As the number and financial influence of High-Net-Worth Individuals (HNWIs) in Central and Eastern Europe continues to rise (as seen in the previous section), so does the demand for more sophisticated financial advisory.

Our latest report dives deep into this evolving ecosystem—examining how a HNWI in CEE choose their advisors, allocate capital, and structure portfolios for the future. It is based on an in-depth survey with wealth and asset managers from across the region.

The project is supported by ROCA Investments and Vertik Group, together with a group of strategic partners: Innotechnics, CEE Wealth Summit, FBN Bulgaria, FBN Hungary, Endeavor, VC Leaders, ROPEA, Bulgarian Angels Club, BVCA, CVCA, 0100 Conferences, Money Motion and Growceanu.

The final conclusions are being released in stages, focusing on different sides of the private capital landscape:

- May 13: High-Net-Worth Individuals in CEE: Investment Preferences and Trends

- June 3: The Role Of Financial Advisors In HNWI’s Investment Decisions

- June 23: Single Family Offices and Their Implications in the CEE Investment Ecosystem

The rise of professional guidance

Nearly 43% of HNWI in CEE work with investment consultants, while more than a third use private banks. A growing number are adopting more structured approaches: 14.3% use multi-family offices, and 5.4% have established their own single-family offices.

This shift reflects a broader trend: high-net-worth individuals in the region are seeking not just returns, but long-term security, discretion, and bespoke solutions. Whether they engage an asset manager to build portfolios or a wealth manager to plan for succession and tax, the demand for holistic, expert-led strategies is clear.

What advisors actually do

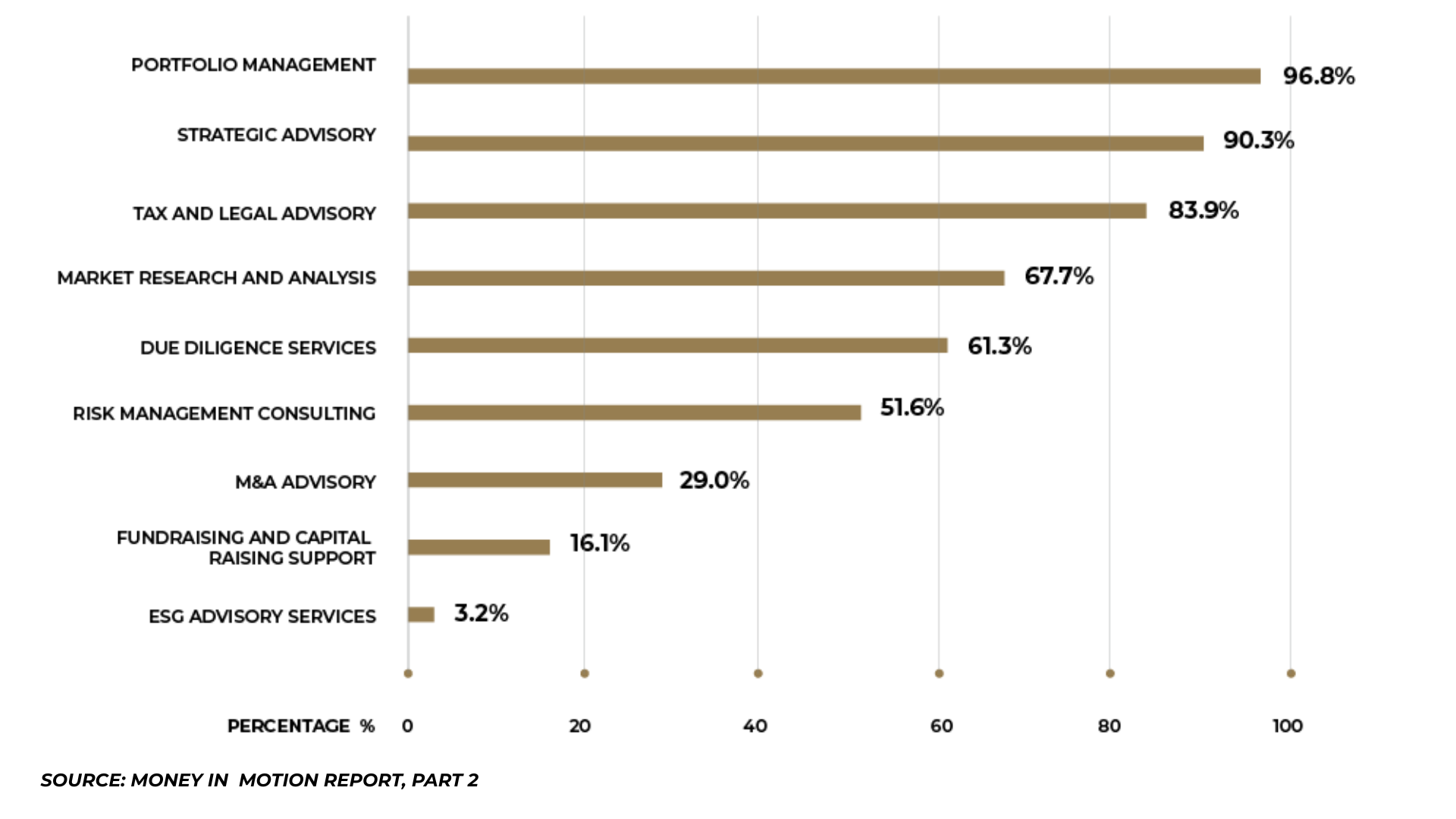

The report draws a distinction between asset and wealth managers. The former focus on returns—constructing and managing portfolios based on financial goals and market data. The latter go further, integrating investment planning with estate structuring, tax optimization, philanthropy, and family governance.

