Today, The Recursive released the second edition of its State of AI in CEE report, offering the most extensive view yet of the artificial intelligence landscape in Central and Eastern Europe. With insights into more than 1,350 startups, investors, and industry players, the report covers key trends in funding, specialization, talent, and regulation across the region’s rapidly evolving AI ecosystem.

Steady AI investment despite VC slowdown

Despite a general slowdown in venture capital across the region, AI investment in CEE has shown resilience. Since 2021, €5B has been invested in CEE-based AI companies. By the end of August 2024, AI-specific funding hit €593M, with additional capital expected to meet or exceed last year’s €850M. Poland, Greece, and Croatia are leading in terms of total AI investment this year, collectively capturing over 75% of AI funding across CEE.

Surge in venture capital funding

VC funding continues to flow strongly across the CEE region. Around 30 VC firms focus on investing in startups from Bulgaria, Poland, Romania, Hungary, and the Czech Republic. Major players like Digital East Fund, OTB Ventures, Presto Tech Horizons, are leading the way, being joined by other more regional VCs eyeing CEE. Fresh capital from newly launched funds totals about €1.4B, with a number more in the fundraising process.

Growing Western interest in CEE AI startups

CEE’s AI ecosystem is drawing increased attention from Western investors, with notable deals highlighting the region’s appeal. This year alone, global giants like Andreessen Horowitz and Toyota have invested in CEE startups, including Polish Eleven Labs and Croatian Gideon, respectively. Saudi Arabia’s Public Investment Fund and Y Combinator also made strategic investments in Croatian firms, while European investors like Atomico, Point Nine Capital, and Lakestar have joined the list of those betting on the region’s AI potential.

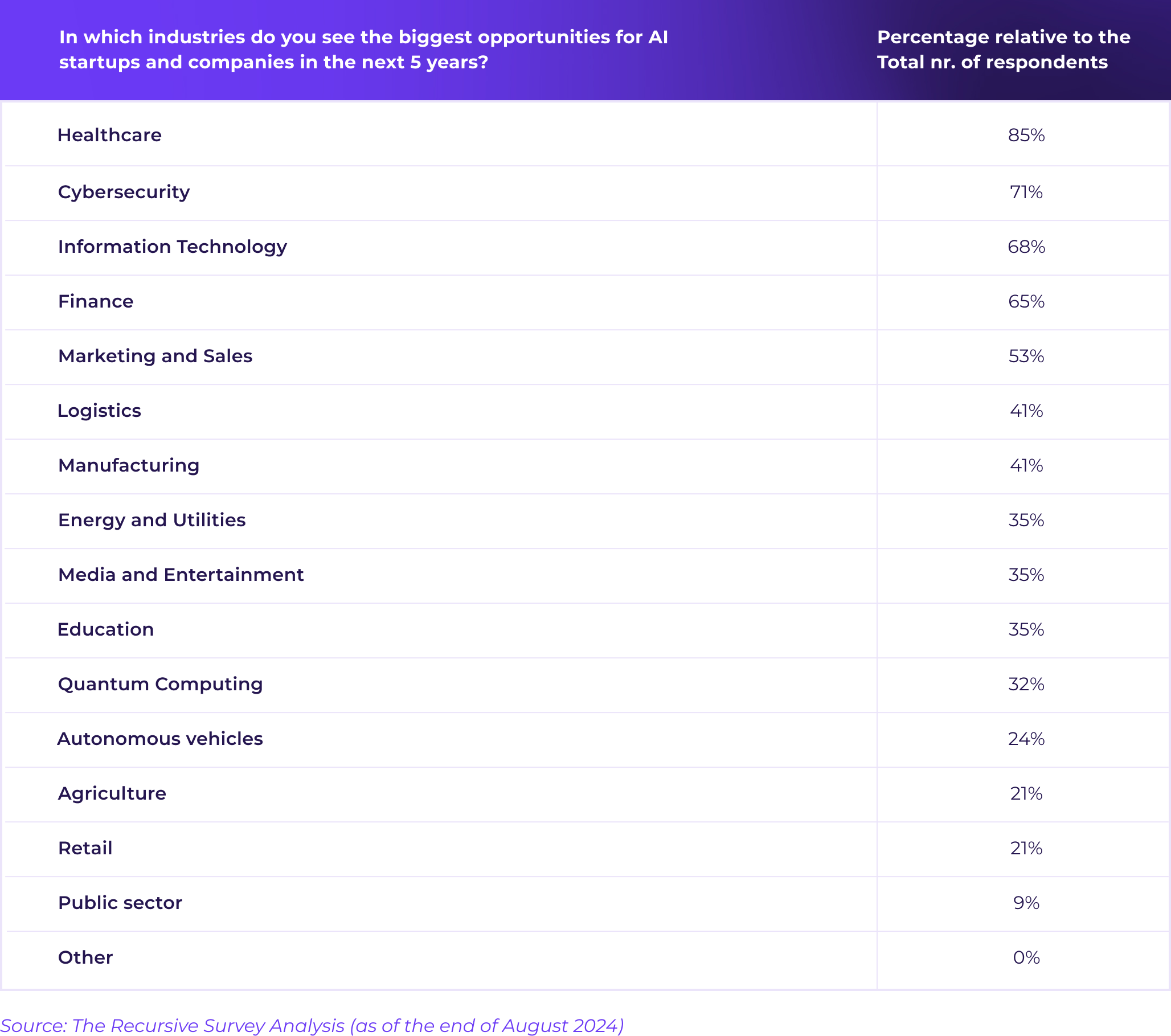

Rise of vertical AI: industry-focused solutions on the horizon

Following global trends, the CEE region is showing early signs of specialization in industry-specific AI solutions. For example, AI media production companies in the region raised over €120M in 2024, led by later-stage funding for startups like ElevenLabs, Colossyan, and Creatopy. Meanwhile, healthcare AI saw similar funding levels but spread across approximately 40 early-stage startups. According to investors surveyed by The Recursive, healthcare, cybersecurity, and finance are expected to become core verticals for AI innovation in CEE.

Acquisitions: a growing sign of maturity

While major acquisitions have yet to take place, international tech leaders like IBM, Intel, WP Engine, and CultureAmp have made strategic acquisitions in Bulgaria, Greece, Poland, and Serbia. This acquisition activity points to an evolving startup ecosystem that is beginning to attract serious attention from global players.

Why CEE could be the next AI hub

While VC interest in the region is strong, high-quality startup creation is not keeping pace with available funding. Many CEE VCs are now investing in diaspora founders or even ventures outside their initial scope. For CEE to truly capitalize on its potential, governments and ecosystem leaders will need to prioritize attracting global networks, resources, and talent—a challenge that remains under-addressed.

However, CEE’s tech talent, cost-effectiveness, and dynamic “underdog” culture present strong incentives for Western founders considering the region as a base for their AI ventures. High-profile expats, like Google Maps co-founder Lars Rasmussen, who has called Athens home for over three years, reflect a growing trend of founders setting up shop in CEE’s startup hubs.

The CEE region’s AI ecosystem is at a pivotal moment, with strong momentum and increasing interest from global investors. For more insights, The Recursive’s full State of AI in CEE report is available for download.