The first half of 2021 is almost gone, so it’s time to stop for a minute and look at all the deals that happened in Southeast Europe’s startup ecosystem in the past six months. Despite the still ongoing pandemic, tech investment-wise this period was the most active in the history of the region. The Recursive team counted rounds of total value surpassing $1.2B (€1B). This number is likely higher given that the financial parameters of multiple deals were not disclosed.

It’s interesting that even if we remove Romanian unicorn UiPath from this calculation, the younger startups in the region have still fundraised a sum that’s close to half a billion dollars. While traditionally strong for SEE verticals like fintech and enterprise automation software still dominate, we can see progress in the deep tech field as well. For the purposes of this summary, we are considering only companies that have had: a. Strategically important function in the region since day one, b. At least one local founder, and c. early-stage capital provided by a regional investor. We have included only money that was raised on the private markets.

The Recursive also discovered that another Series B round of a Bulgarian startup is to be announced in the next few weeks while Croatian Infobip and Greek Viva Wallet are expected to raise $500M each in the next few months. So, if the momentum is kept, there’s a good chance that by the end of the year, we’d be looking at a total deal value of over $3B.

The biggest investments

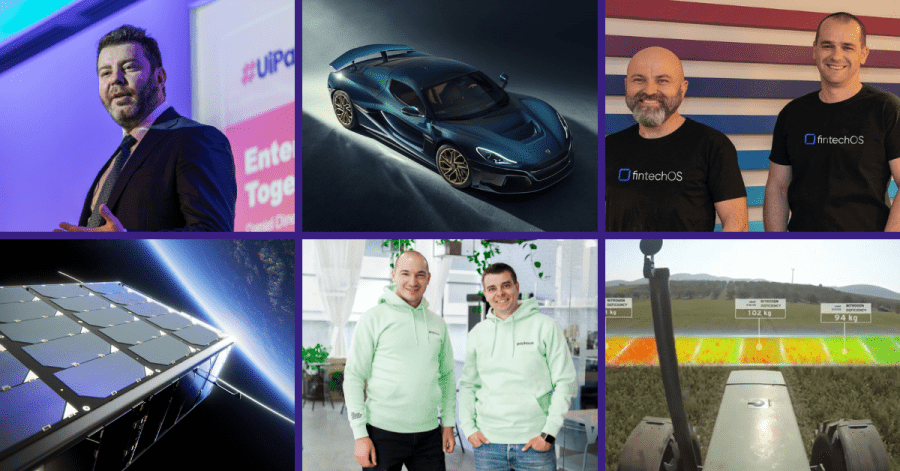

- On the way to its IPO on the New York Stock Exchange, Romanian UiPath kicked-off the year with a $750M Series F round.

- Back in March, Rimac-Automobili, a Croatian company that builds electric sports cars and develops electromobility components for automotive manufacturers, announced an $85M growth round, with which Porsche increased its stake in the company to 24%.

- At the end of April, Viva Wallet, a Greek neobank with focus on SME merchants across Europe, closed an $80M round, in which Chinese Tencent also participated.

- FintechOS, a Romanian startup that gives financial institutions low-code digital infrastructure, raised a $60M Series B round to boost its international expansion. The investment was led by Draper Esprit and joined by previous investors from the region – Early Bird Digital East, Gapminder VC, LAUNCHub Ventures, and OTB Ventures.

- Greek online insurance company Hellas Direct just raised $38M from EBRD, Endeavor Catalyst, IFC, and others to expand across several emerging markets across Europe, including Romania.

- Croatian Gideon Brothers, a company that produces autonomous mobile robots mainly for the logistics and delivery sectors, recently closed a $31 million Series A round.

- One of the first big deals this year came from Bulgarian Gtmhub, an OKR-focused platform helping companies with corporate planning – $30M Series B led by Insight and again joined by LAUNCHub Ventures (existing investor).

- 2021 has certainly been successful for Croatian startups – back in February, Photomath, an edtech company started in Zagreb, raised $23M Series B.

- While not the largest one on the list, Payhawk’s $20M Series A round was the biggest ever for a Bulgarian venture at this stage. Led by QED Investors, a VC with 18 fintech unicorns in its portfolio, this investment was greater in size than the Series A rounds of Revolut, Klarna, and Stripe.

- Causaly, a Greek AI startup that’s helping medical researchers sort through existing literature and clinical trials, raised $17М from Index Ventures and existing investor Marathon VC.

- Distributed across seven countries, including North Macedonia, sales intelligence platform Cognism closed a $12.5M Series B round.

- US-Bulgarian cloud storage startup LucidLink announced a $12M Series A round joined by Adobe as a strategic investor. Previous backer BrightCap Ventures also joined the round.

- Greek cybersecurity training platform Hack the Box raised $10.6M to expand operations and further develop its product portfolio. Marathon VC also participated in the round.

- Yet another company coming from the portfolio of Marathon VC – Greek precision farming startup Augmenta closed a $8M round on its journey to enable greater yields and farming efficiency.

Other key deals

| Company name | Country | Investment Size |

| Anodyne Nanotech | Greece | $4.2M |

| Locktrip | Bulgaria | $4.1M |

| Seedblink | Romania | $3.6M |

| EnduroSat | Bulgaria | $3M |

| Better Origin | Greece | $3M |

| Druid AI | Romania | $2.6M |

| Anari | Serbia | $2M |

| Econic One | Bulgaria | $1.9M |

| Biopix-t | Greece | $1.7M |

| Orqa | Croatia | $1.7M |

| FantasticStay | Bulgaria | $1.6M |

| Questo | Romania | $1.4M |

| Bunnyshell | Romania | $1.3M |

| Bespot | Greece | $1.2M |

| Robotiq.ai | Croatia | $1.1M |

| Milluu | Romania | $1.05M |

| Daibau | Slovenia | $1M+ (undisclosed) |

| Coursedot | Bulgaria | $1M |

| Klear Lending | Bulgaria | $950k |

| Petmall | Bulgaria | $950k |

| WeSave | Bulgaria | $950k |

| SanoPass | Romania | $900k |

| Quendoo | Bulgaria | $890k |

| Plant an app | Romania | $860k |

| Extasy | Romania | $775k |

| Processio | Romania | $730k |

| ProductLead | Romania | $700k |

| Assen Aero | Bulgaria | $700k |

| Finqware | Romania | $600k |

| Boleron | Bulgaria | $600k |

| Hyperhuman | Romania | $600k |

| Oveit | Romania | $600k |

| Siscale | Romania | $550k+ (ongoing round) |

| Rubicon | Albania | $533k |

| *Ensk.ai, Threeding, Neurorehabilitation Robotics, Aquile | Bulgaria | $3.6M |

| *Omnio, Meat Me Bar, Tokwise, Gridmetrics, NulaBG, Augment, TraceTheTaste, FidU, Ecopolytechis, Bye Bye Shuttering | Bulgaria | $1.5M |

| *Bright Spaces | Romania | $1.7M |

+++In case we missed a round larger than $500k, please let us know at [email protected] and we’ll update the list.

+++If you’d like to receive a further segmentation of the most trending SEE deals in the past six months (e.g. by industry), subscribe to The Recursive Newsletter – delivered weekly.