Fintech Super Apps: The Next Frontier for European Startups?

FINTECH SUPER APPS: THE NEXT FRONTIER FOR EUROPEAN STARTUPS? by Elena Ivanova [playht_player

Search for...

Over the past five years, embedded finance (EF) has moved from fintech buzzword to a structural force in European tech. At The Recursive, we’ve tracked this evolution through four market intelligence reports and over 250 fintech interviews, covering everything from open banking to BNPL and payments digitalization.

Embedded finance is fundamentally changing how financial products are consumed. Instead of seeking out a bank or lender, consumers encounter financial services naturally within the platforms they already trust – the apps they message on, the tools they work in, the marketplaces they shop from.

This marks a profound reordering of who delivers financial value. SaaS platforms, retailers, telecoms, and players from all industries are embedding payments, credit, or banking directly into their user experiences. They gain new revenue streams and strengthen customer loyalty. Customers, in turn, enjoy frictionless access to financial tools exactly when they need them – without ever leaving the digital ecosystem they inhabit.

Customers benefit from convenience and speed, while companies unlock new revenue streams and higher user lifetime value by “monetizing through fintech products” embedded in their platforms.

It’s no surprise, then, that Europe’s EF market has been growing at double-digit rates. McKinsey estimated the sector generated €20-30 billion in revenues in 2023 (about 3% of total banking revenues) and could exceed €100 billion by 2030. This is also the year in which a study by IDC Financial Insights estimates that 74% of consumer payments will be handled by non-traditional financial service institutions (FSIs). In some niches like point-of-sale credit, embedded solutions already command a significant share (for example, BNPL accounted for ~9% of e-commerce sales in Europe in 2024, up from 2% just a few years prior).

However, it’s not all roses. The rapid ascent of embedded finance has also come with growing pains. Many VC-backed EF enablers grew aggressively on the back of abundant venture capital and industry hype with little consideration for profitability. Some of these hidden infrastructure players have struggled to stay stable. In the background, they collectively process hundreds of billions of euros annually for millions of consumers and SMEs. So, as the market matures, the question is no longer how fast it grows, but how strong it stands.

The essence of embedded finance is simple: financial services are moving from destination to distribution. In the traditional model, customers went to a bank for a product; in the embedded model, the product comes to them – seamlessly integrated in the platforms they already use.

For the first time, financial infrastructure can be consumed like software. APIs, SDKs, and regulated e-money partnerships allow any company – not just banks – to offer financial features. This shift is redefining financial consumption across Europe’s economy.

At the same time, AI has levelled the tech playing field. Anyone can now build powerful products in weeks using generative tools. The real power, however, is shifting beneath the surface – to the companies that own financial infrastructure, licenses, and regulatory access.

In Europe, platforms with hundreds of millions of users are showing how embedded finance – the quiet integration of payments, credit, and banking into everyday digital services – is becoming the new competitive moat in a world where software itself is no longer scarce.

E-money licenses and regulation – once seen as barriers – are turning into the most valuable assets of the AI economy. As software gets cheaper to build, direct access to payment networks, settlement systems, and regulated infrastructure defines who can truly move money or data, not who has the slickest app.

Embedded finance creates the greatest advantage for companies that already command large, loyal audiences – those with deep customer relationships built over years of service and interaction. These are the businesses that can turn financial features into emotional value.

Why them? Because embedded finance amplifies brand loyalty and trust. When financial services are offered inside a familiar platform, users perceive them not as a new product, but as an extension of an existing relationship. The trust that once belonged to banks is transferred to the brands that deliver daily convenience, reliability, and relevance.

A company with millions of active users – whether a retailer, telecom, travel platform, or SaaS provider – doesn’t just have reach; it has credibility. Its brand already mediates essential parts of customers’ lives. Embedding finance transforms that engagement into a cycle of reinforcement:

This is how a delivery app evolves into a wallet, a messaging app into a payments network, or a SaaS tool into a financial hub. The companies that succeed here are not chasing fintech hype – they’re deepening customer relationships by meeting financial needs exactly where trust already lives.

In this sense, embedded finance is not only a technology play; it’s a relationship engine that rewards scale, consistency, and reputation. The larger and more trusted the user base, the greater the compounding effect of loyalty – a dynamic that turns everyday platforms into the new financial gateways of Europe’s digital economy.

