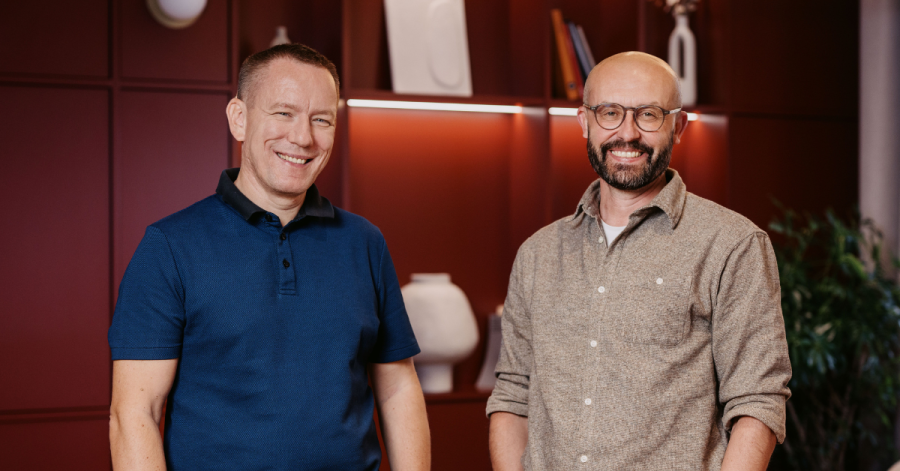

Aspire11 has announced the launch of its inaugural €500 million pension-backed fund, led by veteran venture capital investor Pavel Mucha, with a mission to connect European pension savings to high-growth innovation. The initiative seeks to reshape the way pension funds participate in venture capital (VC), inspired by Canada’s “Maple Model.”

Despite managing trillions in assets, European pension funds currently allocate just 0.02% to venture capital, compared to nearly 2% in the US. Aspire11 aims to break this cycle, opening new pathways for long-term capital to support entrepreneurs and VC investors for decades to come.

“Awakening dormant pension capital and connecting it efficiently to VC investors and lifelong builders has turned into a mission for me,” said Aspire11 founder Pavel Mucha. “With broader shifts in EU pension and investment rules, pension capital can now engage with private and venture markets. Aspire11 is designed to back both lifelong business builders and frontier VC investors.”

Two-pronged investment strategy

Aspire11 will operate with a “barbell” approach consisting of two strategies:

-

- Tribes: backing a new generation of early-stage VC investors focused on emerging technologies and demographic shifts.

- Eternals: long-horizon investments designed to hold companies for 20 years or more, enabling them to scale without the pressure of short-term exits.

Mucha is joined by partner Tülin Tokatli, formerly an investor at the European Investment Fund (EIF), who will lead the Tribes portfolio.

Building on proven experience

Mucha, who previously founded KAYA VC and co-founded Orbit Capital, has invested in some of Central and Eastern Europe’s most successful startups, including Rohlik Group, Mews, Booksy, and DocPlanner. He has also been an early backer of seed funds behind global names such as Revolut, PhotoRoom, Incident, and Yoco.

With more than 15 years in private markets and venture capital, Mucha brings a track record of identifying and supporting category-defining companies to Aspire11’s long-term pension-focused model.

Backed by The Partners Group

Aspire11 launches with support from Czech pension company Rentea, part of The Partners Group, which manages €7 billion in assets across pensions, deposits, and investments. Serving two million clients across four European countries, The Partners Group is one of Aspire11’s cornerstone limited partners.

Together, they aim to demonstrate that pension capital, when entrusted to leading VC investors and entrepreneurs, can deliver both financial security for retirees and sustained prosperity for Europe’s economy.

With the goal to unlock trillions for Europe’s future

Aspire11’s analysis shows that redirecting just 1% of European pension funds’ assets could unlock €87 billion annually — and over €1.1 trillion over a decade through compounding. This would provide much-needed depth to Europe’s private markets and reduce reliance on overseas capital.

“For years, European entrepreneurs have scrambled for patient, long-term capital at home, while investors sought liquidity abroad,” Mucha added. “The contrast with North America has been glaring and demanded change. Aspire11 is here to give European builders the time, stability, and resources to win.”

Looking ahead, Aspire11 plans to gradually expand its footprint globally, while keeping Europe at the core of its mission: strengthening pension funds, supporting innovation, and fueling a more competitive future economy.