Efficient spend management has been a real challenge for many businesses, and for a reason.

Most businesses don’t have a single, clear view of their software and cloud spending. Different teams buy tools in silos, finance departments struggle to track renewals, and executives are too busy to assess ROI.

But what if there’s a way out? Spendbase has released its latest Spending Benchmark Report to find it out.

The findings are based on data from over 3,000 companies and 1,000 vendors across 60 industries — with a total of $800 million in software and cloud expenditures analyzed. The key highlight? Businesses spend far more on their SaaS stack than they need to.

A glimpse into the report

The report is based on anonymized, aggregated transaction data and software usage patterns. These insights are grounded in real spend behavior that reflects an accurate snapshot of current trends across business sizes and sectors.

- How much companies spend on their SaaS and cloud tools on average;

- How the benchmarks differ across business sizes and industries;

- Where overspending happens most;

- How to uncover and bring those costs back under control.

Based on the data benchmark, across all business sizes and industries, it’s evident overspending is a universal issue. Several notable highlights in this area include:

- The average overspend rate on SaaS and cloud tools across all company sizes is 10.5%;

- Monthly billing models often result in companies spending up to 65% more annually compared to annual billing;

- Maximum spend per employee, based on total accumulated tool costs, can reach as high as $2,700.

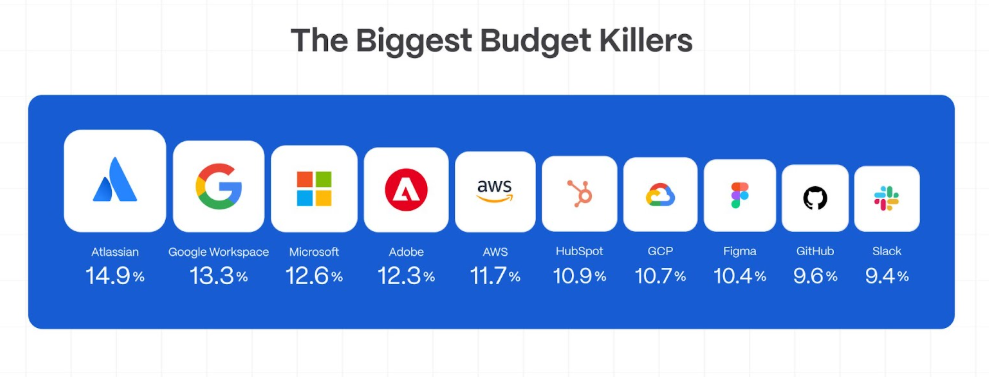

So, where are the most significant budget-eating holes? As findings show, there are several areas.

Cloud costs tend to climb steeply

Businesses that rely heavily on software solutions are among the top spenders — in particular, industries like Information Technology & Services, Financial Services, Computer Software, and Marketing/Advertising.

This high spending is driven by the need for high scalability, real-time collaboration, and data storage. On average, businesses overspend by 10.5% on cloud services, with the spend increasing proportionally as company size grows.

As a result, tech-related costs of such companies are consistently higher, especially when workloads expand rapidly or infrastructure isn’t continuously optimized.

SaaS expenses hit growing businesses hard

Interestingly, companies with 200–500 employees use the highest average number of software tools, even more than larger firms with 500–2000 employees.

This trend reflects a common stage in business growth: as companies expand, different teams continue to adopt specialized tools to meet their specific needs. With workflows still evolving, they often end up with a bloated toolstack that hasn’t been yet optimized.

Small subscriptions create big budget holes

Despite the attention given to large vendors, smaller “long-tail” subscriptions are a major source of inefficiency. These entail the low-cost (and often department-specific) tools that quietly renew month after month, often long after the teams have stopped using them.

Individually, they may seem insignificant, but together they can represent a substantial share of a company’s software budget. In fact, based on the benchmark data, over 50% of optimization potential lies in identifying and eliminating these low-value or redundant subscriptions.

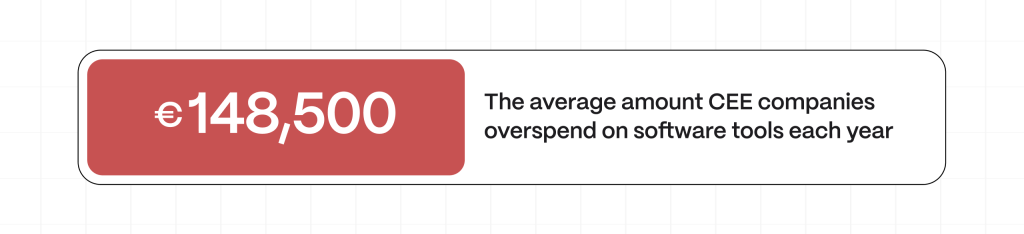

Zooming in on CEE

The Recursive also reached out to Spendbase to extract info on the regional spending.

In Central and Eastern Europe (CEE), the largest SaaS and cloud spenders are Financial Services (€990k/year), IT & Software Development (€850k), Healthcare & Pharmaceuticals (€675k), Retail & E-Commerce (€595k), and Manufacturing & Engineering (€425k).

The top SaaS and cloud software vendors in the region include AWS, Slack, Atlassian, Microsoft, Google Workspace, GitHub, Notion, Zoom, Figma, and Adobe.

Average SaaS spend by company size in CEE:

-

- Small Companies (1-50 employees): €155,000 annually

- Medium-sized Companies (50-200 employees): €360,000 annually

- Large Companies (200-500 employees): €590,000 annually

- Very Large Companies (500+ employees): €1M annually

Cloud market share in CEE is led by AWS (29%), followed by Microsoft Azure (22%), Google Cloud (16%), Alibaba Cloud (8%), Oracle (5%), and others (20%). Cloud spending per year by company size is €49k (1–50 employees), €165k (50–200), €470k (200–500), and €800k (500+). Per-employee cloud costs range from €720–€1,800 for small firms to €3,700–€6,000 for very large ones. Average cloud credits received by companies are highest for medium-sized firms ($120k), followed by large ($100k), very large ($90k), and small companies ($50k).

Cost-saving trends & tips

The accumulated data insights underpin clear opportunities to improve cost efficiency:

Optimizing costs during the scaling stage

Businesses can save more by scaling their teams: as the stats showcase, while total software spending rises, the cost per employee decreases. Here’s why: thanks to economies of scale and stronger vendor leverage, larger companies are in a better position to negotiate favorable deals. This includes volume-based pricing, enterprise-level discounts, and other cost-saving arrangements.

Maximizing the benefits of cloud credits

Another cost-saving area is cloud credits. Typically, underutilized cloud credits can amount to tens of thousands of dollars, especially on platforms like AWS, Azure, and GCP. These credits are typically offered as part of startup programs, partner incentives, or volume-based agreements, but many organizations either overlook them or fail to apply them effectively.

Find out more insights in the report.