Smart money in practice: insights on early-stage fundraising

With the support of one of the leading SEE early-stage venture capital funds Eleven Ventures and Visa Innovation Program, The Recursive worked on a series of explainer articles that demystify how startups in the region can approach their growth plans. These Visa Innovation know-how articles aim to help regional early-stage founders benefit from the wide knowledge generated by the team of Eleven Ventures.

Smart money is a catchy concept in the venture capital world. But what it actually means and how can founders leverage the opportunities provided by their investors to build mutually beneficial value-added relationships? What should early-stage founders know about smart money fundraising and what are the best tactics for approaching institutional investors and preparing for a seed round?

Based on the workshops that Eleven Ventures hosted this year, led by the Partners of the funds, in this article, we emphasize which are the tips and tricks, as well as mistakes to avoid, when you are fundraising as an early-stage founder of a startup. The partners at Eleven also share advice on how founders can get the most out of their investors and build the kind of relationship that will set them for a long-term collaboration.

Smart Money as a

tool for growth

Capital is not the only offering that VCs can give to startups and to some founders, it is not even the most important one. Take for example the story of Vassil Terziev, one of the co-founders of Telerik, who, before actually becoming a Partner at Eleven Ventures himself, was skeptical about the value that VC can offer to founders. He shares that in the early stages of the development of the Bulgarian startup ecosystem, around 2006 and 2007, the level of knowledge of the local ecosystem about venture capital was low and just like many other founders, they actively avoided investors who were interested in Telerik.

The critical moment for us was when we realized that we wanted to grow Telerik from a lifestyle business into a professional international company, but we lacked the skills to do that. It was then when we started looking at VCs as partners and not just as piggy banks that would give us some funding. We started looking for qualities in the investors just like many other founders who were more specific about the people than the actual terms. For us the journey, the learnings, and instilling the right company structure were a lot more important than anything else.

Vassil Terziev

Partner at Eleven Ventures

It is very important in which phase your company is – depending on whether you are in the build-up stage or scale-up stage, you will need different types of partners around you and different kinds of investors.

Daniel Tomov

Partner at Eleven Ventures

VCs are not just “vending machines”

Terziev remembers that back in the days when they were growing Telerik, they didn’t make the most out of their investors before getting the investment – something that he observes with founders he currently works with. “Sometimes VCs are perceived as money vending machines that look at presentations and spit out money,” he jokes. “Whereas, founders can really get a lot more out of the experience of talking to different VCs, because they gain plenty of insights from the conversations,” he says. According to Terziev, when founders go prepared to meetings with investors and if they have not only the attitude of simply pitching and selling but also asking questions, they can get a good understanding of the market dynamics and spot weaknesses and opportunities that they haven’t noticed before.

Keep your investors up-to-date

Founders should nurture their relationship with investors after receiving the capital, show empathy, and do regular reporting. The value of reporting is not simply limited to showing growing numbers but is instead in being transparent and educating investors about both the developments and the problems that you are facing to allow them to help you with the right solution.

Investors as an extension to your team

“Entrepreneurs taking our money is just a currency that translates to us giving them shares of our time. Therefore, they can leverage us as partners with our experience, knowledge, and networks and turn us into a resource of their team,” Terziev explains.

The two cents on fundraising of

Eleven Partners

Venture capital is one of the several other options that you have for funding

And it is definitely not the easiest one. It’s actually arguably one of the most difficult to obtain because venture capital firms are very selective.

