Central and Eastern Europe is home to flourishing car and energy storage lithium ion battery manufacturing infrastructures. Despite challenges ahead, including rising costs of energy and the scarcity of required minerals, CEE countries are expected to continue to rank among top battery producers in the next decade.

Two key drivers are at play: the transition to renewable energy in the context of the decarbonization agenda for the whole EU bloc, and the switch to electric vehicles. Governments, energy market players and manufacturers will need to meet the surging demand of renewables and EVs with an increased use of lithium ion batteries for energy storage and powering electric vehicles.

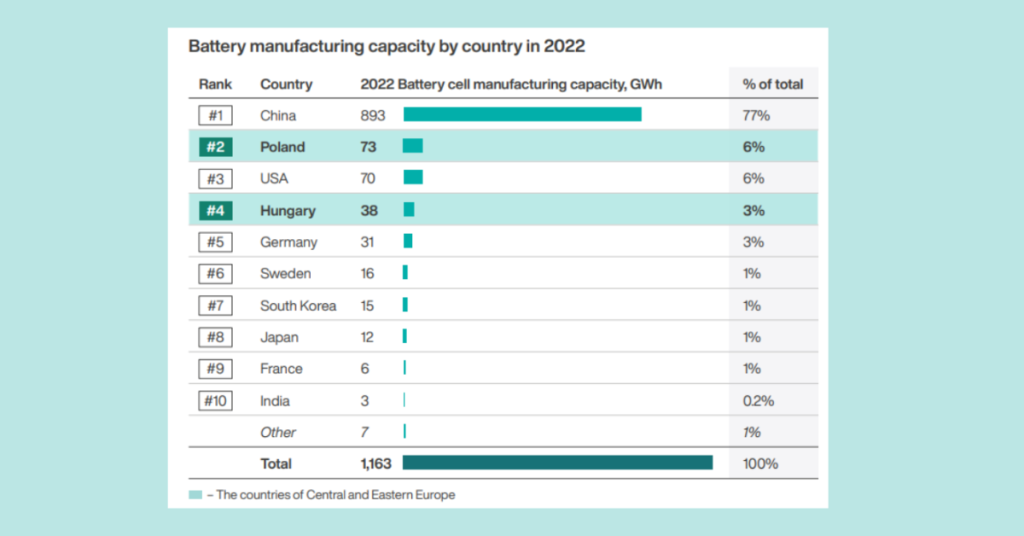

CEE is well-positioned to meet the corresponding demand of batteries as a key market for the automotive industry and increasing investments by European and Asian players in battery manufacturing projects. Currently, Poland ranks second worldwide in battery cell manufacturing capacity, while Hungary ranks 4th, and together they make up for 9% of total demand. By 2027, Poland and Hungary are expected to increase their production capacity and keep high positions in the ranking, as 6th and 4th top worldwide battery manufacturers, respectively.

Drivers of lithium ion battery infrastructure development in CEE

Since the 1990’s, CEE has been an attractive manufacturing location for the global automotive industry, with a vast number of investments from top European and Asian players, in particular. As shown in the graph below, vehicle production has been growing in the last two decades for countries such as the Czech Republic, Slovakia, Romania, and Hungary, while decreasing for countries in the West such as Germany, France, Spain, or Italy. Out of 91 car factories in the EU, 20 are located in Central and Southeast Europe, according to the International Organisation of Motor Vehicle Manufacturers (OICA).

