High-net-worth individuals (HNWIs) and family offices in Central and Eastern Europe are influential players in the investment landscape—much like underground rivers, shaping the financial ecosystem in ways that are not always immediately visible. We know they exist and play a significant role, yet their exact movements and allocation strategies remain largely uncharted.

These difficulties in understanding what they like and how they operate can be addressed, but it requires alignment among key organizations that can navigate the private capital ecosystem and challenge prevailing assumptions.

To shed light on this subject and provide data-driven insights, The Recursive conducted a study supported by ROCA Investments and Vertik Group, together with a group of strategic partners: Innotechnics, CEE Wealth Summit, FBN Bulgaria, FBN Hungary, Endeavor, VC Leaders, ROPEA, Bulgarian Angels Club, BVCA, CVCA, 0100 Conferences, Money Motion and Growceanu.

The report with the final conclusions is being released in stages to highlight distinct perspectives within the private capital landscape:

- May 13: High-Net-Worth Individuals in CEE: Investment Preferences and Trends

- June 3: Role Of Financial Advisors In HNWI’s Investment Decisions

- June 23: Single Family Offices and Their Implications in the CEE Investment Ecosystem

Money in Motion, Part I: Where CEE HNWIs are investing their wealth

Central and Eastern Europe (CEE) is undergoing a quiet, yet profound shift in how private wealth is managed and grown. Long associated with concentrated ownership in traditional sectors such as manufacturing, construction, and real estate, the region’s High-Net-Worth Individuals (HNWIs) are gradually repositioning themselves in the financial ecosystem. Today, with close to 400,000 HNWIs across countries like Poland, Czechia, Romania, Greece, and Hungary, this demographic is becoming a pivotal player in the regional economy.

The change is structural. While tangible assets like real estate and equities continue to account for a high percentage of many portfolios, there is a growing appetite for more complex, less liquid investments. HNWIs and their family offices are broadening their horizons, turning to private markets, alternative asset classes, and innovation-driven sectors to diversify risk and capture new opportunities.

