Bratislava-based developer Miroslav has been an avid crypto enthusiast for the past few years, following different projects such as Cardano, while also investing in some of them. As he explains, getting rich from crypto isn’t a priority for him – instead, finding a project that offers the best utilities and blockchain uses is.

However, when he tries to communicate this to his local community in Slovakia, he most often hits a wall. Some of his friends have even stopped talking to him because of the topic, while others are just quick to dismiss it scam as soon as the conversation starts.

“People now usually see just crypto as a speculation, and do not know or care about any of the different uses or utilities, such as the one that different blockchains have, their use cases, and so on. Most of their views are negative, all they talk about declining prices, scams, and of course some of the arrests that happened the past year,” Miroslav tells The Recursive, recalling from his personal experience.

The factual situation in the industry has unfortunately provided solid backing to such claims. Several big scandals marked the past period for crypto, with the fall of giant cryptocurrency exchange FTX being the biggest one yet. Last month, the company’s former CEO, Sam Bankman-Fried, was found guilty on all seven counts of fraud and money laundering, and now faces a maximum of up to 110 years in prison.

Another fallen crypto kingpin, the co-founder and former CEO of Terraform Labs, Do Kwon, now sits in a Montenegrin prison, waiting to be extradited to either the U.S. or South Korea. Kwon was responsible for the Luna crypto network crash, which wiped out more $60 billion and deeply damaged the market.

These developments, coupled with crashes of other minor, but significant projects such as BlockFi and Celsius, all contributed towards the crypto market having a cap of $1.35 trillion as of last month. A stark decline compared to where the market was at its peak in November 2021, when it reached $3 trillion.

Optimistic, but still very much realistic

Where does the crypto industry goes from here? For big industry players such as Singapore-based cryptocurrency exchange Bitrue, it is more than obvious that the market is indeed in a tough spot.

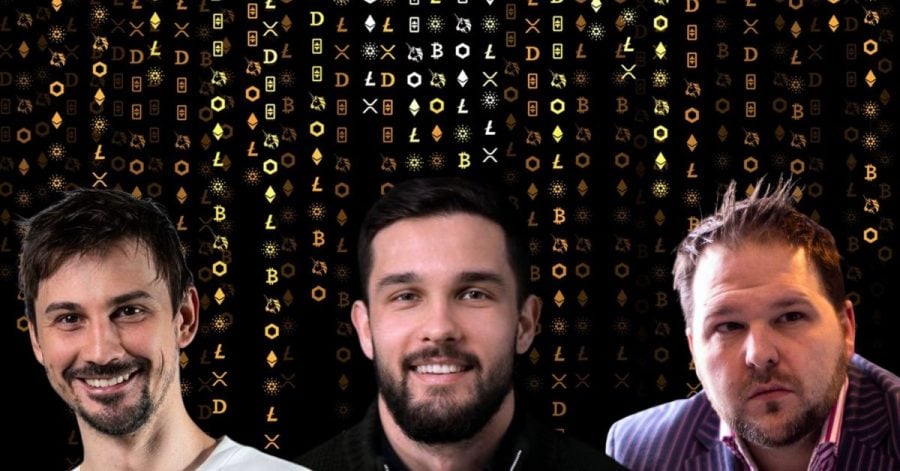

“It’s been a tough year and there’s obviously a number of reasons for that: FTX, Tera/Luna, and so on. At a personal level, you need to be sort of sanguine and optimistic, but at the same time realistic, and there are still some headwinds to overcome. Not just individual project levels, but obviously, on a macro level as well. People are talking about a good year next year. But will it get back to the where it was with the plus 3 trillion valuation? Maybe not,” Bitrue’s chief strategy Robert Quartly-Janeiro, tells The Recursive.

In April this year, Bitrue also had its fair share of problems when it got hit with a hack that cost the company more than $23M. For Quartly-Janeiro, these are the types of situation where companies in the industry just need to get through and come back stronger. However, the same goes for the crypto industry as a whole, and that there are some positive indicators that could affect the future of crypto.

“There is a deteriorating natural economic environment, which will likely push people into digital assets to protect protect their money, which is true. And then at the same time, institutional ETF market in the US for Bitcoin are likely going into other large gap. So if that happens, if BlackRock get an ETF license, and there’s others do the same, then people are thinking okay, well, that means that it then becomes completely widespread market,” Quartly-Janeiro points out.

Therefore, being cautiously optimistic is what could provide as the best strategy for the moment, he says. Additionally, the ongoing bear market is also making the situation more and more complex.

“You just don’t know what’s around the corner. And it’s a very complex time. But I guess another thing is, at what point do you say we’re no longer in a bear market? Because things have appreciated from the bottom,” he tells The Recursive.

Furthermore, one the biggest changes that Quartly-Janeiro expects to see is with the number of existing cryptoexchanges, which according to him is too big.

“I’m anticipating that you’re going to see a big attrition of exchanges. Now that should be a positive thing as people move to bigger firms. But at the same time, you could see a lot of media coverage around people say “hey I lost my money on this exchange and lost more money on this exchange”, which would be a bad thing. But I think that there are too many exchanges and I think it will change – you will clearly have some players who will be very good at a national level, and ones that will be good on a regional level, and international level, etc.” he adds.

Hope for the best, prepare for the worst

The bear market and the many crypto crashes have also affected how investors are seeing crypto projects. For example, in the US, VC crypto investments in the third quarter of 2022 were around $700 million, down from more than $6 billion in the first quarter of the year.

Nikolay Denisenko is the co-founder and CTO of Brighty App, a Swiss bank that combines crypto and fiat banking. According to him, recent developments have also changed how crypto investors are looking at regulation for example.

“We already have very big pressure in terms of regulation right now in Europe. So, some of our partners had their work cut out because of that. For example, we restart partnership, we integrated and at some point they say okay, our bank came to us and say no more crypto – because of that we are still struggling, we are a little bit slower than we should be,” Denisenko tells The Recursive.

The solution for dealing with such issues? Regroup, build and try to survive this market, and the the right product market fit, he adds.

“I think that everybody should starting focusing on profit, and not growing the capitalization. When I was talking to most investors and venture funds, it seems that nobody right now is interested in having a big capitalization, but rather on how you earn and how you can scale risk earning.” Denisenko points out.

Going forward – a bull market and continuous education

For Vlad Svitanko, founder or Dubai-based consultancy Cryptorsy, where the industry currently is at the moment is in between cycles, and it is reasonable to expect that such a situation will have an impact on the market cap.

“I think that we’re now we’re experiencing with somewhere by sitting in between the cycles. Because the bearish market hasn’t been overcome yet, and the bull market hasn’t started yet. That’s actually means that we are sitting in this spot where there is a lot of fueling the market, there’s a lot of anticipation coming into the space, and this cannot just not have an effect on the price of the assets,” Svitanko explains.

Furthermore, aside from regulation, there is also the slightly forgotten aspect of education, which is also hurting the market in its own way.

“The educational layer is very much important, because without education people are won’t get pretty much into crypto and web3, because they don’t understand about what the hell is going on here,” he tells The Recursive.

Education also remains one of the mission for people such as Miroslav.

“It’s a massive bear market, that it’s difficult market cycle. However, adoption is increasing, the technology is much more ready for massive adoption. And now it’s time to educate people to believe and to trust in this technology. So I won’t give up, I’ll keep on sharing content in Slovak language and explain to people what’s going on, what is being developed, and what can be achieved with the technology.” he concludes.