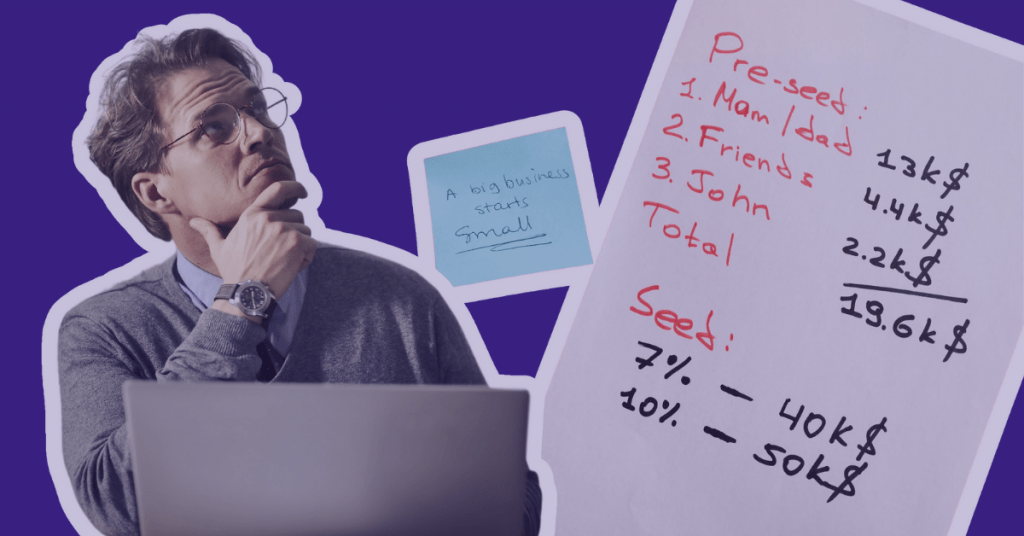

Abundant pre-seed funding and not so abundant seed capital

The good news is that these days, there are more funds in the region and they are mostly supported by the government. There are also almost 200 European accelerators, which means that founders who are looking for very very early-stage funding, have quite a few options. On the other hand, however, there are very few seed funds, which is probably the toughest segment on the fundraising market currently in Europe.

At the earliest pre-seed stage, inception or acceleration phase, you can go with family and friends, accelerators and angels. But at the seed level, I believe it is most reasonable to already consider the onboarding of a professional VC investor.

Valeri Petrov

Partner at Eleven Ventures

Things VCs can’t resist: Strong team and Big market

A rule of thumb is that VCs are mostly looking for a great team and a big market so startups should be able to show that they already have some traction on their market.

Insider tips and tricks:

a break-down

of the process

Clarify who you are fundraising for

“When you are fundraising, you should first clarify who you are fundraising from, whether this is an active investor or someone who can’t support you at that given moment. Unfortunately, in the SEE region there are some investors who only claim to be such and in fact, do not have the experience and act very slowly,” Ivaylo Simov shares.

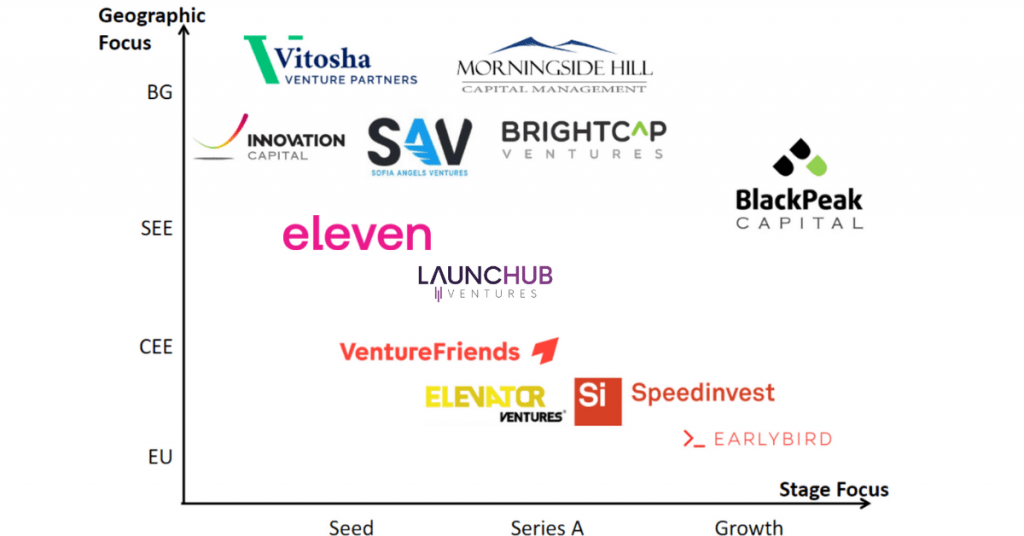

When choosing the right VC, additional considerations are whether it targets startups from your part of the world. For example, Silicon Valley-based VCs are notorious for funding companies that are based in Silicon Valley. This means that in order to get on their radar, early-stage fintech founders have to move there.

