The 2024 edition of the Venture in Eastern Europe report by How to Web, supported by Croatian unicorn Infobip, highlights a substantial increase in venture investment across the region. In 2024, venture deals totaled €3.89B, more than doubling the €1.85B reported in 2023. The inclusion of Turkey in this year’s report contributed €1B to the total. Excluding Turkey, the region still saw a 56% year-over-year increase in investment volume.

* The report covers 19 Eastern European countries: Albania, Bosnia and Herzegovina, Bulgaria, Croatia, Cyprus, Czech Republic, Estonia, Greece, Hungary, Latvia, Lithuania, Moldova, North Macedonia, Poland, Romania, Serbia, Slovakia, Slovenia, Turkey, and Ukraine. 2 countries were not considered, as there were not significant data about the venture deals: Kosovo and Montenegro.

This year’s report takes into account 2 new countries, compared to last year’s edition, Albania and Turkey, and excludes Montenegro.

Czech Republic, Estonia, and Lithuania doubled their volumes

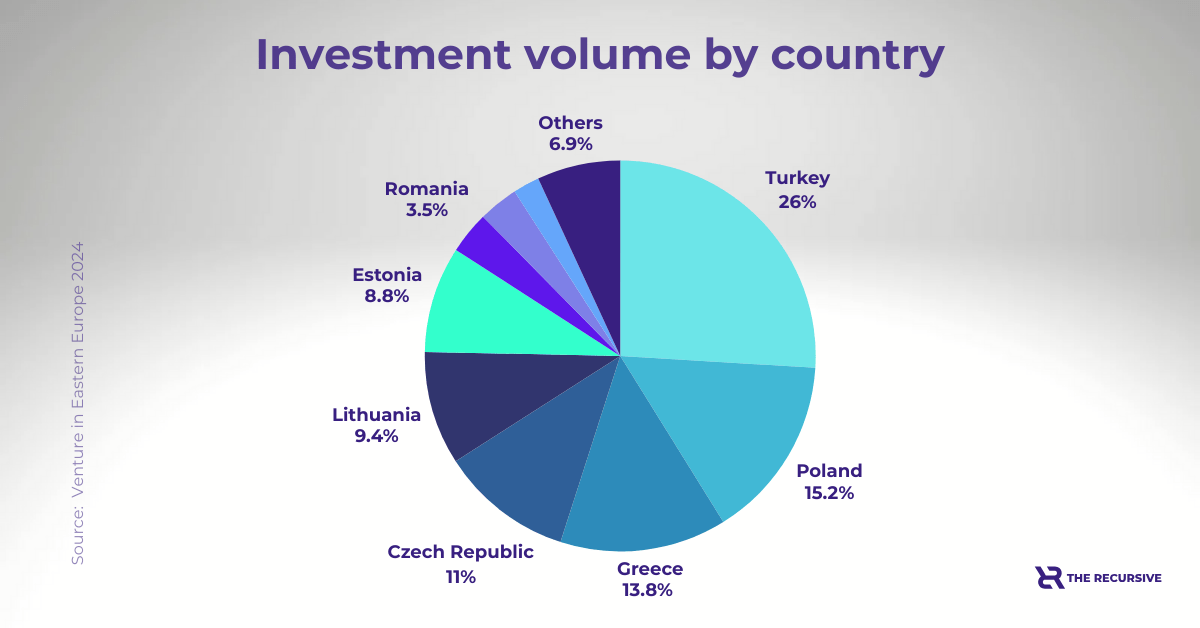

Investment activity was concentrated in a few countries, with 8 nations accounting for over 90% of the total investment, amounting to €3.54B.

The top countries by total venture investment were:

- Turkey: €1,012.2M

- Poland: €592.1M (27.06% increase from €466M in 2023)

- Greece: €536.6M (26.95% increase from €422.7M in 2023)

- Czech Republic: €426M (136.1% increase from €173.1M in 2023)

- Lithuania: €367M (71.43% increase from €214.2M in 2023)

- Estonia: €342.3M (116.65% increase from €158M in 2023)

- Romania: €130.7M (0.85% increase from €129.6M in 2023)

- Slovakia: €129.8M

Countries such as Czech Republic, Estonia, and Lithuania saw the most significant growth, with investment volumes more than doubling compared to 2023.

