Search for...

When starting up a new business, one of the first unspoken challenges you are to face is managing your new business’ finances. The tedious administrative task of managing business’ cash flow and making financial decisions accordingly takes a good amount of time and energy. As most entrepreneurs usually start out of passion for the product rather than operations behind it, such procedures sometimes cause loss of focus for execution and customers. Possibly not as annoying in the beginning, as the company grows, however, each client and employee adds to the books, leaving owners often overwhelmed and despondent.

Optimizing accounting processes for your small or medium enterprise (SME), could grant you more time to focus on your innovation and competitiveness of your offering, as well as reduce the amount of time, expenditure, and other resources they consume on a regular basis.

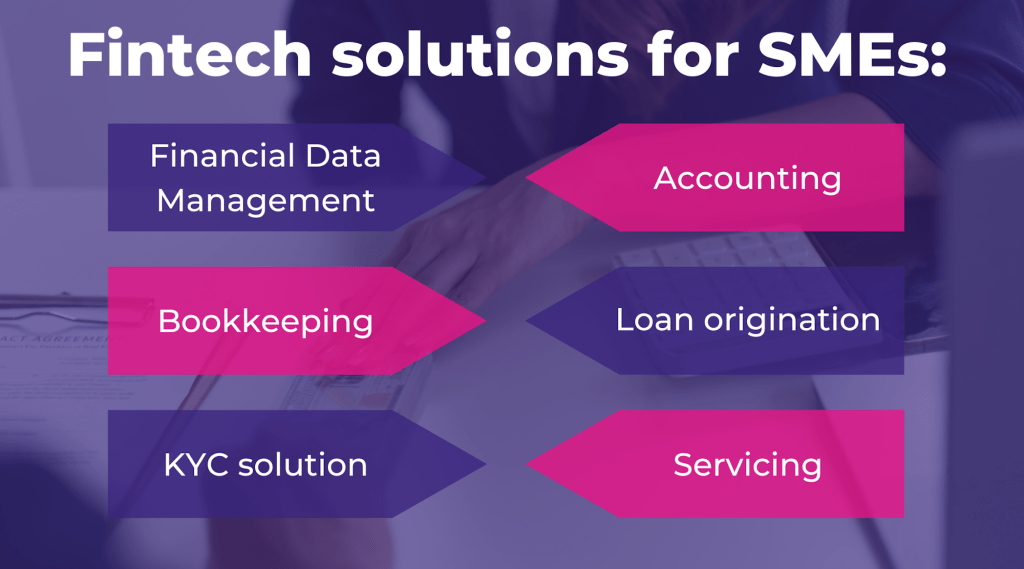

The magic pill is, as in anything related to numbers these days, comes from fintech. New fintech solutions help manage and monitor payments, cash flow and profits and prevent businesses from damaging their credit score, and even running into financial troubles. Some of them also give smart AI predictions based on your financial data.

A wide range of features, round-the-clock availability, and ease of use make more and more companies choose fintech to run their operations. SMEs, as one of the categories of ventures, often focus on becoming more flexible, and able to scale up their services at a lower cost. Fintechs, in their turn, serve such companies to increase their company productivity, and better prepare them for unforeseeable economic uncertainties.

SMEs are known to be the backbone of the global and European economies. More than 90% of businesses in the European Union are small and medium firms, with a total average value to the economy of around 56%. This accounts for more than half of Europe’s GDP. In the EU alone, these firms employ more than 84 million people.

The first-year small business failure statistics, however, is also high. Close to one in five new businesses in the European Union fail according to EU survival rates (2018). In the U.S., the numbers go up to 20% in the first year, 50% in the fifth, and 80% of failing firms by the end of the tenth year.

From an economic point of view, helping more of these firms sustain is important. The number of people SMEs employ, and the increasing influence of them on the fintech world is significant and cannot be ignored. From a business point of view, providing value to the group of companies that account for 50% of Europe’s GDP, and making their work more efficient creates growth opportunities both on an individual level and for the economy as a whole.

SMEs require a high level of digitalization to survive in the competition, and fintech companies can contribute to achieving that. Building fintech product specifically for SMEs is building one for a high number of potential customers both in Europe and globally.