To begin with, why would companies choose to embed financial services instead of building them themselves? Because building licensed infrastructure is slow, expensive, and far outside their core expertise. Becoming a regulated institution means locking capital as reserves, maintaining compliance teams, and facing ongoing audits – all of which divert focus from innovation and customer experience.

Partnering with licensed providers, on the other hand, allows companies to launch financial features faster, scale across markets without new licences, and shift risk and regulatory responsibility to specialists. In short, embedded finance lets companies integrate financial services into their products without becoming banks themselves.

To understand the state of embedded finance in Europe, we first need to map out the industry landscape. Broadly, EF players can be grouped into a few key categories along the value chain: infrastructure providers, orchestration platforms, specialist service vendors, and the front-end brands and platforms that ultimately embed financial services into their offerings. Below is a simplified taxonomy of “who’s who” in European embedded finance, with examples in each segment:

In the past 2 years, AI has levelled the tech playing field – anyone can now build powerful products in weeks using generative tools. But the real moat is shifting beneath the surface to the financial infrastructure, licenses, and regulatory access.

These are the regulated fintechs that provide the banking or payment rails – often holding an e-money or banking license – on top of which others build. They supply core services like account ledgers, payment processing, card issuing, card acquiring, leveraging a plethora of delivery channels including APIs, Wallets, SDKs, plain BIN sponsorship, to name a few. The key challengers at scale in Europe include Solaris (Germany’s high-profile banking-as-a-service platform), Paynetics (Bulgarian-founded e-money institution with EU and UK licenses), Railsr (UK-based BaaS fintech formerly Railsbank), Modulr (UK-based payments infrastructure with an EMI license), Swan (France-based BaaS focused on bank accounts and cards for SMEs), Treezor (France, backed by SocGen), Vodeno (Poland/Belgium, tied to Aion Bank, recently acquired by UniCredit), and OpenPayd (UK, multi-currency account provider).

These players operate behind the scenes to handle the heavy lifting of compliance, fund flows, and integration with banking networks. For instance, as of 2024, Modulr alone processes over 200 million transactions and more than £150 billion in payment volume annually on its platform – a sign of how much scale some EF infrastructure providers have achieved. Paynetics’ figures are not public, but documents show serving a B2B portfolio of 60+ partners, and a pool of 7000 corporate clients across Europe and the UK.

Notably, a subset of this group are full-stack providers (offering both card issuing and card acquiring capabilities under one roof); Paynetics seems to be the sole example in the category, whereas others may specialize in either issuing (e.g. Solaris in card issuance, Modulr in accounts) or payments acquiring.

FINTECH SUPER APPS: THE NEXT FRONTIER FOR EUROPEAN STARTUPS? by Elena Ivanova [playht_player

These application provider companies provide software platforms that bundle and integrate multiple financial services (often from various licensed partners) so that brands can plug in and mix-and-match what they need. They abstract away complexity by orchestrating different fintech APIs into a cohesive solution for the end user.

Examples include Weavr (UK-based, offering pre-packaged “finance-in-a-box” modules), Toqio (Spain/UK, a platform for building fintech apps with ready-made components), Hubuc and Treezor (acting as aggregators), and Flow (a Dutch company that helps businesses become financial service providers and was recently acquired by one of its customers – SnelStart). These platforms typically are not themselves fully licensed; instead, they partner with banks/EMIs to deliver the compliance and regulatory stack, while they focus on the developer experience, front-end components, and compliance facilitation.

Orchestration platforms have gained traction with SaaS companies that want a quicker, less DIY route to embed finance. For example, Weavr and Toqio enable a company to launch, say, a branded payment card or digital wallet for its users without having to individually contract with a BIN sponsor, processor, KYC provider, etc., because the platform has done that integration work. The trade-off is that orchestration platforms may rely on third-party infrastructure in the background, which can introduce dependencies. (In fact, some infrastructure providers also white-label parts of their stack through orchestration players – the lines can blur.)