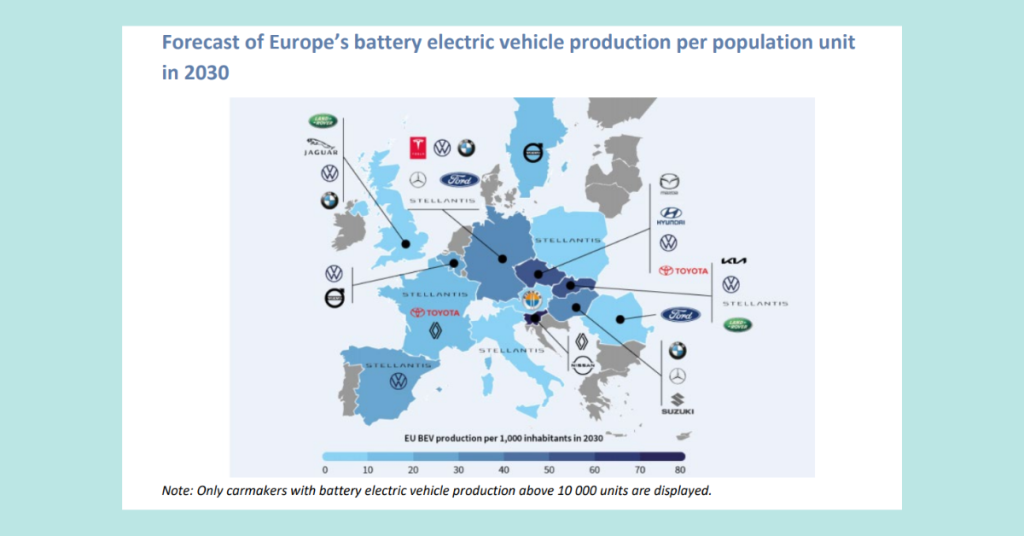

Recently, with the future of automotive being electrified, all major automotive players have been scaling up their e-mobility efforts. The EU is the world’s second largest EV market after China, reaching 2.3M EV unit sales in 2021 a 66% increase from 2020. By 2022, the share of new passenger BEVs and PHEVs on the EU market had already reached almost a quarter of all vehicles, higher than that of diesel vehicles.

This has in turn affected automotive factories in CEE, which are expected to produce either exclusively or in majority electric vehicles in the decades to come.

Countries such as Czech Republic, Slovakia, Hungary, and Croatia are forecasted to have the highest battery electric vehicle production per population unit in 2030, as shown below.

An electric mobility future necessarily translated into a corresponding increase in demand for the key element that will power it: lithium-ion batteries. In fact, the annual production of batteries aimed for EVs will need to jump from 160GWh in 2021 to 6600GWh by 2030, according to the IEA, the equivalent of creating approximately 20 gigafactories every year for the next 10 years.

Transportation is not the only industry putting pressure on the growth of battery production. The energy transition currently under way in the West, as well as the East, relies heavily on renewables. With increasing intermittent solar and wind energy in the system, the need for solutions to deal with short-term volatility also increases. The role of battery storage is deemed critical. Here, IEA estimates that installed grid-scale battery storage capacity needs to grow 44-fold between 2021 and 2030, reaching 680GW, to achieve net zero ambitions.

For CEE, the energy transition is all the more relevant in the context of a prolonged neighboring war that has caused rising energy prices and a search for alternative, domestic energy supplies. A cornerstone of a successful transition from coal and natural gas to renewables is an accelerated uptake of energy storage technologies to improve power system flexibility.

Key lithium ion battery manufacturing projects in CEE

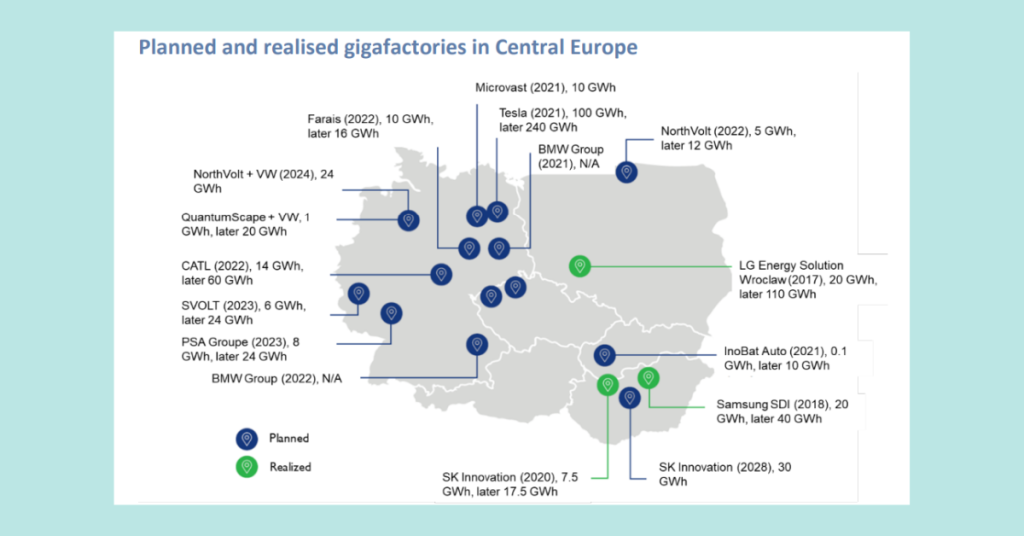

In the V4 states and Germany alone, demand for batteries is expected to reach 480-650 GWh in 2040, according to a report by Deloitte. To make sure that EV assembly stays in the region, countries will need to also boost their battery production capacities by attracting investors and building gigafactories. 4 have already been realized, with more than a dozen others planned.

