Only have 1 minute? Here are 3 key takeaways:

-

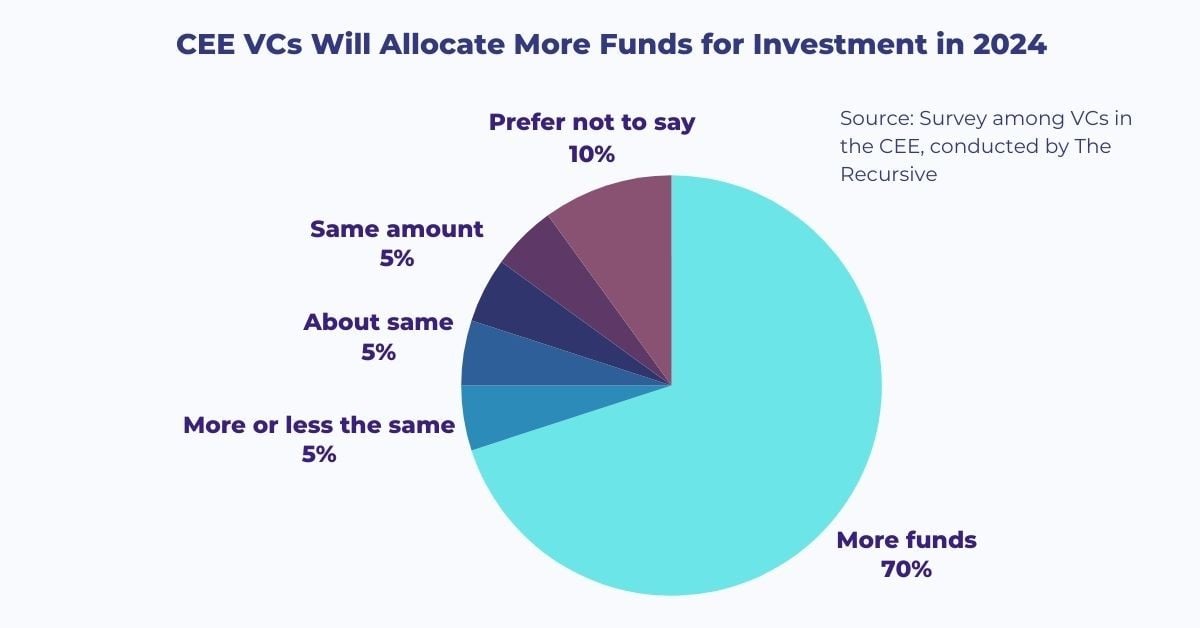

- The Recursive survey of 20 venture capital investors in Central and Eastern Europe (CEE) shows that 70% of them plan to allocate more funds in 2024. They foresee a more favorable or similar market to 2023.

- Generative AI and Deep Tech stand out as key industries for VC investments in CEE, followed by healthtech and biotech.

- Investors expect a few unicorns to emerge from CEE in 2024, but more are betting on the camels and the zebras in the ecosystem.

Startups founders, be more conservative with your burn rate in 2024, and make sure you have a Plan B, as fundraising remains challenging and investors will be diving deeper into the unit economics of your business! Brace yourselves for yet another year of lower valuations and leaner rounds.

The Recursive tested the pulse of CEE investors, their perceptions, and attitudes as they also plan how to navigate a tougher 2024.

We surveyed 20 VC firms from the CEE region for emerging trends and shifts in their investment strategies. Read further for insights into the factors shaping their decision-making process and a snapshot of the prevailing investment climate.

Similar market to 2023, Investors will spend more time on due diligence

Despite geopolitical uncertainty, higher interest rates, and high inflation, funding statistics for 2023 in Europe are the third-highest on record, following ’21 and ’22.

Our survey reveals that 70% of VC investors are planning to allocate more funds in 2024. However, a general consensus exists that the economic climate hurts investment opportunities. Investors share they are evaluating deals more thoroughly, getting more conservative with valuations, and adopting a more cautious approach to their financial allocations, particularly towards riskier assets. Some of them also share they have decided to focus on fewer verticals or industries.