There are also fintech specialists that focus deeply on a single vertical product or service and offer that capability for others to embed. They provide depth in a niche – be it payments, credit, insurance, or compliance – rather than a full suite. Examples include Hokodo (UK/France, B2B “buy now pay later” provider for invoices and trade credit), Qover (Belgium, an insurtech API for embedding insurance products like travel or gadget insurance), and various KYC/AML providers that can be embedded for compliance (e.g. Veriff, Onfido for identity verification). These specialists often partner with the infrastructure providers or directly with customer platforms to enable specific features. For instance, an online marketplace might use a licensed BaaS provider for accounts and cards, Adyen for payment acquiring, and Qover to offer integrated insurance at checkout.

At the end of the chain are the consumer and business-facing companies that integrate all these financial features into their own products to enhance value for their users. These span virtually every industry. A few notable examples in Europe:

Rakuten Viber, one of the continent’s most popular messaging apps, launched an in-app wallet called Viber Pay allowing users to send money to each other instantly and fee-free within chats. At the end of 2025, Viber Pay (currently powered behind the scenes by Paynetics as the regulated e-money partner) had already surpassed 1 million wallets set up by users – demonstrating the demand for financial features embedded in social apps.

In the food delivery space, Delivery Hero built a closed-loop wallet for its orders, letting customers top-up and pay seamlessly, which improves loyalty and margins. This also allows one of Europe’s leading delivery platforms to offer better checkout experience, instant refunds, and cash back incentives.

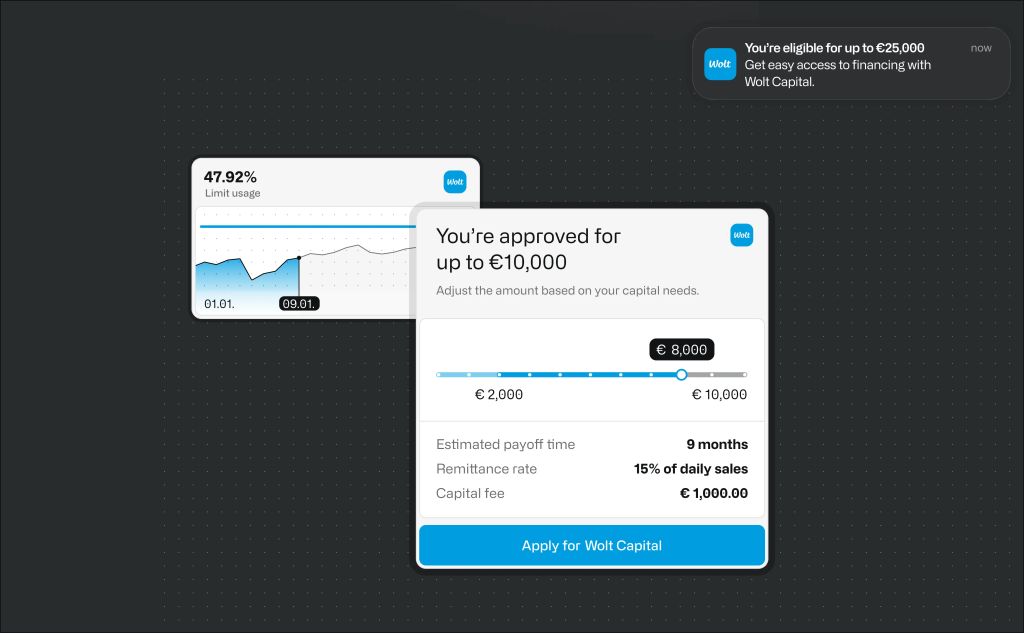

Another relevant example from the industry is Wolt, which expanded beyond food delivery by introducing Wolt Capital, a lending product that provides fast and simple financing to the restaurants on its platform. Many small hospitality businesses need short-term capital to manage operating costs or invest in upgrades, and Wolt uses embedded finance to meet that need inside its existing ecosystem. By offering working-capital loans through an infrastructure partner (Finmid), Wolt strengthens partner loyalty, increases platform stickiness, and uses financial services to support the growth of its merchant base.

From Portugal comes Coverflex, a company which uses embedded finance to manage employee compensation and benefits. The platform leverages embedded finance rails from Monavate and Pecunpay and allows companies to distribute allowances digitally, while employees decide how to allocate them across eligible categories such as meals, childcare, or savings. It shows how financial infrastructure can be embedded even in HR and compensation systems – extending beyond banks and consumer apps into workplace tools.

