Tech companies, startups and scaleups in the SEE region managed to raise more than €2 billion in the first half of 2022. For a comparison, during the whole last year these companies and startups raised just over €2.5 billion, which means that the region is heading for a record year in terms of raising capital.

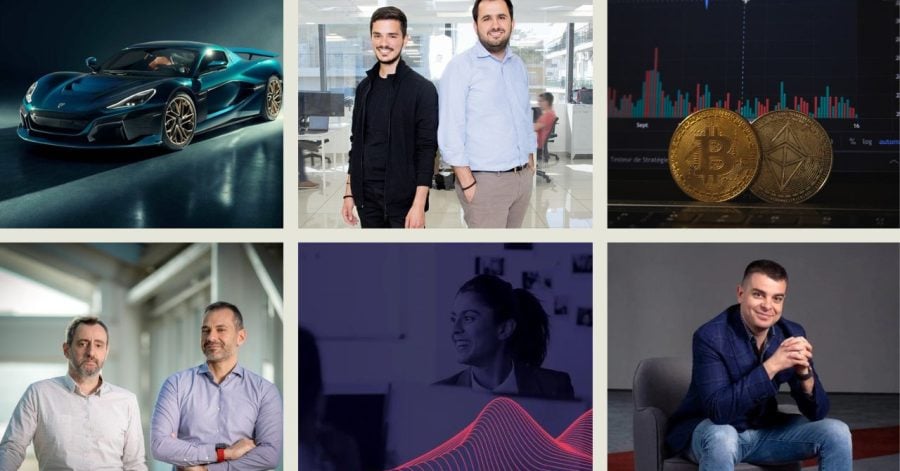

During the first half of 2022, The Recursive counted 63 deals worth more than €2 billion. The biggest deals tech deals in 2022 happened in the fields of fintech and EV (electric vehicles), with unicorns VivaWallet and Rimac Automobili raising €700M and €500M, respectively.

In the biggest deal this year, U.S. bank JP Morgan Chase acquired a 49% stake in the Greek cloud-based neobank Viva Wallet in a deal that turned the fintech company into a unicorn. According to Greek media, the amount of the deal was estimated at around €700M.

The second biggest deal of the year so far comes with Croatian EV giant Rimac Automobili raising €500M in a Series D round led by giants SoftBank and Goldman Sachs, as well as existing shareholders such as Porsche and InvestIndustrial.

In focus: Croatian ecosystem

The latest funding puts the EV maker at a valuation of over €2 billion. Rimac is Croatia’s second unicorn, after communication software company Infobip, marking a strong statement about the Croatian tech ecosystem’s rise in recent years.

According to experts, unicorns such as Rimac and Infobip also pave the way for the rest of the tech companies in the country and in the region when it comes to attracting investment.

“There are a lot of tech companies in Croatia, and at the same time there’s also a lot of space to hire people in up and coming startups that aim to get funding,” Zagreb-based digital content entrepreneur Ivan Brezak Brkan tells The Recursive.

This is what makes the country competitive compared to the rest of the SEE region, he adds. A recent report from Google for Startups, Atomico and Dealroom.co showed that between 2015 and 2021, the Croatian startups and companies received €541 million in VC funding.

Another reason for the success of the country’s tech ecosystem is that most tech companies were early to realize the need for B2B products and services.

“Our companies learned to focus on B2B first. You can build the know-how, the talent, working for clients abroad and so on, but in most cases it is hard to create B2C products. Only now we are looking at B2C successes like Photomath (edtech company), built on top of B2B success,” Brkan tells The Recursive.

The future of buying and owning cars

The third biggest deal of 2022 again comes from Greece, with car-as-a-service startup FlexCar raising €210M, having managed in just three years to increase its turnover eightfold.

A company from Serbia is also among the biggest deals of the first six months of the year – with HTEC Group, a global firm offering consulting, software engineering, and digital product development services, raising $140M in January from growth equity investment firm Brighton Park Capital.

Another Greek startup – Spotawheel, which provides a tech-driven circular economy platform for pre-owned cars, raised a Series B of €100M in an equity round led by local VentureFriends.

The first Bulgarian unicorn Payhawk is also among the top deals, with the company announcing in March that it raised $100M in a round led by the Silicon Valley-based VC Lightspeed Venture Partners.

North Macedonia founded AI-driven sales intelligence provider Cognism is also a worthy mention, after it managed to secure $87.5M in Series C funding in January, led by new investors Viking Global Investors and Blue Cloud Ventures.

| Company name | Funding type | Total investments | Country | Industry |

| Viva Wallet | €700M | Greece | Fintech | |

| Rimac Group | Series D | €500M | Croatia | EV |

| FlexCar | Series B | €210M | Greece | Car leasing |

| HTEC Group | $140M | Serbia | Software | |

| Spotawheel | Series B | €100M | Greece | Car selling |

| Payhawk | Series B | $100M | Bulgaria | Fintech |

| Cognism | Series C | $87.5M | North Macedonia | Martech |

| Byrd | Series C | $56M | Greece | E-commerce |

| Tenderly | Series B | $40M | Serbia | Blockchain |

| LucidLink | Series B | $20M | Bulgaria | Cloud |

| Better Origin | Series A | $16M | Greece | InsectTech |

| Druid AI | Series A | €14M | Romania | AI |

| Orthoson | Series A | €10.4M | Greece | MedTech |

| euShipments | Series A | €7.5M | Bulgaria | E-commerce |

| Sounder | Series A | $7.7M | Serbia | AudioTech |

| Mediately | Series A | €7.2M | Bulgaria | HealthTech |

| Flip.ro | €6.5M | Romania | Refurbished phones | |

| Bware Labs | Series A | €6M | Romania | Blockchain |

| Sportening | €6M | Croatia | SportTech | |

| Bryq | pre-Series A | $4M | Greece | AI |

| Hunch | Series A | $4M | Serbia | AdTech |

| Feel Therapeutics | $4M | Greece | HealthTech | |

| MYX | Series A | €3.5M | Bulgaria | Data Analytics |

| Bunnyshell | €3.5M | Romania | DevOps | |

| Neurolabs | Seed | $3.5M | Romania | AI |

| Tenyks | $3.4M | Bulgaria | AI | |

| Machinations.io | Series A | $3.3M | Romania | Gaming |

| Cyscale | €3.5M | Romania | Cybersecurity | |

| Archbee | Seed | $3M | Romania | Software development |

| Rush | Seed | €2.5M | Bulgaria | E-commerce |

| EmailTree | €2.5M | Romania | AI | |

| CoLumbo | Seed | €2.1M | Bulgaria | AI/MedTech |

| Adservio | €2M | Romania | EdTech | |

| Ogre AI | Seed | €2M | Romania | AI |

| Aggero | Seed | $2M | Romania | MarTech |

| EnterDAO | $1.8M | Bulgaria | Gaming | |

| Tokinomo | pre-Series A | $1.7M | Romania | Retail |

| Stailer | Seed | €1M | Romania | Beauty marketplace |

| Mentessa | Seed | €1M | Bulgaria | AI |

| ThingsLog | Seed | €1M | Bulgaria | IoT |

| XVision | €1M | Romania | AI | |

| Adadot | $1M | Greece | SaaS | |

| Hajde | Seed | $1M | Albania | E-commerce |

Economic uncertainties ahead of the second half of the year might influence valuations and deals. However, with such impressive figures so far this year, the region is still heading into an exciting second half of 2022 that will undoubtedly see records being broken and much more investments for SEE companies, startups and scaleups.