When I was invited to the “Invest in Moonicorns” event, organized by Growceanu on October 1 in Bucharest, I was eager to join and reconnect with the community of investors and entrepreneurs gathering ahead of the main How to Web conference. As this was a side event, many people had flown in from across the region, adding a diverse mix of perspectives to the discussions.

With startup investing on the rise and Romania becoming a key player in the tech scene, I was curious to hear firsthand how the ecosystem is evolving and what opportunities lay ahead for both new and experienced investors.

Romania’s macroeconomic view and its challenges

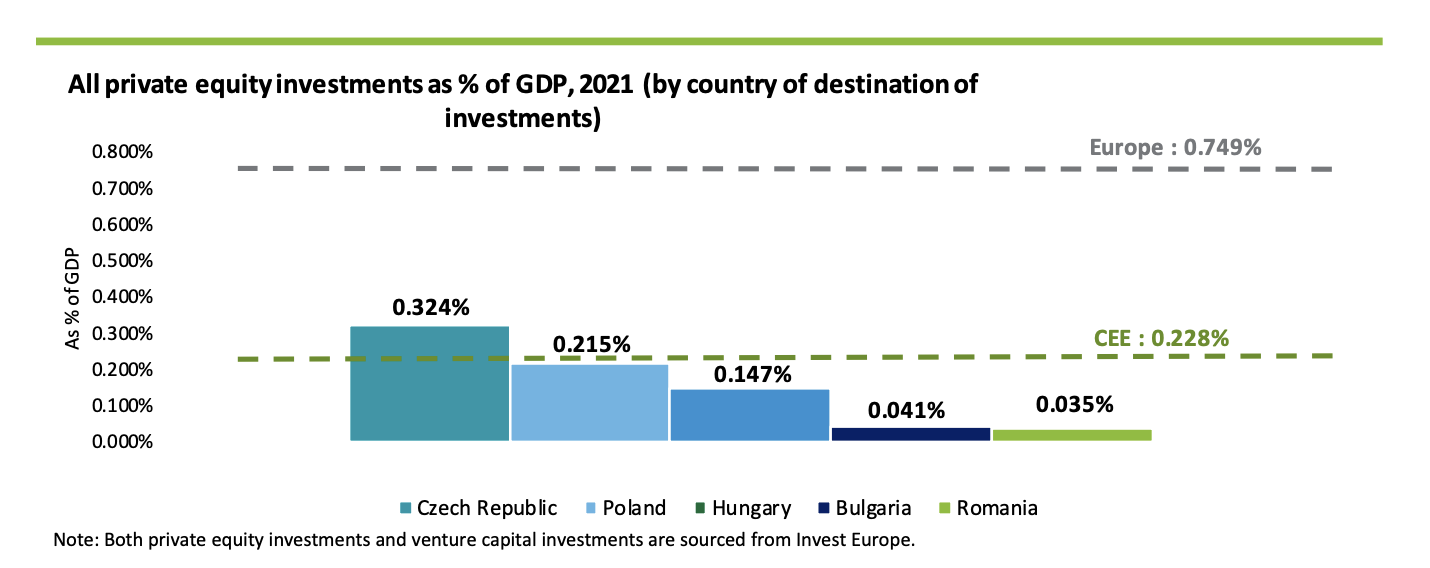

One of the first statements that set the tone for the day came from Iulian Stanciu, Executive President of eMAG, who spoke with passion: “Entrepreneurship is something magic, and I encourage you all to be entrepreneurs and to support entrepreneurs.” This sentiment was echoed by many as we dove into the complexities of entrepreneurship. However, on the not so positive note, Stanciu also highlighted an important economic reality: Romania’s private equity sector is lagging behind. He pointed out that only 0.03% of the country’s GDP comes from private equity, far lower than the Czech Republic (1%) or even Hungary (0.1%). His message was clear—we need to mobilize more capital and get more people out of the corporate world and into building ventures.

