Can you guess which is the most developed innovation ecosystem in Southeast Europe which maintains the harmony of the regional VC landscape? Yesterday, The Bulgarian Private Equity and Venture Capital Association (BVCA) together with Dealroom and the EIB Group, released the first report on the evolution of private capital in Bulgaria and South East Europe.

- The report ranks Bulgaria at the top of developed venture ecosystems in SEE with more than 230 funded startups per 1M inhabitants.

- Together with Croatia, Bulgaria is ranking highest in SEE when it comes to the availability of funding for local founders, slightly above the EU average.

- With 18 active PE and VC funds, Bulgaria leads SEE in the number of locally-based funds. In 2023, as the new investment program of EIF begins, the number of Bulgaria-based funds would most likely increase even further.

- Bulgaria has received the highest volume of VC funding when excluding megarounds above €100M and has seen the highest number of VC investments in SEE.

Read further to dig deeper into the highlights from the report and get the insights from Bulgarian VC investors.

Bulgaria as a SEE investment hub

The report highlights that more funds were raised in the last 18 months than ever before in Bulgaria adding some $251M to the local ecosystem in 2022.

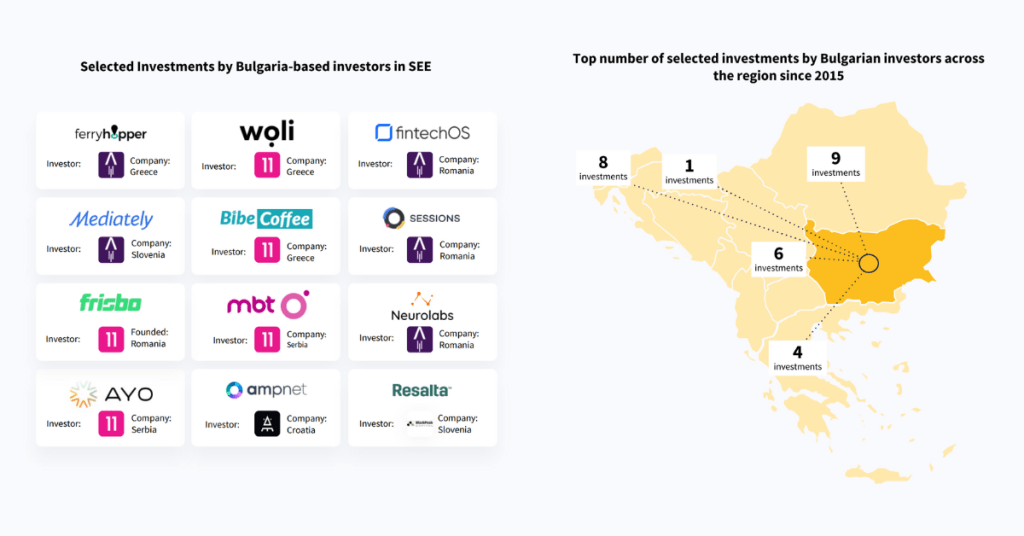

The country is among the leading investor hubs in SEE having made more than 28 investments in neighboring countries since 2015. Three Bulgaria-based VC funds – Eleven Ventures, LAUNCHub Ventures, and BlackPeak Capital, have shown a strong track record in backing startups from across the region.

SEE growing faster than CEE neighbors

“The SEE ecosystem is not as mature as the Western and that is why it is logical to grow at faster rates. But what we have seen in the past couple of years is that world leaders have started to emerge from the region and international investors notice that. I believe the SEE region will be able to sustain its current growth rates for two reasons: first, there is a lot of dry powder that is waiting to be allocated to local companies, and second, we see that traditional industries in the region are increasingly digitizing opening up many new opportunities for local startups”, Ivan Draganov, Senior Analyst at Dealroom highlighted.

