Startups and scaleups in Central and Eastern Europe with technical solutions that target the reduction of climate change effects can now apply to be part of the PwC Net Zero Future 50 Climate Tech Report – CEE Edition. In partnership with Wolves Summit, PwC CEE aims to help match global impact investors with local tech entrepreneurs. The report findings will be presented during the autumn edition of the Wolves Summit in October.

Applications are open until Sunday, July 3rd 23.59 CET. This edition accepts applications from startups across selected countries in CEE and Eurasia: Albania, Armenia, Azerbaijan, Bosnia and Herzegovina, Bulgaria, Croatia, Czech Republic, Estonia, Georgia, Hungary, Kazakhstan, Kosovo, Kyrgyzstan, Latvia, Lithuania, North Macedonia, Mongolia, Montenegro, Moldova, Poland, Romania, Serbia, Slovakia, Slovenia, Tajikistan, Turkmenistan, Ukraine, Uzbekistan.

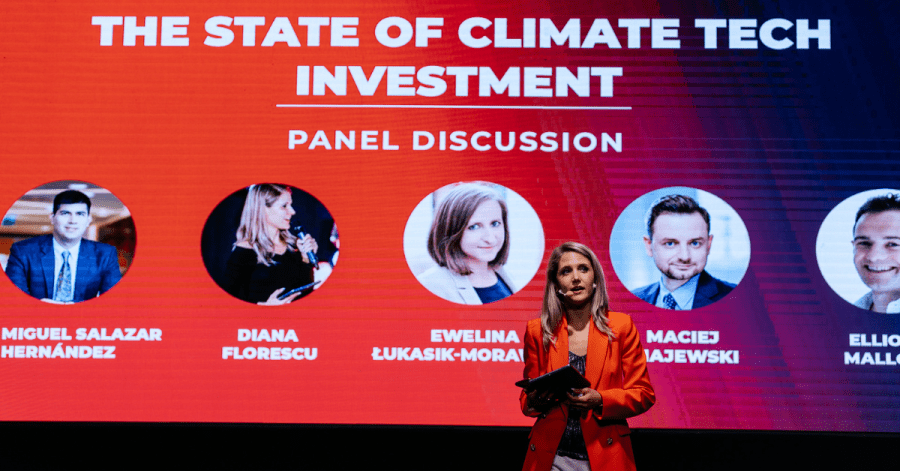

The partnership efforts debuted on May 24th at the Wolves Summit in Wroclaw, Poland, with the organization of the CEE Climate Tech pitch stream. Two startups from the CEE Climate Tech pitch stream impressed the jury and won their place in the finals of The Great Pitch Contest, taking place on May 27th. Agrolink helps farmers optimize the purchase of pesticides for their crops, whereas S.Lab grows 100% biodegradable packaging from hemp and mycelium, with the goal to replace plastic and styrofoam. Both startups come from Ukraine.

Other pitching startups included Deeptraffic, a Greek deep-tech spin-off company of CERTH-HIT providing solutions for dynamic traffic management as a service, with focus on connected and automated vehicles, and mTap Smart City, a Polish startup developing AI-based controllers for LED lamps that help generate electricity savings.

Addressing imbalances and diversifying investments

More funding is flowing towards climate tech than ever before. According to a 2021 climate tech report by PwC, investors poured in $222B from 2013 to 2021, including $60B in the first half of 2021 alone. And the average deal size has jumped from $27M to $96M in the past two years. Climate tech now accounts for 14 cents of every $1 of venture capital invested.

Big rounds such as in the carbon capture field – Swiss startup Climeworks’ €580M round and UK-based Carbon Clean Solutions’ €140M round – show a growing appetite for investment in the sector, and that environmental and financial returns can go hand in hand. Yet both companies are based in Western Europe.

Overall, the US accounts for around 65% of all climate tech funding, leaving less than a quarter to Europe. Further within Europe, investment gravitates towards hubs such as London and Berlin.

Meanwhile, startups in Central and Eastern Europe are left with an even smaller share, which does not do justice to the accelerated growth we’ve seen in the regional tech ecosystem. One reason for the geographic imbalance is the lack of networks and connections to investors, mentors, and partners, which conferences such as Wolves Summit aim to help founders address.

Then, the needs of startups in CEE differ from those of startups from the Western European and US ecosystems. Most climate tech startups are at an incubation stage, looking for smaller tickets, and more support with business skills polishing and MVP development and testing. We need more accelerator programs and early-stage funds to speed up the maturation of startups in CEE and create new opportunities for climate tech investment.

There is one other disconnect that indicates new opportunities for entrepreneurs and investors. By and large, the distribution of climate tech investments across industries has been both uneven and disproportionate to the actual carbon footprint emitted by the sector. As such, the lion’s share (61%) of climate tech investment has been directed towards transforming mobility, even if transportation contributes less than a fifth (16%) of global CO2 emissions. At the same time, manufacturing and the built environment have received only 9% and 4% of climate tech funding, yet they account for 29% and 21% of carbon emissions, respectively.

To reach the ambitious targets proposed by the EU Green Deal, leaders will need to prioritize the sectors and initiatives that can make the most impact. This includes developing new climate tech technologies, and scaling existing ones, in areas such as manufacturing and real estate. For investors, this means actively looking for new opportunities to fund high-impact, yet overlooked projects.

Furthermore, while investors tend to favor software solutions due to familiarity and proven scalability, these must be complemented with more complex hardware solutions. Although more capital intensive, in the fight against climate change, these address one key lever: the direct removal of CO2 emissions.

At the end of the day, there are no silver bullets to solving the climate crisis, which is why diversification in the use and funding of innovative technologies is all the more important.