It’s the season of reports. As we recently published The State of AI in CEE, Atomico launched The State of European Tech, and BVCA completed their research on the Bulgarian startup ecosystem, another important study has joined the mix. The Venture Eurasia Report by tech market intelligence firm Innotechnics explores H1 2024 funding trends in the rapidly evolving markets stretching from the Balkans and the Baltics to Central Asia.

Estonia has long been the region’s superstar, and Central and Eastern Europe startups are steadily gaining global recognition. However, it’s equally fascinating to observe emerging tech hubs. Earlier in 2024, Uzbekistan celebrated its first tech unicorn, the e-commerce new giant Uzum, joining the ranks of Kaspi from Kazakhstan and Picsart from Armenia.

Central Asia and South Caucasus: Growing Venture Ecosystems

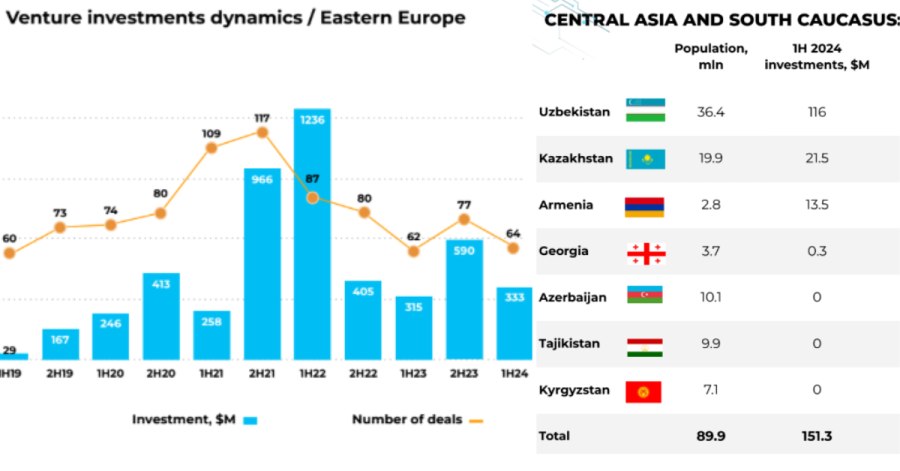

According to the authors of the Venture Eurasia Report, Central Asia and the South Caucasus (Kazakhstan, Uzbekistan, Armenia, Azerbaijan, Georgia, Tajikistan, and Kyrgyzstan) are becoming attractive centers for venture capital. Over the past five years:

- Venture funding volumes have grown 5.5 times, reaching $110 million in 2023.

- The number of startups has increased sixfold, reaching 6,000.

- The number of business angels has grown 2.6 times.

- Public and private venture funds have proliferated.

This growth is underpinned by government support, large-scale IT education initiatives, the expansion of digital infrastructure, and rising internet penetration.

In H1 2024, the region attracted $150 million in venture funding. Uzbekistan led with $114 million raised by Uzum, followed by $21.5 million invested in Kazakh startups and $13.5 million in Armenian ventures.

While these figures still trail behind Central and Eastern Europe’s $850 million in venture funding in 2023 (excluding the Baltics), the CA and SC region’s growth is supported by Western investments, such as those from the European Bank for Reconstruction and Development (EBRD) and the World Bank, alongside active ecosystem players like Global 500 in Georgia and Armenia, and Plug & Play in Armenia.

Startups in these regions primarily focus on sectors like FinTech, E-commerce, AI, LogTech, MedTech, EdTech, and HRTech. Robotics in Armenia and e-commerce in Uzbekistan and Azerbaijan are also gaining momentum.

Southeast Europe and the Baltics: A Snapshot

As per the Venture Eurasia report, Greece leads venture investments in Southeast Europe, supported by maritime tech successes like HarborLab’s $16 million Series A round. In the Baltics, Estonia continues to dominate, accounting for 80% of the region’s venture funding, with over $310 million raised in H1 2024 – $237 million of which came from Bolt’s last funding.

Challenges Ahead

In key metrics such as the share of venture funding in GDP and the average size of startup funding, the region lags significantly behind economically comparable areas. Notably, the substantial growth in venture funding within the region has been driven predominantly by pre-seed and seed stages.

Startups face multiple challenges, including an underdeveloped ecosystem, limited access to funding, and regulatory hurdles. Investment activity is further constrained by concerns about transparency and regional stability.

A shortage of business angels and venture funds affects all stages of investment, particularly late-stage funding. This deficiency forces startups to depend heavily on international investors, as late-round funding within a single country remains scarce.

What’s Next

Despite these barriers, government support and initiatives such as public and private incubators, accelerators, IT parks, special economic zones, grant funding programs, and tax incentives are fostering growth within the startup landscape. Increasing internet penetration and digital literacy further create opportunities, paving the way for a thriving venture ecosystem in Central Asia and South Caucasus.

Although late-stage funding remains a critical challenge, this is partially offset by a significant number of mergers and acquisitions, largely led by domestic commercial banks.

Looking at the broader CEE and European landscape, Arseniy Dabbakh CEO of Innotechnics remains optimistic: “The global venture market is undergoing transformation, and despite apparent recovery, a capital shortage, along with a low number of IPOs and M&As, is still evident. Political and economic disintegration has reduced capital migration, leading to fewer cross-border deals. Investors are increasingly focused on domestic markets, favoring lower-risk investments in more mature companies and concentrating on incremental rather than breakthrough projects. Venture deals in Europe are expected to grow, and I believe there will be a renewed interest in early-stage investments, as over 100 new funds have been launched in the past year. Projects in B2B AI, health, energy, logistics, and security sectors will be in demand and drive the market forward,” he commented for The Recursive.

Emerging Innovation Hubs

According to the report authors, cities like Almaty, Tashkent, and Yerevan are establishing themselves as centers of innovation. These hubs are fostering the growth of the technology sector through the creation of incubators, accelerators, and special economic zones. Examples include U-Enter and Startupfactory in Uzbekistan, Impact Hub in Armenia and Georgia, and Innoland in Azerbaijan.

Kazakhstan and Uzbekistan stand out due to their sizable domestic markets (19.9 million and 36.4 million people, respectively), high internet penetration, and rapid adoption of digital technologies.

- Kazakhstan is experiencing swift growth in FinTech and AI, supported by government initiatives such as Astana Hub and the widespread adoption of electronic payments.

- Uzbekistan has launched a strategy aimed at liberalizing and diversifying its economy, with initiatives like IT Park and extensive IT specialist training programs. Ongoing legal reforms aim to create a more transparent venture investment environment.

- Armenia has established AI9, a dedicated cluster for advancing AI technology development.

Central Asian countries are increasingly attractive as launch pads for startups aiming to enter neighboring markets. Their proximity to major Asian economies such as China and India, along with opportunities to expand into Europe, adds to their strategic appeal and it remains to be seen on how they navigate their challenges and journey towards independent innovation economies.