According to the EY Global Fintech Adoption Index 2019, 25% of SMEs globally have adopted fintech solutions of some sort. Though no current data has yet been published, it is certain that the pandemic has accelerated further adoption and digitalization among these businesses.

Through new solutions like SME lending, more businesses are able to receive capital investment for expansion or for keeping operations running. It has also become easier to file paperwork and start a company through new accounting software that allows SMEs to save on personnel. Targeted and data-driven solutions enhanced reliability in numbers for small business owners.

European accounting tech on its own has become full of players targeting small and medium enterprises. Europe is the second largest global finance and accounting market after the U.S., so it does explain the boom. More companies choose to outsource finance and accounting services which makes the European Finance and Accounting Outsourcing (FAO) market grow exponentially. By 2025, FAO is expected to be worth 921 million with Germany making up around 50% of it.

For a long time, this outsourcing practice was mostly adopted by large companies, but as the market matured, SMEs got also interested in taking advantage of the opportunity. Thus, there was a chance for more finance and accounting tech startups to enter the ecosystem and make their contribution.

European SME-focused accounting tech has received a good amount of attention from investors over the last couple of years. Among the leading Eastern European market participants is Bulgaria’s first unicorn, Payhawk, a global spend management solution for finance automation. Headquartered in London, the company is the Visa Innovation Program first season participant and has so far raised a total of $215M in funding. Romania also has two representatives from accounting tech dedicated to SMEs, Prime Dash and ThinkOut The first is a financial analysis and forecasting SME tool that has, according to Crunchbase, raised a total of €600K. The second, an accounting tool focused on both SMEs and financial institutions, has so far received $499.2K in funding.

Going further in Europe, the biggest participants by investment are two French fintech Pennylane (€69M in funding) and Qonto (€17M). Pennylane is a full-stack financial management and accounting tech platform and Qonto is an SME tool for everyday banking, financing, bookkeeping and spend management. There is also an Amsterdam-based company Finom, a multi-banking, accounting, and financial management tool for SMEs with a total of €16.8M in capital.

Looking into some accounting techs leading the change in Europe, there are a couple of trends that stand out the most.

First, automation in accounting is the priority. It does not mean that machines replace humans, rather enabling staff to shift their focus from mundane tasks towards true priorities. At the end of the day, the implementation of automation technology facilitates accounting processes while minimizing human error.

Second, third-party integrations provide accountants with more information to base decisions on. Businesses are now able to monitor client transactions while improving reliability and saving time on executing such functions on their own.

Third, with its constant development, the blockchain technology helps businesses improve their accounting processes in areas such as auditing, record-keeping, and verification.

With the aim to find out what it is like to develop a fintech solution for SMEs in the CEE region, The Recursive team reached out to Catalin Rus, Co-Founder and COO of Prime Dash, an online platform that offers ML and Advanced Analytics technologies for Real-Time Credit Data provided to financial institutions in relation to the SME segment.

The startup is part of the fourth season of the Visa Innovation Program for SEE fintech innovators that is managed by the Bulgarian early-stage venture capital Eleven Ventures.

Small businesses always worry about their bills and about controlling their expenses. This is one of the problems that we are solving for them, cost control.

Another, maybe even a bigger problem we are solving is we help them make sense of their financials. All business numbers tell stories behind them but very often SMEs do not understand what their financial data actually means and how they can translate it into a story. Once they do, they get to make decisions and see what impact each decision carries.

The idea was born at the time when my partner worked at a large financial consultancy in the U.S. He saw that all such companies have the same problem, so he wanted to create a model that can help everyone navigate around their financials and be able to find any company, in any industry. Later, he pitched me the idea, and I supported it from the technical side.

We decided to focus on SMEs because until then nobody addressed them with a proper BI tool. It’s usually used only for big companies and corporations. They grow fast and do rely on this type of a solution, but it used to be very expensive for them, something not financially affordable. So we decided to come up with something not complicated and cost-effective. We position it as a tool built by entrepreneurs for entrepreneurs because we have the same problems. It’s something that we’ve built from our own experience.

The benefits for SMEs are that as a user, you have a full analysis or reporting of financial data, and you can simulate your decision making.

