The Hofburg Imperial Palace has been the heart of power in Vienna since 1279. The home to decisions that would affect an entire empire, the Habsburgs. Fast forward to the present day, another agenda has been recently discussed at Hofburg: the future of impact investing in Central and Eastern Europe. Every year, Impact Days gathers relevant stakeholders from the region with the goal to make impact investing a fundamental part of the mainstream financial sector.

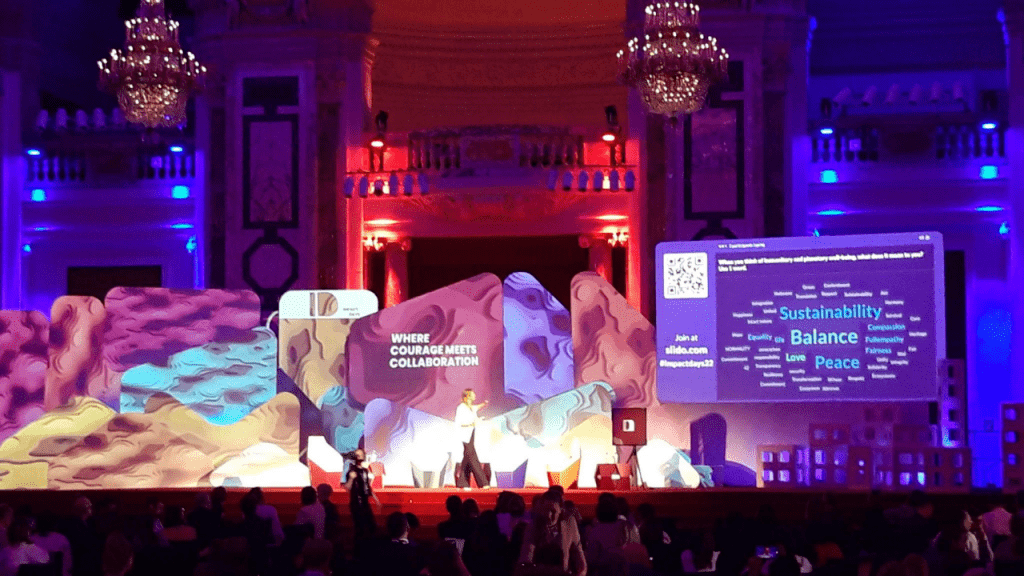

500 people attended, from the former President of Austria, Heinz Fischer, and high officials from European financial institutions, to representatives of banks, VCs and other funds, investors, and impact entrepreneurs.

While impact investing has been around for decades, it has recently gained momentum, to the point where 2021 was declared the year of ESG investing. A recent study by US-based NGP Capital VC indicates that impact-driven startups attracted two to three times more funding than non purpose driven startups. They are also less likely to fail. This is the latest in a series of analyses showing that investing in companies and solutions that perform well on non-financial factors, such as environmental, social, and governance (ESG) impact.

Matei Dumitrescu, General Partner at Romanian early-stage, privately funded VC Roca X, also attended Impact Days, together with his team, investment managers Theodor Genoiu and Bogdan Pasca. Matei has a vast and diverse experience helping build the startup ecosystem in Romania. Among his other hats, he is the founder of Commons Accel, an independent, equity-free accelerator for smart and sustainable projects.

The Recursive reached out to Matei Dumitrescu and the Roca X team to check the pulse of the vibrant impact investing community in Central and Eastern Europe.

The Recursive: What are the key priorities for impact investors in Central and Eastern Europe at the moment?

Matei Dumitrescu, General Partner at Roca X: Among hot topics now are climate change mitigation solutions, green economy, including green energy transformation, but also traditional ones, such as health, education or smart cities.

How about major bottlenecks? What is stopping investors from financing climate mitigation innovations in Central and Eastern Europe?

Matei Dumitrescu: The ventures themselves. They need to be more mature. In the current stage, most of them are very focused on the problem and the solution, and that is great, that people are iterating in order to find sustainable and innovative solutions. Still, they have to be developed into real products, and you have to have a business case after all. And a good and profitable business is not an investment case! To get a real investment you need to have a fast growing business, scalable, with an exit horizon in a couple of years that can provide a multiple for your investors.

Impact investing, ESG, CSR – there are a lot of terms used to describe the current trend around creating more positive impact in society through business activities. Can you walk us through what they mean from your perspective as an impact investor?

Matei Dumitrescu: First, there was Corporate Social Responsibility (CSR), which implies companies are responsible for their outputs and externalities. First, it required companies to conduct their business legally and then ethically. Somewhere on the road came the idea that companies need to spend some of their profits in order to do something measurably good for society, community, and the environment.

NGOs considered it greenwashing until they got sponsored to do the good stuff for the community – and that’s still a debate. Corporations perceived it first as something that had to stay with PR and that can eventually help sales.

