Sustainable urban mobility is a key task for all European cities, as part of the green transition to a more resilient society. Cities have the world’s largest resource and waste footprints. In Southeast Europe, over 50% of the population lives in urban environments. And urban mobility accounts for 40 % of all carbon emissions of road transport and a quarter of the EU’s total GHG emissions. Cities also hold the resources and allies to find the right responses to these challenges.

One important ally is the European Commission. The vision, regulatory framework and legislation packages it sets are among the key drivers of Europe’s urban transport infrastructure and tech development. At the end of 2020, the Commission published its Sustainable and Smart Mobility Strategy for the next four years, in line with the European Green Deal’s 80% emissions cut target by 2050.

The new goals are particularly relevant as EU-level data shows that current urban transport trends indicate no significant changes in terms of modal share, traffic and congestion, and GHG emissions since 2013. Transportation continues to produce substantial environmental costs.

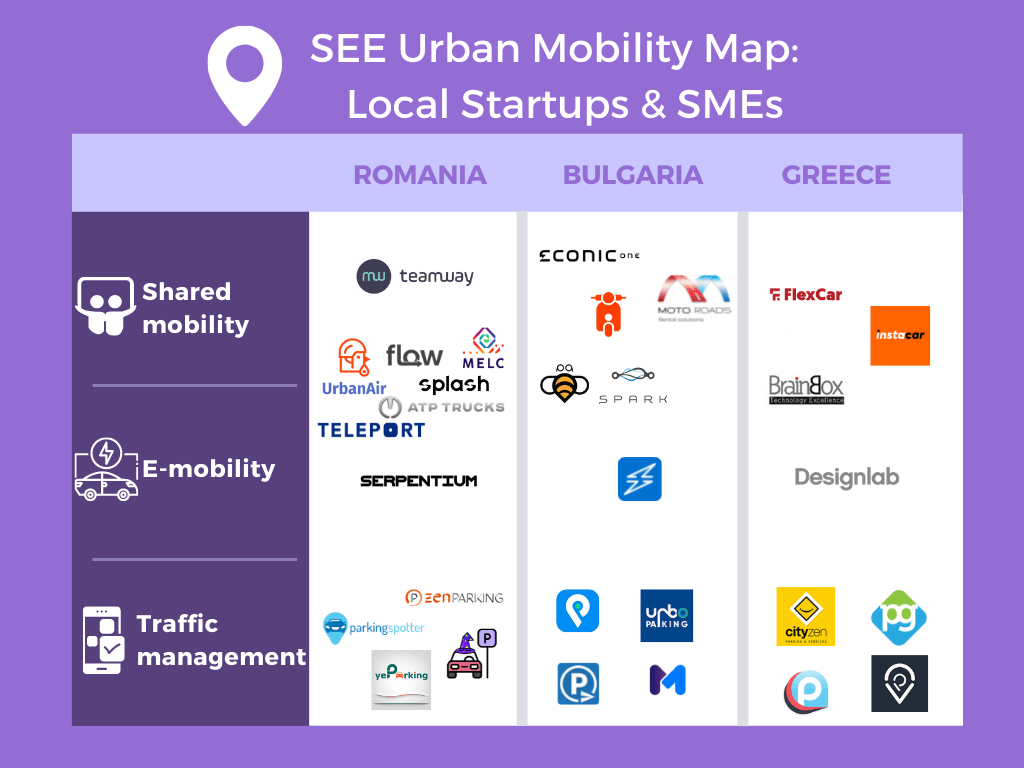

However, in the SEE, the proliferation of shared mobility, electric transportation, and digital traffic management solutions, particularly local ones, indicates a growing interest of the private sector in this niche. The private capital is cities’ other key ally and source of funds and innovation.

The Recursive explored how cities in the SEE have responded to the call for sustainable and smart mobility. In this story you’ll find :

- An overview of key challenges and opportunities in urban mobility in SEE;

- A map of local urban mobility startups and SMEs in the region;

- The key trends in the space: shared mobility, electromobility, and digital traffic management solutions.