We basically provide companies with the first digital CFO, a virtual assistant who’s translating numbers into a business plan or a business strategy. As an owner, you tell the system what you want to do, and it shows you how you can achieve it in the future. Bringing all decision related questions in one tool and offering instant answers to them – I call it a dream shaper.

We first started this tool for SMEs but then banks came to us, asking to be able to offer such products to their clients because if their clients do well, banks also do well. This creates a win-win situation for everybody, allowing banks to have insights on what SMEs need even before they know it themselves which creates a new type of partnership between the two.

This used to be one of the biggest issues they had until the rise of neobanks. Banks realized that neobanks offered a better user experience, better relationship with customers. So this is one of the first advantages for banks is creating loyalty and engagement with the SMEs. The second one is that once you create this loyalty and engagement as a financial institution, you can understand exactly what the real needs in the market of SME are, like hyper personalized financial products and offerings. And the last one, of course, we help financial institutions automate internal processes.

We are now in the growth stage. We have validated our product on the SME side and also on the banking side. We know who the clients are and what they want to do with it. We have raised our investment round mostly dedicated to growth, but a part of it will also go towards software improvements.

We operate in Romania, and we just closed a big contract in the US. We also operate now in the UK, and from the UK we have partnerships that go directly to Emirates and the Gulf countries.

As of plans, regarding the product we want to integrate at least 27 accounting softwares, and we aim for another 10 which are the biggest ones in the world and by this we will be able to offer access to our product to over 60 million SMEs worldwide in 140 countries.

In the next 6 months, we will go on with the integrations and bigger access to data. We will open API’s to be available and integrated in all types of marketplaces because there’re so many marketplaces that digest API for banks and SMEs. And then with these two we want to invest a lot in the AI advisor to deliver much better and unique insights for the behavior of a company.

Our competitive advantage is that we address the right problem and that is communication and the connection between an SME and a bank. Many companies address only SMEs or only banks. There was no company, or rather there was only one, our biggest competitor and biggest model to follow, Fluidly, that addressed the two together. They are a similar product but do not offer things like financial modeling or an AI advisor that we offer. Also reaching an almost 15 million pounds investment, they were recently acquired by one of the biggest banks in England.

Our main business model is B2B2C. We sell APIs or we white label our products directly to a bank and the bank offers these loans directly to its SME portfolio. It’s simple, straightforward, and highly lucrative.

The only problem is that the selling period is very long, meaning 18-24 months staying in negotiations, but the moment you sign you onboard 10K, 20K, 100K companies to your portfolio. It’s a trend that comes from the US, it started now also in the UK. I think Prime Dash will increase this trend in Britain and in Europe.

Especially with the new type of business owners, SMEs now look for digital first experience, something like a one-stop-shop solution.

Even if it’s accounting, they want to work with refiners. Not to work with a bank just because you have a loan there, the new generation wants to work with the bank because the bank wants it to become its partner, to offer not only financial but also non-financial products. And now banks start to see this trend and acquire technology to do this type of engagement where banks help SMEs grow.

The Visa Innovation Program really validated our vision. They were the first to say we believe in this vision saying that they think that banks will resonate with our product. We, thus, closed the fastest deal with a bank since the beginning of the program, in less than two months. It was a good funnel of closing POCs contracts with banks for us. Having a big name behind you that believes in you, helps a lot of companies-participants this way.

The accounting tech market and the fintech market for SMEs overall have a high potential for growth and evolvement. To help SMEs reach their full potential, we need to progress with efficient banking solutions and other financial initiatives that could optimize businesses’ day-to-day operations. Europe especially has good prospects due to its high levels of connectivity and internet access which enables more businesses to be reached via technology.

Such developments come not without their risks, however. A large number of big financial institutions still operate using highly complex and expensive system for compliance and documentary procedures, some of which are still paper-based. With the rise of digital financial data sharing, it is important there are certain tech-driven standards to counter financial crime and ensure data protection.

Nevertheless, fintech solutions often win with their simplicity and adaptability, lack of bureaucracy and the ability to reach more SMEs with the help of technology. It is important, thus, to keep educating SMEs on fintech, so they can streamline their internal procedures like payroll, bookkeeping, payment integrations, and save time on administrative tasks, driving up the value proposition businesses.