Search for...

In the early days of The Recursive, while pitching to one of our investors, Dimitris Kalavros-Gousiou, a question was raised about when we were planning to implement an ESOP structure. Coming from a legal background, Dimitris reminded us of the importance of setting up an ESOP early on. While we are still in the process of developing our ESOP system, we did allocate 10% equity for employees and we were fortunate to have a knowledgeable investor, but many founders, especially in the still tricky legal frameworks of the CEE region, don’t realise the significance of ESOPs or how to go about implementing them.

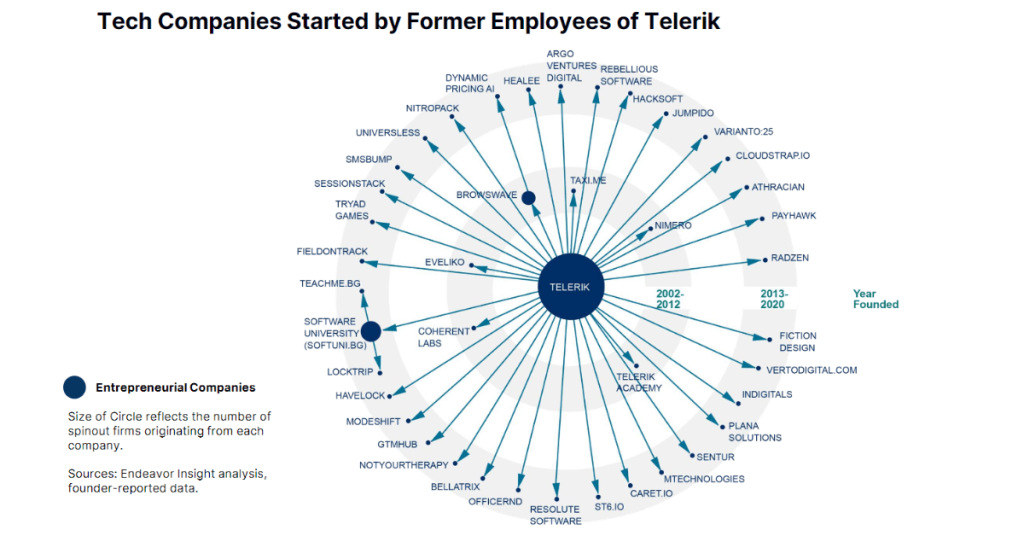

That said, thanks to ESOP, the startup success stories in our region (UiPath, Telerik, Viva Wallet among others) have catalysed a next level of development for the ecosystem, enabling former employees to become entrepreneurs or angel investors. On an individual business level, sharing the company’s success with employees has proven to be beneficial not only for employee engagement but also for sales growth and overall business resilience.

So, in this deep dive we will introduce you to the basics of ESOP, why it’s important for startup companies and the broader ecosystem, and how SeedBlink is aiming to solve many of the challenges founders currently face with ESOP management.

Employee Stock Ownership Plans (ESOPs) are a potent instrument in the arsenal of startups, particularly in the Central and Eastern Europe (CEE) region. They serve as a magnet for top talent, a catalyst for aligning the interests of employees and founders, and a propellant for company growth. ESOPs also have the potential to cultivate a culture of ownership and entrepreneurship, which can be a significant driver of innovation and productivity.

In research studies, ESOPs have been shown to have a positive impact on company growth. A study by the Harvard Business Review found that companies that implemented ESOPs experienced faster growth than their counterparts. The study found that during the five years before instituting their ESOPs, these companies had grown moderately faster than comparison companies (1-2%). However, during the five years after instituting ESOPs, their annual employment growth outstripped that of the comparison companies (5.05%), while sales growth was even faster (5.4%). Moreover, a significant proportion of the ESOP companies (73%) significantly improved their performance after setting up their plans.

Another study conducted by professors at the School of Management and Labor Relations at Rutgers University compared 1100 ESOP companies to 1100 non-ESOP companies. The companies were followed for over a decade, and the results showed that ESOP-owned companies had a business survival rate of 15% higher than non-ESOP companies.

Furthermore, multiple studies over several decades show that employee-owned companies — in particular, ESOPs — are overall more resilient in times of economic hardship than their non-employee-owned counterparts. A 2020 study conducted by the Rutgers School of Management and Labor Relations and the Employee Ownership Foundation found that employee-owned companies outperformed non-employee-owned companies in job retention, pay, and workplace health safety throughout the COVID-19 pandemic. It was found that ESOP companies are 3 to 4 times more likely to retain employees.

Index Ventures, a leading global venture capital firm, also emphasizes the importance of ESOPs in the startup ecosystem. They highlight the “Flywheel Effect” of ESOPs, referring to the positive cycle that can be created when employees are given a stake in the company they work for.

“This has drawn thousands more talented employees into the startup ecosystem. Employees from successful startups often go on to start their own companies, or invest in the next generation of startups as angels. A cycle of entrepreneurship is fostered,” the firm says.