The dynamics of urban mobility in SEE

The stakes for advancing sustainable urban mobility are high. Innovations in the sector will make urban transport more accessible and secure, as well as create free-flowing and greener cities.

Key challenges for SEE countries

In the SEE, there are several historical challenges slowing down the transition to sustainable urban mobility. On the political side, there is low support of sustainable urban mobility development, including a lack of national strategies, incomplete implementation and enforcement of national transport laws, lack of transparency regarding investments, and insufficient awareness and visibility of urban mobility projects.

Traditionally, there is a strong dominance of cars in the market, coupled with a preference for car ownership. Recent national planning frameworks and urban development plans are giving priority to car-based road development, especially since road infrastructure is still underdeveloped. Regulation of car ownership, imports of pre-owned cars, and standards for emissions of harmful pollutants (EURO 1, 2, and 3) are also either lacking, incomplete, or not properly enforced.

Overall, more support is needed from local governments to implement and advance the EU’s progressive agenda on urban mobility. Moreover, it requires the coordination of actions from multiple stakeholders, through public-private partnerships, business-model innovation, technological advances, private investment funding, and consumer-aimed campaigns.

To uncover opportunities for sustainable urban mobility in the SEE, The Recursive started mapping the local startups, SMEs and initiatives driving shared mobility, electromobility, or digital traffic management. The list is not exhaustive and we invite you to add any other project that fits the description here.

Shared urban mobility

The increase in shared mobility and integrated mobility platforms in Europe (such as Uber, Bolt, Clever) is expected to reduce the number of cars in use by 5.4% between 2025 and 2030, after an initial increase up to 2025.

In SEE, issues of congestion and poor road infrastructure are driving the need for alternative transport solutions and models. In Romania, for instance, the number of passenger vehicle registrations has almost doubled between 2015 and 2019, but the road conditions are not keeping up with citizens’ appetite for car ownership. Bucharest is one of the most congested and polluted cities in Europe – and so are Sofia or Athens.

Rental, subscription, sharing, and micro-mobility such as scooters and bikes have proven effective in complementing private cars and public transport elsewhere to improve urban mobility. Shared transport providers have changed the way people move by connecting passengers to a variety of vehicles and drivers to passengers. Shared mobility has attracted the attention of not only startups but also venture capitalists, OEMs and rental companies – all wanting to ride the trend.

In the SEE, we have seen early adopters triggering a boom in models such as scooter rental and ride-sharing. Unfortunately, the trend towards shared mobility has inevitably plummeted during the lockdown. Yet as cities are recovering from the pandemic and return to their usual dynamic, companies expect the interest in shared mobility to take up again.

Romanian-based UrbanAir is a great example of this renewed interest. The app aims to provide a single point of finding and unlocking all shared mobility providers – from e-scooters and bikes to cars. To create a frictionless experience for travellers, Neobility, the company behind Urban Air, plans to launch the platform in all major cities in Europe by the end of 2021. In this way, you can access any local partner services with minimum effort.

Another Romanian tech startup, Teamway, has launched during the pandemic with the goal of making carpooling a viable option for co-workers. Ride-sharing among colleagues can both contribute to fighting congestion and pollution and also save the riders some money. The mobile app uses geolocalization and offers scheduling, chat, and notification features, connecting drivers to riders. Teamway aims to start looking for VC funding and expand across Eastern Europe.

In Bulgaria, Hobo’s shared electric scooters have experienced fast growth since entering the market in 2019. Just recently the company received a €255K investment from Bulgarian fund Vitosha Venture Partners. In addition to Sofia and Blagoevgrad, Hobo now plans to expand to Plovdiv, starting with 100 electric scooters.

E-mobility

When fuelled by carbon-neutral and renewable energy, e-mobility is a key enabler of the green energy transition and a reliable transportation alternative for eco-conscious citizens.

