attract entry and managerial talent from non-EU countries.

In terms of access to capital, the report recommends regulatory reforms that incentivize local institutional investors such as pension funds and mutual funds, to start investing in VCs and startups. To alleviate the financing problems of early-stage founders, BESCO is helping to introduce an incentivization bill for angel investors and increasing the cap on the BEAM SMEs Growth Market for public investments in startups.