Bulgaria’s startup scene is buzzing with innovation and growth. Fueled by strategic location, outstanding talents, and supportive government initiatives, it’s become an appealing spot for entrepreneurs and investors.

Bulgaria ranks #2 by combined enterprise value per capita in 2022 in Southeast Europe according to Dealroom data (Croatia being at #1), while Bulgaria, Romania and Greece together make up more than 70% of the SEE ecosystem enterprise value in 2022. Moreover, the country is one of the leading investor hubs in SEE with Bulgarian VCs investing in companies throughout the region.

We prepared some key insights into the dynamic world of Bulgaria’s startup ecosystem. Dive deeper!

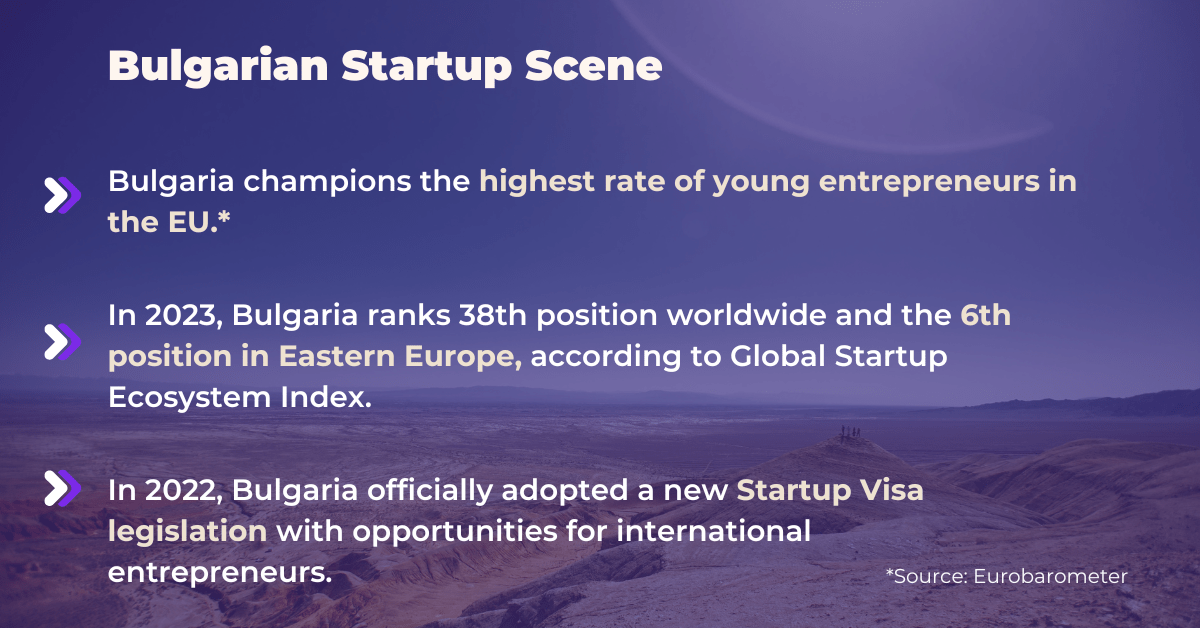

Bulgaria Startup scene

Bulgaria is home to over 800 startups. The entrepreneurial ecosystem has been flourishing, especially in the last five years. In fact, a whopping €1B has been invested in Bulgarian and Bulgarian-founded deep tech & AI startups, according to The Recursive’s report “State of AI Innovation in CEE”.

The country’s advantageous tax policies, access to EU funding, highly skilled workforce, competitive pricing, and low cost of living, make it an appealing destination for entrepreneurs seeking to establish and expand their enterprises. ⅓ of startups are set up by non-Bulgarians according to data from British Private Equity and Venture Capital Association (BVCA).

Moreover, in 2023 Bulgaria introduced the Variable Capital Company (VCC), which allows entrepreneurs to retain more control and contribute positively to the local economy, as a part of a wider regulatory framework that seeks to make the business environment favorable for innovative businesses.

VC Funding Landscape in Bulgaria

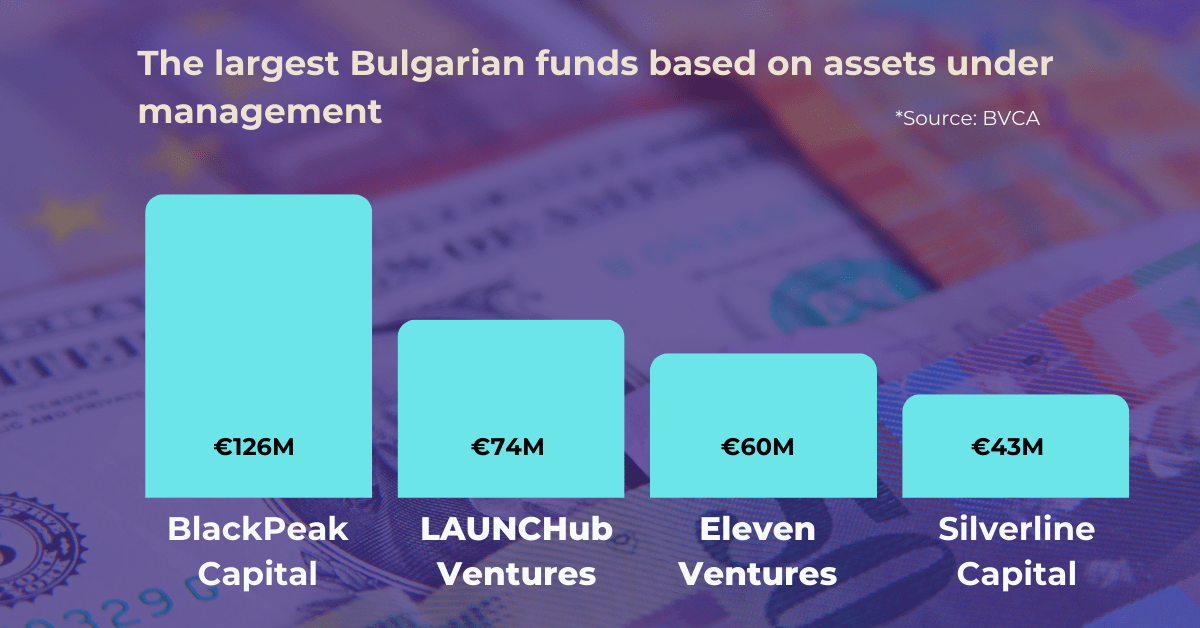

Venture capital firms play a crucial role in fueling the Bulgarian startup scene, not just with financial means, but also offering valuable strategic advice to founders. The Bulgarian investment landscape has gained maturity, with larger rounds and greater participation of venture capital funds.

- A wave of new funds has emerged in Bulgaria since 2012, spurred by the establishment of the Bulgarian Fund of Funds which allocates targeted public funds from EU programs and national co-financing, using different financial instruments.

- Bulgaria leads in Southeast Europe when it comes to the number of locally-based VC funds, with around €500M capital under management by Bulgarian-based GPs, according to Dealroom data.

Unicorn & Future Unicorns

2021 and 2022 have been the strongest years for unicorn creation in CEE, with the number of unicorns more than doubling since December 2020. Bulgaria contributed to these statistics with the emergence of its first officially $1B valued private company in 2022 – the financial platform for expense, payments, and invoice management Payhawk.