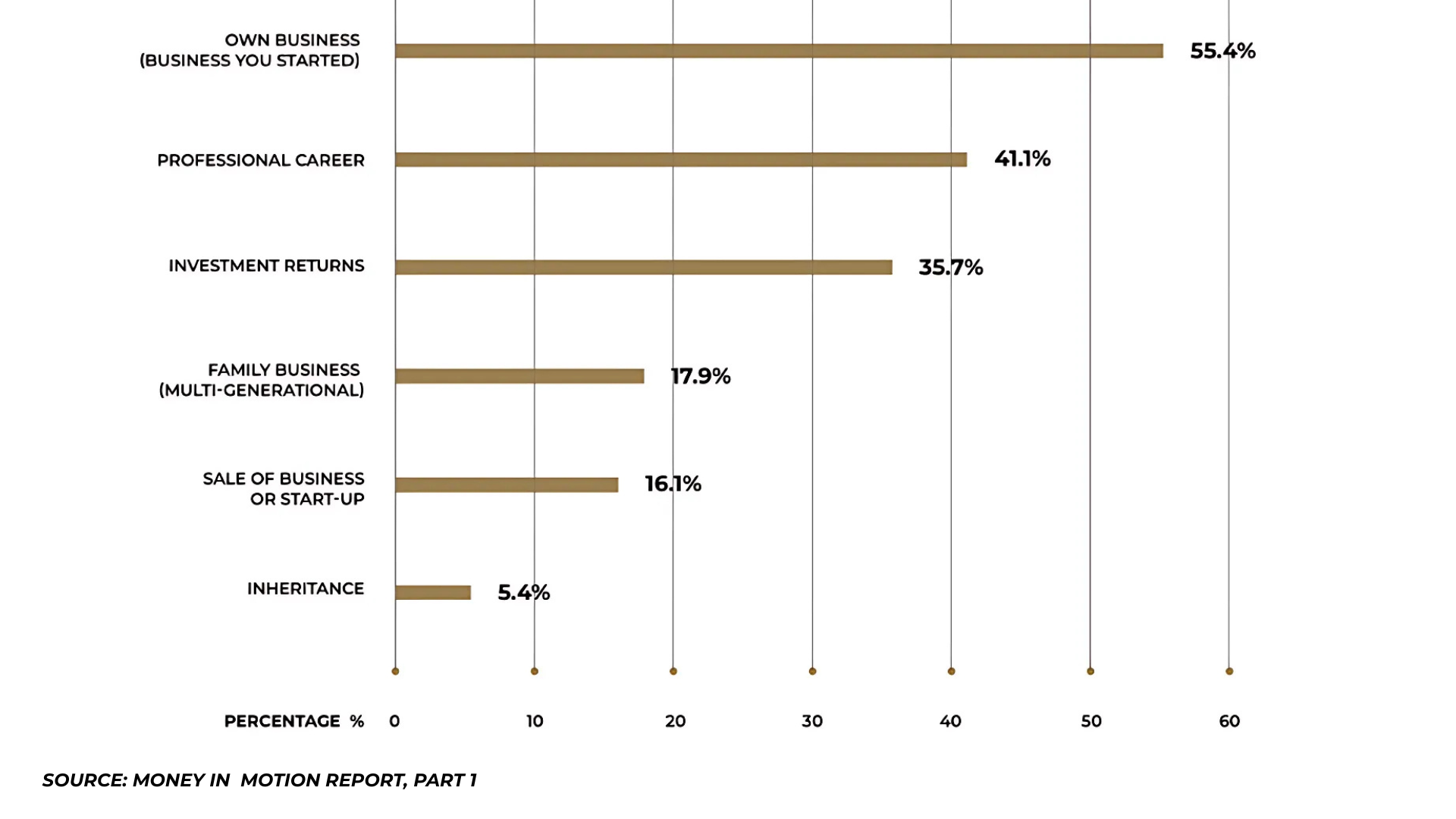

According to our new report, the majority of CEE’s wealthy made their fortunes by building businesses. 55.4% of HNWIs surveyed cited entrepreneurship as their primary source of wealth, followed by professional careers and investment returns. While family businesses and inheritance play a role, they remain less common in this region than in Western Europe.

