Despite all the global macroeconomic hallmarks including rising inflation, unstable geopolitics, and public markets, 2021 and 2022 have been the strongest years for unicorn creation in Central Eastern Europe (CEE). The number of unicorns in the region has more than doubled in the past 2 years, reaching 44 at the end of 2022.

The global economic downturn would leave no tables unturned, and will definitely have a mark on CEE as well. Macroeconomic risks have been realized by regional founders, who are already focusing on decreasing their burn rates.

“In the current economic situation, the software and innovation industry in our region would continue to sustain its growth, get stronger and probably have a better time than the rest of Europe. This has proven to be the case in an economic downturn mainly because of the difference in the compensation models of engineers. That’s probably the biggest opportunity for the region to establish the Balkans as the Silicon Valley of Europe,” Georgi Mitov, Managing Partner at BrightCap Ventures, highlighted recently.

What records did the CEE startup and VC ecosystem break in 2022? Our team dug deep into the latest “The State of European Tech” Atomico report to summarize it for you. Keep reading.

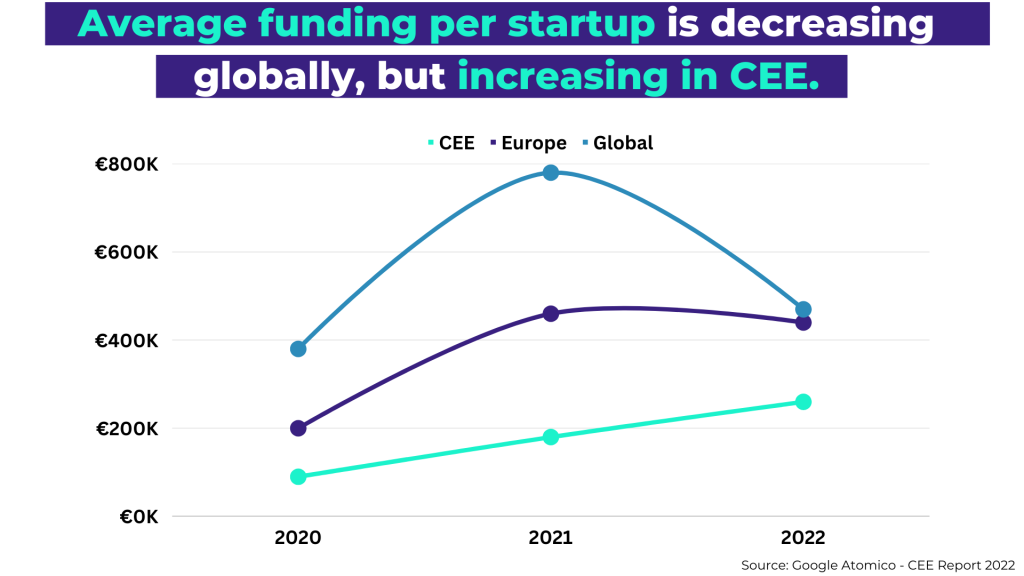

Funding for CEE founders still increases amid the economic downturn

While the average funding per startup is already shrinking both in Europe and globally, CEE founders are still seeing increases in their funding rounds. In Q3 2022, the average funding per startup in CEE was €260K, while that in Europe fell down to €440K, and globally there was a drastic decrease from almost €800K in 2021 to €470K at the end of 2022.