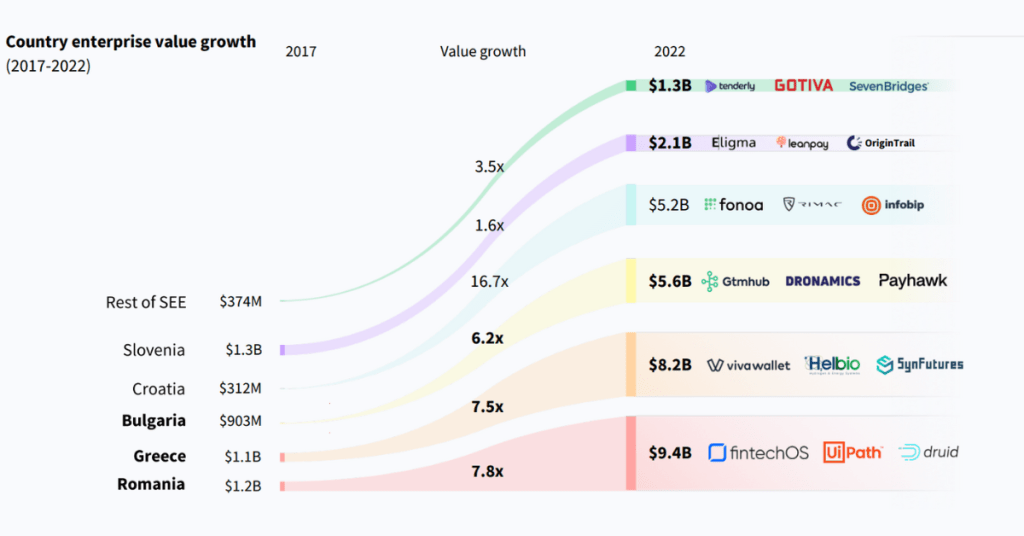

In the past 10 years, the value of SEE startups has grown almost 50 times, which is significantly faster than its CEE neighbors (9.1 times) and quite above the European average of 12.1 times. The ecosystems in Romania, Greece, and Bulgaria have grown to make up more than 70% of the total enterprise value in SEE, which amounts to $31.8B.

VC funding is at an all-time high in the region

Combined VC funding of SEE-based startups has already reached over $1.3B in 2022, an all-time record. Since 2017, VC funding has grown 5.9x and shows signs of continued growth.

According to Georgi Mitov, Managing Partner at BrightCap Ventures, the SEE is at a tipping point where more and more talented engineers who are still working in multinational companies, are starting to consider switching their careers for entrepreneurship and they are encouraged to do so by the larger availability of capital in the region.

“In the current economic situation, the software and innovation industry in our region would continue to sustain its growth, get stronger and probably have a better time than the rest of Europe. This has proven to be the case in an economic downturn mainly because of the difference in the compensation models of engineers. That’s probably the biggest opportunity for the region to establish the Balkans as the Silicon Valley of Europe,” Mitov says.

Enterprise Software, Fintech & Transportation lead in SEE

These 3 industries combined have generated over $24B in enterprise value, which is over 50% of the total value of the region. Success cases include InfoBip (Croatia), UiPath (Romania), and Payhawk (Bulgaria).

9 SEE-bred unicorns

The report by Dealroom counts 9 officially-announced unicorn companies across the SEE region. These are the Croatian full-stack communications platform Infobip and Rimac Automobili which builds electric hypercars, the Greek edutech unicorn PeopleCert, and the neobank Viva Wallet, the Bulgarian financial management platform Payhawk, the Slovenian mobile game and app developer Outfit 7, the Romanian RPA giant UiPath, blockchain app Elrond, and eMag, which became unicorn as a subsidiary.

SEE unicorns contribute half of the region’s combined enterprise value. More importantly, it helps spin the wheel by turning local talents into founders. In H1 2022, unicorn companies in SEE made up 48% of the value of the SEE ecosystem, almost $16B.

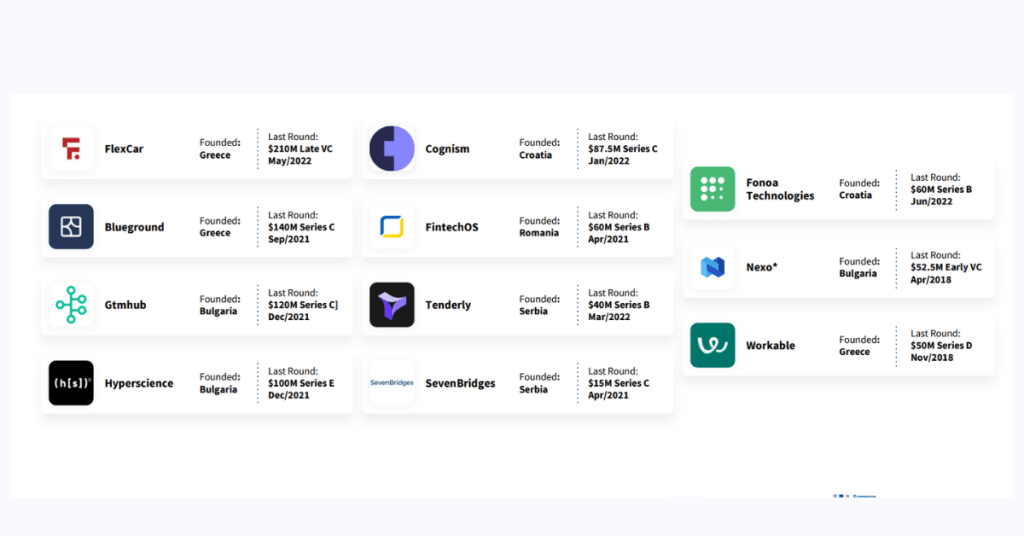

Who are the soonicorns we should be watching?

“There is a correlation between the amount of capital deployed and the number of future unicorns that are born in innovation ecosystems. In order to reach the same value as the rest of Europe, there needs to be more capital deployed in the region,” Ivan Draganov commented.

Given that 2022 was an all-time high in terms of available capital in SEE, there may soon follow new unicorns. Here are the sooniconrs of SEE, spread across 5b countries – Bulgaria, Greece, Croatia, Serbia, and Romania.

Curious to compare data on the innovation performance of the region? Check out the findings of the latest Atomico CEE report.