In the midst of a global recession, political instability, and war, startups in Southeast Europe have secured over €2B in the first half of 2022. Bulgarian startups alone have raised around 47 funding rounds total. As the startup ecosystem matures and founders start to master the art of fundraising, The Recursive turns to explore the state of the local VC ecosystem in 2022.

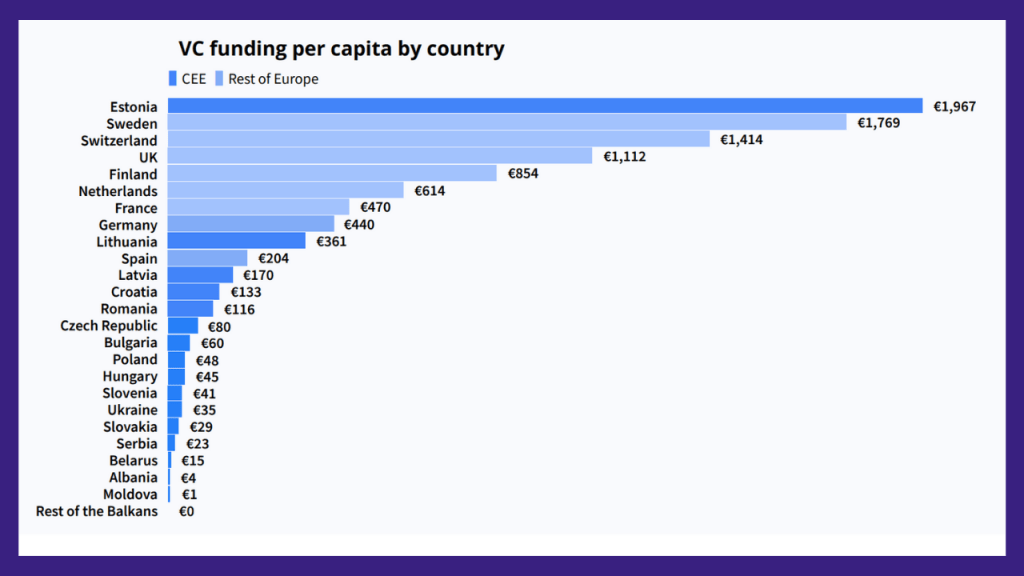

With around €60 VC funding per capita, Bulgaria does not take a good position in the European funding per capita rankings. However, not all that matters is numbers. In this analysis, three experts weigh in to present a qualitative snapshot of the Bulgarian venture ecosystem.

Now find out which are the 10 ways for the Bulgaria venture capital ecosystem to mature according to the three ecosystem experts – Todor Breshkov, Managing Partner at LAUNCHub Ventures, Daniel Tomov, Founding Partner at Eleven Ventures, and Maria Marinova, Executive Director of BVCA.

1. Allowing pension funds to invest in venture capital

“I wouldn’t say that there are many structural challenges but there are some hurdles which impede the natural growth of the ecosystem. For example, one area that bears space for improvement is the diversification of institutional venture capital funding and allowing pension funds to invest in venture capital. Even though this has been an issue for the past 10 years, the need for such diversification is starting to get more tangible now as the ecosystem matures and needs more capital to continue its growth,” Daniel Tomov explains.

He elaborates that in order for pension funds to open up to investing in venture capital, small changes in the legal framework need to happen. Proposals for such changes have been made by the Bulgarian Startup Association (BESCO) and are awaiting approval from the Bulgarian parliament.

Marinova explains that the involvement of insurance companies, pension funds, and family offices in investing in companies through funds is key for further development.

2. More institutional investors

According to Breshkov, raising venture capital is becoming a challenge as the Bulgaria venture capital ecosystem lacks depth.

Maria Marinova outlines that although Bulgaria is still the leader in the region in terms of the number of local funds, the countries are rapidly advancing – mostly through support from their governments. “That is why we risk losing this position if we do not work on modernization of regulations and legislation related to startups and investment funds. Even though there are institutional investors, there are only two of them, which is not sufficient for an ecosystem to be developed and more innovative companies to be supported” she shares.

3. More funding for R&D-heavy technologies

Tomov adds that from a long-term perspective, it is crucial to increase the investments in very early-stage startups, accelerators, and incubation programs. “The maturity of the ecosystem is also measured by the emergence of more companies that develop more R&D-heavy technologies.

According to Tomov, high-tech startups require heavy funding which usually comes in the form of grants. Even though there is enough grant capital in Bulgaria, the process for acquiring grants needs to become easier and faster,” he suggests.

4. An impact fund for social entrepreneurship

Marinova explains that right now, in the local ecosystem there are active funds that support startups in the full spectrum of their life cycle – from the idea to the mature phase. There are also new interesting instruments such as Sofia Angels Ventures which is financed with 50% EIF money and 50% capital from business angels. She also mentions Seedblink which recently opened in Bulgaria to democratize investments in startups, and the active fund toward the Bulgarian Bank for Development (BBD), the Capital Investment Fund, which backs companies that are not specifically in the technology sector.

