Poland’s venture capital market in 2025 was shaped by capital concentrating in a small number of globally competitive companies. In 2025, €0.8 billion flowed through the Polish VC market, state the report by PFR Ventures and Inovo VC. This is the total value of capital that Polish and international funds invested across 183 transactions in 166 domestic innovative enterprises. Comparing 2025 with 2024 and excluding so-called mega-rounds, the market value increased by 28%.

At the top end of the market, Poland saw a small number of exceptionally large transactions that dominated headlines. Among them was ElevenLabs, which closed a €171 million round with participation from international investors such as Andreessen Horowitz and ICONIQ Growth. Another standout was ICEYE, which raised more than €150 million in total.

In 2025, Poland’s Ministry of National Defense joined the company’s customer base, with ICEYE supplying radar satellites to the Polish Armed Forces under the MikroSAR programme.

“Are we dealing with a market bubble if half of the market’s value comes from two mega-rounds? In my view, no,” Mitraszewska noted. “These companies are already profitable, growing very quickly, and are being valued closer to historical multiples.”

That view is echoed by investors on the ground. “The market has simply become more selective and mature. Capital is concentrating where there is global traction, scale, and a technological edge,” said Karol Lasota, Partner at Inovo.vc.

Seed dominance and the expanding role of public capital

Seed-stage investments dominated Poland’s VC market in 2025. A total of 134 seed transactions were completed, nearly 20% more than the year before, while average ticket sizes remained stable at around €1.5 million. Early-stage funding was concentrated among funds prepared to take on higher risk and support companies with clear global ambitions.

“Seed rounds are the foundation of every innovation ecosystem. We need funds that are willing to take the additional risk of financing start-ups at a very early stage,” said Karolina Mitraszewska, President of PFR Ventures. “In 2025, nearly three quarters of seed transactions involved funds from the PFR Ventures portfolio.”

This activity was driven in part by a new generation of funds capitalised with EU resources under the European Funds for a Modern Economy (FENG). Out of 183 identified transactions, 82 involved funds from the PFR Ventures portfolio, meaning the number of rounds backed by EU and PFR capital more than doubled year on year.

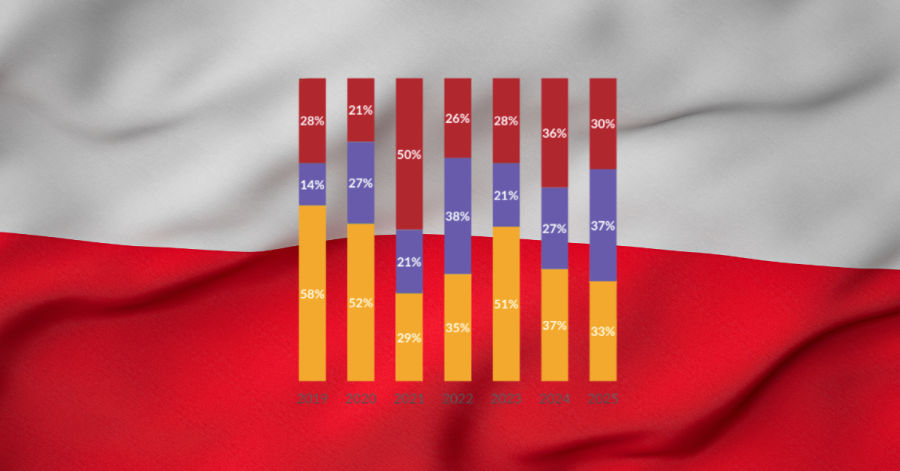

Polish business angels also played a critical role, participating in half of all completed transactions. Meanwhile, rounds backed by international funds accounted for roughly 40% of total capital deployed, with 37% of capital coming from transactions where Polish and foreign funds invested side by side.

Growth-stage activity remained more selective, with seven such rounds completed. In more than half of these, bValue participated, backing companies including Xtreme Brands, Fudo Security, and Sportano.

Co-investments, caution, and global visibility

Persistent geopolitical and macroeconomic uncertainty has made foreign investors more cautious. In 2025, Polish companies raised around €250 million in rounds led exclusively by international funds, while more than twice that amount flowed into transactions where foreign investors co-invested alongside local teams.

An increasingly important, if less visible, trend is the rise of domestic co-investments. More Polish funds are choosing to back the same companies together, increasing round sizes while broadening access to expertise and global networks.

This collaborative model has helped push Polish startups into international media. Rounds for companies such as Spacelift and Nomagic were widely covered in foreign-language press, reinforcing the ecosystem’s competitiveness beyond Central and Eastern Europe.

Healthcare leads, hardware gains ground

For the second year in a row, healthcare remained the leading sector for VC investment in Poland. In 2025, health-focused companies accounted for 13.1% of all completed transactions, buoyed by large rounds such as Jutro Medical’s €24 million and Ingenix’s €9 million raise. Biotechnology also gained momentum, with 11 identified rounds exceeding €20 million in total value.

At the same time, the sector gap is narrowing. Data & Analytics, IT and Internet Services, and especially Cybersecurity are increasing their share of investment, driven in part by the rapid scaling of ElevenLabs. There is also a clear rise in startups with a strong physical component—seen in companies like ICEYE and Nomagic.

This shift is reflected in business models. While Subscription and SaaS remain dominant, Manufacturing and Hardware are growing rapidly. The trend is particularly visible in space technologies and drone-related projects, where domestic investors show rising interest in dual-use applications. In total, SpaceTech accounted for eight foreign investments by Polish funds in 2025, while drone technologies saw five deals. One early signal came from a nearly €7 million round raised by the Polish–Romanian company Orbotix.

From local ecosystem to outbound investor

The final marker of Poland’s VC market maturity may be its growing confidence abroad. In 2025, Polish investors completed a record 86 foreign investments worth more than €128.5 million. The fourth quarter alone delivered over 20 such transactions, with a combined value exceeding €25 million.

Taken together, the data points to a market that is no longer defined by volume alone. Instead, Poland’s VC ecosystem in 2025 is characterised by selectivity, collaboration, and an expanding global footprint—laying foundations not just for the next generation of startups, but for Poland’s role as a serious player in European venture capital.