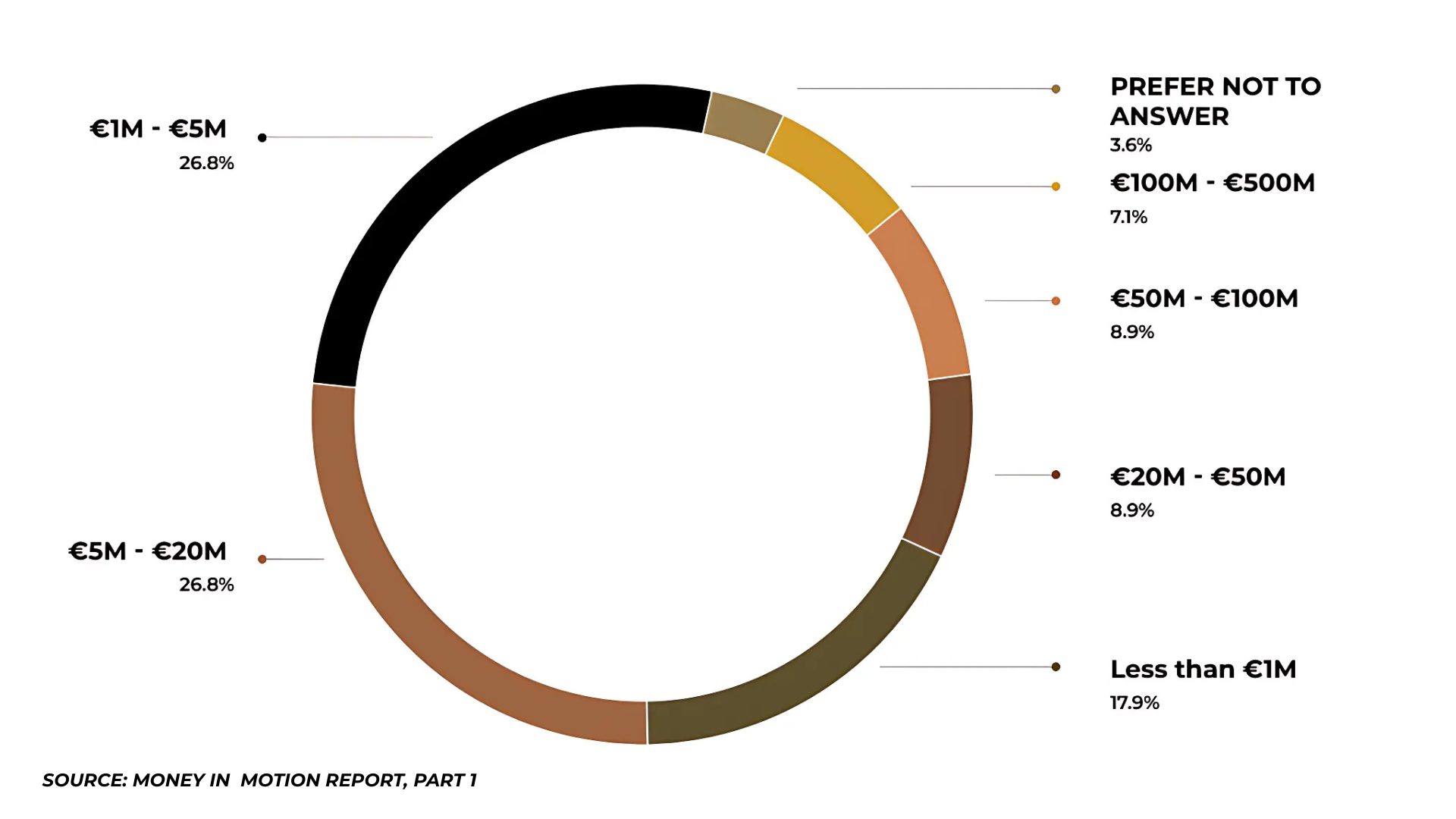

Looking at how wealthy the HNWIs in CEE are, our survey showed a diverse group. Half of the respondents (53.6%) reported liquid assets of up to €20M, pointing to a solid foundation of established private wealth. A further 24.9% fall within the €20M to €500M range, while 17.9% are still building toward their first million in liquid assets. This suggests a pipeline of emerging wealth creators that will continue to reshape the investment landscape in the years ahead.