Marinova adds that one missing element in the Bulgaria venture capital ecosystem is the existence of an active Impact fund which is structured as an accelerator at the beginning or alternatively has an accelerator arm in order to teach young local founders about ESG and sustainable entrepreneurship.

5. Fund for technology transfer

Both Marinova and Tomov highlight the importance of funds for technological transfers as they are crucial for enabling high-impact and high-tech research to commercialize. The establishment of funds for technology transfer requires the heavy support of the government as such structures need to have enough financing to secure patents as well as good relations with the Bulgarian Academy of Sciences.

The opening of INSAIT, The Institute for Computer Science, Artificial Intelligence and Technology, is a positive step in this direction. Even though it is not a fund, the institute offers entrepreneurial-oriented researchers to enroll in a Startup Research Program and receive €200K to work on research that can lead to deep-tech startups.

6. Fund for mature startups

The lack of bigger VC funds for tickets in the Series C range is not a huge bottleneck for growth because local founders are well-connected with foreign investors and funds. However, Marinova adds that the establishment of such a fund would ensure that local founders can grow companies beyond Series B with local money.

7. A long-term for-profit acceleration program

Todor Breshkov points out that one of the major missing pieces is а for-profit active long-term acceleration program. “10 years ago it was Eleven Ventures working in that direction but since 2017 there is no active for-profit accelerator in Bulgaria. It is quite visible that in each country where acceleration programs are active the ecosystem moves forward quicker,” he elaborates.

The same need for the emergence of long-term accelerator programs is observed by Daniel Tomov.

8. Smart VC fundraising

“When local VCs are looking to fundraise, they turn to the local ecosystem. Which is a little different from the startups that have access to all VCs around the world, especially in later stages. It’s a challenging process. We, at LAUNCHub Ventures, see ourselves as a startup. We change with the change in the markets,” Breshkov says.

Dani Tomov supports this opinion and also shares that VCs are evolving in their capabilities to raise money just as founders do.

9. More smart capital potential with more private capital

When it comes to the fact that there is now more private capital invested in local VCs, Tomov highlights the impact of smart capital on the growth of the startup ecosystem.

10. More support from regional founders

Todor Breshkov explains that the fact that there is more private money in local VCs is quite normal. “Private money flows where there is return on investment, and there are a lot of success stories in the local ecosystems in recent years: companies like Gtmhub, Payhawk, OfficeRND, to name a few. The other reason for the influx of private money is that it actually comes from tech entrepreneurs. About a half of LAUNCHub Ventures’ limited partners are techies, including a large portion of alumni from our own portfolio. They are very engaged in giving back to the local ecosystem, and help it raise its profile and exposure,” he concludes.

10 years of VC growth. What is there to be proud of?

Todor Breshkov outlines that the Bulgaria venture capital ecosystem was the first one in the SEE region that was kicked off with the EIF and the local government efforts in early 2012. Nowadays, funds like LAUNCHub Ventures are still sponsored by EIF and IFC but private capital dominates significantly – a situation to an extent unique from the regional perspective. According to Breshkov, the other thing that stands out compared to the other ecosystems in the region is that the local VCs in Bulgaria are quite collaborative. They are often doing deals together to help each other out.

Daniel Tomov shares the same outlook. “Looking back 10 years ago, you can easily observe the big jump that the ecosystem has made – there are more entrepreneurs, more companies, and capital, as well as angel investors, and people engaged in mentoring founders. On the other hand, there is also more velocity which means that knowledge and experience between founders are more rapidly and efficiently shared. The know-how increases among the new generation of entrepreneurs. The systemic cooperation between venture capital funds and investors is also a crucial element for ecosystem growth,” he says.

Maria Marinova shares that investors are important but what matters the most is the success of the startups they are financing. “The main success story in our VC ecosystem is that the companies which are backed by equity funds are one of the most successful and innovative in the country, given as an example of local and international level. It is no coincidence that the first Bulgarian unicorn is also among the portfolio of venture capital funds.

According to her, another success factor in the Bulgaria venture capital ecosystem is that there is an increased interest from foreign entrepreneurs and investors. Around one third of the companies in Bulgaria were founded by expats, and more and more expats are joining as angel investors in startups as well. In addition, the Bulgarian diaspora has also matured in its readiness to support local founders. More and more Bulgarians now bring home their own knowledge and experience from leading companies and universities worldwide. Others such as Vess Bakalov and Momchil Kyurkchiev, act as a bridge of knowledge between countries and continents.

Last but not least, Marinova outlines that there are also successful examples of the common efforts made by the VC ecosystem and the government. One of these is the creation of institutional investors. “First, there was the JEREMIE program through which the EIF set the foundation of the local ecosystem, and later followed the establishment of the second institutional investor in Bulgaria, The Fund of Funds. In the past year, the local VC of the Fund of Funds has attracted twice as much additional private resources, and the European Investment Fund multiplied the national public resource already 5 times,” she highlights.