The other important aspects are how much capital VCs can deploy and do they have any specific vertical focus. “You need to set an appropriate trial size which usually means around 18 months of runway and preferably even more because fundraising takes 6+ months. Lastly, the valuation that you are looking for will be more or less determined by the amount that you are raising. Every time that you are raising a new round, there will be around 10 to 20% dilution,” Simov explains.

Identify whether you are after a “decent” investor

“In our region, there are quite a few country-focused funds, which are usually sponsored with government money, either through The European Regional Development Fund (ERDF) or directly through some local Fund of Funds. This means that they can only invest in local startups at the beginning. Once these funds gain some traction, as ours and LAUNCHub Ventures did, they raise regional funds. There are also a few Austrian and German funds such as Earlybird and Speedinvest that look into Bulgarian startups,” Simov explains. However, according to him, founders should know their local funds and this should be their first go-to venture capital option.

Seek advice from the network you have already created

Before going after VCs, fintech founders should have their product up and running and should be testing it with clients, and gaining traction. “Before going on the fundraising trail, you should also try to seek as much advice as possible from your previous and current investors, advisors, industry experts, and peers. Look for feedback and exercise your pitching in front of these guys before you actually hit the button and go to VCs.

Ivaylo Simov

Partner at Eleven Ventures

Perfect you pitch

When pitching it is important to emphasize your story, make it sound compelling, and show your passion. Having an excellent pitch deck multiplies your chances of closing a fundraising round. Valeri Petrov highlights that many regional tech founders tend to underestimate this particular aspect. “I would advise any founder who has reached the seed stage and feels inexperienced in making impactful presentations to attract people who can deliver presentations,” he says.

The strategic intro

Perhaps the most important part of the early-stage fundraising tactics has to do with the approach founders choose to introduce themselves to VCs. “It is through other founders of our portfolio companies that makes the strongest impact on us as Partners and these recommendations we take very seriously. Therefore, it might be useful that you befriend entrepreneurs from the VCs that you want to get in touch with,” Eleven Venture Partners advise.

According to them, when it comes to getting an intro from another VC first, things are a bit tricky. Usually, this is not a good sign from the perspective of the partners, unless the VC in question has already invested in the idea. “Your objective is to incite excitement in the VC and create a fear of missing out and this usually happens if you have a prominent lead investor. This will make other investors want to join, but getting that first lead investor on board is the challenging part,” Simov highlights.

Preparing for a long-term commitment

When founders reach the stage of having a term sheet on the table, this doesn’t indicate that their work is done. Nowadays, most rounds are done in syndicates and that means entrepreneurs need to close deals with multiple investors. Then more processes follow, such as due diligence, legal terms, and so on. “Don’t relax until the money is in your bank. Even once the money is in your bank, you still need to make your investors happy by increasing your traction, sharing your growth plans with them, and asking them for advice,” Simov remarks.

Getting to the

next stage

The seed round is normally an intermediate step where you already have some traction, having done a PoC. But pretty soon, if everything goes as planned you should be aiming to go to the next level and raise for Series A.

“From day one of closing the seed investment, you should be prepared to answer how you plan to achieve your next milestones. And you should use the time between the seed and the Series A round for building your core team, for delivering the next version of your product, and building a proper sales team, and preparing for the next level,” Petrov explains.

During your seed round, founders already have a product but are still looking for the elusive product-market fit, the funnel, sales metrics, and other KPIs. Ideally, the Series A round should allow them to scale, expand their sales and grow what they have already validated.

A final remark is that in preparation for Series A, founders need to get more senior people on board. In addition to the managerial positions such as CMO, CFO, and others, they should start thinking about attracting more experienced people which will make them look more credible in the eyes of potential investors.

Books & Blogs suggested by

Eleven investors

- Chris Dixon, A16Z

- Roger Ehrenberg, IA Ventures

- Brad Feld, Foundry Group

- First Round Review

- Paul Graham, Y Combinator

- Semil Shah, Angel

- David Skok, Matrix

- Mark Suster, Upfront

- Venture Deals: Be Smarter Than Your Lawyer and Venture Capitalist by Brad Feld and Jason Mendelson

- Mastering the VC game by Jeffrey Bussgang

- The Lean Startup by Eric Ries