Poland and Hungary take the lead

When Swedish Car manufacturer Volvo announced its new electromobility technology hub in Krakow, they justified the chosen location as an emerging tech center. Meanwhile, German Mercedes-Benz announced a €1.3 billion investment – the largest so far among automotive giants – in a factory in Poland to produce exclusively electric vans. As long as we’re counting records, Poland is also the biggest export of electric buses in Europe.

Aside from EV projects, Poland has seen a series of investments in lithium-ion battery manufacturing (shared below, ed.note) that boosted its production capacity to 73GWh in 2022 and made it the largest CEE export of EV batteries.

Poland is currently home to the largest car battery factory in Europe, run by South Korean LG Energy Solution (LGEG) near Wroclaw, employing more than 10,000 people. At the same time, Swedish battery manufacturer Northvolt built in Gdansk the largest factory for energy storage systems in Europe. Other producers such as SK Innovation’s SK Hi-Tech Battery Materials, fellow South Korean-owned KET Poland, Belgian parts maker Umicore, and Foosung and Enchem, have opened production sites in the country.

Meanwhile, Hungary is catching up fast, taking advantage of the automotive industry’s transition. In the last decade, the country’s EV battery production science has taken off fuelled by investments from Chinese, South Korean, and Japanese companies.

The latest news on this front is a €7.4 billion investment in an electric car battery plant in Debrecen planned by the world’s largest battery producer, Chinese company CATL (Contemporary Amperex Technology Co.). The future plant will have a capacity of 100 GWh and employ 9,000 people, making it the largest of its kind in the EU and ramping up Hungary’s overall capacity to over 152 GWh, second only to Germany among European countries.

Poland and Hungary’s early seizing of opportunities in battery production was supported by their respective governments, which have been active in providing incentives to international investors. While Warsaw largely focused on South Korean and European investors, Hungary has also courted larger Chinese investors.

The rest of CEE countries are catching up

Other countries such as Slovakia, Romania, and Bulgaria are looking to catch up with their regional peers in battery manufacturing.

For instance, Slovakia is developing, in parallel, its EV manufacturing and battery producing capacities. One mega investment of €1.25 billion in EV production comes from Volvo, which announced its plans to build a facility with a capacity of 250,000 EVs per year.

Meanwhile, Slovakian InoBat Auto is building a lithium ion battery gigafactory of 10 GWh capacity in Bratislava, to start operating in 2024 and serve up to 240,000 cars.

In Romania, local batteries producer Prime Batteries Technology (PBT), launched in 2016 by two local entrepreneurs, joined forces with EIT InnoEnergy to invest €1bn to boost its production capacity to 8 GWh by 2026 from 0.2GWh in 2022. Meanwhile, Austria Megalodon Storage aims to complete another 7 MW lithium ion battery storage unit in Ilfov in 2023.

Bulgaria is also stepping up its battery production. Organizations such as the Automotive Cluster Bulgaria aim to support new investors in finding suitable locations, partners, and staff. A South African battery manufacturer has recently opened the LiFePO4 Energy Storage manufacturing facility in Ruse, Bulgaria, targeting an initial annual output of 60 MWh.

Recently, the Bulgarian Ministry of Energy and the European Bank for Reconstruction and Development (EBRD) have signed two agreements for the development of renewables in Bulgaria. Following the agreement, EBRD will analyze existing energy storage technologies in order to select the best-suited ones for the country, then organize tenders for the delivery of two turnkey systems.

Navigating challenges in battery manufacturing ahead

Elsewhere in CEE, other countries are in a promising position to boost the region’s competitiveness in battery production, in the context of upcoming challenges.

Recent energy pierce spikes in the region has influenced the postponement of several projects, including Volkswagen’s gigafactory for electric car batteries, for which they were considering Eastern Europe. By comparison, the US green energy subsidies offered under the Inflation Reduction Act package is leading to fears in the EU of an exodus of investments.

Another problem is the huge volume of minerals required to scale battery production. While the IEA estimates a 30-fold increase in the demand for battery minerals between 2020 and 2040, research suggests the world may not have enough resources to meet this demand. It is because the weak value chain for lithium is controlling such a big percentage of battery production.

One answer could be found in the vast lithium reserves located in the Czech Republic’s Ore Mountains. The decision whether the reserves can be exploited is pending with the Czech government. Other commercial mining operations are in the pipeline in Serbia and Romania. Elsewhere in Europe, there’s only one other active lithium mine, in Portugal, with the rest of the mineral being imported from Australia, Chile, the US, and Russia.

Another option is recycling. According to experts, lithium can become more efficient through the recycling process, offering better energy density. And this is only the beginning – other technology innovations and solutions are waiting to be found.