Travel and mobility platforms are also embedding payments and banking: for example, Paynetics powers UK startup Swiipr to work with airlines to embed instant digital compensation payouts for disrupted passengers (replacing clunky voucher and cash processes). On the B2B side, also on Paynetics rails, Payhawk offers an expense management SaaS that comes with corporate cards and multi-currency accounts for its clients – essentially embedding banking services into a finance software platform.

Traditional industries are joining in too: telecom operator A1 launched a digital wallet super-app for its subscribers (with features like contactless payments, P2P transfers, loyalty card storage, etc.) while Samsung provided millions of users in Germany with mobile payments, digital lending and KYC options with Samsung Pay, powered by Solaris.

Even large the automotive industry in Europe has dipped its toes in financial services by offering branded payment solutions or insurance within their ecosystems. A good example is ADAC, Europe’s largest car club with 21 million members. Back in 2022, the association decided to move 1.1 million co-branded credit cards from a traditional bank to Solaris’s platform. The project aimed to modernize ADAC’s program, enhance its capabilities, and deliver a more feature-rich, digital-first customer experience. The program provides members with perks such as discounts on car rentals, fuel, hotels, and leisure activities, alongside travel insurance and free cash withdrawals.

This mapping gives a sense of the European EF ecosystem’s breadth. From licensed “rails” providers like Solaris and Paynetics, through tech platforms like Weavr and Toqio, to specialized fintech APIs and finally the brands deploying these services, each plays a role in delivering embedded finance to end-users. For clarity, one can visualize a value chain: at the bottom, regulated infrastructure handles compliance and money flows; in the middle, orchestration and specialist fintechs provide modular functionality; at the top, customer-facing companies plug these in to create smooth embedded finance experiences.

Yet embedded finance’s meteoric rise has come with real challenges. The industry now faces its first test of maturity – one defined by regulatory pressure, profitability constraints, and fragmentation.

Embedded finance promised to empower a generation of tech companies and non-banks to offer financial services without the burden of being a bank.

And it has delivered on much of that promise – enabling rapid international scaling, new product offerings, and better user experiences. Yet as the industry matures, it is colliding with a test of stability. The exuberant growth of 2018-2021, fueled by cheap capital and FOMO, has given way to a phase of consolidation and scrutiny.

Many EF providers that expanded aggressively are now grappling with structural weaknesses, and the sustainability of their business models is under the microscope. Several have lost their unicorn status, others remain cash furnaces as investor patience runs thin. None have yet managed to scale enough to claim a clear first place in Europe.

A major source of fragility has been compliance and risk management – unsurprising given these fintechs operate in heavily regulated domains. Several high-profile players have faced regulatory pressure or sanctions, undermining trust. Germany’s Solaris is a case in point. Touted as Germany’s largest BaaS platform, Solaris rode the fintech boom to a €1.6B valuation by 2022, but later came under intense supervision by BaFin (the German financial regulator) due to shortcomings in its anti-money-laundering controls and operational compliance.

Solaris’ reliability also stumbled – fintech clients complained of integration delays caused by its complex dual-API structure (Solaris was running separate tech stacks for its German banking license and its Lithuanian EMI) and other technical hiccups. In September, 2024, Solaris discontinued major parts of its EMI business (formerly Contis). By early 2025, Solaris had raised an urgent €140M Series G funding (led by SBI Group and others) essentially to stay afloat and comply with higher capital requirements.

Its valuation reportedly plummeted to just ~€90M in that down round – a dramatic fall from grace for a onetime unicorn. The Solaris saga underscores how compliance lapses can directly threaten an EF provider’s survival, as regulators will not hesitate to intervene when a fintech is powering other companies’ banking services at scale.

The challenges facing Solaris were not isolated. Other European BaaS providers encountered similar regulatory and operational pressure, underlining that these risks are structural to the model. In Germany, Dock Financial entered insolvency in 2024 after failing to secure the funding needed to continue operations, highlighting how dependent BaaS providers are on maintaining both financial resilience and regulatory readiness as they scale. In Sweden, Intergiro saw its e-money license revoked following concerns from the regulator over AML controls.