On the business side, the flywheel effect is also true – when employees have a financial stake in the company’s success, they are more likely to be motivated and engaged, leading to better performance and growth for the company. This growth then increases the value of the employees’ equity, further motivating them and perpetuating the cycle. This effect can be particularly powerful in startups, where the potential for growth is high.

Despite the clear benefits of ESOPs, early-stage founders often face several challenges when it comes to managing employee stock options. ESOP plans can be complex to administer, and founders may struggle to keep track of grant and vesting schedules, exercise deadlines, and tax compliance.

Founders may also face challenges in communicating the value of equity compensation to employees and ensuring that the employees understand their options and the potential risks and rewards of holding equity in the company.

In addition, early-stage entrepreneurs encounter difficulties in designing and implementing equity plans that align with their business objectives and attract and retain top talent. Managing employee stock options can be complex and time-consuming, especially when dealing with compliance and tax regulations. Additionally, tracking employee equity grants, vesting schedules, and option exercises using spreadsheets or manual methods can be error-prone and result in compliance risks.

SeedBlink, a leading financing platform in Europe, has developed a comprehensive solution to address these challenges, by launching Nimity, an equity management solution that simplifies the process of setting up and managing captable dynamics and employees option plans for startups and their stakeholders. First of all, this allows founders to focus on growing their business, rather than getting bogged down in administrative tasks.

Second, it provides transparency for employees. By providing a clear and easy-to-understand interface, employees can better understand their stock options, their potential value, and their vesting progress. This can help to align the interests of employees and founders, and motivate employees to contribute to the company’s growth.

Third, the module automates many of the processes involved in equity and ESOP management, including, for example, the tracking of equity grants, vesting schedules, and option exercises, reducing at the same time the risk of errors and compliance issues.

One of the key features of SeedBlink’s ESOP management is its ability to handle the complexities of vesting. Vesting is a process where the employee gradually gains ownership of the stock options over a certain period. This is typically done to incentivize the employee to stay with the company for a longer period. However, managing the vesting schedule can be complex, especially when dealing with different vesting schedules for different employees. Nimity by SeedBlink automates this process, ensuring that the vesting schedule is accurately tracked and managed.

Some of the specially designed features in this respect are:

Multiple types of vesting schedules: Nimity’s ESOP module offers flexible vesting schedule templates that allow companies to set up complex vesting schedules, including soon to be live milestone-based vesting and partial acceleration.

Multiple ESOP plans for each company: Companies could create multiple ESOP plans, with various characteristics, vesting schedules, and even change vesting schedules from employee to employee within any specific ESOP plan.

Event-based scenarios: The ESOP module provides tools to manage ESOP plans during corporate events, such as mergers and acquisitions, including the ability to transfer equity grants to a new plan, adjust vesting schedules, and provide employees with liquidity options.

Secondary market: In the future secondary market features will allow employees and the companies to be flexibile in trading their shares and / or options for cash at any stage in the life of the company, so that the arrival of company events will ensure maximum benefits and tax breaks for all players.

While European oriented, SeedBlink’s equity management module stands out from other solutions in the market due to its focus on the specific needs of small and medium companies in the CEE region. By understanding the unique legal and business environment in this region, SeedBlink has been able to launch the Nimity platform, with a roadmap tailored to the needs of these startups while also incorporating the financial services such as primaries and secondaries transactions and its private and institutional investors network.

Although the platform includes typical modules for managing equity plans, cap tables, investor relations, and more, special focus was exercised at every step of the design and implementation process to ensure that the platform is easy to use by early-stage companies without need for specialised consultants.

In addition, the Nimity platform is designed to automate and streamline the equity management process, reducing the risk of errors and compliance issues. The platform provides real-time reporting, financing tools, and secure access controls, among other capabilities.

Finally, the platform is backed by SeedBlink’s team of experts, who provide ongoing support and guidance to startups using the platform including a range of consulting services to support companies in designing and implementing their equity plans and in complying with regulatory requirements and tax laws.

ESOPs are a powerful tool for startups to attract and retain talent, drive growth, and build a culture of ownership.

Looking ahead, it’s clear that ESOPs will continue to play a crucial role in the CEE startup ecosystem. However, for ESOPs to reach their full potential, several steps need to be taken.

There needs to be a concerted effort to educate both founders and employees about the benefits of ESOPs. This includes understanding how ESOPs work, the potential financial benefits, and the impact on company culture.

Governments and regulatory bodies in the CEE region need to create a supportive environment for ESOPs. This includes clear and favourable tax treatment, as well as legal frameworks that protect the interests of all parties involved.

Companies like SeedBlink are leading the way in providing accessible and user-friendly solutions for managing ESOPs and extending access to equity ownership and trading.

As more CEE startups successfully implement ESOPs and reap the benefits, they can serve as role models for other startups in the region. Sharing these success stories can help to promote the adoption of ESOPs.

By taking these steps, the CEE region can foster a vibrant startup ecosystem where ESOPs are the norm rather than the exception. This will not only benefit individual startups but also contribute to the overall growth and dynamism of the CEE economy.