Only have 1 minute? Here are 3 key takeaways:

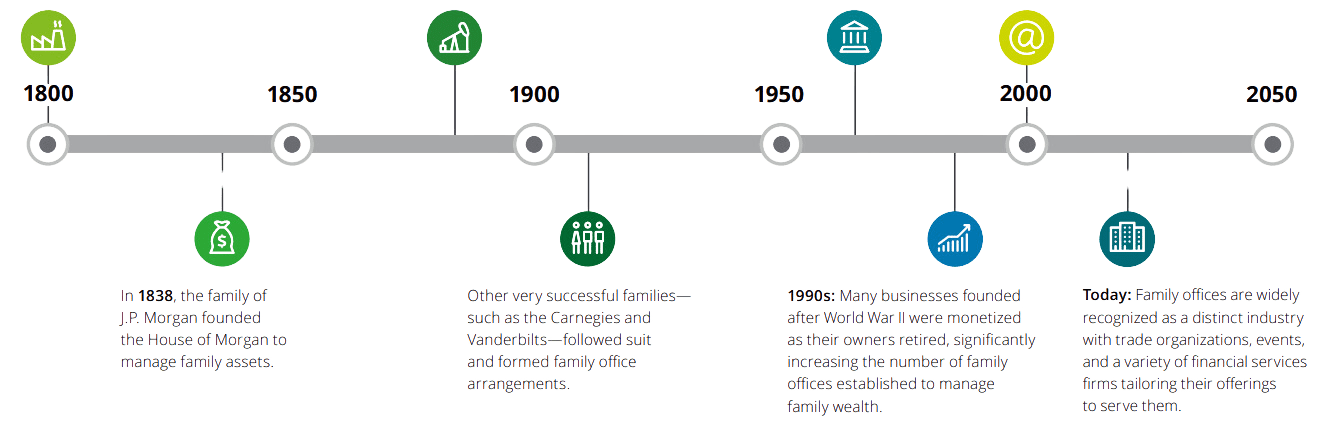

- The concept of the family office has been around since 1838, now in Europe being approx 2,300 family offices.

- 3 family office founders and 2 startup founders have shared their insights on how and why to start or collaborate with such an investment vehicle.

- Compared to VCs, family offices ar more cautions with their investments, but on the same time, with a long-term business view.

The concept of family offices has deep roots in the business history of, tracing back to 1838 with the establishment of the House of Morgan by J.P. Morgan. This initiative paved the way for J.D. Rockefeller to create the first full-service single family office in the United States in 1882.

Source: Deloitte

But what is a family office?

A family office, by definition, is an entity designed to oversee the assets of ultra-high-net-worth individuals, those boasting more than $30M in net worth. Depending on how many families it serves, the setup can be for a single-family office or a multiple-family office.

By looking at the numbers, the family offices have become more and more popular, with 7,300 family offices in the USA and approximately 2,300 in Europe. This data can raise questions and make us wonder where all these offices are. According to experts, family offices don’t like to be too visible for many reasons. Privacy of the family and exclusive selection are just a few. However, some of them are good at being known and are one Google search away.

As one of the main goals of a family office is to multiply the financials of the family, they often look to diversify their portfolio and find the asset class with the highest ROI. Thus, many wealth managers are looking at startup investing, making it a good opportunity for tech startups.

Data from the market, which is confirmed by the PwC’s analysis, shows that family offices are major players in the global market for investment in startups, with 35.5% of all capital invested in startups in 2022 being contributed by family offices.

Looking at the future, most of the family offices in Europe plan to increase their allocation to direct private equity and venture capital, according to an analysis of 102 family offices conducted by Campden Wealth, an organization providing services for family offices. Their data shows that 38% of the family offices will increase their VC investments and 38% will double up on private equity. Also, the same analysis shows that private equity and venture capital are the highest asset classes likely to deliver the best long-term return.

To understand more about how family offices work and what a founder should know when approaching them, we talked with representatives of three out of the eight family offices from this list (in alphabetical order): OPES Family Office, TVP Family Office and Zaka VC.

How to start a family office?

According to Octavian Patrascu, the founder of TVP Family Office and Capex.com, the rule no.1 for starting a family office is to have the money.

“I worked as the VP of business development for Markets.com. Being part of the company from its early stage, I got a stock option plan. In 2015 Playtech acquired Markets.com for €458M and I cashed out my options. Then I continued as the CEO for Trade.com where after 3 years I sold my options. Because I was exposed to the international way of doing business, I learned that when you achieve a specific level of assets, it’s important to manage them correctly. That’s why I decided to open a family office. I put together a team and an investment strategy to create the best returns for all the shareholders,” Patrascu explained.

