Europe’s most ambitious founders are building at the edge of innovation — from AI and robotics to carbon accounting and sovereign cyber-infrastructure. Yet the very qualities that make these startups visionary also make them financially fragile. Long development cycles, capital dependencies, and regulatory hurdles mean the standard startup playbook doesn’t fit.

That gap is what CFO Insights wants to close. The Sofia-based CFO as a service firm is launching a series of practical playbooks to guide founders in three strategic verticals — AI & Deep Tech, Cleantech & Climate Tech, and Defense, Cybersecurity & Sovereign Tech — on how to align capital, milestones, and governance. Each edition distills lessons from years of working with Europe’s frontier companies, helping founders treat finance as architecture rather than administration.

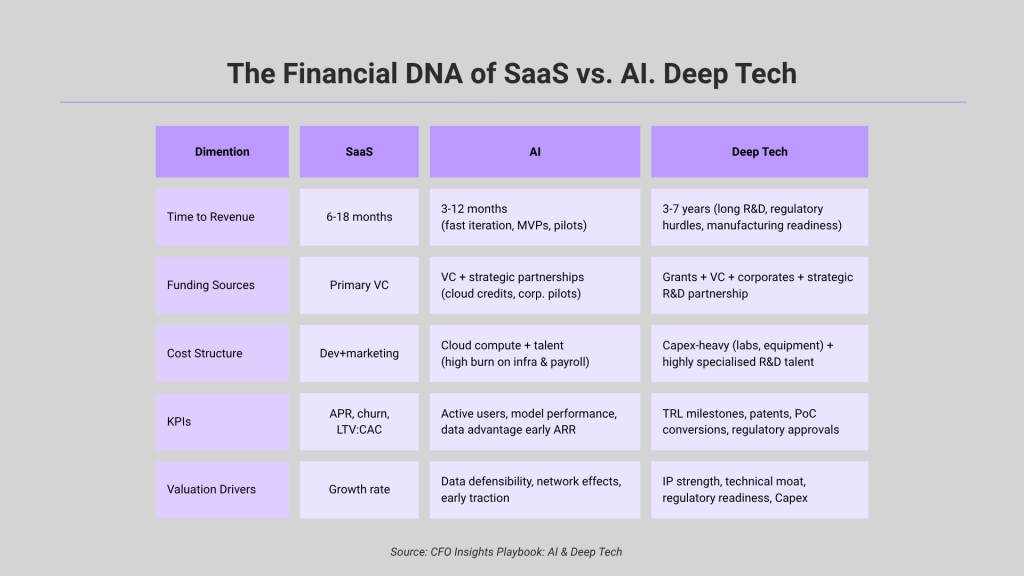

“Deep Tech and SaaS follow entirely different financial logics,” says Diana Aladzhova, CEO of CFO Insights. “SaaS rewards speed and iteration. Deep Tech demands patient capital, multi-stage R&D, and milestone-based funding rather than traditional VC rounds.”

From startup speed to strategic finance

The first AI & Deep Tech Playbook lays out a simple thesis: funding should follow Technology Readiness Levels (TRLs) and IP maturity rather than quarterly revenue curves. CFO Insights calls this approach Deep Finance — financial planning built on scientific and technical milestones, not growth hype. For founders, this shift means rethinking how they define traction.

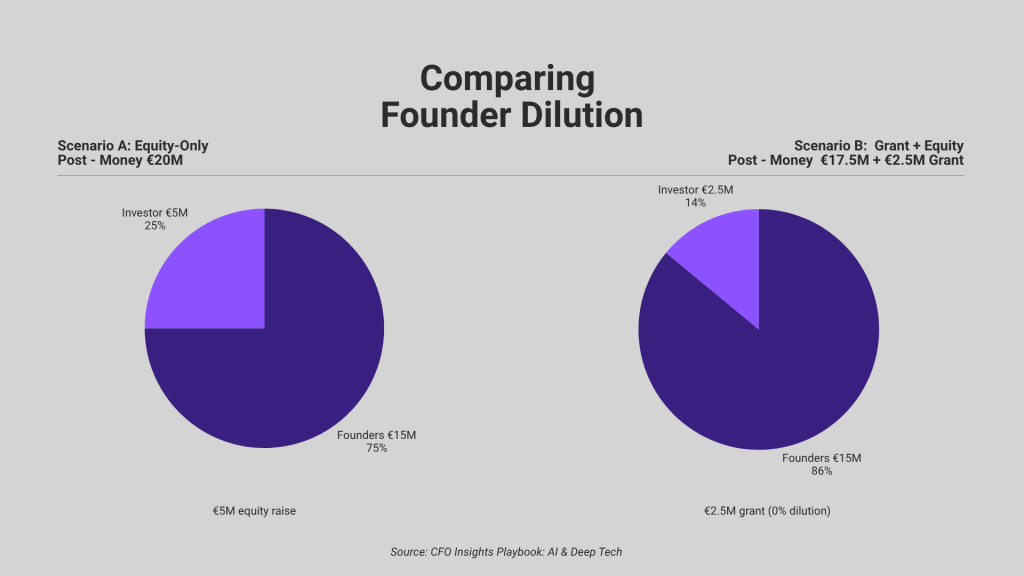

The playbook maps each TRL stage to a specific financial strategy — from securing non-dilutive grants at TRL 1-3, to blending equity and corporate capital at TRL 6-8. Founders are urged to treat each TRL as a funding gate, aligning cash inflows with technological proof points rather than time-based goals.