Yet, EVs are starting from a very low base. Of the 15.2 million passenger vehicles sold in Europe in 2019, only 460,000 were electrically chargeable, as either battery electric vehicles (BEVs) or plug-in hybrid electric vehicles (PHEVs). With a 2.4% growth over the past 6 years, EVs account for a mere 3% of total vehicle sales in Europe.

So far, EVs have been pushed more by regulation than market forces – and regulations are increasingly stringent. By 2030, European CO2 provisions stipulate that EVs must make up 35-40% of overall vehicles sales. And since the availability and location of charging infrastructure are just as important, 3 million public charging points are also targeted, up from ~200k today.

At the beginning of 2020, Romania got approval from European competition regulators to launch a 53 million public support scheme to develop charging infrastructure countrywide. In the near future, the private sector also needs to be persuaded to invest in charging infrastructure, despite the lack of unified charging standards and low-profit margins.

In Bulgaria, AMPECO, the smart cloud software suite for EV charge point management, enables businesses to launch and scale EV charging services. The software can be used to manage, maintain and remote control charging stations. Additionally, it can integrate electricity tariffs and virtual power plants in order to use renewable energy best. Orlin Radev, founder and CEO of AMPECO, further shares that the company is growing fast, matching the speed of its clients. The company aims to become the market leader for EV charging management in Europe, while also entering the US.

E-mobility and shared transportation models form a suitable symbiosis for private investors. For instance, an electric car rental model enables OEMs to test their own vehicles, as well as raise awareness about the specifics of EVs among potential customers.

For instance, Spark recently expanded its electric car-sharing services to Plovdiv, after launching in Sofia in 2017. The Spark brand in the country operates under UAB Ride share, a 50/50 joint venture between Bulgarian-based E-mobility International and Lithuania’s UAB Ride share. The company also has a separate service for businesses with car fleets and ride-sharing services.

Romanian-based Dacia, owned by French producer Renault, will also be launching its first electric car, Dacia Spring. The company started taking pre-orders in March 2021 for what is the most affordable EV in the European market (€18.1K full price or €7.7K subsidized).

Moreover, ATP Trucks Automobile just tested out the first 100% electric bus in the country. e-UpCity is an alternative and competitive solution meeting the needs of modernizing urban public transport cost-efficiently. The prototype has an autonomy of 360 kilometres and a capacity of 83 seats, as reported by Economica:

Electric vehicles and micro-mobility are also enjoying synergies. Bulgarian startup Econic One bets on e-bikes as a solution for sustainable and smart commuting and recreational rides. They already have 10 countries and 80 locations across Europe in their network. The e-bikes have a range of up to 142 kilometres and come with a mobile app that allows smart locking and triggers an alarm if the bike gets stolen.

Digital solutions for traffic management

While the transition to shared and e-mobility improves the quality of transportation and its impact on urban life, other developments and innovations in traffic optimization also help decrease congestion and pollution. Given that there are more cars on the road than any other vehicles, parking spots in urban areas are a necessity. In many SEE cities, mobility is often disrupted by the scarcity of parking spaces.

In response, numerous tech solutions such as mobile apps that optimize parking have appeared in the last few years. Some fitting examples for Romania are Parking Spotter, a smart solution that analyzes video images from parking cameras to determine parking spots availability and communicate them to app users.

Meanwhile, ZenParking and yeParking enable users to reserve parking spots in public and residential areas. yeParking aims to provide a single-connected hub where parking options can be listed, accessed, paid for and earned from, regardless of their nature and ownership. They are working on an Open Parking Protocol – the next step for the industry – whereby parking owners bring their parking management in the cloud, opening it to a wider range of drivers and a better usage efficiency.

Elsewhere in Greece, companies such as Cityzen, Parkaround and Parkguru aim to optimize the parking process. Cityzen even offers monthly parking plans. Parkguru uses AI and information from other sources such as weather forecasts and public holiday calendars to optimize parking for its users.

As these lists are never exhaustive, we invite you to add any other projects that fit the profile here or drop us an email. Let’s bring some visibility to the shared urban mobility ecosystem.