The same advice comes from Ján Kasper, the co-founder of Zaka VC. As an extra he recommends having a partner with as much experience and assets.

“Zaka VC is a business started by me and my partner, Peter Zálešák. That’s also where the names came from, Za from Zálešák and Ka from Kasper. We both are serial entrepreneurs with a combined experience of over 65 years in 12 business sectors.”

According to Zaka’s website, Ján Kasper started his first business in 1988, owns and co-owns 47 companies in 9 industries, reaching a cumulative revenue of €570M. On the other side, Peter Zálešák founded in 1991 the company Nay, the largest specialized retailer of electronics with over 75 stores in Slovakia and Czech Republic. Zálešák’s family holding exceeds revenues of €500M.

What assets does a family office invest in?

Family offices are versatile investors and can invest in multiple asset classes, worldwide. However, many tend to focus on the industry(es) they know best, with private and public markets, venture capital, and real estate being their favorites.

For Octavian Patrascu, investing in equity in three verticals his team knows well is the right strategy. “We invest in real estate, green energy, and tech startups. These are the verticals where we have experience. Regarding investing in startups, we chose this area because there is a level of dynamism we think is good for the business. Also, as a founder myself of Capex.com, I think that working with the startup teams is fun and engaging. Worth mentioning is that we invest directly into startups, for example, Moonpay and Cogito, but also as LPs in VCs, for example, Sparking Capital,” he added.

On the other hand, when it comes to multi-family offices, covering more asset types is the usual practice.

“We often advise and invest in traditional asset classes such as deposits, fixed income, equities, mutual funds, and others. However, we also look at venture capital. For example, we supported our clients to invest in the private placement of SpaceX. The average ticket per transaction was of approx €6M,” mentions Calin Nechifor, founder of the Romanian OPES Family Office.

In Zaka’s example, their focus goes exclusively to technology startups. “In the last 5 years we invested over €8M in 47 startups. In 2023, our focus was on Bio & HealthTech, for example ExcepGen, OlioLabs, and Medisearch.”

How does a family office find & evaluate the deals?

From network “gossip” to events and business intelligence reports, investment managers are always on the lookout for the next great investment opportunity.

“Because of our experience, network and the partnerships we have at Capex.com, we learn about the hottest deals. We also use technology like ERPs to stay on top of the trends and have subscriptions to business intelligence reports,” Patrascu said.

The same strategy works for Zaka VC when it comes to finding the deal. “We source our deals from different sources: our website and social media, events, our investor and accelerator network, and business intelligence services,” Kasper added.

But, what is interesting here is how ZakaVC is evaluating these. As mentioned before, compared to the classic venture capital fund, the family offices are investing their own money. Because of that, Jan mentioned that “they are very motivated to invest it well”. To make sure the selection process is thorough, Zaka VC has lined up no less than 60 questions for the founders pitching them. These are split into what Ján Kasper calls “the three jobs: problem, solution and insights”.

“We are asking about the problem the startups want to solve, then about the solution which ideally should be synchronized with the problem. Then we ask about other insights such as the market, their growth potential, the financials, and other aspects. If 3 out of our 60 questions are not okay, we are not investing,” further explains Kasper. “This process of analyzing a deal takes from two days up to three months. It depends on the deal’s architecture and competitiveness.”

How is a family office different from a venture capital firm?

While venture capital invests the money of LPs or institutional funds (e.g. European Investment Fund), a family office has its own money into play. Probably this is the biggest and most important difference. With this consideration, a family office will be more selective with its investments. Moreover, because of the same aspect, a family office won’t have the same requirements as a VC to show returns over a specific time period.

Founders who have worked with family offices often appreciate the unique blend of personal engagement and strategic flexibility they offer.

“By having a family office on our cap table, I can say that they have a personal approach in investments with a long-term view rather than a short-term “grow or die” approach. Because they usually have fewer companies in their portfolio, they tend to focus on them. For us, our family office investor DZH – Daneta and Dimitar Zhelevi are constantly helping with contacts, advice, and mentorship,” says Mihail Dimitrov, the founder and CEO of Swipe.bg.

Stephen Burke, the co-founder and CEO of the Czech HealthTech Kardi AI has a similar, yet different experience. “In my limited experience having a single-family office as a shareholder, I think they offer a good balance to VCs. While they may not be as active as a VC with a good acceleration program, they tend to be committed investors, aligned to the mission and vision of the company. They are supportive of their network and can be “raving fans” of the product they invest in,” he explains.