But some NGOs started creating real value, value that people were willing to pay for. The fine line between a startup and an NGO became thinner as it was always about solutions to societal problems, not about who’s providing the solution.

There’s an obvious financial trade-off when you do business consciously and pay more for having less bad externalities while creating good ones. The business model is getting balanced only when people are starting to be aware about the value an impact venture is bringing, and when then they are willing and ready to pay more. And it’s also about the regulations – penalizing the polluter, subsidizing the green one.

But once regulations came into place, when public awareness grew, when ventures polished their business models, all these initiatives “to do good” – whether CSR, NGO activities, impact startups, became profitable. And when we speak profits we speak business. There’s nothing bad about being paid to solve real world’s problems.

And then came the impact investing. A term established a bit before the financial crisis of 2008-2009. And it meant a for-profit investment activity that creates intended, measurable positive benefit for society and/or the environment. And yes, that’s about basically a regular VC business, with multiples that competes with the market-rate returns. Studies have shown that median returns of the impact investment funds are just 1 percentage point behind the non-impact ones.

Then the UN SDGs were established in 2015, setting up a global and standardized framework of goals, metrics and key targets on 17 areas, with the intention of designing a sustainable future until 2030. They say, only what’s measured is getting done, however we’re pretty far from achieving the goals in time. And we need $2.4 trillion to fill the investment gap for fulfilling the SDGs – yearly.

Now we also have ESG in the picture. These are corporate policies that may get standardized in the near future as the reporting must be unified across different industries, countries. And because there are a lot of multinational corporations following the same policies in different geographies. Standardization is an actual need.

In impact investing however, it’s still up to the parties involved in a deal, in the investor’s view, or in the institutional investor’s established framework. It relies, however, on a set of metrics that should be observed and reported.

What else is needed to accelerate the achievement of the SDGs and the Green Deal targets?

Bogdan Pasca, Investment Manager at Roca X: Communicate more and make people more aware of the global problems and the need to implement and use the existing solutions. In Western Europe consumers demand that the products or services they’re buying have sustainability embedded into them. That’s not the case in the SEE. We’re still too busy with slot machines to fully grasp that we have a short window of time to fix these things before they become irreparable.

What lessons on scaling can climate tech founders in Southeast Europe draw from success stories in the West?

Bogdan Pasca: Whatever you’re building, make it interoperable. For example, the energy grid of the future will consist of both old and new technologies. The goal is not to replace the entire system, but rather to find innovative ways to make them work together as efficiently as possible.

What advantages do we have on our side in Southeast Europe in developing climate tech innovations?

Bogdan Pasca:

We still lack proper infrastructure in the SEE, and that’s a great advantage, because we can adopt more sustainable alternatives without replacing older ones. Part of the reason we have high speed internet connection is because we were too underdeveloped to adopt the first iterations of the technology. That lag turned out to be a great advantage, eventually.

What do investors expect to see from a climate tech startup in the early stages?

Bogdan Pasca: Among others, a strong proof of concept, and the ability to understand how the market moves. It’s still a blue ocean.

Matei Dumitrescu: What should you do as an early stage impact entrepreneur? Get public money, get angels aboard, enter negotiation with early stage VCs and be flexible with your terms and realistic with your forecasts. Then get into an accelerator for capacity building (for instance, at Commons Accel we already trained over 200 entrepreneurs into successful business execution and more than 20 got funded).

What can founders do to meet and connect with potential climate tech investors interested in the region?

Matei Dumitrescu: They can come to us, to Roca X, or, for the early stage ones, to Commons Accel, which has embedded in its core values the impact and sustainability framework and it’s by itself a platform from which one can get into the spotlight in front of the CEE’s impact investors.

And it’s important not to get unprepared in front of investors. If you are prepared there are also angels out there, on non-dilutive solutions like grants, and even competitions.

What are you bringing back with you in terms of inspiration, vibes, and food for thought from Impact Days?

Matei Dumitrescu, Roca X: My connection to Impact Days, as well as impact investing, started 10 years ago when I attended the Investment Ready Program, an impact accelerator that I later joined as one of the team members. The program became the largest impact accelerator in the region, operating in 17 countries. Its Demo day – which gradually became CEE Impact day – attracted lots of attention and engagement year after year, eventually transforming into a two day event.

This year, in front of 100 startups and investors packed in a breakout room with 50 seats, I presented our achievements and goals at the Roca X VC fund regarding the impact investing area.

It was a vibrating and enriching environment. So many people gathered to innovate and to collaborate in finding ways of transforming our society and economy for a sustainable future.

There are troubles ahead and we have to act, to find global solutions. There will be no more linear economy. A circular economy, closing the loop, will be the new paradigm.

I learned that the shift to the impact economy can be compared to the industrial revolution. And while this process will lead to major disruption and uncertainty, it would also create opportunities for impact startups and impact investors who will thrive by creating new markets, business models, and new sources of value.