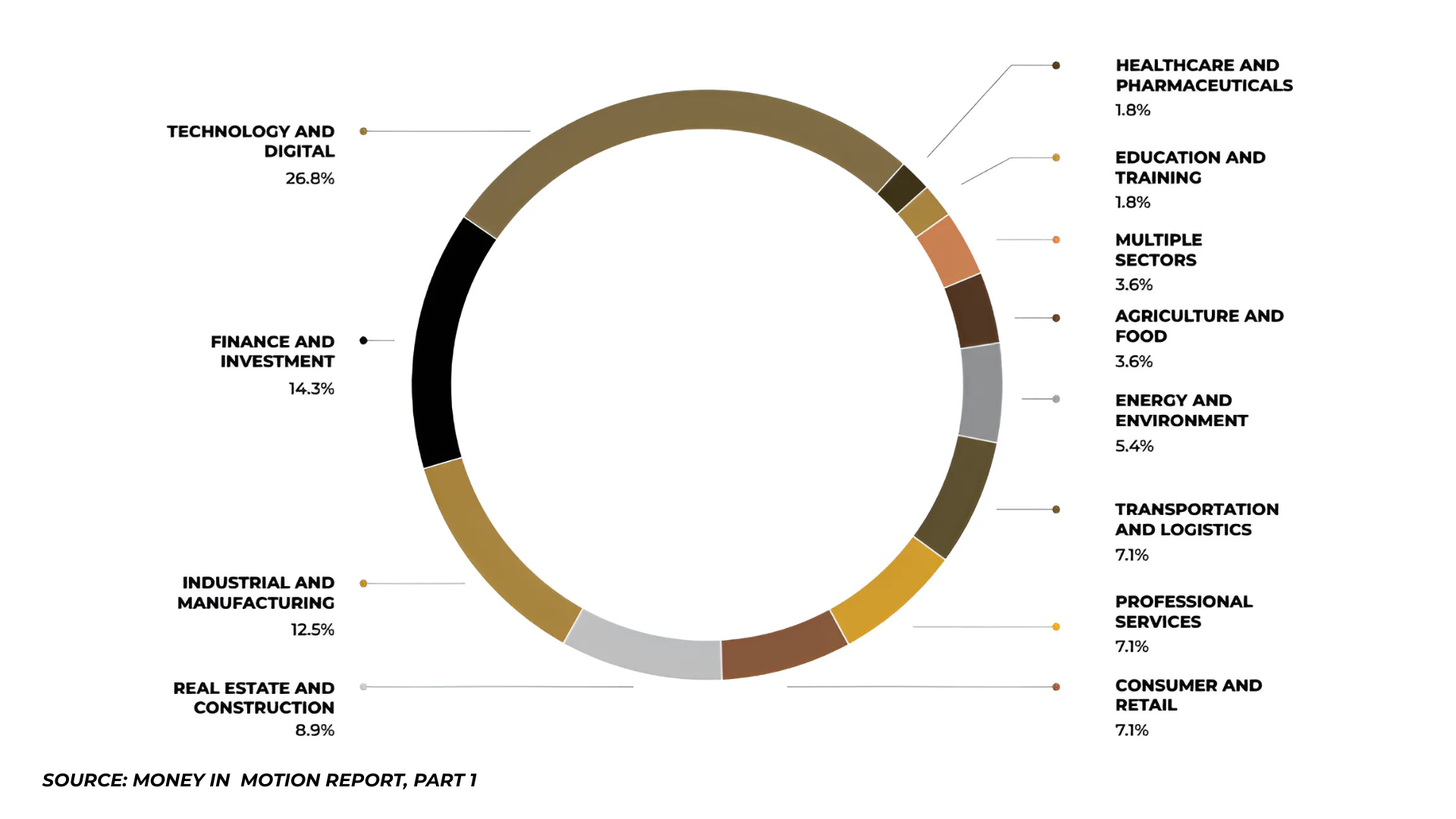

As expected, the region’s wealth creation sectors are evolving. While energy, logistics, and heavy industries remain significant, 26.8% of respondents cite technology and digital as their primary source of wealth, making it the top industry. Finance follows at 14.3%, and industrial/manufacturing at 12.5%. Real estate, traditionally a stable investment, now accounts for a smaller share, with agriculture being even less prominent. These shifts indicate a move from asset-heavy, legacy sectors to innovation-driven models, with technology emerging as both a wealth driver and key focus for future investment.