VCs express they are more eager to prioritize the support for existing portfolio companies, making sure they prolong their runaway and focus on profitability over growth,

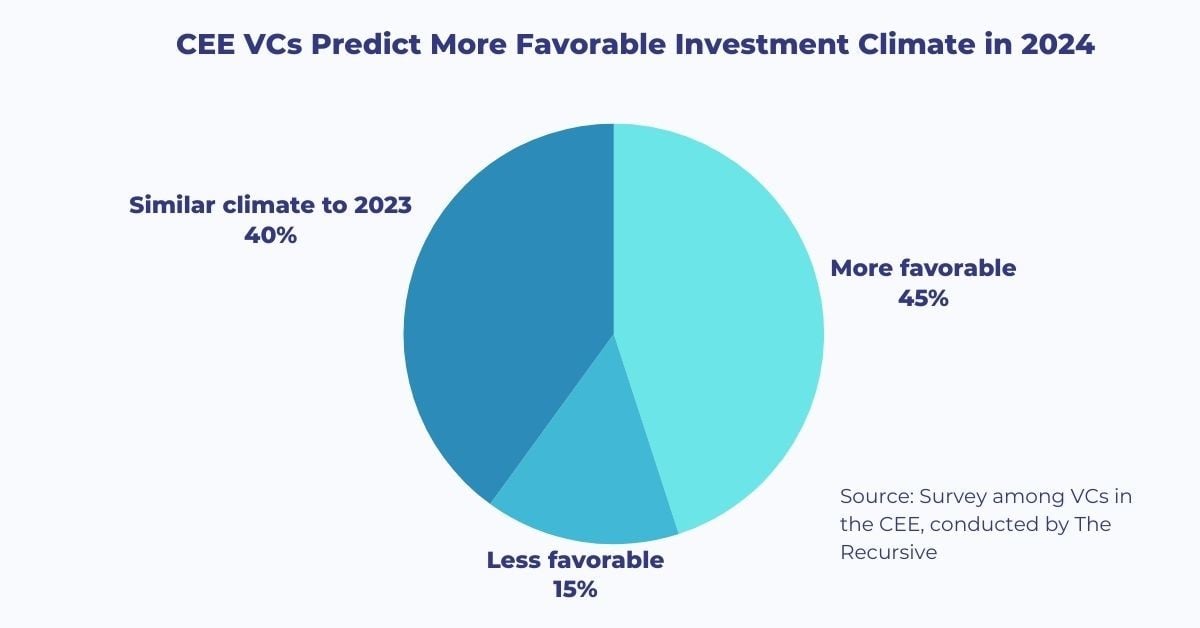

This means putting emphasis on sustainable business models and consistent cash flow, even when companies encounter short-term difficulties. A common approach tends to be avoiding overpriced rounds. Nevertheless, a general opinion is that the current market contraction is a chance for advancement rather than a setback. 45% of the surveyed investors envision the market as more favorable, while 40% predict it would be similar to 2023.

AI and Deep Tech stand out as preferred for investment

Generative AI emerges as a standout industry for investment in 2024. Partially this is due to the hype and investor FOMO, but the latest technological advancements are triggering a growing demand for AI solutions, enhancing software development, marketing, and enterprise automation among many others.

Milan Lupac, Partner at Presto Ventures shares that “while the current AI wave is producing a lot of interesting opportunities, it also brings about a lot of noise – it’d almost seem that companies believe an .ai domain increases their valuation. We stick to our strategy of investing in solutions that aspire to be standalone products with reasonable valuations.”

In general, CEE investors are shifting their focus to acyclical verticals that are not so vulnerable to market conditions like healthtech, biotech, cleantech, and cybersecurity, and those with longer cycles and lesser demand to show revenue like deep tech ventures. Many investors also remain focused on B2B SaaS startups.

In terms of growth opportunities for CEE, investors point at healthtech, biotech, defense tech, energy, and quantum, while fintech, e-commerce, and HR tech are expected to face challenges.

“I would expect vertical AI, vertical SaaS, and defense tech to experience significant growth in CEE. There are a lot of enterprises/businesses with low digitalization and/or inefficiencies. That’s why I expect vertical AI/SaaS to grow significantly. And the Russian-Ukrainian war will push the defense tech”, shares Adam Hashchyshyn, the Principal of Roosh Ventures.

