Insurify, the one-stop-shop comparison platform for car, home, and life insurance, raised $100M in its latest Series B, led by Motive Partners, a New York-based private equity investment firm focused on fintech companies. The round was also supported by previous investors, including cross-stage VC fund Viola FinTech, MassMutual Ventures, and Fortune 500-listed insurance company Nationwide.

With the new funding, the startup has raised a total of $128M. Insurify will use the fresh capital to further develop its product functionalities, increasing its brand awareness, hiring new employees, and expanding operations.

The startup, which was co-founded in 2013 by KAYAK President Giorgos Zacharia and Bulgarians Snejina Zacharia (CEO) and Todor Kiryazov (CPO), reported a compound annual growth rate (CAGR) of 151% in the past three years, leading to a 6-fold increase in its recurring and new revenue. Insurify services over 4 million customers and has sold insurance with coverage of $170B.

“Our mission is to strengthen the trust between the customer and the agent by building the smartest, most reliable virtual insurance agent in the industry. We want to empower our customers to make the best decisions about their insurance and be confident that they can get immediate savings through our product,” said Snejina Zacharia, founder, and CEO of Insurify.

Back in May, Insurify opened its first European office in Sofia, Bulgaria, which serves as an engineering R&D hub of the company.

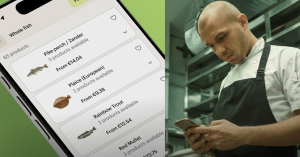

Researching insurance plans the easy way

The AI-powered platform of Insurify accumulates calls from various insurance carriers in the United States to provide users with the opportunity to search, compare, and buy their insurance online, all in a single place. Currently, Insurify offers this service for car, home, and life insurance plans, but is planning to expand its portfolio to add renters and pet insurance, as well as human health in the next few years. On average, Insurify saves its customers $585 per year on car insurance.

The global insurance market is expected to grow from $4.47 trillion in 2020 to $5.05 trillion in 2021. North America is the largest region in the worldwide insurance market and accounted for 34% of it in 2020.

The R&D hub in Bulgaria

Along with a 2.5-increase in its annual revenue for 2020, Insurify also announced a 260%-employee growth rate. Back in May, the Sofia-based team of the company comprised 15 engineers, most of them former employees of metasearch engine and travel agency Skyscanner. Skyscanner closed its Bulgarian office in June 2020 after revenues collapsed, following the Covid-19 lockdown. In our previous interview with Snejina Zacharia, the CEO explained that she was always interested in expanding the business into Bulgaria. “I think that the most important competitive advantage of Bulgaria is the power of being able to hire top world-class engineers and data scientists because we also have an amazing team of data scientists in Sofia,” Zacharia shared with The Recursive.