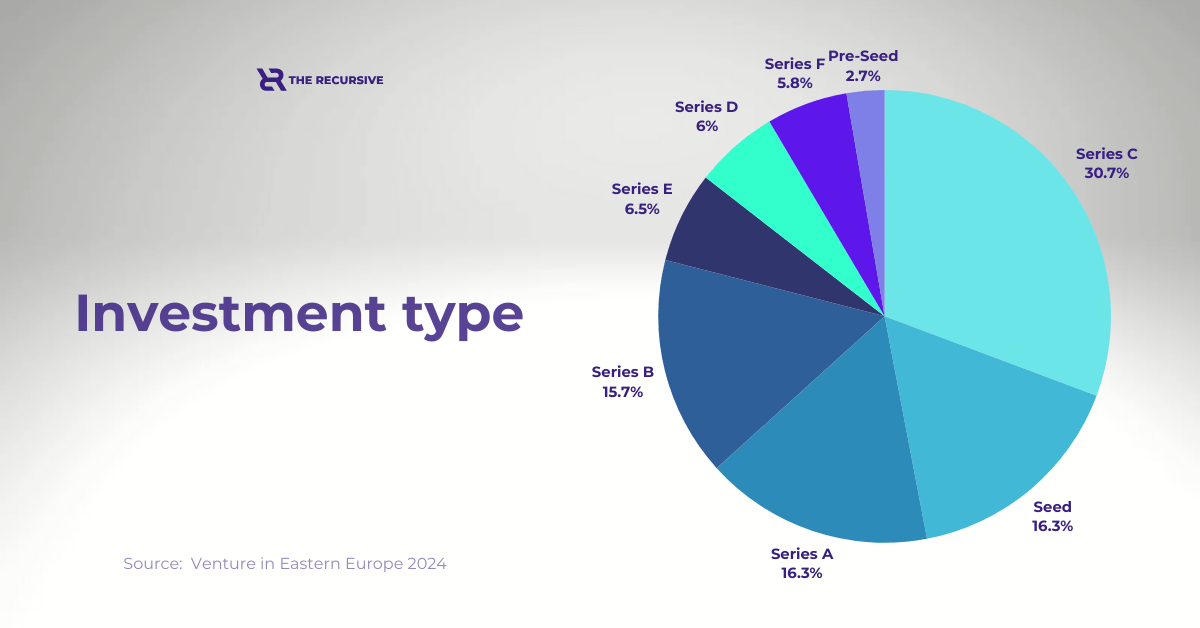

Later-stage rounds saw a notable increase

Late-stage investments saw a notable increase in 2024, with the following allocations:

- Series A: €633.7M

- Series B: €609.6M

- Series C: €1,192M

These figures suggest an increase in larger, later-stage funding rounds. The report’s authors attribute this trend in part to market conditions prompting investors to explore opportunities in Eastern Europe for Series A and beyond, likely driven by comparatively lower deal valuations and access to a skilled talent pool.

Meanwhile, seed-stage investment reached €634M, nearly matching Series A funding. Pre-seed investments remained low, totaling €104.6M.

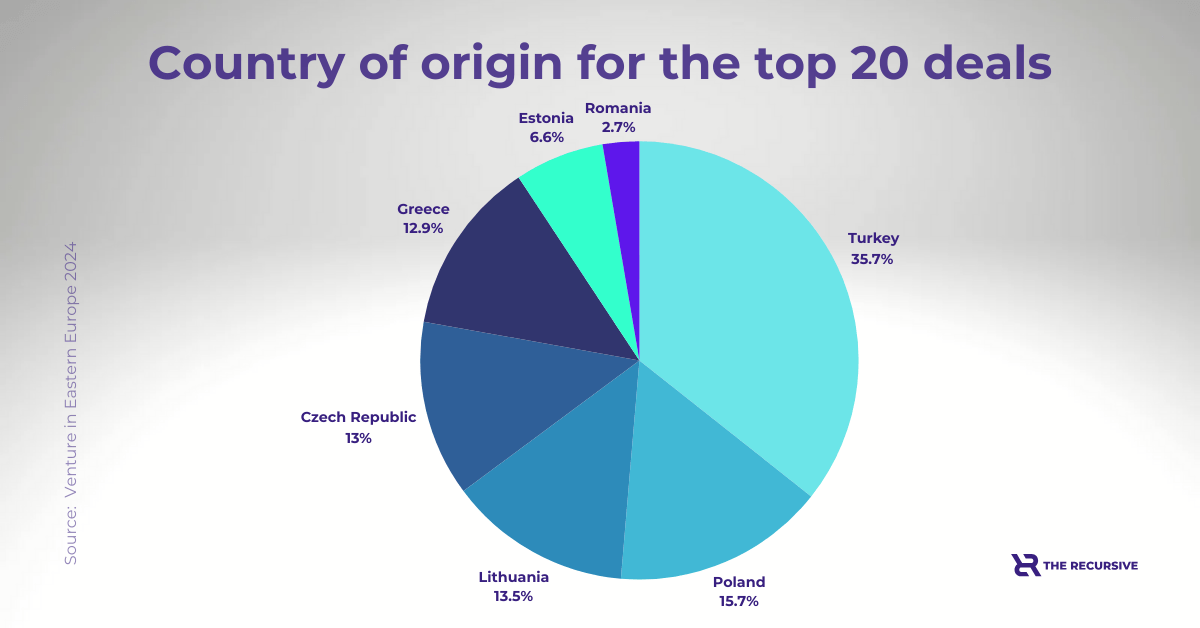

20 companies secured over €2B in funding

A small number of deals accounted for a significant share of the total investment. 20 companies raised 51.6% of the total investment volume, securing just over €2B in funding.

The largest deals included:

- Vorpen AI – €270M (Lithuania)

- Getir – €225M (Turkey)

- Insider – €225M (Turkey)

- ElevenLabs – €162M (Poland)

- Rohlik – €160M (Czech Republic)

- D-Orbit – €150M (Greece)

- ICEYE – €110.6M (Poland)

- Mews – €101.4M (Czech Republic)

- Starship Technologies – €90M (Estonia)

- Axelera AI – €68M (Greece)

- Colendi – €58.5M (Turkey)

- FintechOS – €54M (Romania)

- Dgpays – €45.5M (Turkey)

- Spyke Games – €45M (Turkey)

- Stargate Hydrogen – €42M (Estonia)

- Kontakt.io – €41.8M (Poland)

- Midas – €40.5M (Turkey)

- Picus Security – €40.5M (Turkey)

- Blueground – €40.3M (Greece)

- Plan-S – €36M (Turkey)

These deals reflect the high concentration of capital in a small number of companies, particularly those raising late-stage rounds.

Turkey as an important player in the region

The Venture in Eastern Europe 2024 report highlights a significant increase in investment volume compared to 2023. The inclusion of Turkey contributed to the overall figures, but even without it, the region experienced strong YoY growth.

The rise in late-stage funding suggests an increasing focus on scaling companies, while pre-seed investments remain relatively low. Investment activity remains concentrated, with a small number of companies accounting for over half of total funding.

The data indicates that Eastern Europe continues to attract investor interest, particularly in later-stage startups, as venture capital activity in the region expands.