“As a father, my number one stakeholder is my son. Making sure that he has a role model even in an environment with less opportunities like Macedonia is a priority for me and that mantra follows me in the business world, taking the fatherly figure approach to the new generation of startupers,” says Igor Madzov. He’s the co-founder of Startup Macedonia and Investment Facilitator for the Western Balkans at the Swiss Entrepreneurship Program (EP). Startup Macedonia is an association connecting the Macedonian startup community, whereas Swiss EP aims to facilitate the development of emerging entrepreneurial ecosystems by bringing together key local stakeholders.

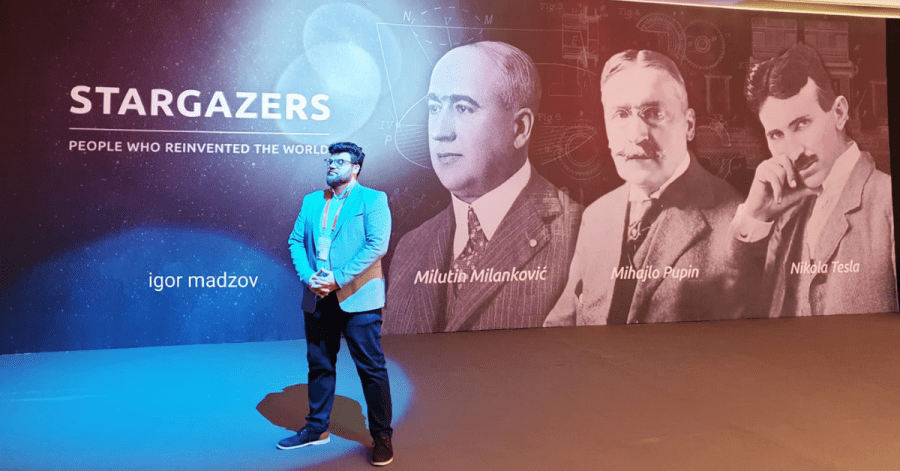

His words highlight what struck me as one of Igor’s preferred “hats”, that of a mentor, while interviewing him during the Alpha Wolves Conference in Warsaw. At the event, Igor was advising scaleups on perfecting their pitches, drawing on his experience of over 5 years in building a support system for the startup ecosystem in North Macedonia, as well as helping startups in Western Balkans accelerate.

Igor is a people person: he recharges his batteries when he is in the presence of others. When he can bring people together and help them find synergies. That makes him a passionate and successful community builder, often taking part in the local and regional initiatives and events, including co-organizing Startup Europe Week and Startup Weekend.

Asked about his definition of success, Igor shares: “In 2016 I set a goal to create a network that will provide entrepreneurs with the know-how, resources, and connections they would otherwise not get. I am happy that many individuals and foreign organizations share the same vision and act upon it in different ways. We need more positivity every day, so I make every individual startup success an Ecosystem and Personal success.”

In this interview for The Recursive, Igor Madzov talks about how he found his passion for tech startups and community building, key development milestones for the Western Balkans ecosystem, and what comes next for the region.

The Recursive: How did you discover your calling as a startup ecosystem builder and investor?

Igor Madzov, co-founder of Startup Macedonia and Investment Facilitator Western Balkans at Swiss EP: I had my first professional engagement with the startup world during university when I wanted to bring A-list celebrity speakers to our region. Making these connections and bringing foreign know-how to aid the local business ecosystem is what drives my focus and my energy.

When I got connected with startups, it was clear to me that this is my calling, this is why I’m here.

Since 2010 I’ve contributed to hackathons such as Startup Weekend, doing all types of mentoring sessions and meetups, which are basically meant to help the creation of an ecosystem and for people to connect and build the necessary know-how. Still, the element that was missing most in the region was the financing part. And that is why I got involved in the acceleration of startups, venture capital financing, and angel investing, which is what I have been doing for the past five years.

One of the main programs that you work on is Swiss EP. When it comes to the Western Balkans focus, what are your objectives and have been the biggest milestones so far?

When Swiss EP was founded I was part of the VC fund in the region and together we created Startup Macedonia. So, we worked together on the support side and found a common understanding that this ecosystem needs more development, more influence from foreign experts, and more exposure for startups from this region. This is how I found a fit with Swiss EP and I took over the investment initiatives as an investment facilitator for the Western Balkans.

My goal was to create a support structure for investors, through education of angels/angel clubs, support for VCs with pipeline, and support for accelerators with programs. With our vast network of entrepreneurs and experts we help accelerators decide which startups to invest in, as well as with training participants, so that we can bring them as close as possible to fundraising.

One of the bigger milestones was that we founded the Western Balkans Angels Community, where we have more than 50 trained angel investors coming from the entrepreneurial world. Individually or through creation of Angel clubs, these entrepreneurs aim to invest private capital into the region.

We need to bring as much venture capital to startups as possible, so that founders can access foreign markets.

Another big project for us is the Investment Readiness Program, which was a success as a start. Hopefully, we’ll have many companies that make their dreams come true by fundraising and expanding their business.

Which are the strengths of founders in our region that stood out to you?

I would say that one of their biggest assets is having a lot of technical know-how, which also means they know how to tackle problems in the best way possible. And that’s why when there is a mix between founders, not just from our region, they’re working great together. As a region, we didn’t have much access to the Western markets. But this is where we can work more.

