The CEE tech startup ecosystem has proven its strength and resilience in the economic downturn of 2022, a new Digital Champions CEE 2022 report by Digital Poland Foundation (DPF) highlights. The report showcases the top 100 CEE tech companies with the highest valuations, their importance to the region, and how the ecosystem has changed since 2021. For a second consecutive year, the ranking was created to promote the CEE potential on a global scale and attract investments to the region’s tech companies, referred to as digital champions.

Based on direct contact with VC and private equity funds, data from leading transaction platforms, and other available sources as of September 30th, DPF included over 50 000 companies from 19 CEE countries in their analysis. The top 100 digital champions were then divided into three categories; Digital Phoenixes (valuation > $1B), Digital Dragons ($250M < valuation < $1B), and Digital Wolves ($100M < valuation < $250M). As much has changed since last year, The Recursive brings you updated key findings and highlights of the 2022 Digital Champions ranking.

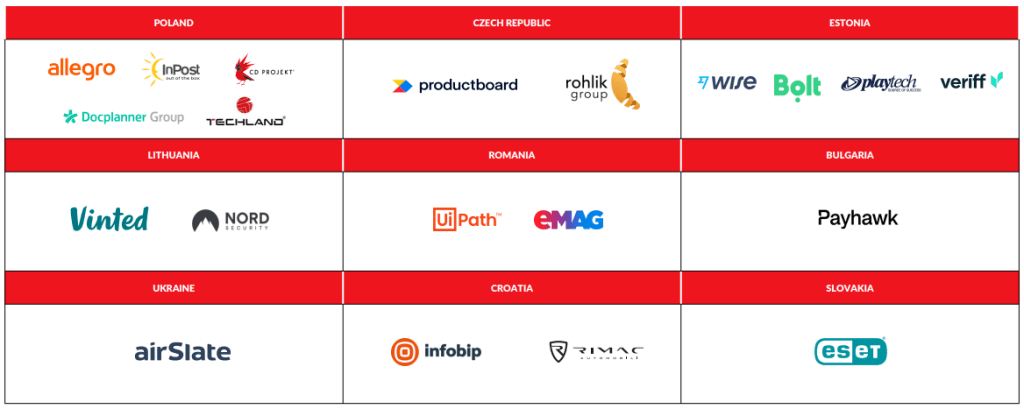

Poland, Estonia, and Romania leading the way

Same as last year, Polish, Estonian, and Romanian digital champions continue to lead the total capitalization in 2022. However, the most notable shift from last year was exhibited by Estonia, which placed second by increasing the number of companies by 60%, and the Czech Republic, also raising the number by 60% and closely following Romania by capitalization. Together, the four countries account for most of the CEE’s valuation (about 75%).

Croatia and Serbia marked the biggest increase in capitalization due to their relatively smaller startup ecosystem. Seven countries (Albania, Bosnia and Herzegovina, Kosovo, Moldova, Montenegro, North Macedonia, and Slovenia) did not record any digital champion in the ranking.

Top CEE tech companies of 2022

DPF recorded the highest number of digital champions in Poland, the Czech Republic, and Estonia. Despite the macroeconomic challenges in the region, 37 new companies joined the top 100 CEE chart. See the largest CEE tech companies, Digital Phoenixes (valuation > $1B), below.

Companies with the highest valuations per each listed country:

- Bulgaria: Payhawk (Digital Phoenix)

- Croatia: Infobip (Digital Phoenix)

- Czech Republic: Productboard (Digital Phoenix)

- Estonia: Wise (Digital Phoenix)

- Hungary: SEON (Digital Dragon)

- Latvia: Printful (Digital Dragon)

- Lithuania: Vinted (Digital Phoenix)

- Poland: Allegro (Digital Phoenix)

- Romania: UiPath (Digital Phoenix)

- Serbia: Tenderly (Digital Dragon)

- Slovakia: ESET (Digital Phoenix)

- Ukraine: AirSlate (Digital Phoenix)

“As we have seen with previous market downturns, transition to new technology tends to accelerate in difficult economic environment. So, it is not surprising that many companies in this ranking are continuing to grow at very healthy rates. Many of the companies in the ranking have managed to secure funding during the upcycle and are in great position to weather the storm. I am therefore very confident that the tech sector in the region will not only survive current turbulences but will continue getting bigger and stronger,” comments Leonid Varpahovsky, Managing Director, Head of CEE, Credit Suisse Bank (Europe), S.A.

The mark of CEE Digital Champions in 2022

The total value of the top 100 digital champions exceeded $75 billion, making up nearly 4% of the CEE’s GDP in 2022. Compared to the previous year, the total capitalization decreased by 43% (from $130 billion) primarily due to lower valuations caused by rising inflation and geopolitical situation, as well as company buyouts (e.g., acquisition of Czech Avast valued at $8 billion) or moving headquarters to the US (particularly Ukrainian companies). Disregarding the last two (dropping capitalization for success reasons), the value would fall by around 34%, which is comparable to global trends, including the US Nasdaq 100 index.

As a result, the most significant decline of nearly 50% was recorded among Digital Phoenixes (currently 20 companies), while Digital Dragons rose by 60% to 40 companies. E-commerce, SaaS, and FinTech were the most valuable sectors.

The report also highlighted the regional trends. Over the past decade, CEE has become one of the fastest-growing regions in Europe. The growth can be attributed to factors such as the inflow of foreign capital and EU funds and the liberalization of economies. Investments in the region have grown by about 550% since 2015.

“The attractiveness of the region is due to a variety of incentives for investors: a large population base exceeding 165 million, stable and fast-growing economies that generally outperform mature markets, highly skilled talents fuelled by strong education systems in the hard sciences, and proximity to Western Europe. CEE’s GDP currently stands at $2.23 trillion, making the market comparable in size to the Nordic countries or Benelux,” says Karim Taga, Managing Partner and Global Practice Leader, Telecommunications, Information Technology, Media & Electronics, Arthur D. Little.