A few years ago, Bulgarian IT company Digital and Software Solutions (DSS) began working with a major Bulgarian bank facing the challenge of extracting and structuring the ID information of its clients. DSS, which has recently become a certified partner of ServiceNow, tackled this problem with determination and its machine learning expertise. This collaboration marked the start of a journey that led to the creation of their first market product: aIDentix.

From Concept to Market: The Evolution of aIDentix

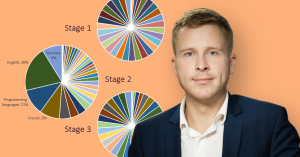

DSS initially focused on developing solutions for the bank’s document processing needs. Through several other successful projects and the processing of over 413,976 documents, DSS refined the original software’s capabilities and laid the groundwork for aIDentix, an OCR-based product for automated identity verification.

aIDentix leverages advanced artificial intelligence to provide precise verification solutions, assisting businesses in meeting regulatory requirements, preventing fraud, and saving significant time on manual verification tasks. It functions as a KYC software solution, enabling companies to create custom KYC questionnaires and automate the customer verification process.

aIDentix aims to serve financial institutions, fintech companies, insurance businesses, and SMEs that need to verify customer identities. Initially focusing on Bulgaria and the DACH region (Germany, Austria, Switzerland), aIDentix plans to expand across the European market, where standardized ID formats make the technology particularly effective. Future plans include adapting aIDentix for the retail sector.

Practical Applications and Benefits

According to Georgi Kotov, Director of IT at DSS, the primary advantage of aIDentix is its user-friendly design, easy integration, and rapid deployment. Businesses can integrate aIDentix into their operations without extensive training or lengthy setup times. By automating the identity verification process, companies can reduce the risk of fraud and ensure compliance with regulations, all while saving hours of manual work.

One of the next items on aIDentix’s roadmap is to enhance the fraud detection aspects of its offering further with a speech-to-text algorithm that would add another layer of verification and proof of humanity.

DSS’s journey from addressing a specific challenge for a Bulgarian bank to launching aIDentix underscores their ability to develop practical solutions for real-world problems.

With several years of consistent growth and its recent certification as a ServiceNow partner, DSS is now well-positioned to further expand its business and capabilities. With this foundation put in place, the company plans to launch more products in the future, reflecting a broader trend in the CEE tech ecosystem where successful IT service companies are transitioning to a product-centric approach.