What does the emergence of the first Bulgarian unicorn mean for the future of the local startup and VC ecosystem? What is the significance of this milestone for the earliest supporters of the company? How does the success of Payhawk change the perception that international investors have towards SEE startups?

Having reached a valuation of $1B, the Bulgarian fintech company Payhawk has achieved a milestone that can potentially pave the road to success for many more startups in Bulgaria and the region. Even though this could be perceived as a single-company success, it is an event that has longer-term implications on the dynamics of the Bulgarian ecosystem such as the development of more high-impact founders, the rise in more engineering talent, and the increased VC interest towards local companies.

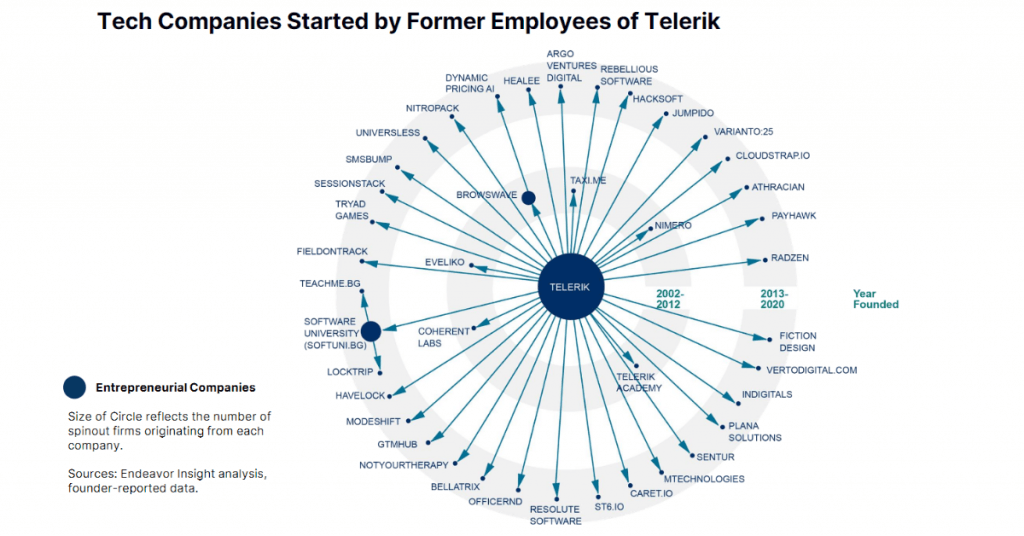

Bulgaria has already seen such ecosystem effects from one similar success story – that of Telerik, the dev tools software company that was acquired by Progress in the biggest to this date exit in the local ecosystem. Even more important than the sum of the exit, the success of Telerik is measured by the fact that more than 50 companies have been founded by former employees of the company, including Payhawk.

To find out what would be the impact of the first Bulgarian unicorn on the SEE startup scene, The Recursive reached out to the first supporters of the fintech company – Vassil Terziev and Svetozar Georgiev, and gathered insights from the Bulgarian Startup Association (BESCO) which has been actively involved in the development of the local business and tech ecosystem by bridging the gap between the startup community and the public institutions.

Prerequisites for growth: what made Payhawk a unicorn

The early backers of Payhawk explain that to some extent the success we see today is a result of the groundwork from the previous generation of entrepreneurs. At Telerik, Vassil Terziev and Svetozar Georgiev built a truly global team with colleagues in pretty much all time zones – from Palo Alto to Sydney. Georgiev shares that Telerik was competing with the leading companies in their market and had to constantly outpace them and out-innovate them. They developed various practices from team structure, knowledge sharing, and fast-paced agile development, to customer-centric product management. And even though all of this knowledge seems more widely available these days, in the early 2000s that was not the case.

“The fact that a major part of the team originates from Telerik certainly helped. If you have been through this at the scale of Telerik once, it is much easier to get going with a flying start and reach much higher levels of performance and execution excellence. So I am humbled to see lots of pieces of the Telerik culture and the Telerik zeal in those groups of companies like Payhawk,” shares Georgiev.

From a more macro-level perspective, Dobromir Ivanov and Ned Dervenkov from BESCO refer to the fact that currently there is an unprecedented amount of VC capital in the local ecosystem. Even though Bulgaria is still far behind its peers in CEE such as Poland, at the moment there are around 16 local venture capital funds that operate with nearly $600M. In perspective, less than 10 years ago, the amount of venture capital was only around $20M. Parallel to that the venture capital managers have become more proficient in mentoring and helping portfolio startups scale.

Where will we see the spillover effect

Svetozar Georgiev believes that the emergence of the first Bulgarian unicorn will give other local entrepreneurs the much-needed confidence that such success could be achieved here. “I think Telerik had a similar effect back in the days (first in 2008 by attracting the first prominent American VC in Bulgaria)* and then in 2014 with our exit. Those milestones certainly energized and boosted the ecosystem and I expect the same effect now,” he adds.

The second equally important spillover effect will be that it puts an even brighter mark for Bulgaria on the global tech/IT map. We are seeing that by the increasing interest by the US and Western Europe VCs. This is important because while the local VC funds play an instrumental role at the early stages of companies, once the startups gain traction they need serious firepower in order to effectively compete on the global scale. And for this, you need the financial, know-how, and networking support of the top global VC, especially in certain verticals.