New Unicorns? Investors are rather optimistic

At least 50% of the investors surveyed expressed positivity that we will see new unicorns emerging from the CEE region during the next year (stay tuned for our list with soonicorns in 2024). This opinion is backed by the capacity of the ecosystem to foster innovative and successful startups. But investors point out many bumps in the road – from geopolitical issues like wars to the slower economy, the lack of availability for late-stage financing, the contraction of valuations in late-stage investments, and tighter budgets from customers – which could limit the full-speed development of startups.

Some are betting on the camels and the zebras in the ecosystem, rather than on unicorns.

Startups will focus on profitablity over growth

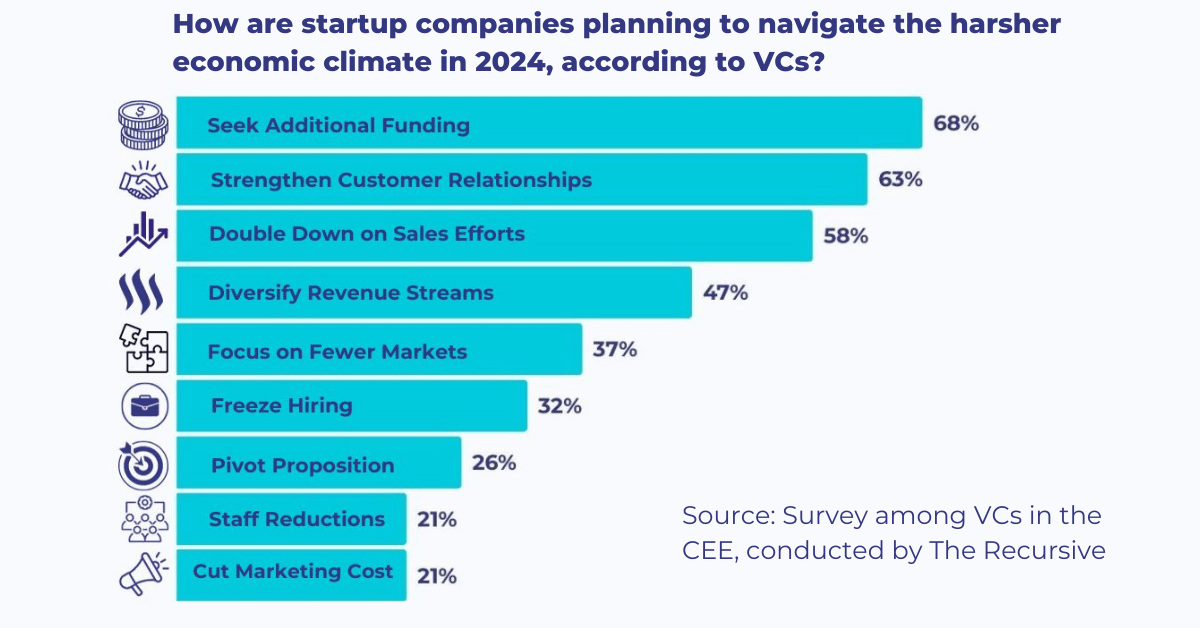

VCs give us insights into their portfolio companies’ plans to minimize losses and enhance the stability of their businesses in 2024.

Despite the more difficult fundraising journey, 70% of surveyed investors say startups will still seek additional funding. Over 60% say startups will be looking to reinforce relationships with existing customers and boost up their sales teams to secure more revenue. Staff reduction, which usually is advised to be a last resort, is a consideration for 20% of the startups while freezing hiring would be a choice for more than 30%.

E-commerce is Facing Challenges

In the upcoming year, there are potential challenges and contractions anticipated in various sectors. B2C businesses, e-commerce, and related startups might encounter increasing regulatory restrictions and rising marketing expenses, posing challenges to scaling.

Based on the survey, a frequent response is that e-commerce and consumer-related businesses are expected to deal with setbacks, particularly impacting non-mission-critical areas like marketing and consumer goods.

In 2024 there are investment opportunities identified in various markets. Based on our survey, founders from emerging markets such as Georgia, Armenia, Azerbaijan, Turkey, and Central and Eastern Europe are perceived as offering valuable investment capacity. Ukraine is singled out as a potentially interesting place for investment in the coming year.