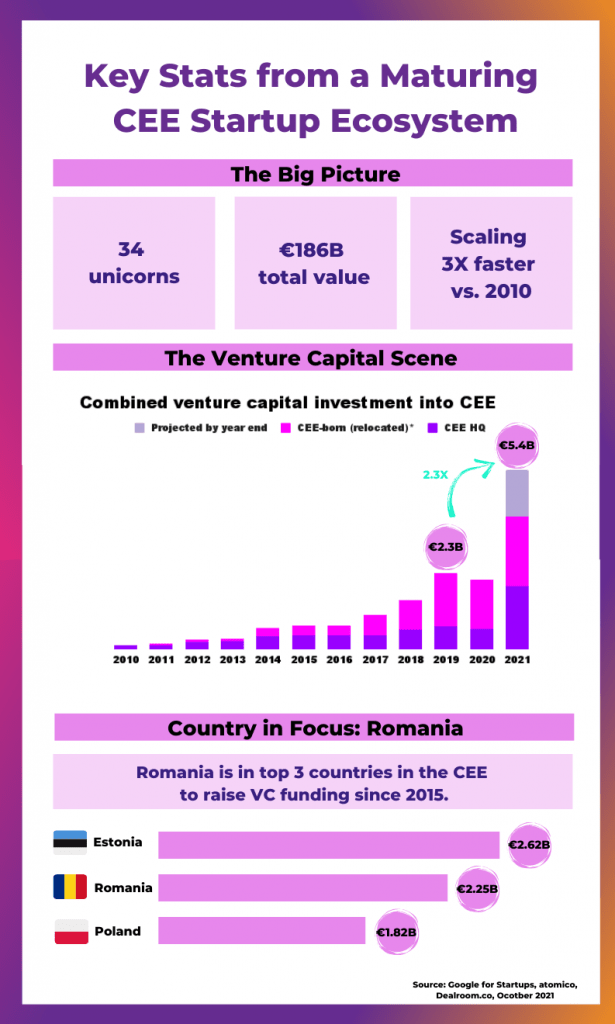

The Central and Eastern European startup ecosystem has been built steadily, deal by deal, unicorn by unicorn, in the past 20+ years. A new study by Dealroom, Google for Startups and atomico shows that CEE startups reached a combined value of €186B.

The ecosystem’s roots go all the way back to the 1980s when the first software companies coming from the region were an early indicator of its ability to capitalize on its exceptional technical talent. Despite missing a strong VC presence, founders have become increasingly ambitious. More and more businesses are built with regional or global scale in mind, companies are scaling faster than ever, and founders go on to build new businesses after their first attempt, the study exemplifies.

The Recursive went through the takeaways of the study: what indicates a maturing startup ecosystem, how are SEE startups integrating into the picture, and what are the dynamics of the venture capital scene.

A mature startup ecosystem, scaling at a faster pace

After decades of leveraging exceptional technology developing capabilities and growing global software companies, the CEE tech ecosystem is at a point where the benefits of hard work can be seen with the naked eye.

To date, 34 unicorns have been created in CEE. By 2015, there were only 6, yet in 2021, alone, 12 startups were declared unicorns, out of which 5 exited. We recently wrote about Czech grocery delivery startup Rohlik hitting the unicorn status after a € 100M Series C investment.

Moreover, companies are reaching the unicorn status almost three times faster than 10 years before. Since 2010, the ecosystem has raised new unicorns almost every year, aside from 4 instances, in a positive flywheel effect. As startups reach global success and exit with support from local talent and regional investors, they attract more and more international investment in the region. Moreover, successful startups produce talent that then builds the next generation of startups.

Part of the reason is that founders are thinking more internationally than ever before, says Maciej Ćwikiewicz, CEO at PFR Ventures, in the study. On the other side of the equation, local funds are also building their international connections and gaining experience in foreign expansion.

Increasing the presence of international funds in the region further brings additional knowledge, network, making future internationalization easier.

Romania, in top 3 countries to bring the largest startup value since 2015

Out of South East Europe, Romania (UiPath, eMag), Bulgaria (Telerik, SiteGround), Croatia (infobip, Nanobit) and Slovenia (Outfit7) managed to produce a few big exits and companies with multimillion valuations. There are more rising stars and future unicorns on the horizon, including Romanian FintechOS, Bulgarian Hyperscience, and Croatian Rimac. When it comes to VC funding per capita, Croatia and Romania are somewhere in the middle among European countries, followed closely by Bulgaria.

Between 2015-2021, Romania has raised the second largest amount of money after Estonia among CEE countries: €2.25 billion. What were the key drivers behind this success?

“Romania’s startup growth is based on the outsourcing industry and development skills accumulated in the past 30 years and is encouraged by the worldwide growing trend in startups. All the while, the local capital (angel investors and local funds) that became available due to the economic growth is fueling the appetite for startup building.

Also, the experience in startup products that various founders gained in the past decade is useful for the new generation of founders that can use their advice and mentoring in the many pre-acceleration programs existing in the bigger cities,” Mircea Vadan, Managing Partner at Activize and Founding Board Member at Transylvania Angels Network, told The Recursive.

The strong community support in the form of conferences, competitions, and mentorship also contributed, by creating connections among interested people, Mircea continued.

“Everybody witnessed a strong growth in the tech startup ecosystem, mostly led by success stories like UiPath, Elrond or FintechOS which on one hand boosted investors’ appetite and the number of investors, and on the other hand helped a lot of young talented people decide to take the entrepreneurship path”, said Matei Dumitrescu, senior partner RocaX, part of Impetum Group, for The Recursive.

Record VC funding 2021, with strong dependence on international investors at late stages

Increasing venture capital availability in the CEE is a pillar for the ecosystem’s growth. So far in 2021, startups founded from the region raised €4B b, and are projected to reach €5.4B by the end of the year – 2.3X more than the previous year. Moreover, they achieved all-time high early-stage VC financing in the first half of 2021 – €733M across pre-Seed to Series B rounds.

Nevertheless, domestic venture capital for late stage funding needs is still lagging behind to the point that CEE is the most foreign VC dependent region in Europe. International investors accounted for 90% of the investment growth since 2017.

As a consequence, international investors have increased their presence in the region. Since 2017, foreign VCs accounted for no less than 90% in investment growth. It also seems that companies are attracting bigger and bigger deals. Megarounds – investments of €100M+ – started appearing in 2017 and ended up accounting for 55% of deals in 2021.

Industry-wise, enterprise software attracts twice the amount of VC financing versus the rest of Europe, indicating a key strength for the region. Most of the value was created by startups in the areas of process automation, developer and collaboration tools, software development, cybersecurity, marketing and sales.

Finally, the region’s strong roots in technical expertise and the ecosystem’s growing business knowledge are another key part of the story. The region still lacks a strong VC scene. CEE startups have had to build their way to success with personal finances more than in any other part of Europe – 31% of CEE-founded unicorns have been bootstrapped, 24% more than in the rest of Europe.