According to our data, the most commonly provided services are portfolio management (96.8%), strategic advisory (90.3%), and tax/legal support (83.9%).

CEE HNWI rely on a mix of local expertise and global reach. Independent investment consultants bring deep knowledge of regional opportunities—from real estate and public markets to crypto and private equity. Global firms, meanwhile, offer access to international markets and estate planning tools. Alternative investment funds are also gaining ground, giving clients exposure to venture capital, private equity, and hybrid portfolios.

How advisors build their clients portfolios

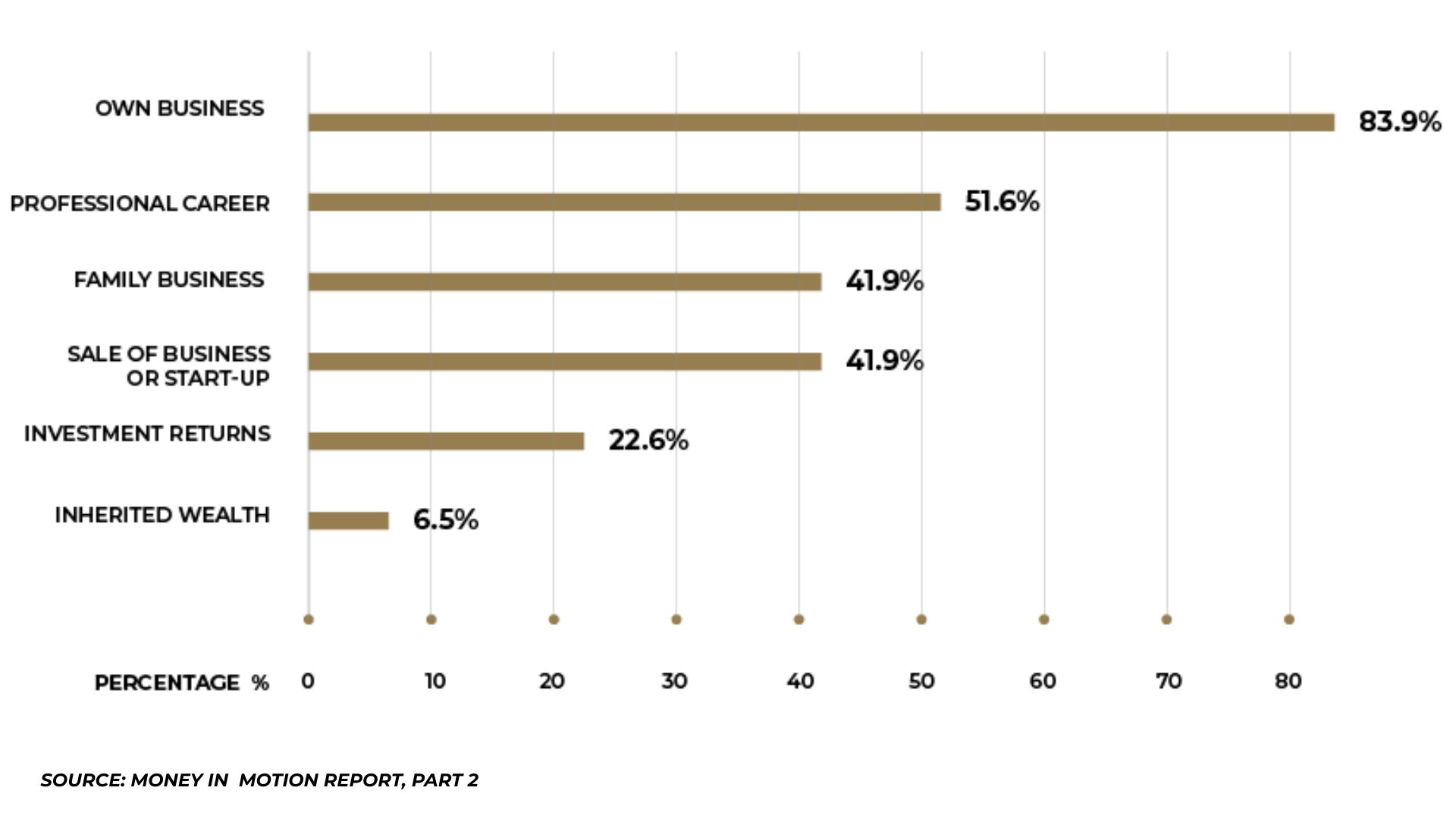

As seen in the previous section of the report, the majority of wealth in CEE is self-made. Over 80% of the financial advisors surveyed say that their clients generated capital through their own businesses, and more than half have a net worth above €5 million. Most prefer to keep their portfolios in the region (93.5%), but diversification is increasing—especially into North America and Western Europe.