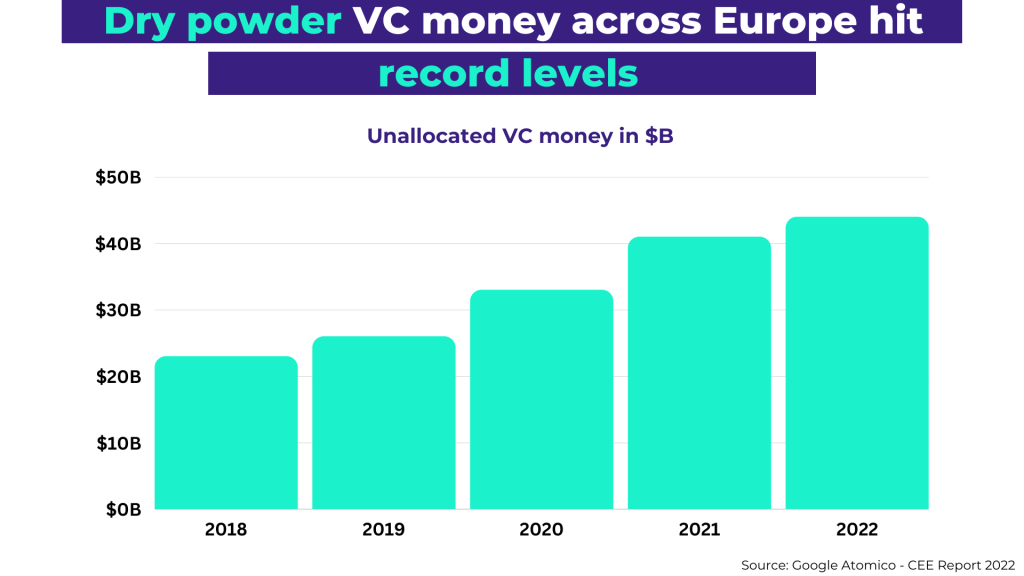

Record levels of dry powder are waiting to be deployed in 2023

The amount of unallocated VC and PE capital in Europe reached €285B in 2021, which equates to 84% of the total equity invested by the industry between 2019 and 2021. Out of that capacity, €42B is purely VC dry powder available for investment. With the recent decrease in startup valuations, 2023 could turn into an excellent opportunity for investors to deploy that lingering capital.

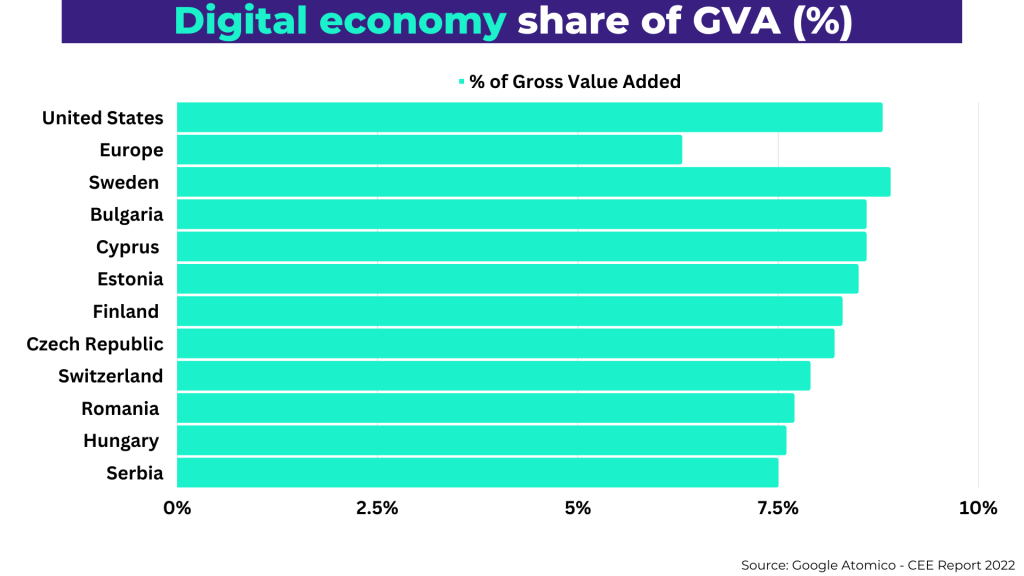

Bulgaria comes close to the US when it comes to the digital economy share of GVA

Economically speaking, startups have become vital to Europe, as technology contributes 6.3% to the continent’s Gross Value Added (GVA). Even though Europe lags behind the US where the percentage jumps to 8.8%, individual countries within the region, such as Bulgaria and Sweden, are close to achieving the same level of GVA contribution from the digital economy.