Balkan people are known to be passionate and sometimes stubborn but the coachability of founders from the region is also a virtue.

Even though in their ecosystem they may be the best, they understand there is still a long way to go to achieve international success and they need to be coached. Founders need to be humble to succeed. This is something that I found great about the companies coming from the Western Balkans.

Which key verticals and solutions are you following? Where do you see the first unicorn in Western Balkans coming from?

We’ll see which vertical will be the first to give rise to an unicorn. In the short run, I would be more pleased to have in each of the countries five companies making significant revenues valued at $200 million+ instead of one unicorn. Having a unicorn could be an exception and not a defining element of an ecosystem, whereas if there are multiple companies with a lower yet still high valuation, employing a large number of people, it actually creates a critical mass of greatness. And in this community people support and motivate each other.

We see more and more companies using AI for the business sector. B2B SaaS is the strongest business model that companies are going after targeting the US and Western European market.

One of the first investments that our office made with South Central Ventures was in Cognism and they have already raised 130 million in under 5 years. So, we expect it to either become a unicorn soon or get acquired. It is a company with Macedonian, Croatian, and UK DNA, but at the roots they call it Macedonian because the core of the business and the technology were built from the ground up in Skopje.

Elsewhere in the region, we have other companies that are already doing great. For example, Serbia is really strong on the gaming site; local startup Nordeus had an exit just last year, and blockchain startup Tenderly recently raised 40M+. Kosovo, Albania and Bosnia & Herzegovina with their strong Diaspora should not be neglected, producing numerous startups based in the US with Western Balkan DNA.

Tell us more about your work at Startup Macedonia. What are your goals in 2022?

For Startup Macedonia, 2022 looks like the most promising year yet. We have built a team that can, and really wants to support the ecosystem. The idea now is to go even harder on the side of community building. This will translate to more work with corporations, as well as with the government. After six years on the scene, we work with over 150 companies. We want to give the voice to the startups, so that they are heard. We’re going to push on that by working with the Ministry of Internal Affairs, with the Information Society, Fund of Innovation with the National Bank for the fintech sector, and by utilizing the assets that corporations have across the country to support the local ecosystems and not just the capital.

In North Macedonia specifically, there is a very interesting phenomenon since the domestic market is so small. Startup companies are rarely looking at the country as a market, but as a product development location. But when they need to do a proof of concept, when they need to validate, they go to other Eastern European countries, to Western Europe, or even directly to the US, which is the case of many companies receiving funding these days, because their target clients are there. Local corporations are slow, not receptive to innovation, and this is something that we are working to address.

How do you see the Great Resignation trend play out in Western Balkans and how do you help with keeping IT talent in the region through your initiatives?

We definitely see the problem. Local startups have a hard time acquiring talent because of having a remote-first type of setup. Many quality developers were hunted by unicorns in Europe. Some of these developers and founders moved to other countries because there is more capital there. So, the question is “What are we left with in the end?”.

But if people are moving and still bring more to the ecosystem, over the years, it will still be a win for the ecosystem. So, I’m a big fan of mixed teams. I don’t think that a global startup can be developed with only local offices and local employees. It requires specific skill sets, culture, and mindset.

In a way, the pandemic showed us that we need to stop thinking about borders, but that we also need to start thinking about developing ecosystems, and providing the infrastructure needed to start and develop a business.

Once companies get more funding, they find themselves in the situation where they need a more developed jurisdiction. We know that they’re going towards markets with larger tickets and larger consumer bases, and there is nothing wrong there. Our market has only 2 million inhabitants, it is too small to even have it as your only test market. But it is also important what the governments offer, so that the companies have incentives to bring back value here as well.

In the second part of 2022, a new public-private investment fund in North Macedonia is expected to start making investments in the startup sector. How do you expect it to work, and what could be potential challenges with placing this new funding?

So far, the Fund of Innovation and Technology Development in North Macedonia has been driving most of the early-stage funding activities in terms of numbers with over 500 companies supported in the past 5 years. These are funds coming from the government in form of grants and favorable loans with a vision to boost innovation with a spray and pray strategy. So, in the end, it’s a question of how many companies will really be on the market if there is no adequate funding to follow.

The demand is certainly there and we have created a good pipeline of companies that are demanding for Local and International Funds and to put the trust in Macedonian companies with global ambitions.

This is the part where we like to see a national VC fund that is really market-driven. That means it asks certain KPIs and has demands from startups. We also want to see more mechanisms motivating angel investors to invest and be matched by a fund for innovation and other schemes necessary to put more private capital in the ecosystem.

On the other side, the plan is definitely to increase the market readiness of the companies that get support from the government, and then to connect them to foreign markets. This is something that we’ve done through one successful pilot project WB Investment Readiness Program, and we would like to do it at scale. As an early-stage startup you need to learn how to approach certain markets. Yes, technology opens doors, but still, there are cultural differences and contract differences to be learned, soft skills that need to be exercised, and relations that need to be built in order to scale.

As a region, Western Balkans is a technology gem that is still unpolished. The question is: “Do we leave it like that, or do we do something about it to really make it shine?”. And shining means creating companies that shine on behalf of the ecosystem.