In a nutshell

- PDQ, an international software asset management company, has acquired CODA Intelligence, a company specialized in next generation cybersecurity solutions and one of Early Game Ventures’s early investments.

- This acquisition marks the first exit for Early Game Ventures in 2024.

Their background story

Early Game Ventures is a Romanian venture capital firm, co-funded by the European Regional Development Fund. They recently launched its second fund, Early Game Ventures II of €60M, managed by the European Investment Fund (EIF).

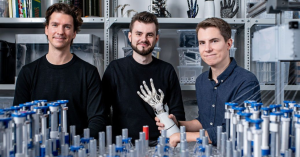

Romanian-rooted CODA Intelligence is a global provider of automated cybersecurity solutions. Founded in 2016, by Christian Sandescu, Andrew Calin, and Octavian Grigorescu, the company aims to deliver hyper contextualized risk signals to SecOps teams, enabling them to effectively manage vulnerabilities across hybrid cloud environments.

The American PDQ helps IT professionals across small and large companies to manage and organize hardware, software, and configuration data for Windows- and Apple-based devices.

Recently, PDQ announced the launch of PDQ Detect, a new software vulnerability detection and management solution, developed following the strategic acquisition of the Romanian company.

In their own words

“We’re thrilled to join forces with the PDQ team,” says Cristian Sandescu, CEO and co-founder of CODA. “The need for real-time, quality risk information is critical for IT, MSPs, and security teams, especially now as they face increasingly sophisticated cyber threats. Partnering with PDQ will allow us to advance our shared mission of enabling organizations of all sizes to maintain a strong security posture.”

Investors’ perspective

“We continue to invest in startups that develop really new technologies, that launch new niches or even new industries, and that have a global potential from the very beginning. CODA has done this. We were happy not only to invest in them, but also to support them along the way. We firmly believe that our role as an investor is not exclusively financial, but, more importantly, that we are a medium and long-term partner for the startups we invest in. This transaction will allow us to provide liquidity to the investors in our first VC fund. Moreover, our first four exits recorded a cumulative IRR of 45% and this number speaks about the quality of our investments”, said Cristian Munteanu, Managing Partner at Early Game Ventures.