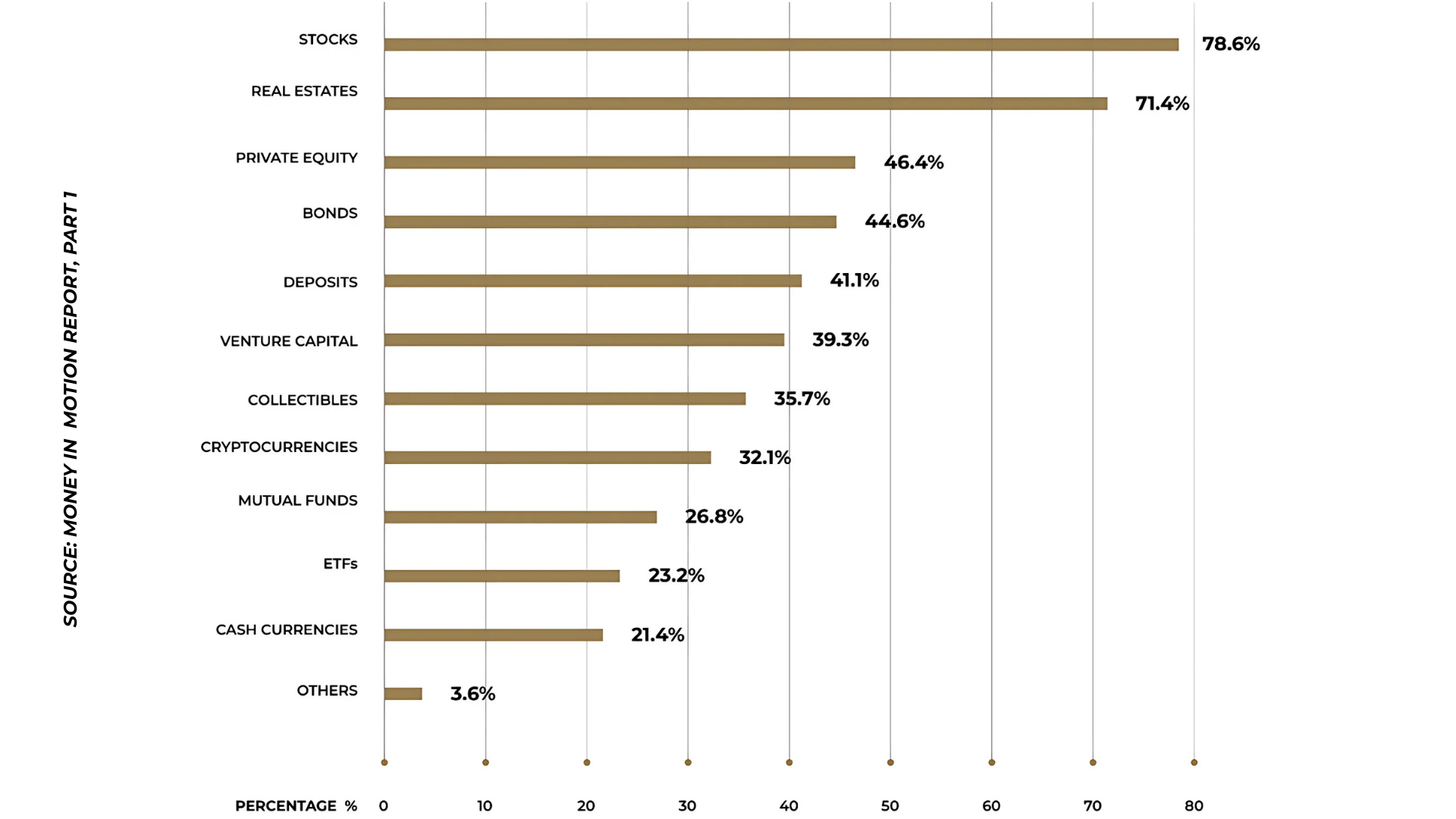

Despite the broadening investment toolkit, traditional assets continue to play a central role in CEE wealth portfolios. Stocks are seen as an important profit returner, offering capital appreciation and dividend income. Real estate remains foundational—spanning residential, commercial, and luxury properties. Bonds are valued for their stability and role in risk diversification. Many HNWIs also use deposits and mutual funds to maintain liquidity while pursuing moderate returns.

However, there is a noticeable shift toward alternatives. A growing number of HNWIs in CEE are allocating capital to private equity, venture capital, hedge funds, art, precious metals, and even digital assets.