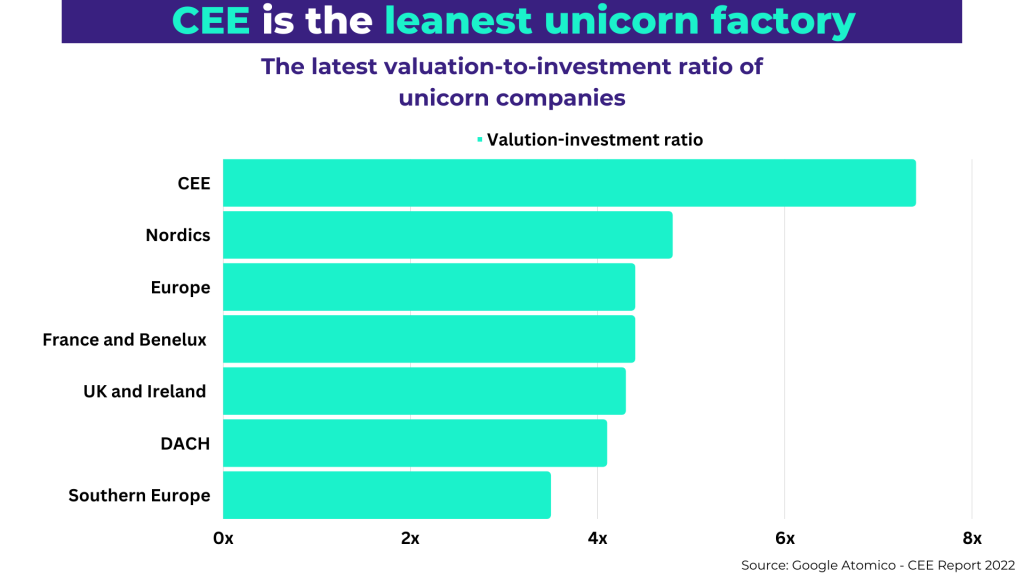

CEE founders are the leanest unicorn creators

CEE unicorn founders are winners at using capital efficiency to create value and are able to scale with fewer investments compared to founders from other regions. With a valuation-investment ratio of 7.4x, CEE stands out as the leanest unicorn factory region in Europe. As a whole, CEE unicorns raise less than their regional counterparts but have proven their ability to do more with less.

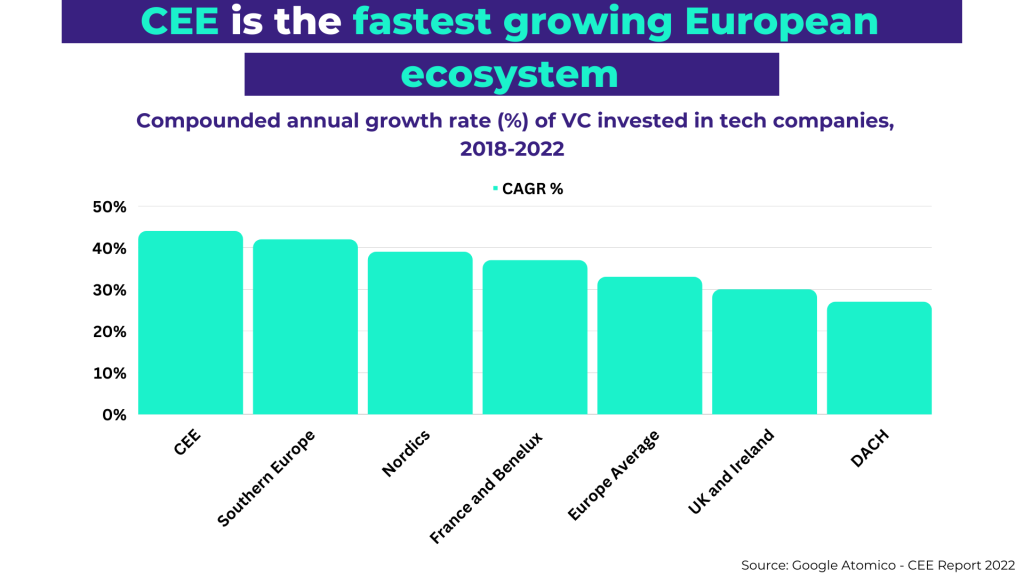

CEE is the fastest-growing innovation ecosystem in Europe

The amount of capital invested has been steadily growing across all European regions since 2018. However, CEE stands as Europe’s fastest-developing innovation region, which has been growing at a compounded level of 44% since 2018.