ROPEA: Romanian Private Equity and Venture Capital Study

The conversation then shifted to the macro level, with Adrian Codirlasu, Vice President of CFA Romania, raising concerns about excessive regulation: “There is no innovation and a lot of regulation in the EU,” citing a competitiveness report by Mario Draghi. This excessive regulation, many felt, was stifling entrepreneurship. Codirlasu also shared some key economic projections, forecasting 4.5% inflation by the end of the year, with a potential VAT increase of 2 points early next year. Also he pointed out that the growing influence of AI could lead to a reduction in IT jobs, especially within multinational companies. It was a reminder that while tech is often seen as a safe bet, even this sector isn’t immune to disruption.

The first panel of the day focused on the state of investments, bringing in experts from various fields to give their take.

Investing in real estate vs art vs startup vs crypto

Andreea Cosma, Managing Director at Premier Estate Management, assured the crowd that “real estate remains a safe investment”. She pointed out that many investors allocate around 30% of their portfolios to real estate, depending on their preferences.

Suzana Vasilescu, representing the Museum of Recent Art, chimed in with an interesting angle on the art market. She highlighted the growing influence of Asia on the global art scene and noted that for serious investors, art could make up as much as 30-40% of their portfolios, especially for those looking to leave a legacy. I was particularly intrigued by the concept of fractional art investment—owning a piece of art collectively with others. In a world where inflation is a constant concern, it was surprising to hear Vasilescu’s assertion that “the art market is relatively immune”.

Then, there was Alexandre Matoso from EIF, who acknowledged that fundraising is tough for GPs right now but maintained an optimistic view: “We see a new hyper cycle coming.” His advice to those considering venture capital? Start small—around 10% of your portfolio—unless you deeply understand the asset class. It was practical, grounded advice that many of the newer investors in the room seemed to appreciate.

Another key takeaway came from Andrew Forson of Hashgraph, who touched on the volatile yet exciting world of cryptocurrency. “You gotta be careful when investing in crypto,” he warned. Forson was candid about the risks, advising potential investors to only use capital they could afford to lose. He suggested allocating no more than 20% to crypto unless you’re seasoned in weathering market storms. It was a cautious yet optimistic outlook, underscoring the specifics of this investment space.

In Alexandru Dobre from Tradeville’s view, bonds and stocks can give you more liquidity, compared to the other classes. Thus, seasoned investors can invest up up 50% of their portfolio, gradually.

Interesting views in investing were also shared by Janne Jormalainen, President of EBAN and angel investor. Based on his experience from investing in over 40 companies, he came to a not-so-appealing conclusion: “two-thirds of companies that angels invest in fail,” stressing that the idea doesn’t matter as much as flawless execution. Jormalainen advised that “if you don’t know how to do it, it’s much better to be an LP in a VC fund.”

Jormalainen’s experience with angel investing was not just about the financials, though. He emphasized the importance of working with people who want to change the world. “Angel investors are changing the world by helping entrepreneurs,” he said, expressing how rewarding it is to support innovation. He also highlighted the biggest mistakes in pitches, saying: “I don’t like bullshit and when the founder tries to paint an ideal picture.”

The state of angel investing

Continuing the good practice of knowledge sharing, the day continued, after a short break, with the panel titled Angels Call: Investment Decisions in a Bear Market. Here, the panelists Petr Sima from Depo Ventures, Daniel Mereuta, angel investor, and Vlad Sarca from Sparking Capital agreed on the fact that CEE needs more private money, specifically from corporations, “Corporations need to understand that innovation comes from startups, not from within,” Sima stressed. It felt like a call to action for the region, urging larger organizations to tap into the innovative potential of startups instead of relying solely on internal R&D.

In the final fireside talk, Marius Istrate shared a bold vision for the future of Romania’s startup scene: to create 10 unicorns in the next 10 years. How? “We have a very high density of technical talent per 100,000 habitants – the highest or second highest in the EU, according to which sources you are consulting. We can be THE tech country in Europe,” he optimistically expressed.

The day was a whirlwind of information, but as I walked out of the event, one theme resonated deeply: Romania and the CEE region are sitting on untapped potential. While the numbers may not yet compare to other regions, the ambition is there—and so is the talent. The next step is building an ecosystem that supports bold ideas, embraces risk, and accelerates innovation.

As I left the venue, I couldn’t help but feel excited about what’s to come. We are at the beginning of something big, and I have a feeling that Romania’s startup scene is about to make some serious waves.