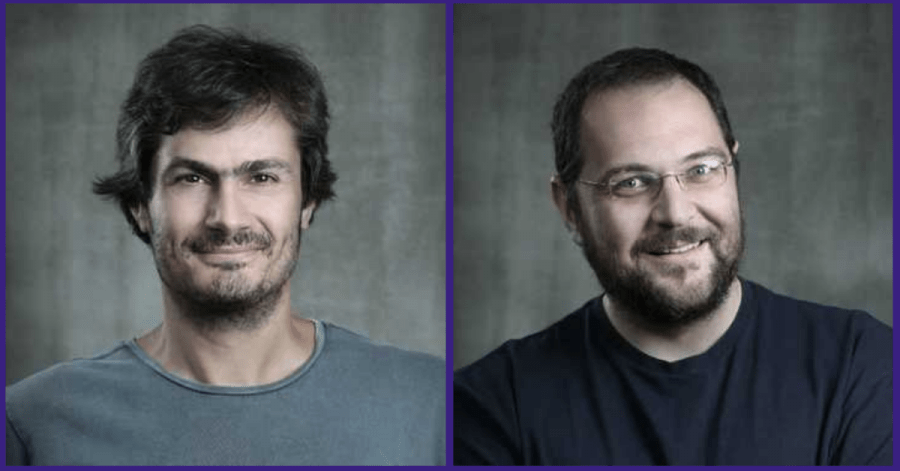

Founded in 2016 by the serial entrepreneurs and angel investors Apostolos Apostolakis and George Dimopoulos, the Greek Venture Friends has recently expanded its investment focus well beyond Europe. Their latest investment is in the Latin American open finance API startup Belvo. Venture Friends also participated in the funding round of the Amazon-like marketplace factory14, which is based in Luxembourg.

Up to this point, the VC has targeted mostly SEE-based tech startups and companies, and in their portfolio are the Greek startups InstaShop and Blendo.

“We believe that investing in startups and founders from different cultures enhances the collective understanding of the ecosystem and improves the outcomes for everyone,” the co-founder of the fund Apostolos Apostolakis shared in an interview with The Recursive team in April. He explains that the goal of their first fund was to support the local and regional founders in times when there was not so much capital available in the SEE. Since then, however, more funds that are interested in investing regionally, have emerged. “We are narrowing the scope a bit by investing in sectors where we have a stronger network and a stronger understanding such as e-commerce, fintech, and SaaS, but we are expanding our geographical scope,” says Apostolakis.

Belvo and its historic $43M Series A

The investment in Belvo reportedly marks the largest Series A round that has even been raised by a Latin American fintech. Besides Venture Friends, the other participants in the $43M round are Future Positive, FJ Labs, Kaszek, MAYA Capital, Kibo Ventures, and a couple of angel investors including the CTO of Wise (ex Transferwise).

Latin America is notorious for being highly underbanked and that is why the mission of Belvo to democratize access to finance and financial data, resonates with the acute needs of its Latin American end-users. The fintech API platform of Belvo helps developers of neobank and fintech apps access and draw insights from the financial data of end-users to allow them to build better products. In other words, similarly to Plaid, Belvo unlocks the power of open banking by enabling fintech engineers to its API and connect bank accounts to their apps. However, according to the co-founder of Belvo Pablo Viguera, the key differentiation between the two fintech API startups is that Belvo is able to take and process more information and empower users to decide whether they want to share their personal data with third parties.

Belvo also works with financial data, taken from gig economy platforms, and currently operates in Mexico, Brazil, and Colombia. Their team recognizes that other Latin American markets such as of Chile, Argentina, and Peru also pose an opportunity for expansion. Their plan is to use the raised money to boost their product, and keep on expanding – both internally as a team and geographically.

A $200M boost for the marketplace model of factory14

The round, which was announced at the beginning of May, comes mostly in the form of debt, while the equity-based funding comes from the VC of the Daily Mail Group, Dmg Ventures, DN Capital, and Venture Friends. The Luxembourg-based startup Factory14 acquires and sells e-commerce brands, which lists their products on online marketplaces. According to tEO Guilherme Steinbruch, even though the e-commerce sector is becoming increasingly saturated, factory14 can compete against already successful international names by acquiring brands that have already established models and better product offerings.