Wealthyhood, the DIY wealth-building app for long-term investors, recently raised €630K from Genesis Ventures, the new Greek venture capital fund, and 10 angel investors. With this, the fintech startup seals its pre-seed round at €920K, after raising its first €290K from angel investors and investors from the Pringle Angel Network in May 2021.

With the latest funding, Wealthyhood will grow its team, expand to the wider EU market, and release the mobile app version of its web platform to help more people in the EU rationalize the way they invest.

“Successfully closing the first VC-backed funding round is always a major milestone for an early-stage startup, even more, when it is led by an amazing team, Genesis Ventures, of Dimitris Maroulis and Stergios Anastasiadis, and backed by experienced angel investors. We’re now full-power on releasing the Wealthyhood mobile app by the end of May and looking forward to expanding to South and Southeastern Europe in the coming months,” Alexandros Christodoulakis, co-founder and CEO of Wealthyhood, shares for The Recursive.

Smart, simple, and personalized wealth-building

Founded in November 2020 by Alexandros Christodoulakis and Konstantinos Faliagkas, Wealthyhood provides long-term beginner investors with a mix of personalization and automation investment tools to help them navigate the stock markets. The founding team brings years of experience in trading, portfolio modeling, and computer engineering in Morgan Stanley and Sony PlayStation.

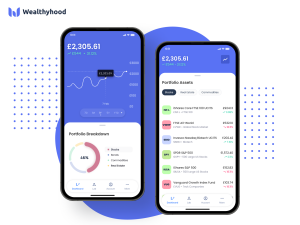

Their solution provides users with smarter tools and personalized insights to allow them to develop, optimize, and automatically maintain their wealth-building strategy. More specifically, the Wealthyhood app offers unlimited commission-free ETF investing, portfolio automations, real-time guidance, and over a million personalized portfolio templates.

Users can invest in stocks, bonds, commodities, and real estate from all around the world, as well as choose from a range of sector-tracking and thematic ETFs, including biotechnology, cloud computing, AI, digitalization, clean energy, and gaming.

Investing should not be gambling

According to Wealthyhood, more than 100M millennials across Europe experience the problem of wanting to start investing but struggling to find the right app. Most of the apps on the market are a bit too complex for first-time investors and do not offer proper guidance on how to create a portfolio. In turn, this leads to around 80% of first-time users losing their money within the 1st year, according to data from the stock platform Etoro.

In addition, it looks like robo-advisors are not a solution as they offer only a couple of pre-made portfolios, which limits the personalization users can get. The AI advice of such robots also comes expensive with around 1% in annual fees.

Wealthyhood positioned itself in the middle between trading apps and robo-advisors to guide Millennials and beginner investors to build their wealth in an intelligent and personalized way. The other differentiating factor is that the startup charges a flat monthly fee and does not take any commission to avoid negatively impacting the user’s wealth building.

Next in the journey of Wealthyhood

In less than 4 months after the official product launch, Wealthyhood has attracted over 4,000 active users. Besides customer validation, the startup has been recognized as the winner of the FinQuest Accelerator and participated in the Visa Innovation Program for SEE fintech startups and the CDL Accelerator by Oxford University.

With a team of 10 individuals and 2 Board Advisors, Wealthyhood has three main targets for the coming months. They will focus on releasing the mobile app for iOS and Android by the end of May, set foot outside of the UK into the EU market and especially into the SEE region. In addition, they plan to hire more people to gain the capacity that would allow them to achieve their expansion goals.