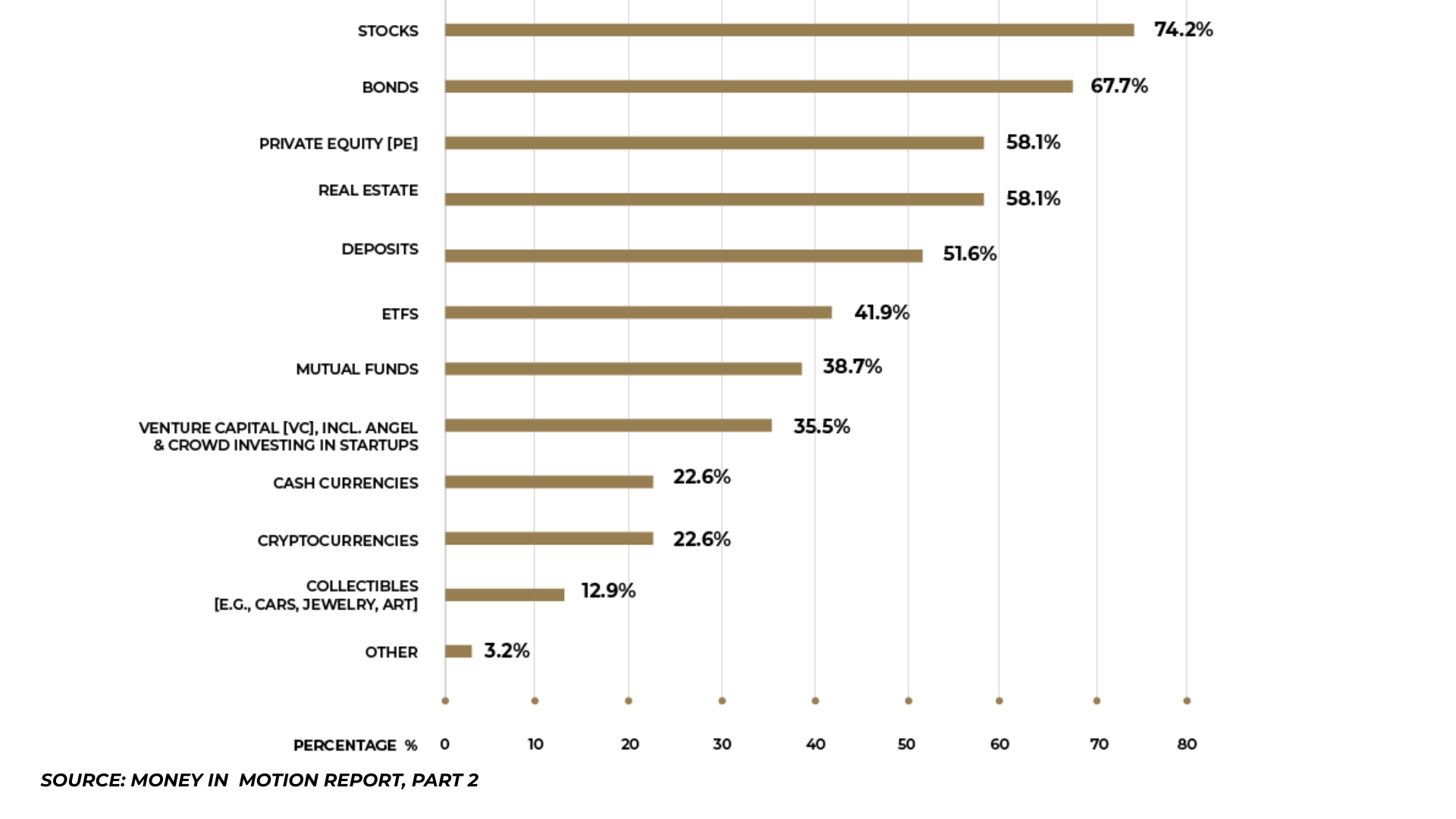

When it comes to strategy, capital growth, diversification, and preservation top the list. Stocks and bonds remain staples, while private equity and real estate feature prominently in nearly 60% of portfolios. Venture capital is gaining traction, but interest remains mixed.

Most important in the HNWI – advisor collaboration

Ultimately, trust is the foundation of the advisor-client relationship. Many HNWIs grant full discretion to their advisors, and expect not just technical know-how, but proactive guidance and discretion. Advisors who communicate clearly, anticipate needs, and act with integrity tend to build the longest-lasting relationships.

Technology is also reshaping the space—generative AI, real-time dashboards, and automation are helping advisors deliver faster, smarter service. But even in a digital age, clients still value a human touch.

Want to dive deeper into the numbers, quotes, and insights?

Download the report to discover how a new generation of investors is influencing the future of the region’s capital markets.