“Once companies like Payhawk get on the global dojo, sparring with the best in the world, they inevitably develop know-how and practices that you can’t just read in the books. And this knowledge permeates into other companies in the region, elevating the overall level,” Georgiev points out.

Similarly, Ned Dervenkov, CEO of BESCO, points out that one company which has managed to raise a $200M round, brings in invaluable know-how for all other companies from the region. In addition, the fact that reputable global investors have backed Bulgarian companies also opens many doors for future unicorns, because the worth-of-mouth element is very important among the investor community.

Another spillover effect that Svetozar Georgiev outlines is the recycled capital and the stock opportunities which multimillion-dollar companies can offer to their employees. According to him, unicorns give birth to a whole cohort of people who will have substantial capital to back other startups or establish new companies later on.

Implications for the ecosystem growth and VC activity in SEE

The first Bulgarian unicorn will further have a positive impact on the development of the ecosystem and VC activity, ecosystem leaders agree.

“I hope that this milestone will position Bulgaria not only as a destination for great tech talent, but also a destination where truly global businesses could be scaled and orchestrated to become market leaders. Building a great software or tech product is half of the challenge, usually the easier half. The more difficult one is building an efficient, well-connected global go-to-market organization that can put the product in customers’ hands and develop long-term brand loyalty. This requires a skill set and talent that historically has been scarce in the region. But this is changing and companies like Payhawk are paving the way in this direction,” Georgiev shares.

In a recent interview with The Recursive, Bogomil Balkansky, Partner at the global VC Sequoia Capital, highlighted that the milestone of Payhawk proves that Bulgaria and other countries in the SEE region are already on the map for American VCs, investors, and American entrepreneurs. According to Balkansky, the emergence of unicorn-status tech companies changes the awareness of our region and this is a process that started with the successes of UiPath.

Just as the co-founders of Payhawk have shared multiple times, Balkansky also points out that one of the key premises for startup success is going after a big market. “VC companies are just looking for compelling investment opportunities. Compelling investment opportunities means fast-growing companies. Companies that first of all have compelling teams going after what could be a big market. And honestly, the majority of investors are pretty indiscriminate when it comes to where these opportunities come from,” he adds. Another point worth mentioning is that in order for local companies to embark on a journey resembling that of Payhawk, they need to strategically go after global customers from the very beginning.

According to Georgiev, despite the vibrant local tech ecosystem, Bulgaria’s neighbors like Romania and Greece are one step ahead as they have already given birth to multimillion-dollar companies. However, he explains that it is not a matter of having a unicorn company, but rather having the systemic environment for many multimillion-dollar companies – something that he sees is becoming a reality with major deals and rounds being announced almost every month.

The network effect behind the numbers

Very recently, a report by Endeavor Bulgaria representing an analysis of the local entrepreneurial community, outlined that founder-to-founder connectivity is one of the key growth ecosystem drivers. In addition, according to the findings, certain types of connections have proved to be particularly helpful for scaling founders.

The results hint at the conclusions that oftentimes startup success depends on relationships between founders, companies, and investors, be it former employment, mentorship, or angel investment. The term “Telerik Mafia”, for example, is already coined in the local ecosystem as a reference for the connectivity and give-back mentality which are characteristic of the Bulgarian ecosystem. The software company Telerik, is so far the biggest catalyst of entrepreneurship in the local ecosystem. Considering that Payhawk, started off by former Telerik employees, it is yet to be seen whether the next Bulgarian unicorn would be also tightly connected to the “Telerik Mafia”.

“Payhawk was the first to announce this milestone, but believe me – this is just the first of a sequence. We will very soon see the 2nd and the 3rd unicorn. There are a few other companies that share the focus, energy, and ambition of Payhawk. So the combined effect of this “herd” of unicorns will bring exponential longer-term benefits to the whole ecosystem,” highlights Svetozar Georgiev.

Ned Dervenkov refers to the fact that Payhawk itself can be viewed as a spillover effect from the success of Telerik and this on its own is a prerequisite to believe that we would soon see the emergence of a “Payhawk Mafia”.

How can we make sure that more unicorns will follow

The first Bulgarian unicorn will certainly not be the last. Here are the insights that Svetozar Georgiev shares on the topic:

To ensure a more systemic long-term success of our little and fragile ecosystem, we need a few important ingredients:

- Substantial improvement in the educational system, both at school and university levels. I know this is a complex machine with a lot of inertia and intertwining interests, but unless we move radically faster we will not have the talent to fuel that already overheated IT labor market.

- The fundamental aspects of society – the justice system, the healthcare system, eradication of widespread corruption. This will bring talented Bulgarians back and will make our country attractive for foreigners, who are an essential part of the equation due to our poor demographics.

- Companies need to be responsible “citizens” of the country and the ecosystem. They should not only demand but also provide – knowledge, service, funding so we all as a group make Bulgaria a better place to live and do business.

And according to Dobromir Ivanov and Ned Dervenkov, the following structural changes need to take place:

- Pension Funds Reform that allows pension funds to invest in alternative investment funds such as VC funds. This is important because it would allow VCs to invest in later-stage rounds above Series A. In addition it would bridge the gap that founders experience when they are in-between switching from local to international investors, as it would give local funds the opportunity to co-invest in bigger rounds

- Mechanisms that incentivize angel investments and increase the threshold of the BEAM market. In addition, we need to establish a fast-track for tech entrepreneurs and set up a working startup visa, as well as mechanisms for stock options and vesting so that the unicorn stories can be replicated.