Even well-established firms aren’t immune: in late 2023, the UK’s FCA ordered Modulr to pause certain customer onboardings over regulatory concerns, signaling that regulators across Europe are tightening oversight on BaaS/EF players.

These cases collectively show that the vulnerabilities exposed at Solaris reflect a broader pattern in the BaaS ecosystem. The lesson is straightforward: embedded finance only works at scale when a provider’s compliance controls, capital base, and core systems are strong enough that brands can rely on them without interruption. Providers that get this right don’t just “avoid problems”, they become stable long-term partners that brands can confidently build products, revenue lines, and customer relationships on top of.

Another stress point has been the basic economics. Many embedded finance providers chased growth “at all costs” – offering low fees, customizing heavily for clients, expanding into multiple markets – all of which drove up costs. With rising interest rates and a sharper investor focus on profitability, that strategy has run into a wall. Several players remain deeply loss-making and reliant on continual fundraising to cover their burn. Solaris again illustrates this, having reportedly lost a whopping €178M in 2023 alone.

UK-based Railsr (formerly Railsbank) similarly expanded fast (at one point powering 5+ million end-user accounts through various fintech clients) but never achieved profitability; by early 2023, Railsr hit a cash crunch and could not secure new funding. The result: it was forced into a fire-sale, being acquired by a consortium via a pre-packaged administration (bankruptcy protection) – a hard landing for a company once valued near $1B.

That said, Railsr seems to be rebounding after a new growth equity round and the $361 million acquisition of Equals Group.

The Railsr collapse raised broader questions about the viability of the BaaS model: was it a case of one bad execution, or a sign that the economics for many EF providers simply don’t add up if they don’t reach a massive scale? It’s worth noting that even Modulr, which has a solid payments business, only managed to trim its losses to £11M in 2024 (on revenues of ~£53M) and remains in the red – though it says it’s on track to break even with double-digit growth. In short, profitability is the exception, not the norm today among Europe’s embedded finance platforms.

The twin pressures of regulation and profitability are driving industry consolidation and shake-outs. We’ve seen some outright exits and restructurings: besides Railsr, several smaller BaaS startups quietly folded or refocused in 2023-24. Others have been acquired or absorbed into larger entities – notably, Italy’s banking giant UniCredit agreed to acquire Vodeno (a BaaS fintech affiliated with Polish digital bank Aion) in 2024, as part of a strategy to bring BaaS capabilities in-house.

Traditional banks are thus entering the space both as competitors and rescuers, picking up fintech capabilities on the cheap. Meanwhile, even survivors are slimming down: Solaris undertook mass layoffs (over one-third of staff in 2022) and radically restructured to cut costs; Railsr similarly downsized and retrenched to its core business. “Growth-at-all-costs” has firmly fallen out of favor – now the mantra is sustainable growth, with a clear path to profitability and a tighter ship operationally.

Looking across the competitive landscape, many EF players also revealed strategic or technical weaknesses that needed addressing. Few had the full package that partner companies ideally want (geographic coverage, multiple products, rock-solid tech, strong compliance, and a stable balance sheet). Some were strong in tech but weak in licenses/compliance; others had licenses but weaker tech or limited product scope.

For example, Swan (France) found a good niche offering quick-to-launch banking features for other startups (like debit cards and IBAN accounts for HR and proptech apps), but it remains limited in geography and primarily focuses on accounts/cards; acquiring availability is limited/partner-based.

OpenPayd, focusing on multi-currency accounts and FX, is valued for its API-based currency accounts in 12 currencies, yet it lacks direct card acquiring or broad lending capabilities, and relies on third-party banks for some services. Many UK-based EMI providers (Moorwand, PayrNet which underpinned some Railsr services, etc.) had a narrow regulatory scope and partnered for everything else, adding complexity and counterparty risk.

A common theme is that lots of BaaS platforms excelled in one area but lacked others: e.g. some had card issuing but no acquiring; some could handle payments but offered no wallet or deposit functionality; several operated only under an EMI license (limiting them from holding deposits or offering credit unless via partners); documentation and integration quality varied widely, as did uptime and “operational reliability” which is crucial when you’re effectively outsourcing your bank. These gaps have made customers (the fintechs, SaaS, or corporates using EF providers) more cautious and prompted them to multi-source or switch providers in some cases.

