On June 1st, Sin Cars Industry, the sports cars and EV manufacturer, raised €1 M (BGN 2 M) through an initial public offering (IPO) on the Bulgarian Stock Exchange. This was three times more than the demand and vastly exceeded the minimum requirement of 250,000 shares at BGN 1 par value. This follows the company’s recent strategic shift towards serial production of sport electric vehicles, after winning over 30 races in 3 continents with the flagship SIN R1 racing car.

Racing runs in the heart of the company, with founder, CEO, and the majority owner of the company, Rosen Daskalov, a former car racer with 30 years of experience in motorsport and industry. Mr. Daskalov is also a keen supporter of electromobility. “We happen to be the second company to list on the BEAM market, so it is relatively new to Bulgaria. (…) We expected mainly individuals who like what we do and believe in the path we have taken, namely electric cars,” he tells The Recursive.

From winning sports cars to mass production of EVs

Since 2018, Sin Cars Industry continues to be part of the activity of Sin Cars International, a business with 10 years of experience in producing racing cars. The prototype won the hearts of racing fans at Autosport International in Birmingham, England. Today, Sin Cars Industry is tapping into the emerging electric vehicles market.

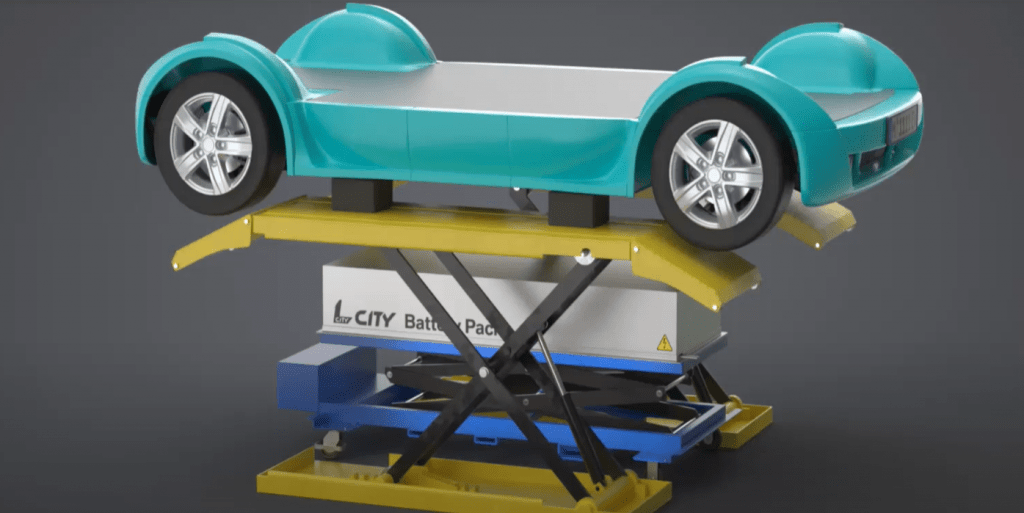

At its 6000 square meters factory in Ruse, the company produces electric car components such as chassis and coupe parts, while assembling takes place at the German base. Its L City platform was designed for electric vehicles and is protected by a utility model and a patent.

Prior to the IPO, the company had already been backed up by investors and partners. With a capital of BGN 18.5M (€9.5M), its main shareholder was the software company VK Solutions EOOD, with 500,000 shares.

In the next 5 years, the manufacturer plans to expand the capacity of production to 20 platforms per day, or 5,000 electric vehicles per year. To raise new funding, the company applied for registration on the SME Growth Market (BEAM) segment of the Bulgarian Stock Exchange. This builds on the potential to sell to a booming EV market in Germany and other European countries.

The Recursive reached out to Rosen Daskalov to discuss the company’s move into the stock market and the overall potential of the EV market in SEE.

Congratulations on issuing an IPO for Sin Cars on the Bulgarian Stock Exchange BEAM market. How did you get to this point? Tell us a bit about the journey.

The business started in 2012 with the establishment of the company Sin Cars International Ltd. and the first Bulgarian sports and racing car SIN R1. Its homologation for the GT4 world championship and sales on 3 continents are proof of the experience gained and the successful realization of the company’s products. After nearly 10 years of testing, prototyping, participation in competitions, and numerous exhibitions, we have created and established the SIN CARS brand not only in Europe but also in Australia and America. In 2016, we received European approval for a car manufacturer.

In connection to the efforts to reduce harmful emissions and bring electrification worldwide, in 2018 the L CITY project was launched – a platform for EVs.

We had planned the IPO earlier but waited for the stabilization of markets and business after COVID-19. We used this time to test and further develop the L CITY models. Now that we have a real market product, not a prototype with an uncertain future, we feel even more confident.

You managed to raise the €1 M (BGN 2 M) sought. What were your expectations in terms of the interest in the market?

We expected mainly individuals who like what we do and believe in the path we have taken, namely electric cars. We do not rule out the inclusion of legal entities wishing to become part of our business. Due to the specifics of the BEAM segment, though, pension funds cannot join the company.

How will the new funds support the Sin Cars business, both locally and internationally?

For the next 2 years, we have secured financing from banking institutions, but it does not provide us with rapid growth. The BGN 2 million raised from the IPO will be invested for this purpose. We intend to finance:

- The establishment of a representative office in Germany

- The construction of a robotized line for welding and painting of chassis

- A laser for cutting machine for tubular and sheet material

- The production of test electric cars for initial sales and testing in a real working environment

- And the recruitment of additional staff.

The company’s L City Platform, photo: LinkedIn

What would help grow the overall EV market in EE and SEE?

Global sales of electric vehicles are growing staggeringly from 2016 to 2018 by 60%, reaching 201 million in 2019, according to analyst McKinsey & Company. They remain the only growing segment within the automotive industry in the last year. 2020 saw the most registrations of new electric cars in Europe – 1,368,167, with Germany leading at 394,943 units.

New rules on global carbon emissions are pushing carmakers to progressively turn to electric cars to avoid huge fines for breaking ecologic norms. The EU sets extremely tough rules for car companies, aiming to reduce their carbon emissions by 40% between 2007 and 2021.

Germany will soon overtake Norway as Europe’s main market for electric cars. Their government provides incentives in the form of a financial bonus of €4K when buying new electric vehicles. A package has been adopted, according to which the bonuses for the purchase of electric cars with a price of up to €40K will be €6K and this will equalize the costs of buying an electric car with those for a car with an internal combustion engine.

Based on these success stories, the restrictions about global carbon emissions and environmental bonuses for buying electric vehicles could also help grow the EV market in EE and SEE.

What is the market potential for electric vehicles in the sports cars niche in EE and SEE?

The sports cars market is already quite saturated in EE and SE with imports from countries like Italy, Germany, and the UK, and even across the Atlantic and East Asia. When talking about electric sports cars, the main problem is charging, since they tend to consume a lot of energy, but charging is slow. Also, let’s not forget that part of the sports car’s charm is the noise and vibrations of the engine, which is missing in EVs. So, we expect such market potential, but it will not come in the next few years.

Do you have any advice for young entrepreneurs tapping into a niche market?

Just to follow their dreams and work really hard to achieving them. This is my key to success.

You may also read:

+++Stock exchange opportunities for founders in Southeast Europe