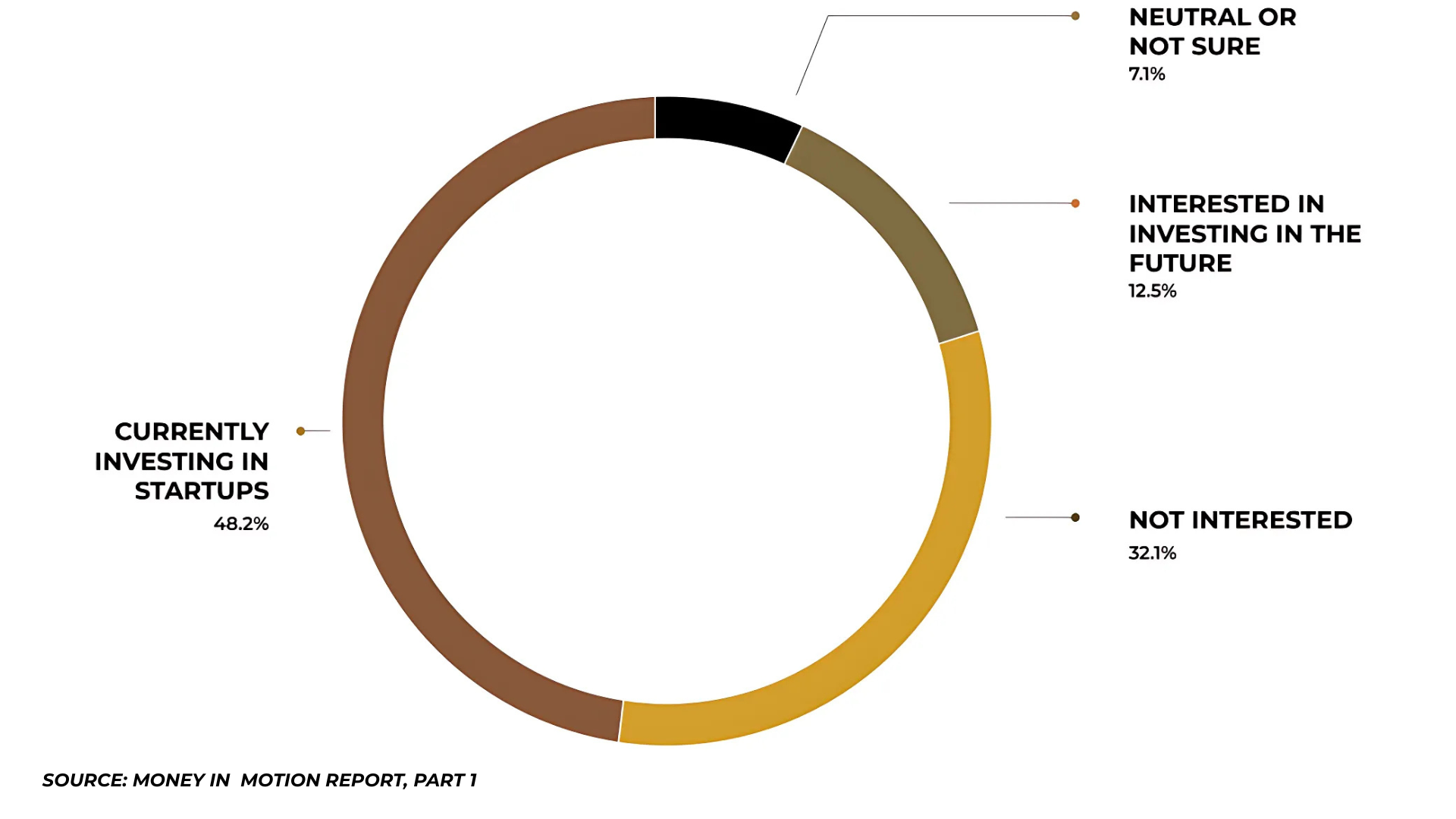

Looking further into venture capital and startup investments, we learn that nearly half of our respondents (48.2%) indicated that they are currently investing in startups. Another 12.5% are considering entering this space in the near future, while 32.1% are not interested—highlighting a mixed but steadily warming interest in this high-risk, high-reward category.

Want to dive deeper into the numbers, quotes, and insights?

Download the report to discover how a new generation of investors is influencing the future of the region’s capital markets.