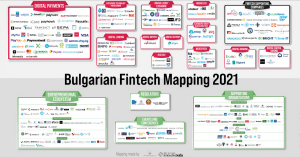

What does the Bulgarian fintech ecosystem look like in 2021 and what are the trends, and market forecasts that will shape the future of the region? One year after the pandemic it looks like Covid-19 accelerated the creation of Fintech companies which currently amount to 135. This marks the emergence of almost 20 new fintech companies since 2020.

Today the Bulgarian Fintech Association (BFA) together with its ecosystem partners released the Annual FinTech Report 2021 to highlight how the local ecosystem has grown during the past year. According to the report, in spite of the challenges posed by the pandemic, the total operating revenue of Bulgarian fintech reached an all-time high in 2021 with over $800M. Moreover, more than half of that sum came from the 5 top performing companies – Datecs, Paysafe, Experian, myPOS, and EasyPay.

By combining financial analysis based on public data available in the National Commercial Register of the Republic of Bulgaria with the results from the Annual Fintech Survey, the Annual FinTech Report 2021 gives a well-rounded perspective on the actual advancements in the local fintech landscape.

Coincidence or not, the release of the report celebrating the success of the Bulgarian fintech ecosystem comes at the same day as the announcement of Payhawk’s historic $112M Series B round.

What are the key numbers and findings

When it comes to traction by verticals, the Digital Payments segment remains the most developed one and is the largest contributor with 66% of the total operating revenue. Other verticals that also show fast track growth are Alternative Credit and Data Analytics, and Digital Asset Exchange companies such as the crypto lending platform Nexo.

Venture capital investment has been one of the main driving forces behind the fast growth of the local ecosystem, as in 2021 Bulgarian fintechs received a total of €32.2M.

Even though in terms of main technologies used in the sectors, Bulgarian fintech appears to be rather skeptical about the introduction of blockchain and RPA technologies, almost 75% of the companies in the report are found to apply Big Data and Data Analytics. In addition, AI and Machine Learning are used in almost half of the surveyed fintechs.

The unique selling proposition of the Bulgarian fintech ecosystem

The Bulgarian capital, Sofia, is dubbed in the report as being the most cost-effective fintech location in the world. Some of the most prominent initiatives highlighted in the study include the public-private partnership between InvestBulgaria Agency (IBA) and BFA that aims to attract foreign direct investments.

During the past three years, BFA has been actively involved in the Bulgarian fintech legislation process and regularly submitted opinion papers to the authorities. These included the National Strategy for Financial Literacy and Consumer Protection Law, as well as the Digital Strategy For the EU – European Measures to Support Digital Finance in the Post-COVID-19 Context.

In terms of talent, the number of people employed in the fintech sector also reached its all-time peak with almost 9K personnel in 2020. Moreover, female talent is well represented in the fintech sector as a 2021 study of BFA showed that 44% of all employees in the sector are women. Almost two-thirds of all fintech companies in Bulgaria have at least one female representative on the Board of Directors.

In 2021 the Bulgarian fintech ecosystem showed great commitment to nurturing local talent. Fintech educational initiatives such as webinars and hackathons attracted the interest of younger fintech enthusiasts, While on the academic side, this year marked the second successful launch of the “Finance, Investments, and Fintech” Master’s Degree program of the Faculty of Economics and Business Administration at Sofia University and BFA.