All of the above factors have created a moment of truth for the industry. The promise of embedded finance now hinges on stability: enterprises embedding financial services need partners they can trust to still be standing (and compliant) five years from now. Indeed, when a large brand considers adding a payment or banking feature, one of the first questions now is “which provider can we trust with our customers’ money and data, and will that provider be stable and regulated enough not to get shut down?” The turbulence at Solaris, Railsr and others has been a wake-up call.

On the positive side, a handful of players have emerged as examples of a more resilient model. These tend to combine financial discipline, strong compliance, and a broader product offering. For instance, Paynetics – cited by industry insiders as one of the few profitable embedded finance providers at scale in Europe – chose a more deliberate growth path: it built its own infrastructure, offers both issuing and acquiring under its own licenses, and focused on being operationally efficient rather than chasing hyper-growth.

As a result, Paynetics has remained financially stable and earned regulatory trust, which in turn helps it win over larger corporate clients who might be wary of newer upstarts. Industry estimates suggest Paynetics has now surpassed the €50 million ARR threshold – positioning it among the more advanced EF infrastructure-providers in Europe.

Another example comes from the UK-based platform Orenda, which has grown profitably by following a similarly disciplined but distinct model. Orenda focuses on orchestration rather than full-stack issuing, offering modular infrastructure for EMIs, HR platforms, mobility services, and other niche verticals that need compliant payouts, branded accounts, or card functionality. Its bootstrapped approach and diversified customer base show that resilience in embedded finance doesn’t come from one type of business model alone, but from matching regulatory scope with operational focus and sustainable economics.

With all that said, the industry appears to be coalescing around the notion that trust, reliability, and breadth of service matter just as much as speed and innovation in the next phase of embedded finance.

In summary, the EF sector in Europe at the end of 2025 is at an inflection point. The hype has been tempered by hard lessons in compliance and economics. We are likely to see a more consolidated landscape going forward – with perhaps fewer total players, because only some will pass the gauntlet – but those that remain (or new entrants that are well-capitalized and regulated, including some banks’ own BaaS divisions) will be more robust and sustainable. This maturation is healthy if it leads to greater trust in embedded finance offerings.

After all, for corporates and SaaS platforms evaluating EF partners, “Will you still be around in 5 years?” has become a key question. The providers that can confidently answer “yes” – by showing profitability or a strong balance sheet, a clean compliance record, and solid uptime – are gaining a clear edge in the market. The hidden banking infrastructure of Europe is only as strong as its weakest link, and the current times might be remembered as the period when those weak links were exposed and either strengthened or removed from the chain.

Given the shake-out underway, how do investors view the embedded finance market now? To find out, we tapped into perspectives from leading fintech and SaaS-focused venture capitalists – including firms like Earlybird and Dawn Capital. Their take provides a nuanced “VC lens” on where EF stands and where it’s headed beyond 2025.

Rehder notes that the market is now shaped by a new generation of infrastructure providers that enable others to embed financial products at scale. “Companies such as Finmid in lending, and Swan in banking, exemplify this shift from distribution toward deep technical enablement, together forming the backbone of Europe’s emerging embedded-fintech stack,” he explains.

Looking ahead to 2026 and beyond, Rehder believes embedded finance will become seamlessly woven into the workflows and ecosystems where businesses already operate. “As these infrastructure layers mature, we expect embedded finance to shift from individual product integrations to holistic financial operating systems powering the next generation of business software. And this is just the beginning.”

For Rehder, embedded finance represents not just a fintech opportunity, but a software one. “Embedded finance will likely be one of the defining growth levers for European SaaS and technology businesses over the next decade,” he says. As software markets mature and subscription revenues plateau, EF integration offers new monetization paths and deeper customer engagement.

“At Earlybird, we’ve seen this transformation firsthand through our investment in Finmid, which enables SaaS companies and vertical platforms to offer financing to their business customers in just a few clicks,” he explains. “Instead of relying on static KYC or credit scoring, Finmid leverages proprietary transaction and behavioral data from its partner platforms to assess creditworthiness in real time.”