Examples show that sequencing grants before equity rounds can preserve more than ten percentage points of founder ownership — often the difference between retaining control and over-dilution.

“Investor interest in Deep Tech is shifting toward technologies with strategic and sovereign relevance — quantum computing, space infrastructure, advanced materials, and AI for defense and cybersecurity are leading the way,” Aladzhova explains. “These are not short-cycle innovations; they redefine entire industries and national capabilities. The smartest capital today looks beyond fast exits and focuses on long-term technological advantage.”

Her words capture a shift that’s already underway: the move from growth-at-all-costs toward durable financial strategy.

Finance as the backbone of decision-making: The CFO as a Service Model

For many of CFO Insights’ CFO as a service clients, that transformation starts when finance stops being a back-office function and becomes the operating system of every strategic decision.

LAM’ON, a biodegradable and compostable packaging company, experienced this shift firsthand. Co-founder Angela Ivanova recalls how structured forecasting and scenario planning helped them scale more confidently:

“CFO Insights fundamentally reshaped the way we think about finance and fundraising. What started as support with our business plan and forecasts quickly grew into a true strategic partnership. They helped us see finance not as an administrative task, but as the backbone of every smart decision we make.”

The insight for founders: structure actually creates speed. When forecasts, risk models, and capital plans are clear, leadership can make faster and more confident decisions — without the chaos that often accompanies growth.

Ivanova’s experience mirrors a broader trend across the climate-tech ecosystem — where scaleups must balance fast-moving impact goals with tight financial rigor.

A similar pattern appears in Plan A, a carbon-accounting platform that grew from an early-stage startup to an international scaleup. Lubomila Jordanova, Co-founder & CEO, says their biggest learning was not to equate financial sophistication with bureaucracy:

“Rather than scaling our finance function through headcount, we learned to architect more intelligent processes around due diligence and operational finance. This freed our leadership team to focus on strategic value creation. The result has been materially faster execution without compromising rigor.”

The investor’s test of discipline

From the investor’s perspective, financial maturity signals more than stability; it signals discipline. Elvin Guri, Managing Partner and CEO at INVENIO Partners, sums it up:

“The CFO role, when executed well, can become so much more than ‘simply’ the financial conscience of a company. It can make the entire difference between growing with discipline and quality and total disaster.”

George Sidjimkov, a seasoned investor and fund manager, adds a pragmatic view from early-stage investing:

“A competent CFO ensures that gross margins, pricing, marketing efficiency, and working capital are aligned. At the same time, they safeguard financial integrity — preventing fraud and maintaining business continuity. These details often define the difference between a well-run business and one exposed to unnecessary risk.”

For founders, the takeaway is clear: investors notice when a company’s financial system is coherent — and they reward it.

Finance as a strategic edge in cybersecurity and defense

The Cybersecurity, Sovereign Tech & Defense Playbook, released together with the AI & Deep Tech edition, extends these principles to one of Europe’s fastest-growing and most regulated sectors. It notes that financial control in cybersecurity and defense is defined less by market volatility and more by the rhythm of institutions — long procurement cycles, delayed cash conversion, and complex compliance frameworks.

According to the playbook, success in this environment requires financial strategy as a core competency, not a support function. CFOs must plan for 9–12 months of working-capital buffer, treat government contracts as back-loaded cash inflows, and use bridge instruments such as venture debt or revenue-based financing to cover procurement delays.

Equally, compliance becomes a strategic milestone. Certifications such as EUCC, EUCS, or ISO/IEC 27001 are described as “unlocking customer bases” and materially affecting valuation and procurement success. The playbook highlights dual-use positioning as another differentiator: startups that segregate financial data between commercial and government streams gain both investor credibility and eligibility for public funding.

Deep Finance, not fast finance

The AI & Deep Tech Playbook warns founders against running capital-intensive companies on startup-era reflexes. It replaces linear growth forecasts with milestone-based models; flags red-zone patterns like TRL stagnation, grant over-dependence, or opaque burn; and analyses emerging trends such as outcome-based pricing — models that can destabilize cash flow if not supported by alternative funding structures like grants or debt.

In that sense, the modern CFO is no longer the company’s accountant; they are its architect. And as Europe races to build sovereign capacity in AI, climate, and defense, CFO Insights is designing the financial systems that will determine which of its frontier startups make the leap from promise to permanence.