This data-driven underwriting advantage, he notes, inverts the traditional model: “It allows platforms to extend credit faster and more precisely, while significantly reducing default risk.” For SaaS partners, embedded lending becomes not a side feature, but a core engagement and retention tool.

On the banking side, Swan complements this trend. “Swan provides the infrastructure that enables software and tech companies to embed accounts, cards, and payments directly into their products,” Rehder says. Its developer-first APIs and passported e-money license simplify the regulatory and operational hurdles that once slowed pan-European expansion.

“Together, Finmid and Swan illustrate how embedded finance allows SaaS and tech companies to evolve from pure workflow tools into integrated financial platforms,” he adds. “They don’t just process transactions; they own the financial relationship. That shift drives monetization, deepens customer loyalty, and accelerates international expansion.”

Despite its potential, Rehder cautions that the next phase of EF will be defined less by growth and more by resilience. “The experience of Solaris in Germany is a cautionary example,” he says. “Rapid scaling, complex partnerships, and insufficient control frameworks led to repeated regulatory interventions and losses. It underlined that even the most innovative models cannot outgrow regulatory responsibility.”

Future winners, he argues, will be those who embed governance and compliance into their DNA early. “That means either holding your own licenses, as Swan does, or developing transparent, tightly managed partnerships.”

Rehder also points to credit and data risks as critical issues: “As these models scale, data consistency and model robustness will be tested. Sustainable growth will require balancing innovation with rigorous risk management.”

In short, he says, the embedded finance sector’s next chapter will reward maturity. “The companies that combine regulatory strength, data-driven risk management, and capital discipline will form the lasting infrastructure layer of Europe’s fintech landscape.”

This perspective reflects a broader sentiment among investors: EF remains one of Europe’s biggest fintech opportunities – but VCs are now backing fewer, stronger players. “It’s no longer about who can launch fastest,” says Rehder. “It’s about who can stay compliant, scale profitably, and build trust with enterprise partners.”

As EF moves from its “growth-at-all-costs” phase into consolidation, investors are seeking resilience over hype. “The winners will be those that are not just embedded in name, but truly built to embed – responsibly, resiliently, and at scale,” Rehder concludes.

While lending and banking have led the embedded finance wave, investors are increasingly turning their attention to embedded insurance as the next frontier. The logic is compelling: the global protection gap has widened to over $1.5 trillion, revealing how disconnected traditional insurance remains from customers’ actual points of need.

Digital platforms – from e-commerce and travel to mobility and property – are ideally positioned to bridge this gap by offering protection exactly when risk is top of mind: booking a flight, renting a car, or managing a business expense. For platforms, this means new high-margin revenue streams and stronger user retention; for underwriters, it means lower distribution costs and richer real-time data for pricing and personalization.

As Dan Chaplin, Partner at Dawn Capital, explains:

“Insurance has long been one of the least digitised corners of financial services. Embedded models finally allow protection to meet customers where they are – in the flow of a purchase or service – rather than forcing them to seek it out separately. It’s a structural shift that benefits everyone: customers, platforms, and underwriters alike.”

The next phase of embedded finance will likely be defined less by expansion and more by consolidation and compounding impact. The breakneck growth of the past few years has revealed the limits of fragmented infrastructure. Now, the market is moving toward fewer, stronger, and more diversified players capable of operating profitably and at scale.

But consolidation is only half the story. The second defining trend of this new phase is the accelerating diversification of use cases. Embedded finance is no longer confined to payments and consumer credit. It is becoming a horizontal capability that adapts to the business logic of each sector.

Each new application validates the model, attracts new participants, and strengthens the ecosystem. As adoption grows, the industry enters a snowball effect:

This feedback loop will gradually push embedded finance beyond its fintech roots into the core infrastructure of European commerce. Financial functions will no longer appear as “add-ons” but as native components of digital life – as fundamental as connectivity or cloud computing.

The next wave of winners will be those that can navigate both dynamics: operate with the discipline of a bank and the adaptability of a technology company. As consolidation removes weaker links and new use cases multiply, embedded finance is set to evolve from an innovation trend into a systemic layer – the financial backbone of Europe’s digital economy.